Earnings summaries and quarterly performance for Hilltop Holdings.

Executive leadership at Hilltop Holdings.

Jeremy Ford

Chairman, President and Chief Executive Officer

Bradley Winges

President and Chief Executive Officer of Hilltop Securities

Corey Prestidge

Executive Vice President, General Counsel and Secretary

Darren Parmenter

Executive Vice President, Chief Administrative Officer

Keith Bornemann

Executive Vice President, Chief Accounting Officer

Stephen Thompson

President and Chief Executive Officer of PrimeLending

William Furr

Executive Vice President, Chief Financial Officer

Board of directors at Hilltop Holdings.

Carl Webb

Director

Hill Feinberg

Director

Jonathan Sobel

Director

Kenneth Russell

Director

Lee Lewis

Director

Rhodes Bobbitt

Director

Robert Nichols

Director

Robert Taylor

Director

Taylor Crandall

Lead Independent Director

Thomas Nichols

Director

Research analysts who have asked questions during Hilltop Holdings earnings calls.

Michael Rose

Raymond James Financial, Inc.

6 questions for HTH

Woody Lay

Keefe, Bruyette & Woods (KBW)

5 questions for HTH

Jordan Ghent

Stephens Inc.

3 questions for HTH

Wood Lay

Keefe, Bruyette & Woods

3 questions for HTH

Matt Olney

Stephens Inc.

2 questions for HTH

Stephen Scouten

Piper Sandler & Co.

2 questions for HTH

Andrew Gorczyca

Piper Sandler

1 question for HTH

Jordan Gantt

Stephens Inc.

1 question for HTH

Jordan Jen

Stephens Inc.

1 question for HTH

Tim Mitchell

Raymond James Financial

1 question for HTH

Timothy Mitchell

Raymond James

1 question for HTH

Recent press releases and 8-K filings for HTH.

- Hilltop Holdings reported Q4 2025 net income of $42 million ($0.69 per diluted share), contributing to a full-year 2025 net income of $166 million, a 46% increase over the prior year.

- The company maintained strong capital levels with a Common Equity Tier One capital ratio of 19.7% and a Tangible Book Value per share of $31.83.

- PlainsCapital Bank's net interest margin expanded to 329 basis points in Q4 2025, with $43.5 million in pre-tax income, while Hilltop Securities generated $26 million in pre-tax income on $138 million in net revenues.

- Hilltop returned $229 million to stockholders in 2025 through share repurchases and common dividends, including $61 million in repurchases and $11 million in dividends in Q4 2025.

- For 2026, the company projects full-year average bank loan growth of 4%-6% and expects Hilltop Securities' pre-tax margin to be in the 10%-14% range.

- Hilltop Holdings reported net income of approximately $42 million or $0.69 per diluted share for Q4 2025, and $165.6 million or $2.64 per diluted share for the full year 2025, marking a 46% increase over the prior year's net income.

- The company returned a total of $229 million to stockholders in 2025 through share repurchases and common dividends, including $11 million in dividends and $61 million in share repurchases during Q4 2025. The Common Equity Tier 1 capital ratio stood at 19.7%, and tangible book value per share increased to $31.83.

- PlainsCapital Bank's net interest margin expanded to 329 basis points in Q4 2025, contributing to a consolidated net interest margin of 302 basis points, a 30 basis point increase from Q4 2024. Average HFI loans grew by 1.8% in Q4 2025, with an expected full year 2026 average bank loan growth of 4%-6%.

- Hilltop Securities achieved a 13.5% pre-tax margin on net revenue of $501 million for the full year 2025, and an 18% pretax margin on net revenues of $138 million in Q4 2025. The pre-tax margin for Hilltop Securities is expected to range between 10%-14% for 2026.

- Net charge-offs for Q4 2025 totaled $11.5 million, primarily due to $9.5 million related to two stressed auto note credits, with full year 2025 net charge-offs equating to $16.9 million.

