Intercontinental Exchange (ICE)·Q4 2025 Earnings Summary

ICE Posts Record 20th Year as Energy Trading and Data Services Surge

February 5, 2026 · by Fintool AI Agent

Intercontinental Exchange delivered a clean beat across the board in Q4 2025, capping its 20th consecutive year of record revenues with strong momentum in energy trading and data services. Net revenues of $2.50B grew 8% year-over-year, while adjusted EPS of $1.71 topped consensus by 6.4%. The stock rose 3% in after-hours trading.

CEO Jeff Sprecher highlighted the durability of ICE's "all-weather" business model: "Across our exchanges, fixed income, and mortgage technology platforms, we continued to modernize critical financial infrastructure leveraging best in class technology and automation."

Did ICE Beat Earnings?

Yes — ICE beat on both revenue and EPS, extending its streak of consistent execution.

The beat was driven by record volumes across the exchange complex, particularly in energy derivatives, and continued scaling of data services.

Beat/Miss History (Last 8 Quarters)

ICE has beaten EPS estimates in 7 of the last 8 quarters, demonstrating consistent execution:

Data from S&P Global

What Drove the Quarter?

Segment Performance

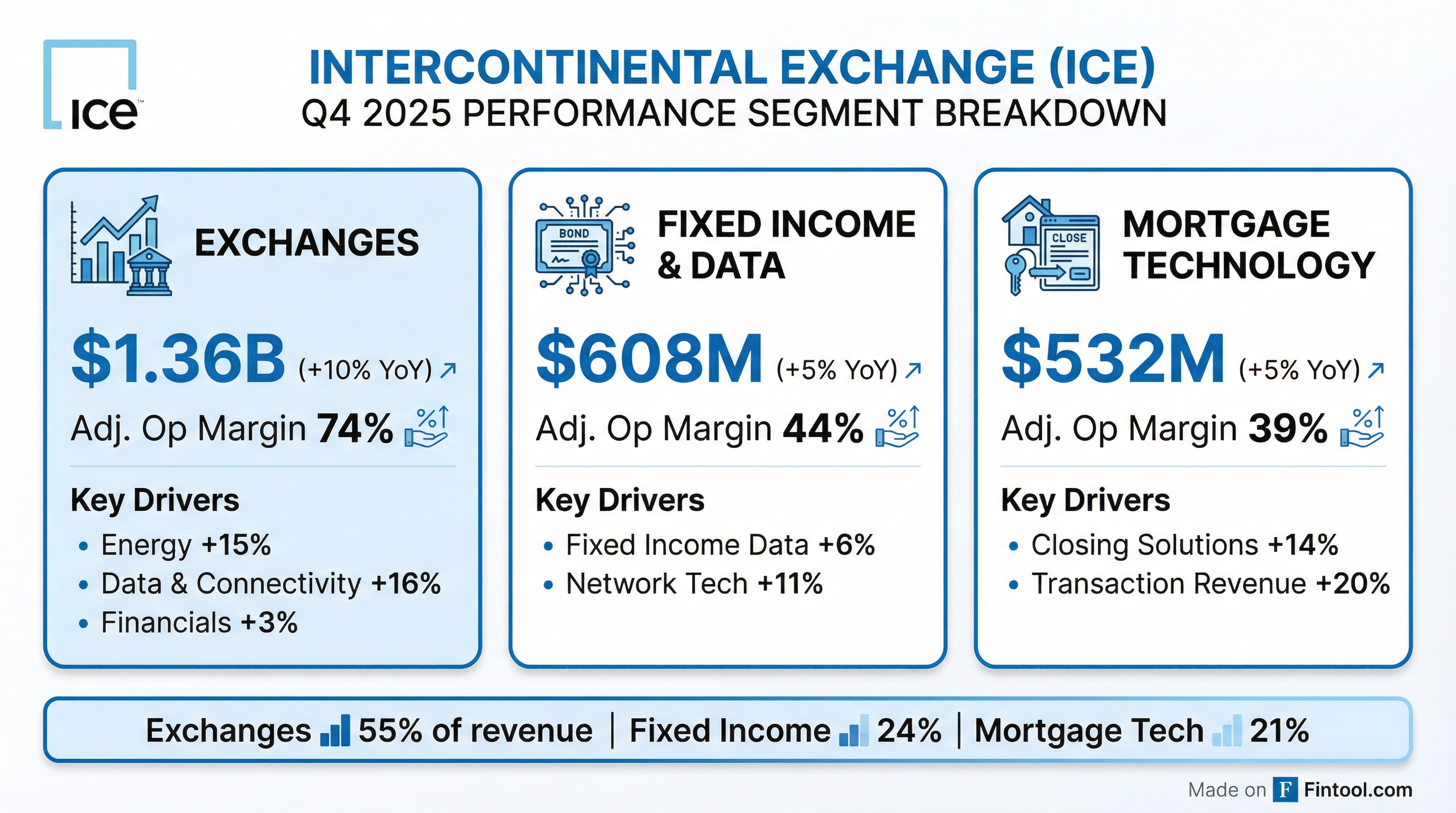

Exchanges ($1.36B, +10% YoY) — The crown jewel. Energy trading revenue surged 15% to $548M on the back of elevated volatility and record volumes. Data and Connectivity Services grew 16% to $266M. Adjusted operating margin held at an impressive 74%.

Fixed Income and Data Services ($608M, +5% YoY) — Steady growth with Fixed Income Data and Analytics up 6% and Data and Network Technology up 11%. CDS clearing declined 5% on lower notional volumes. Adjusted operating margin improved to 44%.

Mortgage Technology ($532M, +5% YoY) — The turnaround story continues. Origination Technology grew 6%, Closing Solutions jumped 14%, and transaction-based revenue surged 20%. Adjusted operating margin of 39% showed meaningful improvement from the prior year's losses.

Full Year 2025 Highlights

What Did Management Guide?

ICE provided 2026 guidance that implies continued steady growth with expense discipline:

CFO Warren Gardiner emphasized capital allocation balance: "We maintained a balanced approach to leverage, ending the year well within our target leverage range, enabling us to reinvest in our network, while also returning $2.4 billion to shareholders."

Capital Return

Through 2025, ICE returned $2.4 billion to shareholders:

- $1.3 billion in share repurchases

- $1.1 billion in dividends

The company ended the year with $837M in unrestricted cash and $19.6B in debt.

How Did the Stock React?

ICE shares rose +3.0% in after-hours trading to $168.02, following the earnings release.

The positive reaction reflects:

- Clean beat on both revenue and earnings

- Record 20th year of revenue growth

- Mortgage technology showing sustained recovery

- Strong free cash flow generation

- Continued capital return to shareholders

What Changed From Last Quarter?

Positive shifts:

- Mortgage Technology delivered positive GAAP operating income ($8M) for the first time in recent memory, vs. losses a year ago

- Energy trading volumes hit records amid geopolitical volatility

- Data and Connectivity Services accelerated to 16% growth (from 9% FY run rate)

- Free cash flow conversion strengthened (+16% YoY on an adjusted basis)

Watch items:

- Fixed Income Execution revenue declined 6% — rate-sensitive volumes under pressure

- CDS Clearing down 5% on lower notional activity

- Ags and Metals segment contracted 5% in Q4

Key Quotes From Management

Jeff Sprecher, CEO:

"For over two decades, ICE has been built around the simple idea that markets function best when their infrastructure is trusted, neutral, and engineered to work in all environments... We've built an all-weather model that performs through cycles rather than around them."

"ICE's role is to remain a trusted operator through this change, investing in technology where it removes friction, expanding our networks where it creates efficiency, and maintaining discipline in how we allocate capital."

Warren Gardiner, CFO:

"2025 was a landmark year for ICE. We delivered record adjusted earnings per share of $6.95, a 14% increase year-over-year, marking the best performance in our company's history."

Ben Jackson, President:

"Where FIDS turns market data into workflow intelligence, mortgage technology applies those capabilities across the life of a loan... AI is an enabler and an accelerator to deliver workflow efficiencies."

January Momentum: A Record Start to 2026

Management highlighted exceptional trading momentum carrying into 2026:

President Ben Jackson emphasized the structural drivers: "You have geopolitical flashpoints, supply chain evolution, the energy evolution, trade and tariff issues, energy security concerns... this confluence of issues is what's really led to our energy business being up 30% year-to-date."

NYSE Tokenization: A Major Strategic Initiative

CEO Jeff Sprecher announced ICE is developing a tokenized securities platform for NYSE, following an investment and distribution partnership with Polymarket:

- ICE plans to seek SEC approval under existing federal securities law — not dependent on new legislation

- Will leverage existing securities passporting relationships for foreign distribution

- Tokens will attach full contractual rights: ownership, dividends, voting privileges

- Recently announced acceptance of tokenized collateral with BNY and Citi

- Positioned as infrastructure evolution, not novelty

"We are not pursuing tokenization as a novelty or as a substitution for how markets operate today. We're exploring tokenization as a potential evolution of existing market infrastructure." — Jeff Sprecher, CEO

ICE Aurora: AI Agents Rolling Out in H1 2026

ICE is deploying its ICE Aurora AI platform with four new agent-based solutions launching in the first half of 2026:

- Business Intelligence Agent — Analyzes data, identifies errors, highlights bottlenecks to accelerate loan cycle times

- Virtual Servicing Agent — Handles payment scheduling, issue resolution, and direct borrower interactions in Servicing Digital (in beta)

- Customer Service Agent — Summarizes notes, predicts call context, helps representatives resolve inquiries faster

- Exception-Handling Agent — Responds to natural language queries in real-time, facilitates exception handling with approved guardrails

"Applying our ICE Aurora platform and agents to workflow automation remains the most effective lever. Moving manual stare-and-compare tasks to exception-based workflows, where people focus only on what needs human judgment." — Ben Jackson, President

Black Knight Synergies: Ahead of Schedule

ICE exceeded synergy targets from the 2023 Black Knight acquisition:

CFO Warren Gardiner: "This outperformance underscores our integration capabilities and our proven ability to identify incremental value creation opportunities."

Mortgage Market Outlook: Tailwinds Building

Management provided granular color on the mortgage opportunity:

Refinance Potential:

- 4 million loans currently "in the money" to refi (rates 75bps below current rate)

- With 25bps rate decline: 5.5 million loans in the money

- With 50bps rate decline: 7.5-8 million loans in the money

Purchase Market:

- Affordability at 4-year highs

- Administration vocal about stimulating housing starts

- Potential capital gains exemption expansion under discussion

Normalized Market Opportunity:

- 7-10 million annual loans = "normal" (10M is 30-year average, 7-8M is median)

- At normalized levels: $200M-$500M incremental revenue opportunity

Q&A Highlights

On AI and Data Defensibility (Benjamin Budish, Barclays): Chris Edmonds emphasized ICE's unique position: "We generate proprietary, mission-critical content from our exchange and clearing activities... The culmination of all that is something you can't get anywhere else." He highlighted that fixed income pricing and reference data require 10-30 year history as a trusted source — not easily replicated.

On Energy Sustainability (Patrick Moley, Piper Sandler): Ben Jackson cited multiple tailwinds: India trade deal requiring substitution of Russian crude with Brent-priced Middle Eastern/US grades, Venezuela developments benefiting Brent and Canadian crude pricing, and structural demand for energy risk management globally.

On Mortgage Minimums Headwind (Ashish Sabadra, RBC): CFO Warren Gardiner noted that 2020 vintage contract renewals are complete, with 2021 vintage largely finishing in 2026. The minimums headwind is declining each year and is "baked into" the low-to-mid single digit guidance.

On Encompass Sales Momentum (Ken Worthington, JP Morgan): Ben Jackson reported 90 Encompass deals closed in 2025, including 32 in Q4 alone. Recent wins include one of the largest HELOC lenders and one of the largest correspondent lenders in the US. He noted that "the largest players in the market are as engaged as ever."

On Pricing Strategy (Alex Kramm, UBS): Warren Gardiner confirmed a similar approach to prior years, with selective price increases in areas where ICE has created value — particularly within financials futures and exchange data. January's higher energy RPC was driven by TTF mix shift, not contract pricing changes.

Earnings Call Details

ICE held its Q4 2025 earnings call on February 5, 2026 at 8:30 a.m. ET. The next earnings call is scheduled for April 30, 2026 for Q1 2026 results.