Earnings summaries and quarterly performance for GE HealthCare Technologies.

Executive leadership at GE HealthCare Technologies.

Peter J. Arduini

President and Chief Executive Officer

Betty Larson

Chief People Officer

Frank Jimenez

General Counsel and Corporate Secretary

James Saccaro

Vice President and Chief Financial Officer

Kenneth Stacherski

Chief Global Supply Chain and Service Officer

Kevin O’Neill

CEO, Pharmaceutical Diagnostics

Roland Rott

President and CEO, Imaging

Taha Kass-Hout

Chief Science and Technology Officer

Thomas Westrick

CEO, Patient Care Solutions

Board of directors at GE HealthCare Technologies.

Anne T. Madden

Director

Catherine Lesjak

Director

H. Lawrence Culp, Jr.

Chair of the Board

Phoebe L. Yang

Director

Risa Lavizzo-Mourey

Lead Independent Director

Rodney F. Hochman

Director

Tomislav Mihaljevic

Director

William J. Stromberg

Director

Research analysts who have asked questions during GE HealthCare Technologies earnings calls.

David Roman

Goldman Sachs Group Inc.

8 questions for GEHC

Joanne Wuensch

Citigroup Inc.

8 questions for GEHC

Vijay Kumar

Evercore ISI

8 questions for GEHC

Anthony Petrone

Mizuho Group

6 questions for GEHC

Robert Marcus

JPMorgan Chase & Co.

6 questions for GEHC

Larry Biegelsen

Wells Fargo & Company

4 questions for GEHC

Lawrence Biegelsen

Wells Fargo

3 questions for GEHC

Matthew Taylor

Jefferies

3 questions for GEHC

Ryan Zimmerman

BTIG

3 questions for GEHC

Craig Bijou

Bank of America Securities

2 questions for GEHC

Matt Miksic

Barclays Investment Bank

2 questions for GEHC

Patrick Wood

Morgan Stanley

2 questions for GEHC

Travis Steed

Bank of America

2 questions for GEHC

Allen Gong

JPMorgan Chase & Co.

1 question for GEHC

Jason Bednar

Piper Sandler Companies

1 question for GEHC

Matt Taylor

Jefferies & Company Inc.

1 question for GEHC

Navann Ty Dietschi

BNP Paribas

1 question for GEHC

Rick Wise

Stifel Financial Corp

1 question for GEHC

Robbie Marcus

JPMorgan Chase & Co.

1 question for GEHC

Vik Chopra

Wells Fargo & Company

1 question for GEHC

Recent press releases and 8-K filings for GEHC.

- GE HealthCare delivered 5% orders growth and 3.5% organic revenue growth in 2025, laying the foundation for 2026 execution.

- Photonova Spectra (photon-counting CT) is slated for FDA approval in 2026 with revenue impact in 2027, alongside whole-body PET and AI-enhanced ultrasound solutions from AVS.

- Launched a 10-year collaboration with UCSF to advance remote imaging, workforce training and MR innovations under a customer-backed model.

- Issued 2026 organic revenue guidance of 3–4%, with Q1 at 2–3% and a back-half ramp; maintains mid-single-digit growth and 17–20%+ EBIT margins target by 2028.

- Effective tariff mitigation in 2025 may be offset by new 15% IEEPA-related duties; full impact and mitigation plans to be detailed on the next earnings call.

- GE HealthCare closed 2025 with 5% orders growth and 3.5% organic revenue growth, and is guiding 3–4% organic growth for 2026, with a ramp in the back half driven by orders booked in 2025.

- The company is executing a multi-year innovation cycle, launching products like Photonov Spectra (photon counting CT), Omni Total Body PET/CT and StarGuide SPECT/CT, with most revenue impact expected in 2027–28, contributing an incremental 1–2% growth in the medium term.

- GE HealthCare has adopted a customer-backed Heartbeat product-planning system and inked a new 10-year collaboration with UCSF to co-develop and commercialize imaging and AI solutions, reinforcing its go-to-market and service model.

- The company remains active in strategic tuck-in M&A, completing deals such as IntelliRad, Caption Health and MIM to fill portfolio gaps with revenue-accretive, high-ROI assets, while pausing on larger transformational deals.

- Aggressive tariff mitigation has largely offset new US import duties; any net relief will fund R&D and SG&A to support long-term innovation and commercial excellence.

- In 2025, GEHC achieved 5% full-year orders growth and 3.5% organic revenue growth, guiding 3–4% organic growth for 2026 with a 2–3% Q1 trajectory and back-half acceleration.

- New photon counting CT (Photonov Spectra) is expected to gain FDA approval in 2026 with orders starting that year and significant revenue impact in 2027; Omni total-body PET/CT and StarGuide SPECT/CT will open new imaging segments outside the US.

