ING GROEP (ING)·Q4 2025 Earnings Summary

ING Beats Q4 as Record Year Drives 2027 Outlook Upgrade

January 29, 2026 · by Fintool AI Agent

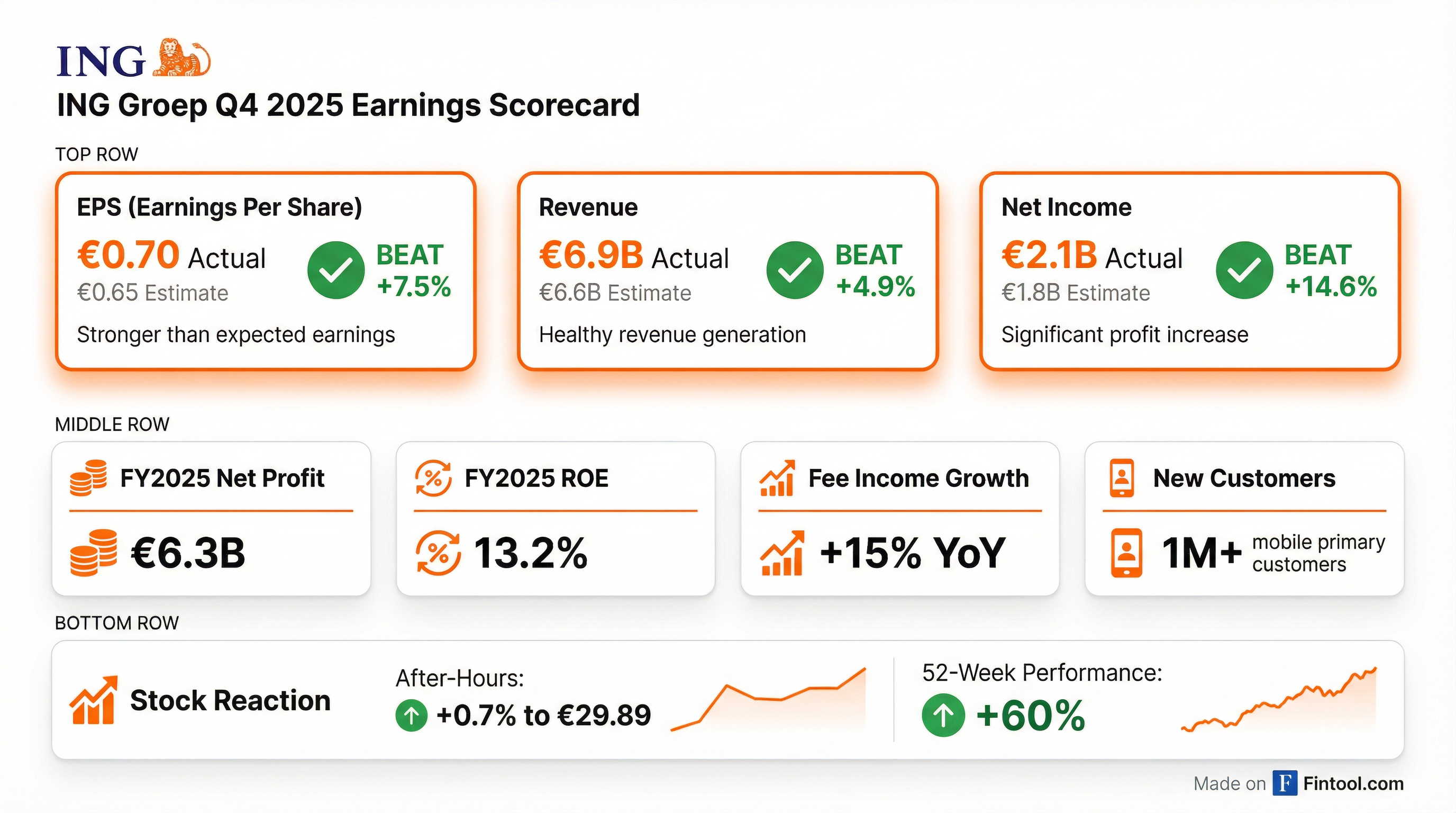

ING Groep reported Q4 2025 results that beat across the board, capping a third consecutive record year for total income. EPS came in at €0.70 versus the €0.65 consensus (+7.5%), while revenue of €6.9B topped estimates by 4.9% . Management used the momentum to upgrade its 2027 outlook, now targeting total income exceeding €25B with 15% ROE .

