Earnings summaries and quarterly performance for HERSHEY.

Executive leadership at HERSHEY.

Kirk Tanner

President and Chief Executive Officer

Deepak Bhatia

Senior Vice President, Chief Technology Officer

James Turoff

Senior Vice President, General Counsel and Secretary

Jason Reiman

Senior Vice President, Chief Supply Chain Officer

Steven Voskuil

Senior Vice President, Chief Financial Officer

Board of directors at HERSHEY.

Barry Nalebuff

Director

Chris Brandt

Director

Cordel Robbin-Coker

Director

Deirdre Mahlan

Director

Harold Singleton

Director

Huong Maria Kraus

Director

Kevin Ozan

Director

Marie Quintero-Johnson

Director

Mary Kay Haben

Lead Independent Director

Timothy Curoe

Director

Research analysts who have asked questions during HERSHEY earnings calls.

Alexia Howard

AllianceBernstein

8 questions for HSY

Andrew Lazar

Barclays PLC

8 questions for HSY

David Palmer

Evercore ISI

8 questions for HSY

Leah Jordan

Goldman Sachs Group, Inc.

8 questions for HSY

Michael Lavery

Piper Sandler & Co.

8 questions for HSY

Peter Galbo

Bank of America

8 questions for HSY

Robert Moskow

TD Cowen

8 questions for HSY

Scott Marks

Jefferies

8 questions for HSY

Jim Salera

Stephens Inc.

7 questions for HSY

Max Gumport

BNP Paribas

7 questions for HSY

Chris Carey

Wells Fargo Securities

4 questions for HSY

Christopher Carey

Wells Fargo & Company

4 questions for HSY

John Baumgartner

Mizuho Securities

4 questions for HSY

Megan Clapp

Morgan Stanley

4 questions for HSY

Tom Palmer

JPMorgan Chase & Co.

4 questions for HSY

Bingqing Zhu

Redburn Atlantic

3 questions for HSY

Matt Smith

Bank of America

2 questions for HSY

Megan Alexander

Morgan Stanley

2 questions for HSY

James Salera

Stephens Inc.

1 question for HSY

Kenneth Goldman

JPMorgan Chase & Co.

1 question for HSY

Max Andrew Gumport

BNP Paribas

1 question for HSY

Megan Christine Alexander

Morgan Stanley

1 question for HSY

Megan Klatt

Morgan Stanley

1 question for HSY

Peter Graham

UBS

1 question for HSY

Peter Grom

UBS Group

1 question for HSY

Thomas Palmer

Citigroup Inc.

1 question for HSY

Recent press releases and 8-K filings for HSY.

- The snacks business delivered 18% growth in Q4 on double-digit volume gains, with both salty and sweet portfolios driving top-line momentum heading into 2026.

- Pricing taken in 2025 does not fully offset 2026 cocoa cost inflation, and the company has locked in 10% price increases for 2026 while planning for an elasticity of ~0.8 (favorable so far).

- 2026 guidance assumes stable broad commodity costs, targeting 41% gross margin, with Q1 margin pressure from higher-cost inventory and a tariff carryover followed by a Q2 inflection and double-digit EPS growth through year-end; marketing investment is set to rise double-digits.

- Cocoa markets are expected to move into a supply surplus in 2025-26, with Hershey hedged above current levels, implying further deflationary benefit in 2027.

- With tariffs and high cocoa costs abating, capital allocation is normalizing: CapEx is returning to typical levels, free cash flow will fund both business investments and potential share repurchases.

- Heading into 2026, Hershey expects 4–5% net sales growth and meaningful earnings recovery.

- In Q4 2025, the snack business grew 18% with double-digit volume growth, driven by both sweet and salty portfolios.

- Pricing actions, initiated mid-September 2025, aim to partially recover cocoa inflation while keeping 75% of products under $4 to maintain affordability.

- The 2026 cocoa hedges are above current market prices, limiting near-term cost relief but offering potential for further deflation tailwinds in 2027.

- Hershey plans a double-digit increase in brand investment, including R&D, innovation, and in-store activation, as multi-year initiatives to sustain growth.

- Heading into 2026, Hershey expects 4%–5% net sales growth and a meaningful earnings recovery on the back of a resilient portfolio.

- Cocoa markets are moving into deflationary territory, but Hershey’s 2026 cocoa hedges remain above spot; further cost tailwinds may materialize in 2027 if current prices hold.

- The company plans a double-digit increase in brand investment in 2026—including R&D, marketing, and in-store activation—to drive household penetration and sustain top-line momentum.

- Q1 2026 will see margin pressure from higher-cost inventory and tariffs, with a profitability inflection in Q2 and double-digit EPS growth expected for the balance of the year.

- In Q4 2025, organic sales grew 3% in confection, mid-single digits in salty snacks, and declined low-single digits internationally; all segments achieved double-digit EBIT growth.

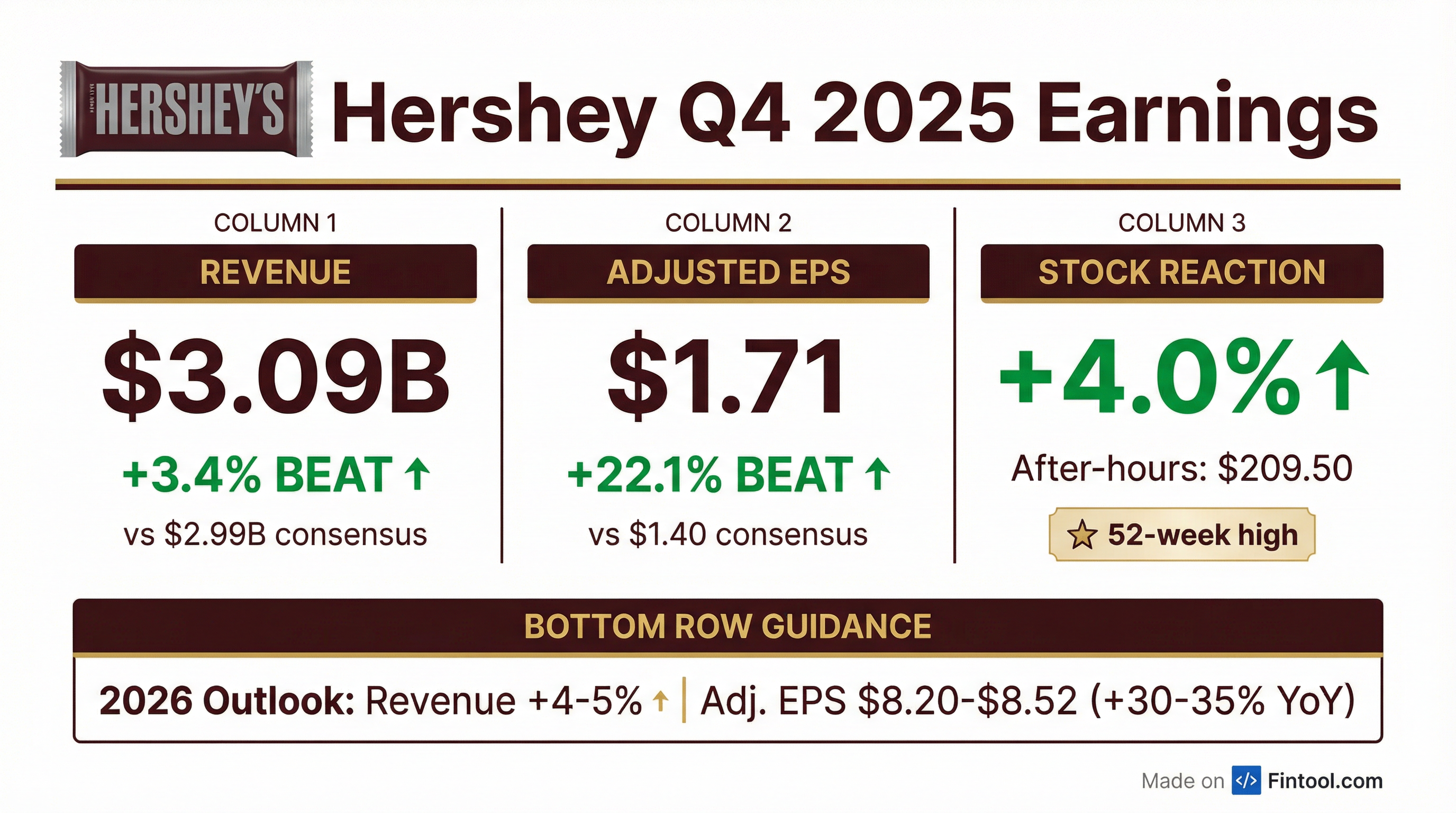

- Hershey’s consolidated Q4 net sales rose by 7% to $3.1 billion, with full-year net sales up 4.4% to $11.7 billion.