- Hilltop Holdings (HTH) reported Q4 2025 net income of approximately $42 million, or $0.69 per diluted share, with full-year 2025 net income reaching $165.6 million, or $2.64 per diluted share, representing a 46% increase over the prior year.

- The company maintained a Common Equity Tier One capital ratio of 19.7% and saw its Tangible Book Value per share increase by $0.60 to $31.83 in Q4 2025.

- Hilltop returned $229 million to stockholders in 2025 through share repurchases and common dividends, including $11 million in dividends and $61 million in share repurchases during Q4 2025.

- PlainsCapital Bank's net interest margin expanded to 329 basis points in Q4 2025, while Hilltop Securities achieved a 13.5% pre-tax margin on net revenue of $501 million for the full year 2025.

- For 2026, the company anticipates full-year average bank loan growth of 4%-6% and expects Hilltop Securities' pre-tax margin to be in the low double digits to low teens (10%-14%).

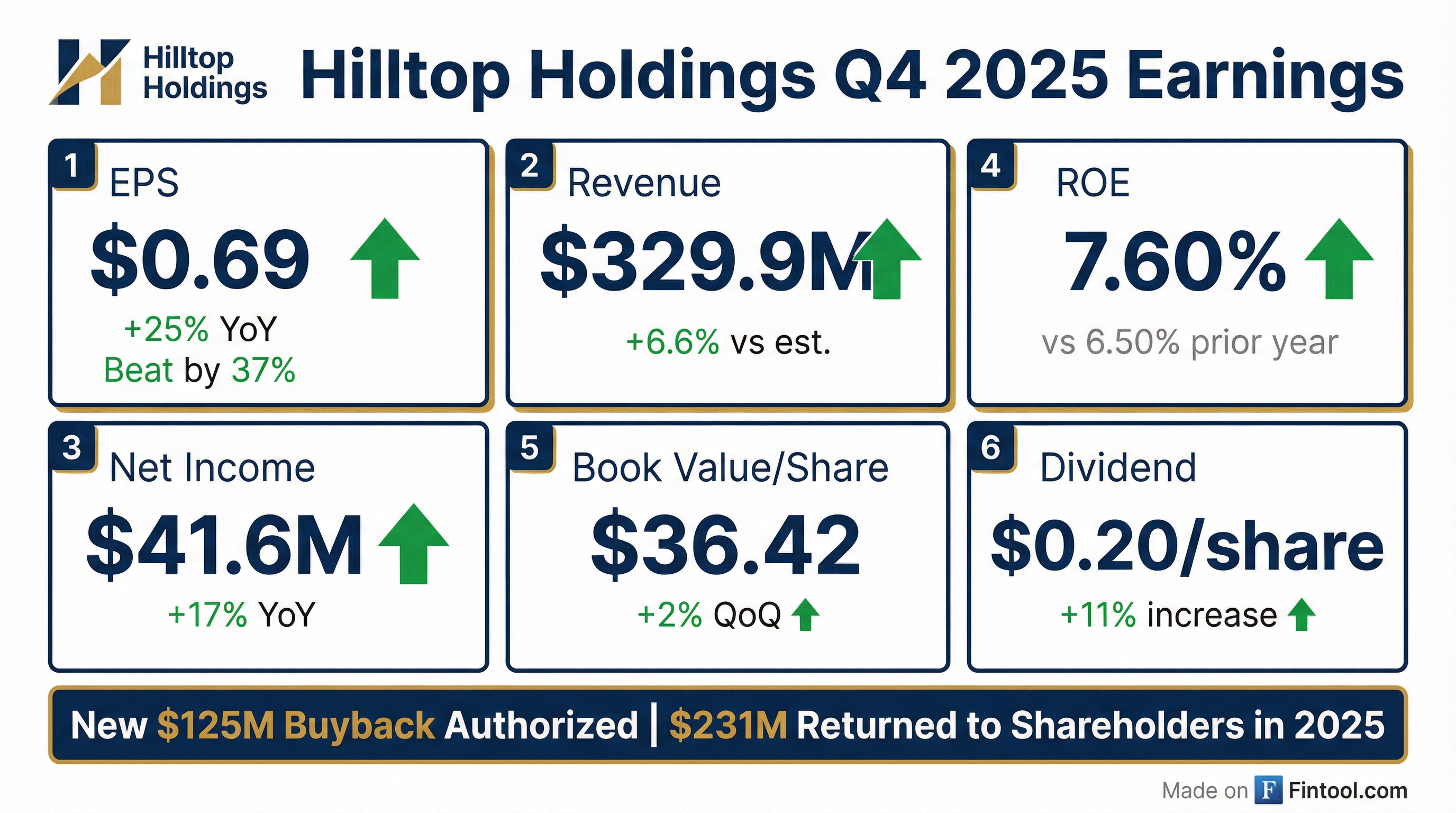

- Hilltop Holdings Inc. reported income attributable to common stockholders of $41.6 million, or $0.69 per diluted share, for the fourth quarter of 2025, compared to $35.5 million, or $0.55 per diluted share, for the fourth quarter of 2024. For the full year 2025, income attributable to common stockholders was $165.6 million, or $2.64 per diluted share, up from $113.2 million, or $1.74 per diluted share, for the full year 2024.

- The Board of Directors declared a quarterly cash dividend of $0.20 per common share, representing an 11% increase from the prior quarter.

- A new stock repurchase program was authorized through January 2027, allowing for the repurchase of up to $125.0 million of outstanding common stock. During 2025, Hilltop repurchased 5,705,205 shares for $184.0 million.

- For the fourth quarter of 2025, Hilltop's consolidated annualized return on average assets was 1.09% and return on average stockholders’ equity was 7.60%. PrimeLending reduced pre-tax losses by 48% in 2025, and HilltopSecurities achieved $501 million in net revenue with a 13.5% pre-tax margin in 2025.