Key highlights: lending book grew 8% to €782B , fee income surged 15% to €4.6B , and investment products/e-brokerage reached €278B (+60% YoY) . The quarter also marked CFO Tanate Phutrakul's final earnings call before retirement, ending a 25+ year tenure at ING .

Did ING Beat Earnings?

ING delivered a clean beat across all key metrics:

Values retrieved from S&P Global

For the full year 2025, ING generated net profit of more than €6.3B, translating to ROE of 13.2% — well above the guidance provided at the start of the year .

Commercial momentum drove results: ING added over 1 million mobile primary customers during 2025, hitting the target set at Capital Markets Day . Loan growth was robust at 8.3% YoY, with Q4 alone contributing €20.4B in net core lending . Fee income grew 15% for the year, now accounting for 20% of total income .

What Did Management Guide?

ING provided detailed guidance for 2026 and upgraded its 2027 outlook:

2026 Guidance

2027 Outlook (Upgraded)

CEO Steven van Rijswijk emphasized the shift from cost/income ratio targets to hard expense numbers: "We've moved away from the cost income ratio and instead provide a clear hard outlook for operating expenses... This reinforces our continued focus on cost discipline and operational efficiency" .

What Changed From Last Quarter?

Several notable developments emerged in Q4:

1. Positive Jaws Territory: ING achieved positive operating leverage for the first time in recent quarters, with revenue growth outpacing cost growth. Management expects this trend to continue into 2027 .

2. SRT Program Expansion: ING completed two Significant Risk Transfer transactions in November 2025, contributing ~12 bps to CET1. The bank plans 15-20 bps of additional benefit from SRTs in 2026 .

3. Capital Allocation Shift: Retail banking now commands 54% of allocated capital (up from 50/50), with wholesale banking optimization ongoing .

4. Replication Portfolio Tailwind: The €400M headwind from short-term replication is diminishing, while the 55% long-dated portion continues to accrete positively into 2026-27 .

5. CFO Transition: Tanate Phutrakul's final call, with Ida Lerner taking over as CFO after the April 2026 AGM .

How Did the Stock React?

ING shares closed at $29.68 on January 28, down 0.3% on the day. After-hours trading showed modest gains to $29.89 (+0.7%) following the earnings release.

Context matters: ING stock has been on a strong run, gaining nearly 60% over the past year . The muted reaction likely reflects much of the positive outlook already being priced in, with shares near 52-week highs of $30.10.

Key Q&A Highlights

From the Analyst Call

On German investments and client acquisition:

"The client growth that we have, 1 million customers per year, a very significant portion comes from Germany, which is our main market. So that's why the investments in client acquisition, in creating new product, creating new segments is very strong in Germany." — CFO Tanate Phutrakul

On AI and operational efficiency:

"We do about €60 million in customer lending without manual intervention... We increased STP in onboarding from 66% to 79%. We're actually quite optimistic on the impact [GenAI] will have on our operational leverage going forward." — CEO Steven van Rijswijk

On M&A appetite:

"If we can accelerate growth by means of acquisitions, we will look at it... We bought [an asset manager] from Goldman Sachs in Poland... But it needs to fit, add local scale, and be accretive for shareholders." — CEO Steven van Rijswijk

On deposit campaigns:

"About two-thirds of the money after the campaign is over will stick with ING. We are very happy with the approach we've taken... we will keep on having these campaigns and make them more bespoke by the year." — CEO Steven van Rijswijk

From the Media Call

On competing with neobanks (Revolut, N26, Trade Republic):

"We compete with incumbents that are more branch-based models that move to digital, and we compete with new neobanks... Our challenge is to grow up, to get out of, let's say, puberty... We are more digital than incumbents. There are things we can learn from the neobanks." — CEO Steven van Rijswijk

On SRT strategy and capital flexibility:

"We only started to do SRTs for the first time last year... The impact of these trades in 2025 was 12 basis points. This year we expect 15-20 basis points in 2026. It's also about having a valve to release capital so that you continue to grow with customers." — CEO Steven van Rijswijk

On defense lending expansion:

"Our exposure is at least €2 billion. We have grown from almost nothing... We have 40 to 50 projects in the pipeline. We want to help Europe build up their defense capabilities within UN limitations." — CEO Steven van Rijswijk

Segment Breakdown

Retail Banking — Strong Customer Growth

- Net core lending growth of €10.1B in Q4, driven by mortgages

- Deposits up €11.3B, benefiting from targeted campaigns and seasonal inflows

- NPS #1 position maintained in 5 of 10 markets

- Business banking rollout progressing in Germany and Italy, with Spain under consideration

Wholesale Banking — Volume Rebound

- Net core lending growth of €10.3B in Q4, strongest in H2

- Strong demand for working capital solutions as client financing needs increased

- Financial Markets delivered strong results despite seasonal slowdown

- NPS of 77, reflecting quality of client service

How Is ING Competing with Neobanks?

