HERSHEY (HSY)·Q4 2025 Earnings Summary

Hershey Beats on Revenue and EPS, Stock Hits 52-Week High

February 5, 2026 · by Fintool AI Agent

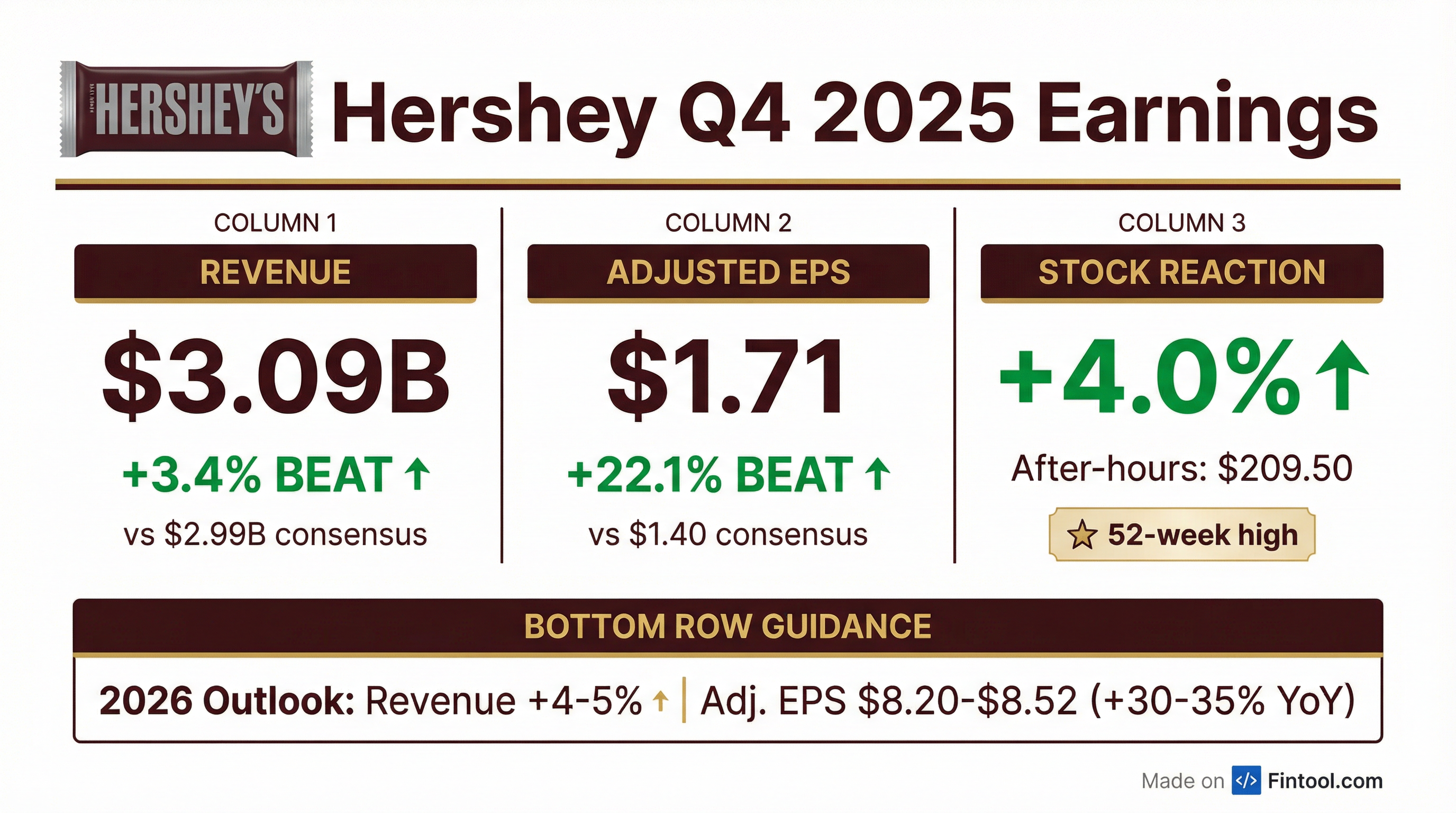

Hershey delivered a strong Q4 2025, beating analyst estimates on both revenue and earnings while providing an upbeat 2026 outlook. Net sales of $3.09 billion topped consensus of $2.99 billion by 3.4%, driven by 9% net price realization and an extra shipping day. Adjusted EPS of $1.71 crushed the $1.40 estimate by 22%, though still down 36% YoY due to commodity headwinds.

The stock surged to a 52-week high of $209.50 in after-hours trading, up 4.0% from the prior close.

Did Hershey Beat Earnings?

Yes — a double beat with significant upside on EPS.

The revenue beat was driven by 9 points of net price realization and one additional shipping day vs the prior year. The EPS beat reflects better-than-feared gross margin performance — partly due to lower-than-expected tariffs on suppliers' materials.

