Earnings summaries and quarterly performance for InfuSystem Holdings.

Executive leadership at InfuSystem Holdings.

Board of directors at InfuSystem Holdings.

Research analysts who have asked questions during InfuSystem Holdings earnings calls.

James Sidoti

Sidoti & Company

6 questions for INFU

Anderson Schock

B. Riley Securities

4 questions for INFU

Kyle Bauser

B. Riley Securities

4 questions for INFU

Matthew Hewitt

Craig-Hallum Capital Group LLC

4 questions for INFU

Brooks O'Neil

Lake Street Capital Markets

3 questions for INFU

Jim Sidoti

Sidoti & Company, LLC

2 questions for INFU

Aaron Warwick

Breakout Investors

1 question for INFU

Ben Haynor

Lake Street Capital Markets

1 question for INFU

Benjamin Haynor

Lake Street Capital Markets

1 question for INFU

Kyle Bowser

Lake Street Capital Markets

1 question for INFU

Tolf Corman

Craig-Hallum

1 question for INFU

Tollef Kohrman

Craig-Hallum Capital Group LLC

1 question for INFU

Recent press releases and 8-K filings for INFU.

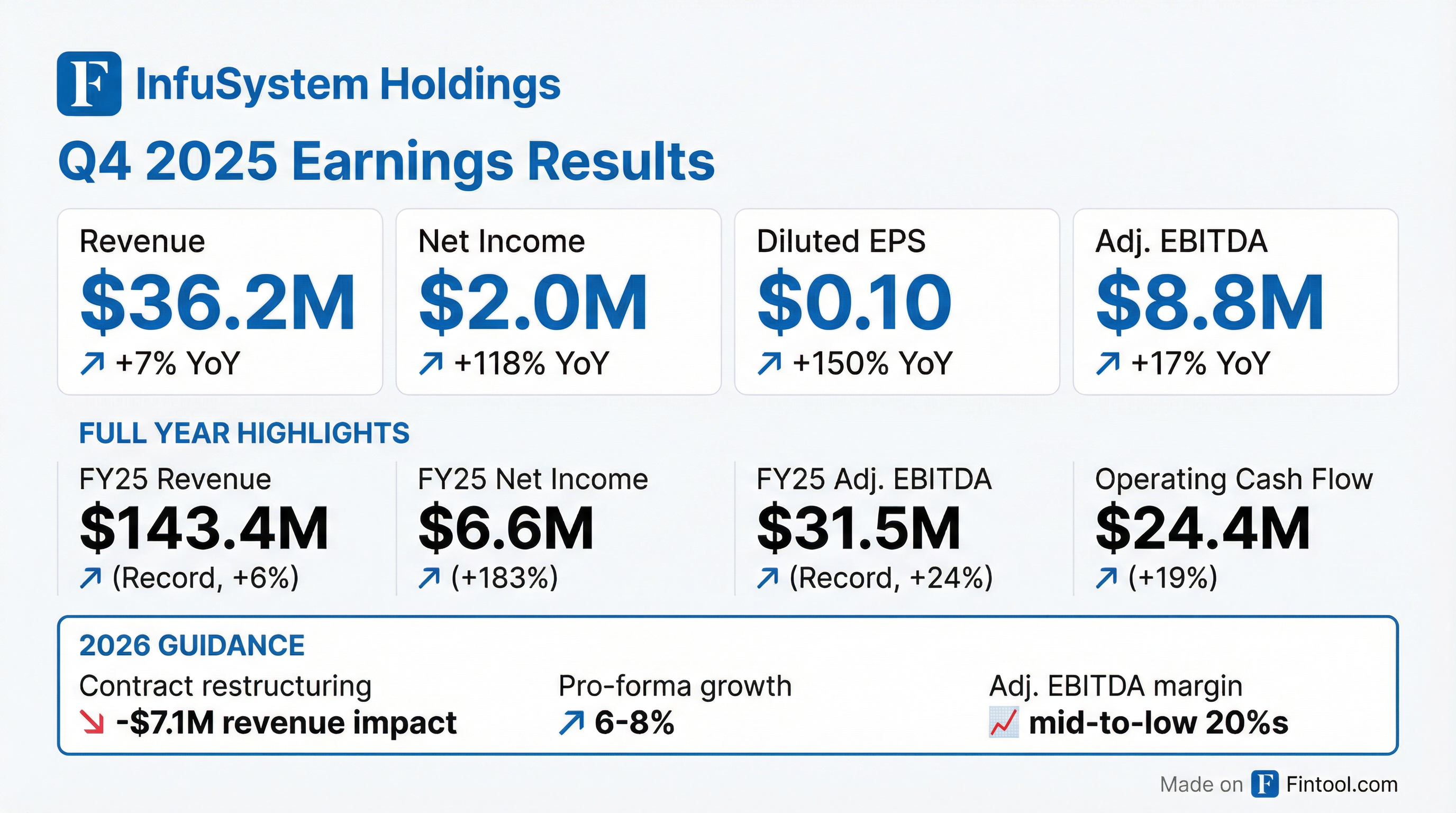

- InfuSystem Holdings, Inc. achieved seven consecutive years of record revenue, reaching $143.4 million in 2025, with Adjusted EBITDA of $31.5 million and $24.4 million in cash flow provided by operations for the year ended December 31, 2025. The Patient Services segment contributed $86.5 million (60%) and the Device Solutions segment contributed $56.9 million (40%) to the total 2025 revenue.

- The company reported a strong balance sheet as of December 31, 2025, with a net leverage ratio of 0.52x, total long-term debt of $19.6 million, and total available liquidity of $58.2 million.

- InfuSystem is focused on growth initiatives, expanding into Pain Management and Wound Care and leveraging new partnerships, including distribution agreements with Smith+Nephew and ChemoMouthpiece, LLC in 2024.

- The company's capital allocation priorities include a $20 million share repurchase program, renewed on May 20, 2024, under which $11.0 million of shares were purchased as of December 31, 2025.

- InfuSystem reported net revenue of $36.2 million in Q4 2025, a 7% increase from the prior year, and full year 2025 Adjusted EBITDA expanded 24% to $31.5 million.

- The company anticipates 2026 annual revenue growth in a range of 6%-8% on a pro forma basis, after a $7.1 million reduction due to a restructured Biomedical Services contract, and expects Adjusted EBITDA margin to remain in the mid to low 20% range.

