INGLES MARKETS (IMKTA)·Q1 2026 Earnings Summary

Ingles Markets Posts 70% EPS Surge as Margins Expand, Stock Hits 52-Week High

February 5, 2026 · by Fintool AI Agent

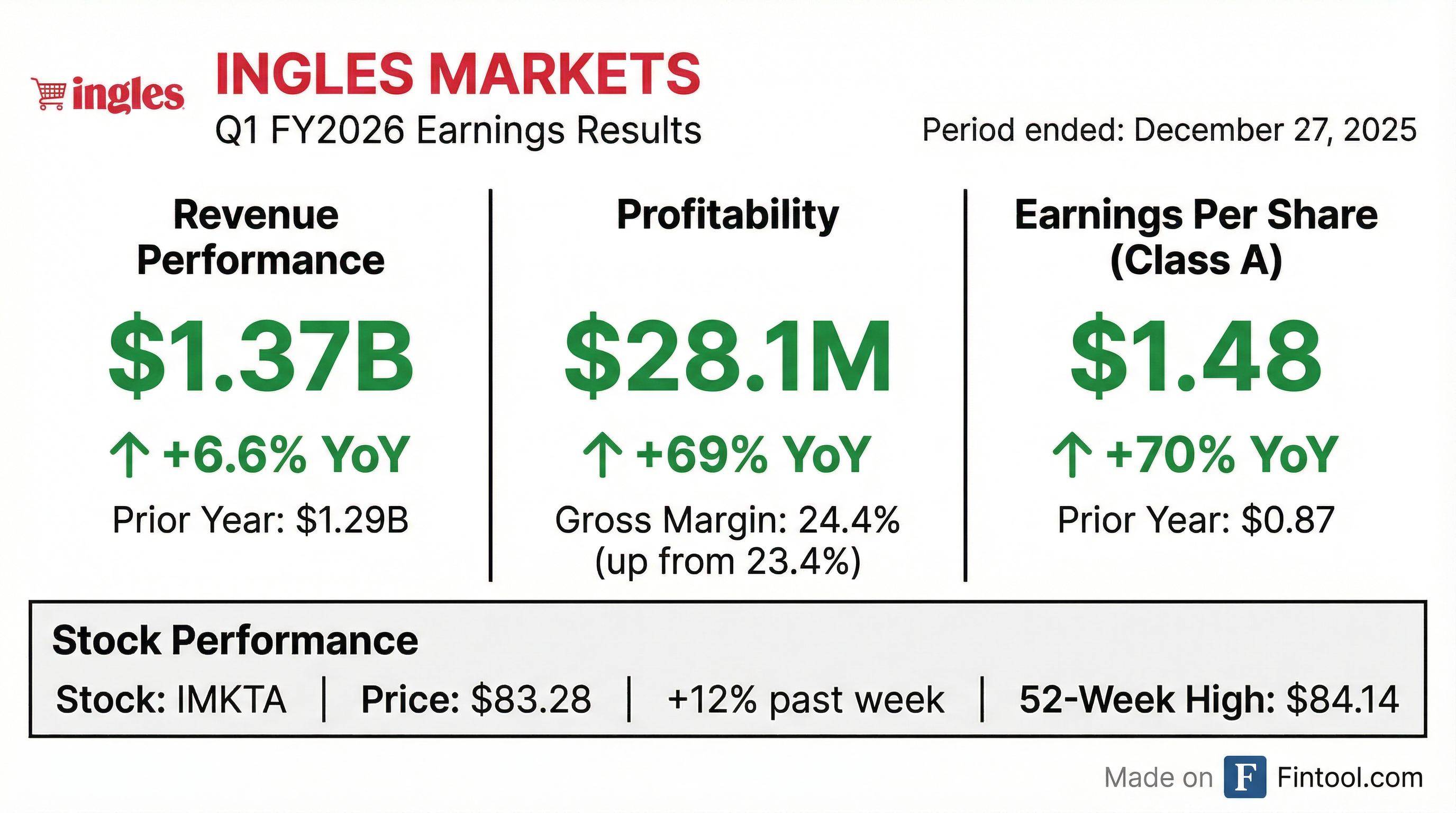

Ingles Markets (NASDAQ: IMKTA) delivered a standout Q1 FY2026, with net income surging 69% year-over-year to $28.1 million and diluted EPS for Class A shares climbing 70% to $1.48. The regional grocer's gross margin expanded 100 basis points to 24.4%, driving the stock to a new 52-week high of $84.14 intraday.

What Were the Q1 FY2026 Results?

Ingles Markets reported the following for the quarter ended December 27, 2025:

The quarter benefited from strong holiday season execution, with Chairman Robert P. Ingle II thanking associates for "their continued commitment and efforts throughout the holiday season."

How Did the Stock React?

IMKTA shares rallied approximately 12% in the week leading into earnings, hitting a 52-week high of $84.14 on February 5, 2026. The stock closed at $83.28, up 3.1% on the day.

The stock is up 24% from a year ago ($67.47 on Feb 5, 2025), outperforming many regional grocery peers.

What Is Driving Margin Expansion?

Gross margin expanded 100 basis points year-over-year to 24.4%, the strongest Q1 margin in recent history. This improvement came despite:

- Operating and administrative expenses increasing to $295.4M from $280.7M (+5.2%)

- Three stores remaining closed due to Hurricane Helene damage

The margin expansion suggests successful pricing strategies and potentially favorable product mix during the holiday quarter.

*Values retrieved from S&P Global

What Is the Balance Sheet Position?

Ingles Markets continues to strengthen its financial position:

The company has minimal borrowings on its $150 million credit facility, with only a $500,000 letter of credit outstanding. Management expressed confidence that financial resources will be "sufficient to meet planned capital expenditures, debt service and working capital requirements for the foreseeable future."

What About Hurricane Helene Impact?

Three of four stores temporarily closed due to Hurricane Helene damage remained shuttered as of December 27, 2025. Management expects these stores to reopen during 2026 and 2027.

Despite these closures, Ingles operates 197 supermarkets across six southeastern states, with the hurricane impact representing a small fraction of the store base.

What Changed From Last Quarter?

Positive Developments:

- EPS accelerated from $1.38 in Q4 FY2025 to $1.48 in Q1 FY2026 (+7% sequential)

- Gross margin improved another 10bps sequentially (24.3% → 24.4%)

- Stock broke out to new 52-week highs

- Debt continued declining (down $4M sequentially)

Concerns:

- Operating expenses grew 5.2% YoY, outpacing revenue growth of 6.6%

- Three hurricane-impacted stores still closed

- No analyst coverage means limited visibility on forward expectations

Key Takeaways

-

Earnings Power: Q1 FY2026 EPS of $1.48 represents the strongest first quarter in company history, driven by gross margin expansion to 24.4%

-

Momentum: The stock's 12% rally into earnings and new 52-week high suggests investor confidence in the grocery chain's execution

-

Financial Strength: Debt continues declining while cash remains robust at $362M, providing flexibility for reinvestment

-

Risks: Hurricane Helene store closures and rising operating expenses bear monitoring

Ingles Markets, Incorporated is a leading grocer with operations in six southeastern states. Headquartered in Asheville, North Carolina, the company operates 197 supermarkets and a fluid dairy facility.

Related: IMKTA Company Profile | Q1 FY2026 8-K Filing | Prior Quarter: Q4 FY2025