Beat/Miss History (Last 5 Quarters):

Hershey has now beaten EPS estimates in 5 consecutive quarters.

What Did Management Guide for 2026?

Hershey provided a constructive 2026 outlook with strong EPS recovery expected:

Key guidance drivers:

- LesserEvil acquisition contributes ~150bps to revenue growth

- Gross margin recovery of ~400bps as cocoa hedges roll off at more favorable rates

- AAA Program expected to deliver ~$100M in incremental savings (on top of $300M+ over prior 2 years)

- Efficiency & transformation savings of ~$230M in 2026

- Brand investment up double digits, with first new Reese's and Hershey media campaigns in 8 years

- Dividend increased 6% reflecting confidence in cash generation

Quarterly Cadence: Management provided detailed guidance on phasing :

- Q1: Strongest top-line growth as momentum carries from Q4, but margin/earnings pressured due to higher-cost inventory and tariff carryover

- Q2: Gross margin inflection point expected — double-digit EPS growth begins

- H2: Tougher comps but continued double-digit EPS growth; brand investment up double digits across all quarters

The gap between reported and adjusted EPS growth reflects the large derivative mark-to-market loss ($2.08/share) recorded in 2025 that won't repeat.

Investor Day: March 31st will unveil long-term vision and portfolio/capability-building initiatives.

How Did the Stock React?

HSY shares rose sharply on the results:

The stock has rallied 15% from its 52-week low, with today's move driven by the EPS beat magnitude and favorable 2026 guidance.

What Changed From Last Quarter?

Several notable shifts from Q3 2025:

Positive Changes:

- Gross margin improved to 37.0% from 32.6% in Q3 (still down from 54.0% in Q4 2024)

- North America Salty Snacks accelerated to +28% growth (vs +11% in Q3) with LesserEvil adding 10pts

- Beat magnitude expanded — 22% EPS beat vs 21% in Q3

Concerning Trends:

- International segment loss deepened to -$31.6M from -$4.2M expected, with margins at -12.4%

- Volume declines persisted at -3% organic, reflecting price elasticity

- Tariff headwinds emerging as a new cost factor

How Did Segments Perform?

North America Confectionery: Price realization of ~10% offset 5pts of elasticity-driven volume declines. U.S. CMG retail takeaway grew 6.5%, in-line with category, with share gains in chocolate, sweets, and refreshment.

North America Salty Snacks: The standout performer with 18% organic growth in Q4 on double-digit volume growth. Retail sales growth accelerated to 15.6% in Q4, resulting in 11.3% for the full year. SkinnyPop up 8%, Dot's Pretzels up 21% — both among the fastest-growing top salty brands. The salty business gained ~40bps of share in 2025. With LesserEvil, Hershey now has the third-largest portfolio in U.S. salty snacks. CEO Tanner noted: "Customers reward space on performance and velocity... we're expanding with our customers."

International: Significant challenges with segment loss of $31.6M driven by higher commodity costs and volume declines that more than offset price realization. However, for the full year, the segment achieved 2.2% organic constant currency net sales growth with market share gains in Mexico, Brazil, and the U.K. Notably, Reese's exceeded $300 million in international net sales, recording double-digit growth outside the U.S.

Q&A Highlights

The Q&A session revealed several key insights beyond the prepared remarks:

On Cocoa & 2027 Outlook: CFO Steve Voskuil noted cocoa is hedged "above current market levels" for 2026, meaning if spot prices stay low, 2027 could see further margin expansion. He added: "If you kind of extend current market levels flat, that would suggest that we still have some upside for further deflation in 2027."

On Pricing Discipline: CEO Kirk Tanner emphasized a measured approach: "We don't take pricing lightly... The pricing we took in 2025 does not fully cover our cocoa cost inflation in 2026. So we're on a recovery path." CFO confirmed all pricing is sold in with no rollbacks planned.

On Price Elasticities: Elasticities are tracking better than expected, though management is planning for 0.8 to account for fluctuations as price changes fully roll through. The CFO noted: "While we're experiencing elasticities right now that's favorable to our original outlook, we continue to plan for around 0.8."

On SNAP Waivers: Only 2 of 12 approved states have implemented SNAP waivers for candy so far. Management called it a "manageable headwind" factored into guidance and is working with retailers on affordable price points and immediate consumption strategies.

On US vs European Elasticity: When asked why US elasticities are better than Europe's, Kirk Tanner explained: "There's more brand differentiation [in the US]... The category is affordable. It skews mainstream. 75% of our portfolio is still under $4." Europe skews premium with higher private label penetration.

On Volume Recovery: Management's goal is to return to a balanced price/volume mix by 2027. Steve Voskuil noted: "We know we've got parts in the portfolio that even with some of the macro headwinds are set up for volume growth — sweets, better-for-you, premium, the functional products."