- Strategic initiatives include completing the migration of the Wound Care business to a new revenue cycle application, with the Oncology business next, and the main information technology business application upgrade is expected to be completed in Q1 2026.

- InfuSystem strengthened its balance sheet with net debt declining 30% year-over-year and returned capital to shareholders by retiring 1.3 million shares for the full year 2025 through its share repurchase program.

- InfuSystem reported net revenue of $36.2 million for the fourth quarter of 2025, a 7% increase from the prior year, contributing to full-year 2025 Adjusted EBITDA expanding 24% to $31.5 million.

- The company strengthened its balance sheet by reducing net debt by 30% year-over-year and repurchasing 1.3 million shares for the full year 2025.

- For 2026, InfuSystem forecasts annual revenue growth in a range of 6%-8% on a pro forma basis (after adjusting for a $7.1 million reduction from a restructured Biomedical Services contract) and anticipates Adjusted EBITDA margins in the mid to low 20% range.

- Key initiatives include completing the migration of its Wound Care business to a new revenue cycle application and expecting the main IT business application upgrade to complete during Q1 2026, which is projected to result in $2 million in annual savings.

- InfuSystem reported Q4 2025 net revenue of $36.2 million, a 7% increase from the prior year fourth quarter, and full-year 2025 Adjusted EBITDA of $31.5 million, expanding 24%.

- For 2026, the company forecasts 6%-8% annual revenue growth on a pro forma basis and anticipates an Adjusted EBITDA margin in the mid to low 20% range.

- The restructuring of the GE HealthCare contract is expected to reduce annual revenue by $7.1 million (5.5%), but is projected to have an immediate favorable impact on reporting, earnings, and cash flow due to an even larger reduction in expenses.

- The company completed the migration of its Wound Care business to a new revenue cycle application and expects to complete its main information technology business application (ERP) upgrade in Q1 2026, which is projected to result in approximately $2 million in annual savings.

- InfuSystem strengthened its balance sheet, with net debt declining 30% year-over-year, and returned capital to shareholders by repurchasing 1.3 million shares for the full year 2025.

- InfuSystem Holdings, Inc. reported net revenues of $36.2 million for Q4 2025, an increase of 7% year-over-year, and $143.4 million for the full year 2025, up 6%.

- Net income for Q4 2025 increased 118% to $2.0 million, with diluted EPS of $0.10. For the full year 2025, net income was $6.6 million, up 183%, and diluted EPS was $0.31.

