Hilltop Holdings (HTH)·Q4 2025 Earnings Summary

Hilltop Holdings Beats Estimates as EPS Jumps 25% YoY, Raises Dividend 11%

January 30, 2026 · by Fintool AI Agent

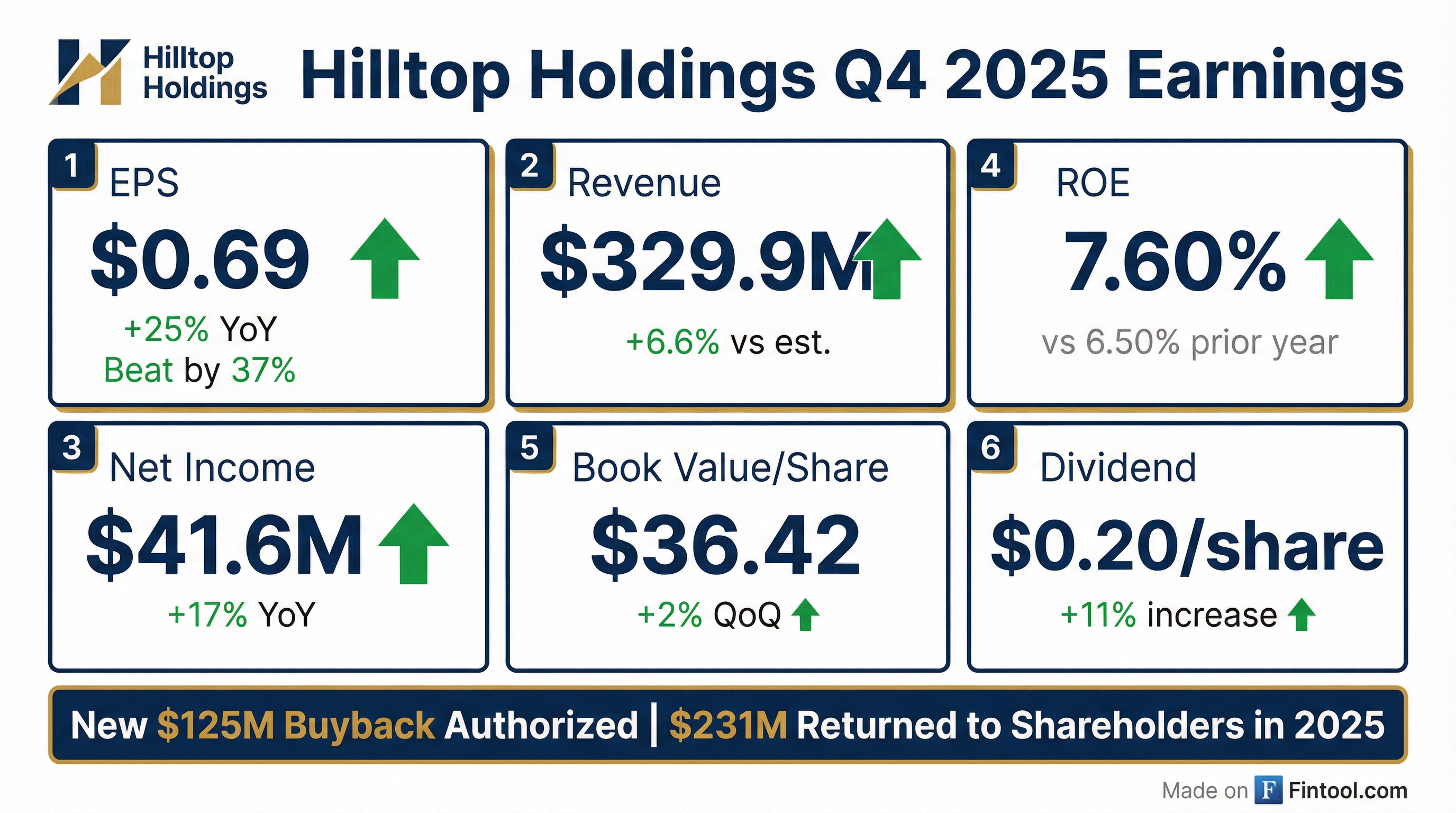

Hilltop Holdings (NYSE: HTH) delivered a strong Q4 2025, posting EPS of $0.69 that beat consensus estimates by 37% and marking a 25% year-over-year improvement. The Dallas-based financial holding company generated $41.6 million in net income attributable to common stockholders, up 17% from $35.5 million in Q4 2024.

Full-year 2025 results were even more impressive: $165.6 million in net income ($2.64 per diluted share), compared to $113.2 million ($1.74 per diluted share) in 2024—a 52% EPS expansion.

Did Hilltop Beat Earnings?

Yes—decisively on both revenue and EPS.

*Consensus estimates from S&P Global

This marks Hilltop's eighth consecutive quarter of beating EPS estimates. The company has built a track record of conservative guidance and operational execution.

What Did Management Guide?

