HONEYWELL INTERNATIONAL (HON)·Q4 2025 Earnings Summary

Honeywell Beats on Adjusted EPS, Accelerates Aerospace Spin-Off to Q3 2026

January 29, 2026 · by Fintool AI Agent

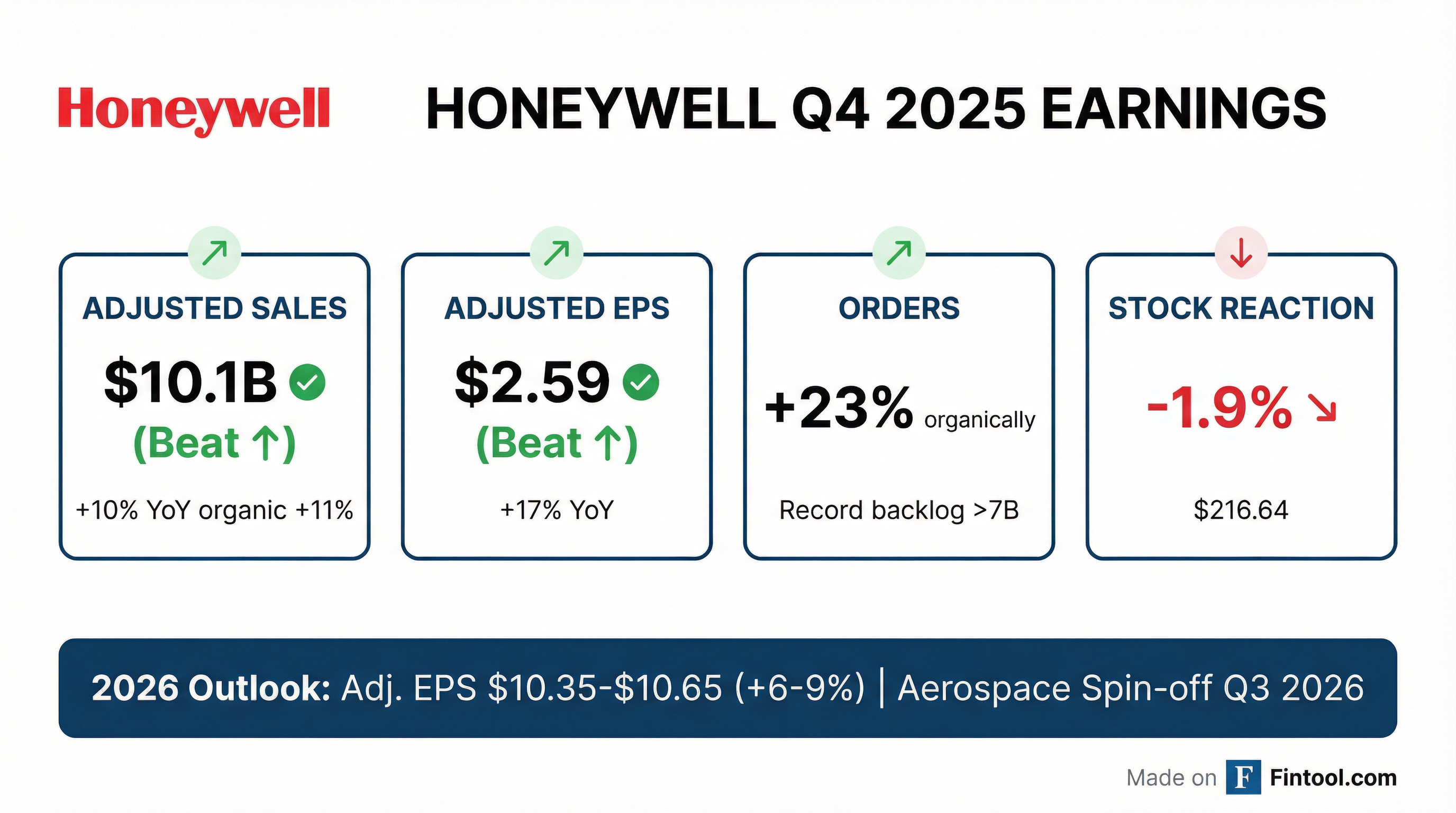

Honeywell reported Q4 2025 results that beat guidance on both adjusted sales and adjusted EPS, driven by exceptional demand in Aerospace Technologies (+21% organic) and record orders pushing backlog above $37 billion . The company accelerated its Aerospace spin-off timeline to Q3 2026 and announced key leadership appointments, while taking significant one-time charges that masked underlying operating momentum. Shares fell ~2% to $216.64 as investors digested the complex quarter.