- Adjusted EBITDA grew 17% to $8.8 million in Q4 2025 and 24% to $31.5 million for the full year.

- As of December 31, 2025, the company had $58.2 million in liquidity and net debt of $16.4 million, representing a 30% year-over-year decrease in net debt. InfuSystem also repurchased 1.3 million shares during the full year 2025.

- For fiscal year 2026, InfuSystem expects a $7.1 million reduction in annual revenue due to a biomedical services contract restructuring, but anticipates pro-forma net revenue growth of 6% to 8% for the unaffected business and an Adjusted EBITDA margin in the mid to low 20% range.

- InfuSystem reported record net revenues of $143.4 million for the full year 2025, an increase of 6% compared to the prior year, and $36.2 million for the fourth quarter, up 7%.

- Full year 2025 net income increased 183% to $6.6 million and Adjusted EBITDA grew 24% to $31.5 million. Fourth quarter net income was $2.0 million, up 118%, and Adjusted EBITDA was $8.8 million, up 17%.

- The company ended 2025 with $58.2 million in liquidity and reduced net debt by 30% year-over-year to $16.4 million, while repurchasing 1.3 million shares during the year.

- For fiscal year 2026, InfuSystem projects a $7.1 million reduction in annual revenue from a restructured biomedical services contract but expects pro-forma net revenue growth of 6% to 8% for the unaffected business and Adjusted EBITDA margin in the mid to low 20%'s.

- InfuSystem Holdings' CADD-Solis™ and Sapphire™ electronic infusion pumps have been added to the list of qualifying products for separate Medicare payment under the Non-Opioids Prevent Addiction in the Nation (NOPAIN) Act.

- This separate payment for qualified non-opioid treatments, when provided with a covered surgical procedure, will be effective starting January 1, 2026, and is mandated through December 31, 2027.

- The Centers for Medicare and Medicaid Services (CMS) has set a payment limitation of up to $1,997.16 for these products.

- InfuSystem's CEO, Carrie Lachance, stated that this rule change has the potential to act as a catalyst for volume growth in the company's Pain Management business.

- InfuSystem Holdings, Inc. announced that the Centers for Medicare and Medicaid Services (CMS) has added two of its electronic infusion pumps, the CADD-SolisTM and SapphireTM, to the list of qualifying products for separate payment under the NOPAIN Act.

- This decision, effective January 1, 2026, allows Hospital Outpatient Departments (HOPDs) and Ambulatory Surgical Centers (ASCs) using these pumps to receive separate Medicare reimbursement, with a payment limitation of up to $1,997.16.

- The NOPAIN Act mandates separate payments for qualified non-opioid treatments through December 31, 2027, when provided with a covered surgical procedure, as part of a broader strategy to combat the opioid crisis.

- InfuSystem's CEO, Carrie Lachance, stated that this rule change has the potential to act as a catalyst for volume growth in the company's Pain Management business, although the forward outlook will remain tempered until reimbursement requirements are clearer and customer adoption is observed.

- InfuSystem Holdings, Inc. reported six consecutive years of record revenue through 2024, with net revenues of $134.9 million and Adjusted EBITDA of $25.3 million for 2024.

- For the twelve months ended September 30, 2025, the company achieved net revenues of $141.1 million and Adjusted EBITDA of $30.2 million.

- As of September 30, 2025, the company reported a strong balance sheet with a net leverage ratio of 0.66x and total available liquidity of $54.6 million.

- The company's capital allocation strategy includes a $20 million stock repurchase program, renewed on May 20, 2024, under which $9.7 million of shares had been purchased as of September 30, 2025.

- 2024 revenue was segmented with Patient Services contributing $80.4 million (60%) and Device Solutions contributing $54.5 million (40%).

- InfuSystem reported record net revenues of $36.5 million for the third quarter of 2025, marking a 3% increase from the prior year.

- Net income rose 25% to $2.3 million, resulting in $0.11 per diluted share for the quarter.

- Adjusted EBITDA increased 6% to $8.3 million, with the Adjusted EBITDA margin expanding to 22.8%.

- Year-to-date net operating cash flow grew 38% to $17.3 million, and $2.2 million in stock was repurchased during the quarter.

- The company reaffirmed its full-year 2025 guidance, expecting net revenue growth of 6% to 8% and an Adjusted EBITDA margin of 20% or higher.

Quarterly earnings call transcripts for InfuSystem Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more