Earnings summaries and quarterly performance for INGLES MARKETS.

Executive leadership at INGLES MARKETS.

Board of directors at INGLES MARKETS.

Research analysts who have asked questions during INGLES MARKETS earnings calls.

Recent press releases and 8-K filings for IMKTA.

Ingles Markets Announces First Quarter Fiscal 2026 Results

IMKTA

Earnings

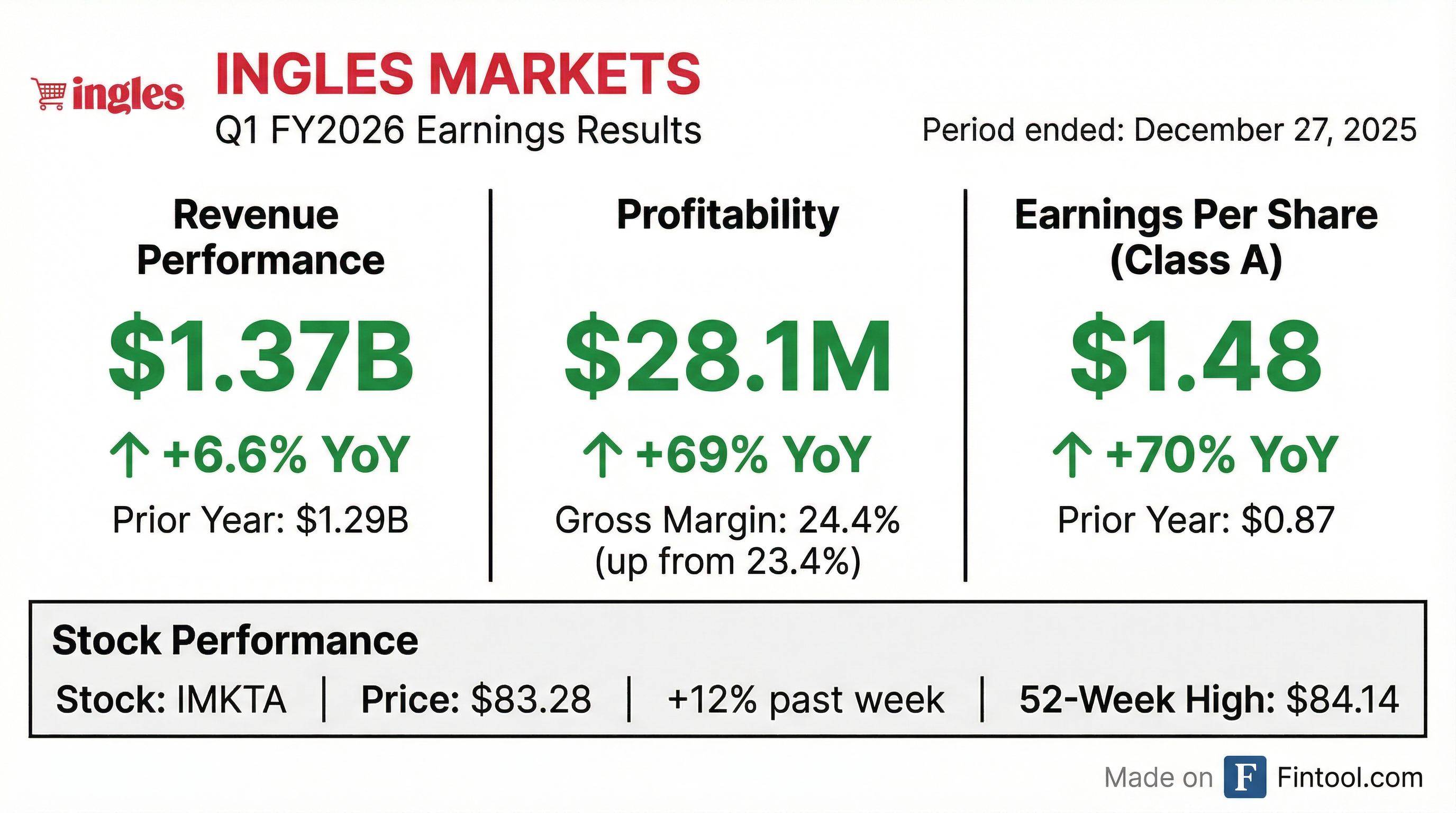

- Net sales for the first quarter of fiscal 2026 increased 6.6% to $1.37 billion compared with $1.29 billion for the quarter ended December 28, 2024.

- Net income for the first quarter of fiscal 2026 totaled $28.1 million, a rise from $16.6 million in the first quarter of fiscal 2025.

- Basic earnings per share for Class A Common Stock for the quarter ended December 27, 2025, were $1.51, up from $0.89 in the prior year period.

- Gross profit for Q1 2026 was $334.6 million, or 24.4% of sales, compared to $301.1 million, or 23.4% of sales, in Q1 2025.

- Total debt at the end of the first quarter of fiscal 2026 was $511.5 million, a decrease from $529.4 million at the end of the first quarter of fiscal 2025.

1 day ago

Ingles Markets Reports First Quarter Fiscal 2026 Financial Results

IMKTA

Earnings

Revenue Acceleration/Inflection

- Net sales for the first quarter of fiscal 2026 totaled $1.37 billion, an increase of 6.6% compared to $1.29 billion in the prior-year quarter.

- Net income for the quarter ended December 27, 2025, was $28.1 million, significantly up from $16.6 million in the first quarter of fiscal 2025.

- Basic earnings per share for Class A Common Stock increased to $1.51 for Q1 FY2026, compared to $0.89 for the quarter ended December 28, 2024.

- Gross profit for Q1 FY2026 was $334.6 million, representing 24.4% of sales, an improvement from $301.1 million, or 23.4% of sales, in Q1 FY2025.

- Total debt decreased to $511.5 million at the end of the first quarter of fiscal 2026, down from $529.4 million at the end of the first quarter of fiscal 2025.

1 day ago

Ingles Markets, Incorporated Reports Q4 and Fiscal Year 2025 Results

IMKTA

Earnings

Demand Weakening

- Ingles Markets, Incorporated reported net income of $25.7 million for the fourth quarter ended September 27, 2025, a significant improvement from a net loss of $1.5 million in the prior year's fourth quarter, which included $30.4 million in inventory impairment and $4.5 million in property and equipment impairment due to Hurricane Helene.

- For the fiscal year ended September 27, 2025, net sales totaled $5.33 billion, down from $5.64 billion in fiscal year 2024, and net income was $83.6 million, compared to $105.5 million in the previous fiscal year.

- The company's total debt decreased to $514.8 million at the end of fiscal year 2025 from $532.6 million at the end of fiscal year 2024.

- Capital expenditures for fiscal year 2025 were $114.5 million, a decrease from $210.9 million in fiscal year 2024.

Nov 26, 2025, 12:35 PM

Quarterly earnings call transcripts for INGLES MARKETS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more