On Capital Return: After pausing buybacks, the CFO indicated the conversation is "back on the table" given strong cash flow: "If we can't wisely invest [shareholders' money] for the future, we're gonna give it back."

On Salty Snacks Momentum: Kirk Tanner highlighted: "Dot's Pretzels really shows how you can reinvent a category and drive growth. Dot's is now the number one pretzel in the category."

On Protein Opportunity: Management signaled interest in building the protein portfolio: "It's a big white space... We're also open for those opportunities that build our portfolio." — potentially through M&A.

Key Margin Dynamics

Gross Margin: Reported gross margin of 37.0% decreased 17.0 percentage points YoY, largely due to the lap of $264.7M in derivative mark-to-market gains in Q4 2024. Adjusted gross margin of 38.3% was down 650bps, reflecting:

- Higher commodity costs (cocoa, sugar)

- Incremental tariff expenses

- Lower volume

- Inventory valuation timing headwind

Operating Margin: Adjusted operating profit margin of 17.1% was down 700bps YoY as cost inflation and increased SG&A investment offset pricing benefits and transformation savings.

What Did Management Emphasize?

CEO Kirk Tanner struck an optimistic tone:

"I want to start by expressing my confidence and enthusiasm as we enter 2026, a true inflection point on our journey towards a stronger, more ambitious future."

2026 Strategic Priorities:

- Deliver top-line growth at or above market categories (4-5% net sales growth)

- Restore margins and earnings while increasing investments for 2027-2028 growth

- Evolve strategy and organization — more details at March Investor Day

Innovation Pipeline:

- Reese's Oreo — continues to outperform expectations, production capacity increased

- Shaq-A-Licious SLAMS — multi-texture gummy with unique sensory experience

- Jolly Rancher Heat Wave — targeting bold, adventurous consumers

- SkinnyPop White Cheddar reformulation to drive penetration

- Groundbreaking innovation coming for Hershey, Dot's, and protein portfolio

Cultural Activation: 10 major seasonal/cultural moments in 2026, starting with Olympics and Valentine's Day, followed by March Madness and Easter. Kirk Tanner noted: "This is the year of Hershey... It really is an action-packed year that really celebrates these two big brands." A Milton Hershey biographical movie is set to release in fall 2026.

Management highlighted that three-quarters of their portfolio sells under $4, keeping emotional and experiential benefits accessible to consumers despite price increases.

Balance Sheet & Capital Allocation

The balance sheet reflects the LesserEvil acquisition with goodwill up $290M and intangibles up $602M. Long-term debt increased $1.5B while short-term debt decreased $1.1B, extending the maturity profile.

2026 capital expenditure guidance of $425-475M will support supply chain investments and capacity expansion.

Share Repurchases: No buybacks in Q4, but the CFO indicated capital allocation is "resetting back to normal" and the buyback conversation is "back on the table" given improving cash flow outlook. Dividend increased 6% for 2026.

Risks and Concerns

-

Commodity Inflation: Cocoa hedged above current market levels for 2026, limiting near-term benefit from recent price declines. Tariffs adding new cost pressure — though Q4 saw lower-than-expected supplier tariffs.

-

Volume Elasticity: Organic volume down 3% as consumers respond to higher prices. Management plans for 0.8 elasticity, though currently tracking better.

-

SNAP & GLP-1 Headwinds: Only 2 of 12 approved states have implemented SNAP waivers for candy, with more coming. GLP-1 adoption being closely monitored. Management called these "manageable headwinds" but acknowledged uncertainty in modeling cumulative macro effects.

-

International Struggles: Segment posted a $32M loss with -12.4% margin. Premium positioning drives higher elasticity.

-

Integration Execution: LesserEvil acquisition must deliver expected synergies to hit guidance.

Forward Catalysts

- Investor Day (March 31st): Unveiling long-term vision, portfolio strategy, and capability-building initiatives

- Q1 2026 Results (late April): First full quarter with normalized cocoa hedges

- LesserEvil Integration: Full synergy realization expected through 2026

- Gross Margin Recovery: ~400bps improvement expected as hedges roll off at better rates

- Easter Season: Key seasonal period — part of 10 major cultural activations planned for 2026

- Innovation Pipeline: Reese's Oreo production ramp, Shaq-A-Licious SLAMS, Jolly Rancher Heat Wave launches

Bottom Line

Hershey delivered a clean beat in Q4 2025, with the 22% EPS surprise driven by better-than-feared margin performance despite persistent commodity headwinds. The 2026 guidance of 30-35% adjusted EPS growth signals management confidence in margin recovery as cocoa hedges roll off at more favorable levels.

CFO Steve Voskuil noted: "We have very good visibility into our cost basket... a significant recovery is projected to begin in the second quarter."

Key watch items: International segment turnaround, volume elasticity trends, and LesserEvil integration execution. The stock's move to 52-week highs suggests investors are buying the recovery story. The March 31st Investor Day will be critical for validating the long-term growth thesis.

Related Research: