Earnings summaries and quarterly performance for IES Holdings.

Executive leadership at IES Holdings.

Board of directors at IES Holdings.

Research analysts covering IES Holdings.

Recent press releases and 8-K filings for IESC.

IESC announces Q1 2026 results

IESC

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

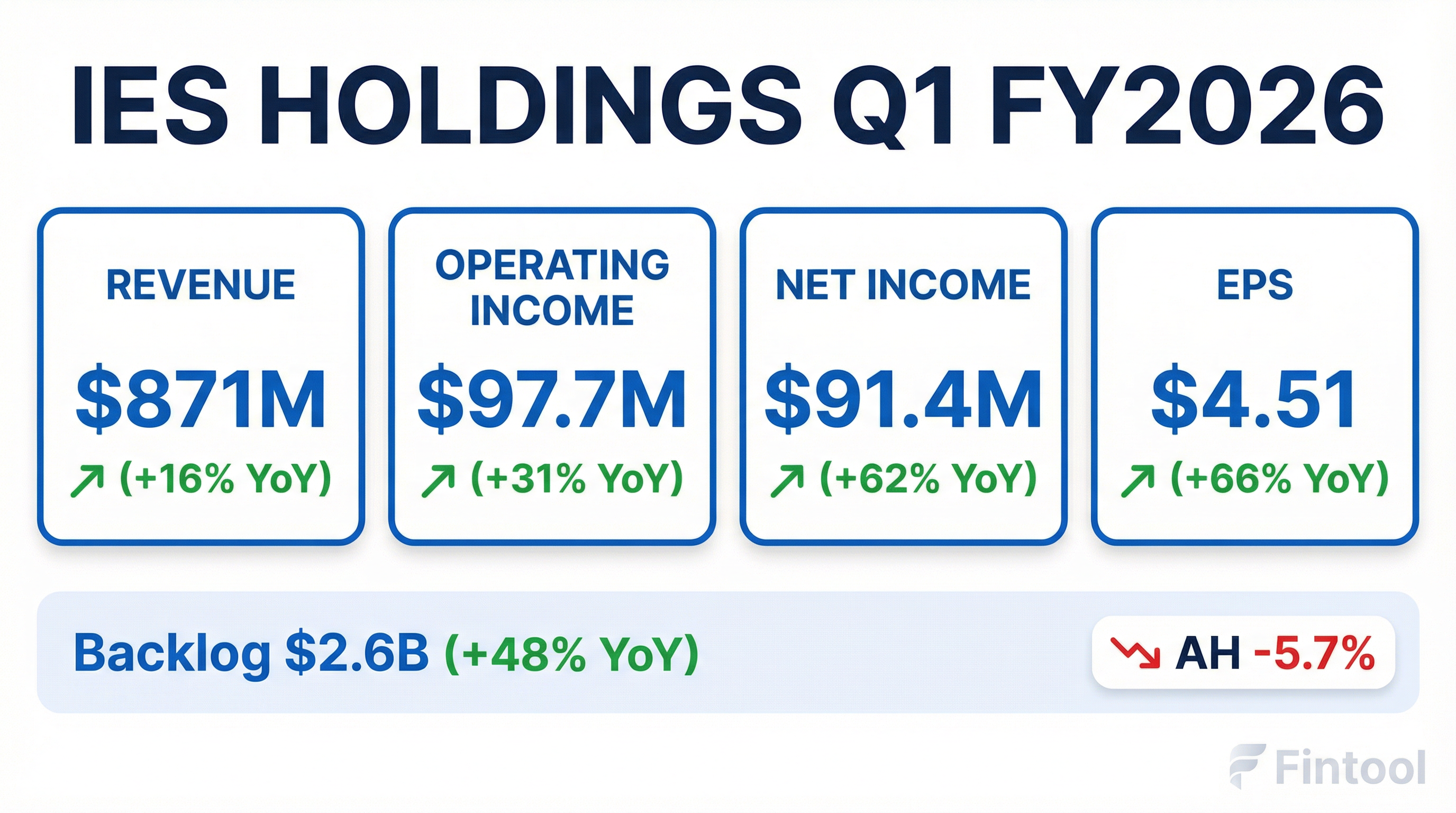

- Revenue for Q1 2026 was $871 million, an increase of 16% year-over-year.