- North America Confection sales grew 5.3% in Q4 with 10 pts net price realization offset by 5 pts volume decline; Salty Snacks surged 28%, driven by organic growth of 18.2% and the LesserEvil acquisition.

- Q4 adjusted gross margin was 38.3%, down 650 bps year-over-year due to commodity inflation and tariffs, partially offset by pricing and productivity gains.

- For 2026, Hershey projects 4–5% net sales growth, ~400 bps margin recovery, 30–35% adjusted EPS growth, and a 6% dividend increase.

- Hershey delivered Q4 net sales of $3.1 billion (+7%) and full-year net sales of $11.7 billion (+4.4%), with organic constant-currency growth of 4.2% for 2025.

- Q4 adjusted gross margin was 38.3%, down 650 bps year-over-year due to commodity inflation and tariffs, but ahead of internal expectations.

- The company expects 2026 net sales growth of 4–5% (organic 2.5–3.5%), ~10 pp net price realization, ~400 bps gross margin recovery, and 30–35% adjusted EPS growth.

- Strategic focus includes expanding innovation and cultural activations to drive top-line growth, delivering $230 million in incremental efficiency savings, and investing in R&D and brand building.

- Capital allocation highlights: acquired LesserEvil in November 2025, full-year capex of $455 million, raised the dividend by 6%, and maintained share repurchase capacity.

- Hershey’s consolidated net sales rose 7% in Q4 to $3.1 billion and full‐year net sales grew 4.4% to $11.7 billion.

- Segment performance in Q4: North America Confectionery +5.3%, Salty Snacks +28%, International +0.4%.

- Adjusted gross margin declined 650 bp to 38.3% in Q4 due to cocoa inflation and tariffs; company expects roughly 400 bp of margin recovery in 2026.

- 2026 outlook: net sales growth of 4–5%, adjusted EPS up 30–35%, dividend raised by 6%, and continued share repurchase capacity (~$470 million).

- Q4 net sales reached $3,091.0 million, up 7.0%, with organic constant-currency growth of 5.7%.

- Q4 adjusted EPS was $1.71, a 36.4% decline versus Q4 2024.

- Full-year 2025 net sales were $11,692.6 million, up 4.4%, and adjusted EPS was $6.31, down 32.7%.

- 2026 guidance: net sales growth of 4%–5%, adjusted EPS of $8.20–$8.52 (up 30%–35%) and reported EPS of $7.77–$8.19 (up 79%–89%).

- Q4 2025 consolidated net sales of $3,091.0 M (+7.0%; organic +5.7%), reported EPS $1.57 (-59.9%), adjusted EPS $1.71 (-36.4%)

- FY 2025 consolidated net sales of $11,692.6 M (+4.4%; organic +4.2%), reported EPS $4.34 (-60.3%), adjusted EPS $6.31 (-32.7%)

- 2026 outlook calls for net sales growth of 4–5% (≈150 bps benefit from acquisitions; FX neutral), reported EPS of $7.77–$8.19 (+79–89%), and adjusted EPS of $8.20–$8.52 (+30–35%)

- The Hershey Company closed its acquisition of LesserEvil, adding a high-growth organic snack brand and manufacturing capacity to its portfolio.

- The deal broadens Hershey’s better-for-you and salty snack offerings, with its salty portfolio growing 1.5x faster in 2024 than the prior three years.

- LesserEvil’s leadership team will remain in place, ensuring continued production with the same organic ingredients and accelerated go-to-market capabilities.

- The combined organizations will focus on category-leading growth and leveraging insights to deliver the right products at the right time.

- Hershey, with over 20,000 employees, operations in approximately 70 countries, and annual revenues exceeding $11.2 billion, strengthens its snack portfolio through this acquisition.

- Hershey reported strong Q3 sales led by demand for healthier, zero-sugar and salty snack brands, with SkinnyPop and Dot’s Pretzels volumes up 11%.

- The company raised its 2025 net sales growth forecast to ~3% and increased the lower end of its adjusted EPS target to $5.90 (from $5.81).

- Despite sales momentum, Hershey warned profits could decline by up to 37% due to rising tariffs and cost pressures, with tariff expenses projected at $160 M–$170 M.

- Q3 adjusted EPS was $1.30, beating expectations, while GAAP net income fell to $276.3 M ($1.36/share) versus $446.3 M ($2.20/share) a year ago.

Quarterly earnings call transcripts for HERSHEY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more