Earnings summaries and quarterly performance for HAWTHORN BANCSHARES.

Executive leadership at HAWTHORN BANCSHARES.

Board of directors at HAWTHORN BANCSHARES.

DT

David T. Turner

Detailed

Chairman

DT

Douglas T. Eden

Detailed

Director

FE

Frank E. Burkhead

Detailed

Director

GS

Gus S. Wetzel, III

Detailed

Director

JD

Jonathan D. Holtaway

Detailed

Director

JL

Jonathan L. States

Detailed

Director

KL

Kevin L. Riley

Detailed

Director

PD

Philip D. Freeman

Detailed

Director

SM

Shawna M. Hettinger

Detailed

Director

Research analysts covering HAWTHORN BANCSHARES.

Recent press releases and 8-K filings for HWBK.

Hawthorn Bancshares Reports Fourth Quarter and Full-Year 2025 Results

HWBK

Earnings

Dividends

Share Buyback

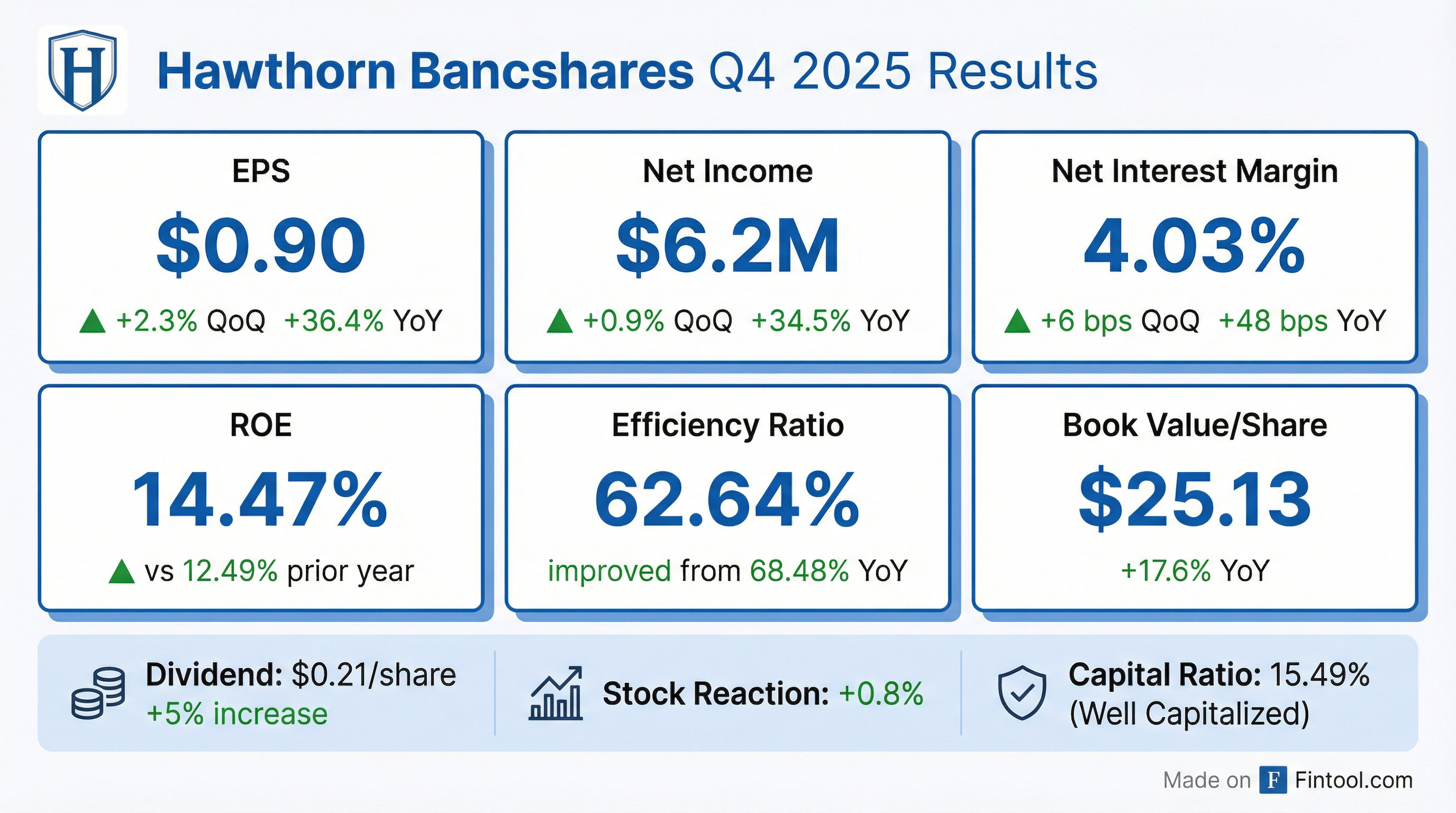

- Hawthorn Bancshares reported net income of $6.2 million, or $0.90 per diluted share, for the fourth quarter of 2025, and net income of $23.8 million, or $3.43 per diluted share, for the full year ended December 31, 2025.

- The company's Board of Directors approved a quarterly cash dividend of $0.21 per common share, representing an increase of $0.01, or 5%, from the previous quarterly dividend.

- Loans held for investment decreased by $27.2 million, or 1.8%, to $1.49 billion at December 31, 2025, compared to September 30, 2025, while total deposits increased by $28.2 million, or 1.9%, to $1.55 billion over the same period.

- The net interest margin (FTE) improved to 4.03% for the fourth quarter of 2025, up from 3.97% in the prior quarter, and the efficiency ratio for the full year 2025 improved to 63.41% from 67.92% in 2024.

Jan 28, 2026, 10:00 PM

Hawthorn Bancshares Reports Q4 and Full-Year 2025 Results, Increases Dividend

HWBK

Earnings

Dividends

Share Buyback

- Hawthorn Bancshares reported net income of $6.2 million and diluted EPS of $0.90 for the fourth quarter of 2025, and net income of $23.8 million and diluted EPS of $3.43 for the full year ended December 31, 2025.

- The Board of Directors approved an increase in the quarterly cash dividend to $0.21 per common share, up $0.01 or 5% from the previous dividend, payable on April 1, 2026.

- For the full year 2025, the company's efficiency ratio improved to 63.41% from 67.92% in 2024, and the net interest margin (FTE) increased to 3.89% from 3.41% in 2024.

- As of December 31, 2025, loans held for investment were $1.49 billion and deposits totaled $1.55 billion.

- The company repurchased 100,358 common shares during 2025, with $8.4 million remaining available for share repurchases as of December 31, 2025.

Jan 28, 2026, 9:36 PM

Hawthorn Bancshares Reports Third Quarter 2025 Results

HWBK

Earnings

Dividends

Share Buyback

- Hawthorn Bancshares reported net income of $6.1 million for the third quarter of 2025, an increase of 34.1% from the prior year quarter, with diluted earnings per share (EPS) of $0.88.

- The net interest margin (FTE) improved to 3.97% in Q3 2025, compared to 3.36% in Q3 2024, and the efficiency ratio improved to 62.30% from 66.23% in the prior year quarter.

- Loans increased $51.1 million, or 3.5%, and deposits increased $7.9 million, or 0.5%, compared to the prior quarter.

- The company's Board of Directors approved a quarterly cash dividend of $0.20 per common share, payable January 1, 2026.

Oct 29, 2025, 9:38 PM

Hawthorn Bancshares Reports Strong Q3 2025 Results and Declares Dividend

HWBK

Earnings

Dividends

Share Buyback

- Hawthorn Bancshares, Inc. reported net income of $6.1 million and diluted EPS of $0.88 for the third quarter of 2025, representing a 34.1% and 33% improvement, respectively, from the prior year quarter.

- The company's net interest margin (FTE) improved to 3.97% in Q3 2025, compared to 3.89% for the prior quarter and 3.36% for the prior year quarter.

- Loans held for investment increased by $51.1 million (3.5%) to $1.51 billion as of September 30, 2025, compared to the prior quarter.

- The Board of Directors approved a quarterly cash dividend of $0.20 per common share, payable January 1, 2026, to shareholders of record on December 15, 2025.

- Hawthorn Bancshares maintained a total risk-based capital ratio of 14.90% and repurchased 90,466 common shares totaling $2.5 million during the first nine months of 2025.

Oct 29, 2025, 9:07 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more