- Hilltop Holdings Inc. reported Income Attributable to Hilltop of $41.6 million and Diluted EPS of $0.69 for Q4 2025, with Total Revenue reaching $329.9 million. For the full year 2025, Income Attributable to Hilltop was $165.6 million and Diluted EPS was $2.64.

- The company returned $71.8 million to stockholders in Q4 2025 through $11.0 million in dividends and $60.8 million in share repurchases.

- Key segments showed varied performance in Q4 2025: PlainsCapital Bank generated $43.5 million in pre-tax income, HilltopSecurities generated $25.5 million in pre-tax income, while PrimeLending incurred a $5.2 million pre-tax loss.

- For 2026, Hilltop Holdings expects full year average Bank loans to increase 4% – 6% and full year average Bank deposits to increase 2% – 4%, with Net Interest Income (NII) anticipated to be relatively stable with 2025 levels (-3% – 1%).

- Hilltop Holdings Inc. reported income attributable to common stockholders of $41.6 million, or $0.69 per diluted share, for the fourth quarter of 2025, and $165.6 million, or $2.64 per diluted share, for the full year 2025.

- The Board of Directors declared a quarterly cash dividend of $0.20 per common share, an 11% increase from the prior quarter, and authorized a new stock repurchase program of up to $125.0 million through January 2027.

- For the fourth quarter of 2025, Hilltop's consolidated annualized return on average assets was 1.09% and return on average stockholders' equity was 7.60%. Book value per common share increased to $36.42 at December 31, 2025.

- For the full year 2025, HilltopSecurities delivered $501 million in net revenue with a pre-tax margin of 13.5%, and PrimeLending reduced its pre-tax losses by 48%.

- Net income attributable to Hilltop Holdings was $45.8 million, or $0.74 per diluted share, for Q3 2025, representing a 27% increase from Q2 2025 and a 54% increase from Q3 2024.