- GEHC has invested $3 billion in R&D over three years, developing 100+ FDA-approved AI-enabled devices (e.g., AIR Recon DL for faster MRI) and innovating products that deliver workflow efficiencies.

- M&A strategy prioritizes revenue-accretive, synergetic acquisitions—such as IntelliRad for imaging archiving, Caption Health for ultrasound AI and MIM for oncology workflow—with future deals expected to mirror current sizes.

- Recent US tariff changes are likely net neutral due to mitigation efforts—despite new 15% levies offsetting IEEPA relief—and any tariff savings will be reinvested in R&D and SG&A to support long-term growth.

- FDA 510(k) clearance achieved for three new SIGNA innovations: Sprint with Freelium 1.5T, Bolt 3T, and the AI-driven SIGNA One workflow ecosystem.

- SIGNA Sprint with Freelium offers helium-free operation (<1% helium), ventless siting flexibility, and autonomous magnet monitoring to minimize downtime and service visits.

- SIGNA Bolt 3T delivers research-grade performance with an 80/200 gradient system, ~30% lower power consumption, up to 65% reduction in peak power demand, and 34% smaller equipment room footprint versus previous models.

- SIGNA One integrates AI-powered automation—including patient positioning verification, contactless gating, and live in-room console feeds—to streamline workflows and boost MRI throughput.

- The Board of Directors declared a $0.035 per share cash dividend for Q1 2026, payable May 15, 2026, to shareholders of record as of April 3, 2026.

- GE HealthCare is a $20.6 billion business with approximately 54,000 colleagues, serving patients for 130 years.

- Recognized among the 2026 Fortune World’s Most Admired Companies.

- GE Medical Holding AB, a subsidiary of GE HealthCare Technologies, will exercise 26,973,169 warrants in EXACT Therapeutics.

- The warrant exercise will generate NOK 33 million in gross proceeds for EXACT Therapeutics.

- These warrants were issued in the December 2024 private placement and became exercisable after a positive safety read-out from the phase 2 ENACT pancreatic cancer trial on 27 January 2026.

- Remaining warrant holders may exercise their warrants until 26 February 2026.

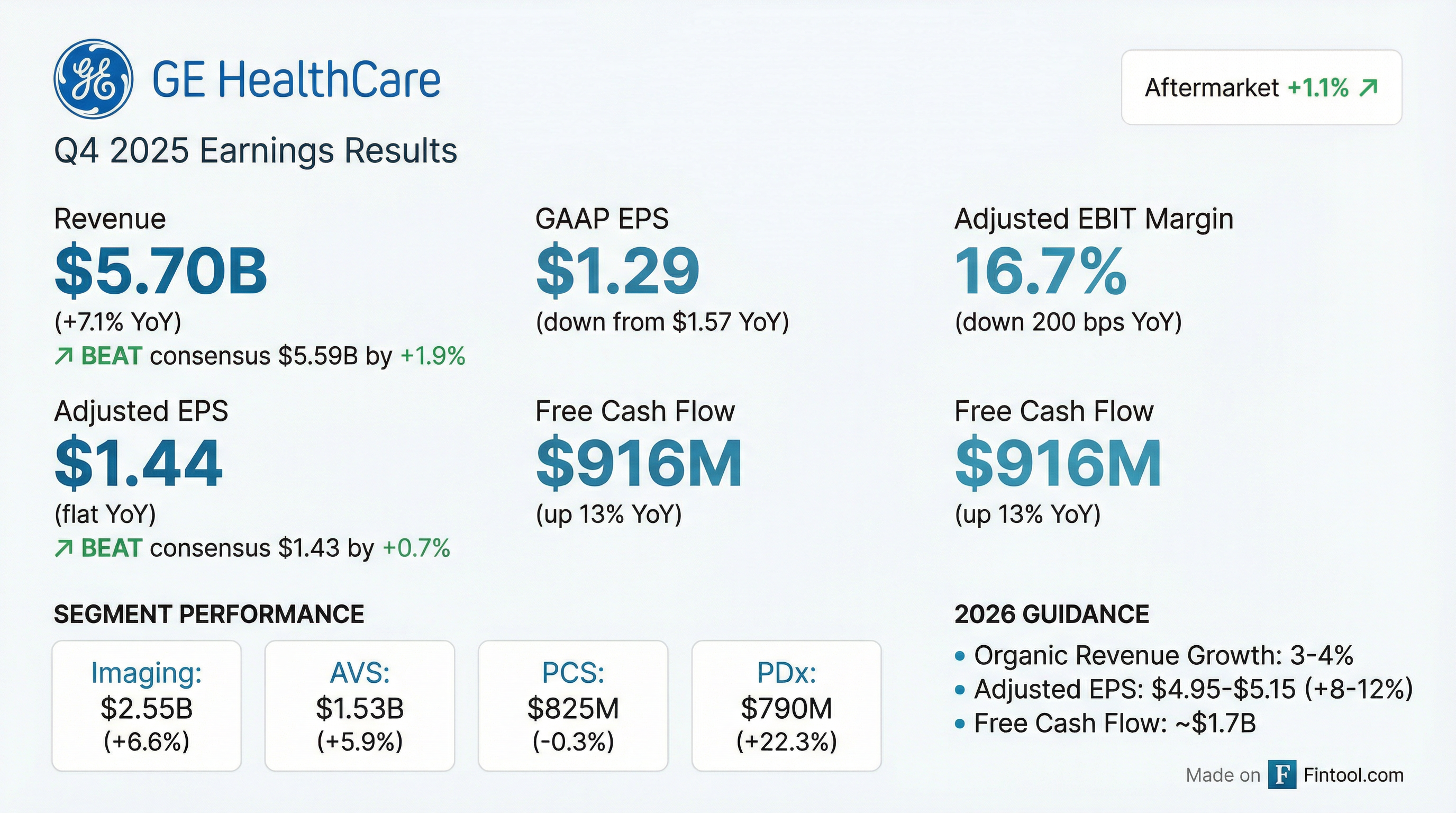

- GE HealthCare delivered record FY2025 revenue of $20.6 billion and Q4 revenue of $5.7 billion, led by Imaging and advanced visualization growth.

- The company achieved full-year adjusted EPS of $4.59 and Q4 adjusted EPS of $1.44, overcoming a $0.43 EPS tariff headwind in 2025.

- Segment revenues were $9.25 billion for Imaging (EBIT down 12.5%), $5.35 billion for AVS (EBIT up 0.7%), and $2.9 billion for Pharmaceutical Diagnostics (EBIT up 10%).

- Management set FY26 guidance for adjusted EPS of $4.95–$5.15 and 3–4% organic revenue growth, and expects a reduced tariff impact next year.

- Q4 ended with a record $21.8 billion backlog, a 1.06x book-to-bill, and $916 million in free cash flow.

- Q4 revenue of $5.7 billion, organic growth 4.8%, adjusted EPS $1.44, free cash flow $916 million; record backlog of $21.8 billion and book-to-bill of 1.06x

- Full-year 2025 revenue of $20.6 billion (+3.5% organic) with adjusted EPS $4.59 and adjusted EBIT margin 15.3%

- 2026 guidance: organic revenue growth 3%–4%, adjusted EPS $4.95–$5.15 (+8%–12%), adjusted EBIT margin 15.8%–16.1%, and free cash flow of $1.7 billion

- Announced planned acquisition of Intelerad, expected to add ~$270 million in first-year revenue (low-double-digit growth) with >30% adjusted EBITDA

- Innovation pipeline remains strong with a three-year vitality rate of 55% and new launches including Omni total body PET, next-gen SPECT, Photonova Spectra photon-counting CT, SIGNA MR with Freelium, Vivid Pioneer ultrasound, and Flyrcado perfusion imaging

- Revenue of $5.7 B with 4.8% organic growth and 1.06× book-to-bill, driven by strength in U.S. and EMEA and record backlog.

- Adjusted EPS of $1.44, down 0.7% YoY, excluding a $0.17 tariff impact.

- Free cash flow of $916 M, up $105 M YoY, despite a $90 M tariff headwind.

- 2026 outlook: organic revenue growth 3.0%–4.0%, adjusted EBIT margin 15.8%–16.1%, adjusted EPS $4.95–$5.15, and FCF ~ $1.7 B.

- Delivered $5.7 billion in Q4 revenue with 4.8% organic growth; adjusted EBIT margin was 16.7%, adjusted EPS $1.44, and free cash flow $916 million.

- Full-year 2025 revenue of $20.6 billion (+3.5% organic), record backlog, adjusted EPS $4.59, and free cash flow $1.5 billion, despite a $245 million tariff impact.

- 2026 guidance: 3–4% organic revenue growth, adjusted EBIT margin 15.8–16.1%, adjusted EPS $4.95–$5.15, and free cash flow of $1.7 billion.

- Announced acquisition of Intelerad, expected to contribute $270 million in first-year revenue and >30% adjusted EBITDA.

- Heartbeat business system rollout drove a 25% monthly improvement in past-due backlog, boosting sales and cash conversion in 2025.

Quarterly earnings call transcripts for GE HealthCare Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more