Did Honeywell Beat Earnings?

Yes — Honeywell beat the high end of guidance on both adjusted sales and adjusted EPS .

The massive divergence between GAAP and adjusted EPS stems from $508M in one-time charges: a $288M goodwill impairment related to Industrial Automation, a $220M impairment on PSS/WWS assets held for sale, and $373M related to the Flexjet litigation settlement .

Orders grew 23% organically — led by double-digit growth in Aerospace Technologies and Energy & Sustainability Solutions — driving backlog to a record $37+ billion, up 4% sequentially .

Organic Growth Acceleration

Honeywell's LTM average organic growth has accelerated from 2.6% in Q1 2024 to 5.7% in Q4 2025 :

This acceleration reflects improvements across end market demand (aerospace defense/commercial, LNG, data centers), portfolio repositioning (exiting cyclical businesses, adding higher-growth via M&A), and 4% growth from new product introductions in 2025 .

How Did Each Segment Perform?

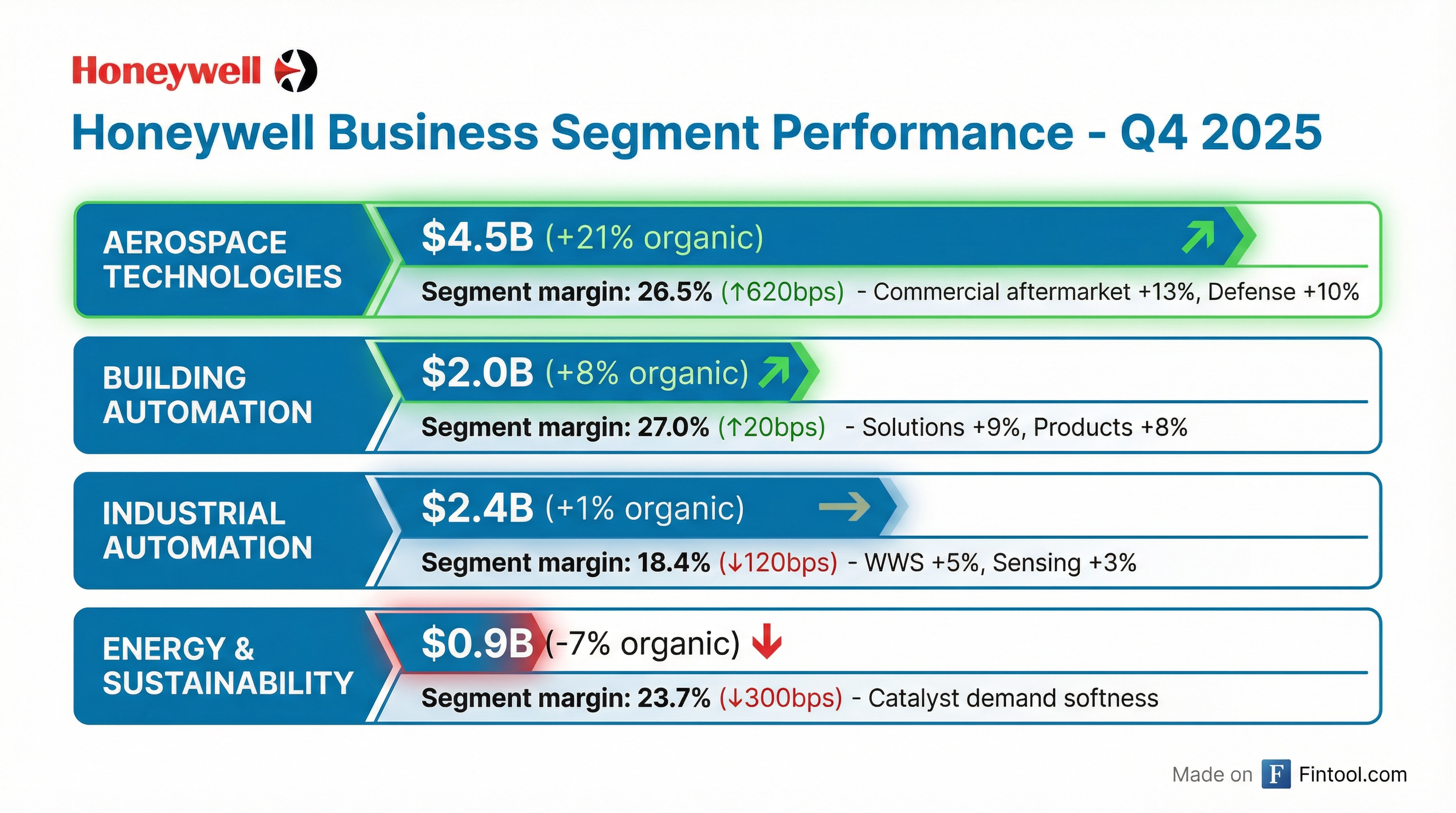

Aerospace Technologies was the clear standout, delivering 21% organic growth and 620 bps of adjusted margin expansion :

Key drivers by segment:

- Aerospace: Commercial aftermarket +13% (business jets and air transport both double-digit), Defense & Space +10% on elevated global demand, commercial OE accelerating as supply chain improves

- Building Automation: Solutions +9% led by double-digit services growth, Products +8% with strength in North America and Middle East

- Industrial Automation: WWS +5% on pipeline conversion, Sensing +3% on industrial/aero tailwinds, PSS returned to +1% growth with double-digit orders

- Energy & Sustainability: Weakness in petrochemical catalysts offset by strong LNG and refining orders in UOP

What Did Management Guide for 2026?

Honeywell's 2026 outlook implies acceleration from current run-rates, with adjusted EPS guidance of $10.35-$10.65 representing 6-9% growth .

The guidance includes full-year expected results for Aerospace, PSS, and WWS but excludes the pending Johnson Matthey Catalyst Technologies acquisition .