- The company returned $66.3 million to stockholders in Q3 2025, comprising $11.2 million in dividends and $55.1 million in share repurchases.

- PlainsCapital Bank generated $54.7 million in pre-tax income, and HilltopSecurities generated $26.5 million in pre-tax income during Q3 2025, while PrimeLending incurred a $7.2 million pre-tax loss.

- Noninterest expenses increased to $271.9 million in Q3 2025 from $264.3 million in Q3 2024, with the company's efficiency ratio at 82.3%.

- The company's tangible book value per share increased to $31.23 as of September 30, 2025, and its Common Equity Tier 1 Risk-Based Ratio was 20.33%.

- Hilltop Holdings reported net income of approximately $46 million or $0.74 per diluted share for the third quarter of 2025, with a return on average assets of 1.2% and return on average equity of 8.35%.

- PlainsCapital Bank generated $55 million of pre-tax income with continued net interest margin expansion and strong core loan and deposit growth. Hilltop Securities Inc. produced $26.5 million in pre-tax income from robust net revenue growth across all business lines, achieving an 18% pre-tax margin. Conversely, PrimeLending reported a pre-tax loss of $7 million due to a subdued mortgage market.

- The company maintains strong capital levels, with a common equity tier one capital ratio of 20% and tangible book value per share increasing to $31.23. Hilltop returned $11 million to stockholders through dividends and repurchased $55 million in shares during the quarter, indicating a more consistent approach to buybacks.

- Credit quality remained strong, with the allowance for credit losses declining by $2.8 million to $95 million, resulting in a coverage ratio of ACL to loans HFI of 1.16%. Net charge-offs for the quarter were $282,000 or one basis point of the overall loan portfolio, and management does not anticipate significant systemic risk.

- Management expects net interest income (NII) levels to remain relatively stable over the coming quarters, with modest downward pressure in Q1 2026 due to seasonal mortgage production weakness. Full-year average total loans are projected to increase 0% to 2% from 2024 levels.

- Hilltop Holdings reported net income of approximately $46 million or $0.74 per diluted share for Q3 2025, achieving a return on average assets of 1.2% and return on average equity of 8.35%.

- PlainsCapital Bank generated $55 million of pre-tax income with a seven basis point increase in net interest margin, while PrimeLending recorded a pre-tax loss of $7 million due to a subdued mortgage market.

- Hilltop Securities Inc. delivered a strong quarter with $26.5 million in pre-tax income on $144.5 million of net revenues, resulting in an 18% pre-tax margin driven by robust growth across all business lines.

- The company maintained strong capital levels with a common equity tier one capital ratio of 20% and increased tangible book value per share to $31.23. Hilltop returned $11 million to stockholders through dividends and repurchased $55 million in shares during the period.

- The allowance for credit losses declined by $2.8 million to $95 million, reflecting improved asset quality and stronger economic conditions, with a coverage ratio of ACL to loans HFI of 1.16%.

- Hilltop Holdings reported net income of $46,000,000, or $0.74 per diluted share, for Q3 2025, with a return on average assets of 1.2% and return on average equity of 8.35%.

- PlainsCapital Bank achieved $55,000,000 in pretax income, driven by a seven basis point increase in net interest margin and 6% linked-quarter core deposit growth. Hilltop Securities delivered $26,500,000 in pretax income on $144,500,000 in net revenues, while PrimeLending recorded a $7,000,000 pretax loss due to a dampened home buying market.

- The company maintained a strong common equity Tier one capital ratio of 20% and increased tangible book value per share by $0.67 to $31.23. Hilltop returned $11,000,000 to stockholders through dividends and repurchased $55,000,000 in shares, indicating a more consistent approach to buybacks.

- The allowance for credit losses declined by $2,800,000 to $95,000,000, with net charge-offs at $282,000. Management anticipates one additional 25 basis point rate cut in 2025 and two more in 2026, expecting net interest income to remain relatively stable.

Quarterly earnings call transcripts for Hilltop Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more