- Operating income for the quarter reached $97.7 million, growing 31% year-over-year.

- Earnings per share for Q1 2026 was $4.51, with adjusted earnings per share at $3.71.

- As of December 31, 2025, backlog stood at $2.6 billion and remaining performance obligations were $1.8 billion.

- The Communications segment reported a 51% increase in revenue to $351.9 million and a 101% increase in operating income to $57.4 million in Q1 2026 compared to Q1 2025.

Jan 30, 2026, 1:00 PM

IES Holdings Announces Strong Fiscal Q1 2026 Results and Gulf Island Acquisition

IESC

Earnings

M&A

Revenue Acceleration/Inflection

- IES Holdings, Inc. reported revenue of $871 million for the first quarter of fiscal 2026, marking a 16% increase compared to $750 million in the same quarter of fiscal 2025.

- Operating income rose by 31% to $97.7 million for Q1 fiscal 2026, up from $74.6 million in the prior year.

- Net income attributable to IES increased by 62% to $91.4 million, with diluted earnings per share attributable to common stockholders at $4.51 for Q1 fiscal 2026, compared to $2.72 in Q1 fiscal 2025.

- As of December 31, 2025, the company's backlog stood at approximately $2.6 billion, with remaining performance obligations of approximately $1.8 billion.

- Subsequent to the quarter end, IES Holdings completed the acquisition of Gulf Island Fabrication, Inc., which adds significant capacity and capabilities to its Infrastructure Solutions segment.

Jan 30, 2026, 12:51 PM

IES Holdings Reports Strong Fiscal 2026 First Quarter Results

IESC

Earnings

Revenue Acceleration/Inflection

M&A

- IES Holdings reported strong financial results for the first quarter of fiscal 2026, with revenue increasing 16% to $871 million and diluted earnings per share rising to $4.51 compared to the prior year.

- Operating income grew 31% to $97.7 million and net income attributable to IES increased 62% to $91.4 million for the quarter ended December 31, 2025.

- The company's backlog was approximately $2.6 billion as of December 31, 2025, and it completed the acquisition of Gulf Island Fabrication, Inc. subsequent to quarter end.

- IES Holdings ended the quarter with $88.8 million of cash, no debt, and $169.9 million of marketable securities.

Jan 30, 2026, 12:45 PM

IES Holdings Completes Acquisition of Gulf Island Fabrication

IESC

M&A

New Projects/Investments

- IES Holdings, Inc. (IESC) completed its acquisition of Gulf Island Fabrication, Inc. on January 16, 2026.

- The acquisition was for $12 per share in cash, representing an aggregate equity value of approximately $192 million and an enterprise value of approximately $152 million.

- Gulf Island will become part of IES's Infrastructure Solutions segment, enhancing its capacity and capabilities for custom engineered solutions, including generator enclosures and related power products.

- This acquisition advances IES's strategy to expand its role in U.S. infrastructure and capitalize on growth in data center customers and opportunities in the energy markets.

Jan 16, 2026, 1:35 PM

IES Holdings, Inc. Announces Strong Q4 2025 Results and Acquisition Agreement

IESC

Earnings

Revenue Acceleration/Inflection

M&A

- IES Holdings, Inc. reported revenue of $898 million for the fourth quarter of fiscal 2025, representing a 16% increase year-over-year, and operating income of $104.3 million, up 39% year-over-year.

- Earnings per share were $4.99, with adjusted earnings per share at $3.77 for Q4 2025.

- The company achieved a record backlog of $2.4 billion as of September 30, 2025.

- Subsequent to the quarter end, IES Holdings, Inc. entered into a definitive agreement to acquire Gulf Island Fabrication, Inc..

Nov 21, 2025, 2:30 PM

IES Holdings Reports Strong Fiscal 2025 Fourth Quarter and Full Year Results

IESC

Earnings

M&A

Revenue Acceleration/Inflection

- IES Holdings, Inc. reported record fiscal year 2025 results, with revenue of $3.37 billion, a 17% increase compared to fiscal 2024, and diluted earnings per share of $15.02, up 52% from fiscal 2024.

- For the fourth quarter of fiscal 2025, revenue increased 16% to $898 million, and diluted earnings per share rose 63% to $4.99 compared to the same quarter in fiscal 2024.

- The company's backlog, a non-GAAP financial measure, was approximately $2.37 billion as of September 30, 2025, indicating future revenue potential.

- Subsequent to quarter end, IES Holdings, Inc. entered into a definitive agreement to acquire Gulf Island Fabrication, Inc., and expects continued growth in its Communications, Infrastructure Solutions, and Commercial & Industrial operating segments in fiscal 2026, particularly driven by strong demand in the data center end market.

Nov 21, 2025, 12:55 PM

IES Holdings to Acquire Gulf Island Fabrication

IESC

M&A

New Projects/Investments

Takeover Bid

- IES Holdings, Inc. has entered into a definitive agreement to acquire Gulf Island Fabrication, Inc..

- IES will pay $12.00 in cash per Gulf Island share, totaling an aggregate equity value of approximately $192 million.

- This offer represents a 52% premium to Gulf Island's trading price as of November 6, 2025.

- The transaction is expected to close in the quarter ending March 31, 2026, subject to Gulf Island shareholder and regulatory approvals.

- The acquisition is strategically aimed at expanding IES's fabrication footprint and services capabilities, leveraging Gulf Island's 450,000-square foot facility on 160 acres in Houma, Louisiana.

Nov 12, 2025, 10:07 PM

IES Holdings to Acquire Gulf Island Fabrication

IESC

M&A

Takeover Bid

- IES Holdings has entered into a definitive agreement to acquire Gulf Island Fabrication, Inc. for $12.00 in cash per share, representing an aggregate equity value of approximately $192 million.

- This acquisition price offers a 52% premium to Gulf Island's trading price as of November 6, 2025.

- The transaction is expected to close in the quarter ending March 31, 2026, pending Gulf Island shareholder and regulatory approvals.

- The strategic rationale for the acquisition includes expanding IES's capabilities in complex steel structures and specialty services, supporting growth in the data center market and U.S. infrastructure.

Nov 7, 2025, 1:15 PM

IES Holdings Reports Fiscal Year 2024 Results and Provides Fiscal Year 2025 Outlook

IESC

Earnings

Guidance Update

New Projects/Investments

- IES Holdings reported approximately $2.9 billion in total revenue and $9.62 per share in adjusted EPS for fiscal year 2024, which ended September 30, 2024.

- For the first nine months of fiscal year 2025, the company generated $279 million in operating income, representing a 24% increase year-over-year.

- The company's growth is significantly driven by strong demand in data centers, e-commerce, and high-tech manufacturing, with continued strength expected in its communications and infrastructure solutions businesses.

- IES Holdings pursues a strategy of organic growth supplemented by acquisitions, emphasizing diversification across its business segments to mitigate cyclicality.

- While expecting continued strength in some areas, the residential business faces headwinds due to housing affordability and high borrowing costs, which are anticipated to persist for a few more quarters.

Aug 28, 2025, 9:42 PM

IES Holdings' Monsoon Wind Power Project Achieves Commercial Operation

IESC

New Projects/Investments

Product Launch

- The 600 MW Monsoon Wind Power Project, developed by IES, officially reached Commercial Operation on August 22, 2025, four months ahead of schedule.

- This project is the largest utility-scale onshore wind farm in Southeast Asia and Asia's first cross-border renewable energy project, supplying clean electricity from Lao PDR to Vietnam's national grid.

- The project is expected to offset approximately 1.3 million tonnes of CO2 annually and invests US$1.1 million annually in community development.

Aug 28, 2025, 12:36 PM

Quarterly earnings call transcripts for IES Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more