2026 Segment Growth Outlook

Q1 2026 Guidance

Q1 is expected to see organic growth led by Aerospace (ramping OE, defense spending, supply chain unlock) and Building Automation (robust NPI), partially offset by PA&T (catalyst softness) and IA (short-cycle weakness) .

2026 Segment Margin Expansion Drivers

Additional 2026 Financial Inputs

Forward consensus estimates for upcoming quarters:*

*Values retrieved from S&P Global

What Changed From Last Quarter?

Aerospace Spin-Off Accelerated

The most significant strategic update: Honeywell Aerospace spin-off now expected in Q3 2026, ahead of prior expectations . Key leadership appointments:

- Jim Currier — President and CEO of Honeywell Aerospace

- Craig Arnold — Chairman of Honeywell Aerospace Board

- Josh Jepsen — CFO of Honeywell Aerospace

Portfolio Simplification Continues

- Solstice Advanced Materials spin-off completed October 30, 2025, now trading as 'SOLS' on Nasdaq

- PSS and WWS sale expected 1H 2026 — following strategic alternatives review

- Flexjet litigation settled January 21, 2026, with engine maintenance agreement extended through 2035

Quantinuum Commercial Progress

Honeywell's quantum computing subsidiary Quantinuum continues to hit milestones :

Upcoming catalysts include creation of an independent board of directors, quantum-enhanced AI enterprise use case in pharma, Helios operational in Singapore, and SoL product launch with ~100 logical qubits .

Investment impact: Quantinuum investments will increase corporate costs by ~$100M in 2026 to ~$650M total, representing a 30 bps headwind to segment margins .

Process Automation & Technology Backlog Momentum

PA&T orders surged 26% organically in Q4, driving backlog to $7.3 billion — up 20% from Q1 2025 :

The 17% orders growth in 2H 2025 resulted in a 16% increase in opening backlog, supporting a second-half 2026 ramp . Orders strength is concentrated in long-cycle Process Technology, particularly LNG and refining in the U.S. and Rest of World. Management noted 2025 PT backlog up over 30% 1H to 2H .

New Segment Structure for 2026

Beginning Q1 2026, Honeywell will realign into four reportable segments :

- Aerospace Technologies

- Building Automation

- Process Automation and Technology (new — combining Process Solutions core + UOP)

- Industrial Automation (remaining businesses)

How Did the Stock React?

Shares fell 1.9% to close at $216.64 on January 29, 2026, despite the beat on adjusted metrics:

Why the sell-off despite the beat?

- GAAP EPS shock — $0.49 vs. $1.74 prior year looks alarming at first glance

- Operating cash flow down 38% to $1.2B, though free cash flow rose 48% after adjustments

- ESS organic decline of -7% raises concerns about chemicals/refining exposure

- Execution complexity — investors may be discounting spin-off and portfolio transition risks

The stock has risen 8% over the past 3 months and is trading at 21x forward adjusted EPS based on 2026 guidance midpoint of ~$10.50.

Q&A Highlights

Pricing Strategy and Sustainability

Analysts questioned whether Honeywell's 4% price contribution is sustainable. Management expects 3.5% pricing in 2026, driven by persistent inflationary trends across labor (3-4% annually), electronics/memory, and commodities . CEO Kapur noted pricing varies by region and product, with new product introductions enabling better pricing power.

"Fundamentally, the inflationary trend in industrial segments... remain quite persistent. And our pricing strategy, therefore, has become more mature, really, to look at it as a long-term trend."

— Vimal Kapur

Margin Expansion Cadence

CFO Stepniak clarified that operational margin expansion is 50-90 bps, with 30 bps of Quantinuum investment offsetting it to the reported 20-60 bps guidance . Q1 will be the weakest quarter for margins (~20 bps expansion) with sequential improvement through the year as Quantinuum headwinds ease and tax/interest timing normalizes .

Aerospace margin outlook: "Low 30s incrementals" expected for 2026, with modest expansion driven by improved pricing alignment with tariff costs, tapering acquisition integration costs, and continued supply chain improvements .

Regional Dynamics and Short-Cycle Trends

Management highlighted a divergence in short-cycle demand by region :

The Europe/China weakness is specific to Industrial Automation — Building Automation does not see similar pressure due to different end markets and product lines .

OE Contract Renegotiations

A significant discussion around commercial aerospace OE contract renewals. Some contracts are 5-8 years overdue for renegotiation, meaning Honeywell has been absorbing significant inflation that will be recaptured :

"When you're renegotiating a contract after five, seven, eight years... these renegotiated contracts will bear very well for aerospace margin expansion in the future. It will be a great setup because we lap all the previous long-term inflation we have been absorbing."

— Vimal Kapur

Building Automation and Data Centers

Data center revenue is now >5% of Building Automation revenue, up from essentially zero a few years ago . Honeywell provides three solutions: fire safety, building management systems (environmental controls), and security. The Access Solutions acquisition is growing high single digits with strong sales synergies pulling through to the solutions business .

Quantinuum IPO Progress

The company filed a confidential S-1 in January for a potential Quantinuum IPO . Investment is increasing ~$100M YoY to support Helios commercialization and development of the next quantum machine (committed for 2027) . Key commercial conversations are underway with banks, pharmaceutical companies, and governments.

Process Automation Dynamics

Management explained the bifurcation in Process Automation :

Backlog conversion timing means strong orders from Q3-Q4 2025 will convert to revenue in 2H 2026 (12-18 month cycle time) .

New Product Vitality

Honeywell measures two KPIs for innovation :

R&D spend is now at 4.8% of sales, which management considers the "sweet spot" . The prior year's step-up is now normalized and won't be a headwind in 2026.

Key Management Quotes

"We concluded 2025 with strong results that exceeded the high end of our guidance for adjusted sales and adjusted EPS. Orders grew 23% stemming from robust demand in the Aerospace Technologies and Energy and Sustainability Solutions segments, including from our LNG acquisition that closed last year. As a result, we exited 2025 with a record backlog of over $37 billion which positions us well for 2026."

— Vimal Kapur, Chairman and CEO

"With strong management teams and clear strategies in place for both automation and aerospace, we are confident in our ability to deliver on our 2026 commitments."

— Vimal Kapur

Full Year 2025 Summary

Honeywell exceeded the high end of its original full-year guidance by 2 points on organic sales .