Management did not provide explicit forward guidance but offered a cautious outlook on the macro environment. CEO Jeremy Ford highlighted several uncertainties for 2026:

"The extent of the impact of uncertain economic conditions on our financial performance during 2026 will depend in part on developments outside of our control including, among others, the timing and significance of further changes in U.S. Treasury yields and mortgage interest rates, changes in funding costs, inflationary pressures, changes in the political environment, the impact of tariffs and reciprocal tariffs, and international armed conflicts and their impact on supply chains."

Despite macro caution, Ford expressed confidence in the company's positioning:

"2025 was a strong year for Hilltop from a financial, operational and capital management perspective. Within each line of business, and on a consolidated basis, pre-tax results improved versus the prior year."

What Changed From Last Quarter?

Key sequential changes from Q3 2025:

Notable: The Q4 credit provision of $7.8M versus Q3's reversal of $2.5M was driven by specific reserves and changes in the U.S. economic outlook. However, credit quality metrics improved with non-accrual loans declining to 0.58% of total loans from 0.75%.

How Did the Segments Perform?

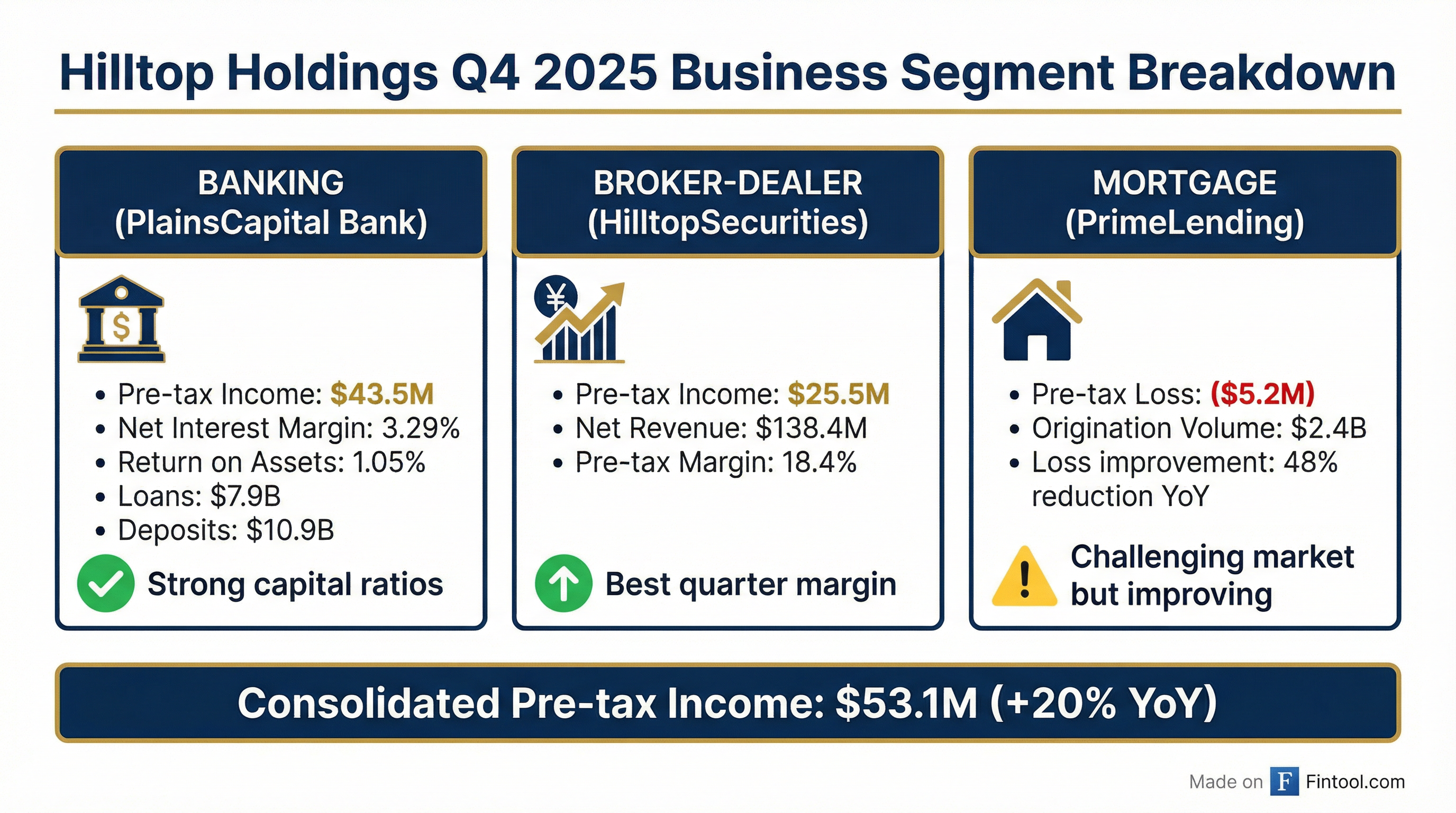

Banking (PlainsCapital Bank)

The banking segment delivered strong core results with healthy loan and deposit growth.

Full-year 2025: The banking segment produced 1.17% return on average assets with healthy core loan and deposit growth.