A notable theme from the media call was ING's positioning against digital challengers like Revolut, Trade Republic, and N26.

The challenge: ING was essentially the "neobank" 25 years ago with ING Direct — digital-only, no branches, simple products. Now it faces competition from two directions: incumbents going digital, and new neobanks carving out niches .

ING's response:

- Subscription packages — Rolling out Spotify-style bundled offerings, starting in Romania, to better target subsegments (Gen Z, affluent, expats)

- Legacy modernization — Moving core banking systems to cloud, making them modular rather than monolithic "spaghetti" systems

- Investment products — €278B in asset management/e-brokerage, up 60% YoY, as ING moves beyond execution-only to advisory services

Market leadership: ING maintains top NPS in 5 of 10 markets. In Germany and Spain, it's still seen as "the digital bank" — but management acknowledges neobanks are gaining traction with Gen Z .

Strategic Growth Initiatives

SME Banking in Germany

ING is building a digital SME bank in Germany, targeting self-employed and small businesses — a natural extension from retail customers who become entrepreneurs .

- Currently small but growing quickly from zero base

- Focus on current accounts and payments first (self-employed care more about invoicing than lending)

- Germany was 3rd highest market for business banking customer growth in 2025

- M&A remains an option to accelerate if the right target emerges

Defense Lending Expansion

ING has significantly ramped up defense sector financing:

CEO van Rijswijk: "We are a sizable European bank, and we want to help [European societies] build up their defense capabilities."

Sustainability Finance

Despite geopolitical noise around climate policy, ING's sustainable volume mobilized rose from €140B to €166B in 2025, exceeding the target set in 2007 .

Renewable energy financing nearly quadrupled — from €2.5B annually to €9B, versus the €7.5B target .

Climate litigation update: Milieudefensie filed suit against ING a year ago. ING's response is due in approximately one month .

Capital Returns and Distributions

ING remains committed to attractive shareholder returns:

CET1 ratio management remains focused on the ~13% target, with capital planning update expected at Q1 2026 results .

2026 Funding Plan

From the fixed income investor call, ING outlined its 2026 debt issuance guidance :

Liquidity position: ING maintains an LCR of 140%, with over two-thirds of the balance sheet funded by customer deposits. The TLAC/MREL buffer stands at approximately €12B above requirements .

Par call clarification: Management noted evolving market practice where peers exercise par call options at the beginning of the call window rather than at first reset date. ING emphasized its policy is based on first reset date, and not calling on the first day of the window should not be interpreted as a non-call event .

Risk Factors and Concerns

Credit Quality: Q4 risk costs of €365M (20 bps of customer lending), in line with through-the-cycle average. However, stage 3 provisions increased due to individual files in wholesale banking .

Competition in Deposits: Management acknowledged ongoing deposit competition, particularly in the Netherlands where mortgage new production margins face pressure .

Neobank Competition: While ING maintains digital leadership, management acknowledged losing traction to neobanks like Revolut in certain markets, particularly with Gen Z customers . The challenge is competing on innovation while maintaining the trust and scale of an incumbent.

Climate Litigation: Milieudefensie's lawsuit against ING represents reputational and potentially financial risk. ING's formal response is due within a month . Management emphasized a "transitionary path" approach versus immediate fossil fuel exit demands.

Cost Inflation: While efficiency gains are offsetting wage inflation, sticky inflation remains a headwind expected to moderate only gradually in 2027 .

FTE Over Balances: While improving (+7% since 2023), management noted the 10% target may be reached ahead of 2027 schedule — positive for operating leverage .

Forward Catalysts

The Bottom Line

ING delivered a strong finish to 2025 with beats across all key metrics. More importantly, management's upgraded 2027 outlook — with total income exceeding €25B and ROE targeting 15% — signals confidence in the bank's growth trajectory. The combination of customer momentum (1M+ new customers), positive operating leverage, and disciplined capital returns positions ING well among European banks.

The muted stock reaction reflects the strong run-up into earnings, but the fundamental story remains intact: a digital-first bank gaining share in core European markets while driving fee diversification and operational efficiency through AI.

Related: ING Company Overview · Q4 2025 Transcript