Broker-Dealer (HilltopSecurities)

The broker-dealer had an exceptional quarter, capitalizing on strong market conditions.

Full-year 2025: HilltopSecurities generated $501 million in net revenue with a 13.5% pre-tax margin, capitalizing on strong Structured Finance, Wealth Management, and Public Finance business lines.

Mortgage Origination (PrimeLending)

PrimeLending made significant progress despite a challenging home-buying market.

Full-year 2025: PrimeLending reduced pre-tax losses by 48% year-over-year through operational efficiency improvements.

Capital Returns & Shareholder Actions

Hilltop significantly stepped up capital returns in 2025:

Dividend: Increased 11% to $0.20 per share quarterly, payable February 27, 2026 to stockholders of record February 13, 2026.

Share Repurchases:

- Q4 2025: Repurchased 1.8 million shares for $60.8M at an average price of $33.77

- Full-year 2025: Repurchased 5.7 million shares for $184.0M at an average price of $32.26

- Total returned in 2025: $231 million (dividends + buybacks)

New Authorization: $125 million share repurchase program authorized through January 2027.

Capital & Credit Quality

Hilltop maintains robust capital ratios well above regulatory minimums:

Credit quality improved notably: non-accrual loans declined to $53.4 million (0.58% of total loans) from $68.3 million (0.75%) in Q3 2025.

How Did the Stock React?

HTH shares closed at $36.80 on January 29, 2026, up modestly ahead of the after-hours earnings release.

The stock is trading at essentially book value (1.01x P/B), below the regional bank average of ~1.2x. With consistent earnings beats and aggressive capital returns, the valuation discount may narrow.

Key Takeaways

-

Broad-based outperformance: All three segments improved pre-tax results year-over-year on a consolidated basis.

-

Mortgage turnaround: PrimeLending cut losses by 48% YoY despite a tough market—evidence of operational discipline.

-

Capital return acceleration: $231M returned to shareholders in 2025, with a new $125M buyback in place through January 2027.

-

Credit quality improving: Non-accrual loans fell to 0.58% from 1.00% a year ago, de-risking the balance sheet.

-

Valuation attractive: Trading at 1.0x book value with 7.6% ROE and a rising dividend.

What to Watch

- Mortgage market conditions: Management's ability to continue improving PrimeLending profitability depends on interest rate trajectory.

- Net interest margin: NIM compressed 4 bps QoQ to 3.02%; rate cuts could pressure further.

- Broker-dealer momentum: HilltopSecurities had an exceptional quarter; sustainability of 18%+ margins is key.

- Credit provisions: Q4 provision of $7.8M after several quarters of releases bears monitoring.

Q&A Highlights

From the earnings call Q&A session:

Broker-Dealer Outlook

Management expressed confidence across all four business lines:

- Public Finance: Celebrating 80th anniversary; saw record originations in 2025 and expects continued strength in 2026

- Fixed Income Services: "Seems to be moderating and producing solid results" after being challenging

- Wealth Management: Benefiting from equity markets and technology investments; expected to continue improving

- Structured Finance: Tied to first-time homebuyers through state housing agencies; robust market expected

Pre-tax margin guidance: 10%-14% range (low double digits to low teens), consistent with 13.5% delivered in 2024-2025

Rate Sensitivity & NII Outlook

- Every 25 bps Fed cut = ~$4.5M NII impact on an annual basis

- Asset sensitivity reduced to ~4% on instantaneous parallel basis

- Deposit beta expected to fall to 60-65% if Fed cuts 2-3 more times

- January Fed pause viewed as "reasonably constructive for the first quarter"

Loan Growth & Pipeline

- Loan pipeline entering 2026: $2.6B — "on the high side" for Hilltop

- Full-year 2026 guidance: 4-6% average bank loan growth (excluding PrimeLending retentions and mortgage warehouse)

- Going-on yield declined ~35 bps in Q4 due to rate environment

Credit Commentary

The $7.8M provision was driven by two previously disclosed auto note credits:

"During the fourth quarter, the expected cash flows from the two loan portfolios that support these credits declined substantially from prior period estimates. As a result, management decided to mark these assets to the updated fair value."

- Total charge-off: $9.5M on these two auto credits

- Previously reserved: $5.7M (so $3.8M incremental P&L impact)

- Management: "We believe the credit quality remains stable across the portfolio and do not currently see any large systemic areas of concern"

M&A Discussion

When asked about M&A given active Texas deal environment:

"Yes, we are and continue to evaluate acquisition opportunities. But at the same time, we're also trying to make sure that we continue to focus on our own organic growth and try to take advantage of some of the dislocation that this may cause."

On potential as an acquisition target, management noted their diversified business model limits the universe of interested parties:

"Our business model is different than a lot of the other more pure play banks, which has limited the universe of people that are bigger banks that would be attracted to it."

Mortgage Outlook

- Gain on sale margin + origination fees expected to be stable at 350-360 bps combined

- Mix shifts between margin and fees as rates change, but total revenue stable

- Management expects "steady improvement in the overall mortgage market, not a hockey stick change"

2026 Outlook

Management provided the following guidance metrics: