Earnings summaries and quarterly performance for ING GROEP.

Research analysts who have asked questions during ING GROEP earnings calls.

Anke Reingen

RBC

5 questions for ING

Benjamin Goy

Deutsche Bank

5 questions for ING

Farquhar Murray

Autonomous

5 questions for ING

Tarik El Mejjad

Bank of America

5 questions for ING

Benoit Petrarque

Kepler Cheuvreux

4 questions for ING

Giulia Miotto

Morgan Stanley

4 questions for ING

Arne Petimezas

AFS Group

2 questions for ING

Chris Hallam

Goldman Sachs Group Inc.

2 questions for ING

Delphine Lee

JPMorgan Chase & Co.

2 questions for ING

Hari Sivakumaran

Keefe, Bruyette & Woods

2 questions for ING

Hugh Moorhead

Berenberg

2 questions for ING

Johan Ekblom

UBS

2 questions for ING

Kirishanthan Vijayarajah

HSBC

2 questions for ING

Namita Samtani

Barclays

2 questions for ING

Samuel Moran-Smyth

Barclays

2 questions for ING

Giulia Aurora Miotto

Morgan Stanley

1 question for ING

Jonathan Matthew Clark

Mediobanca

1 question for ING

Juan Pablo López Cobo

Banco Santander

1 question for ING

Marta Sánchez Romero

Citi

1 question for ING

Matthew Clark

Piper Sandler

1 question for ING

Recent press releases and 8-K filings for ING.

- ING announced progress on its €1.1 billion share buyback programme, which was initially announced on October 30, 2025.

- During the week of January 26 up to and including January 30, 2026, ING repurchased 2,606,377 shares at an average price of €24.76, totaling €64,545,806.61.

- To date, a total of 25,520,672 shares have been repurchased under the program at an average price of €23.23, for a total consideration of €592,900,930.89.

- Approximately 53.90% of the maximum total value of the share buyback programme has been completed as of February 3, 2026.

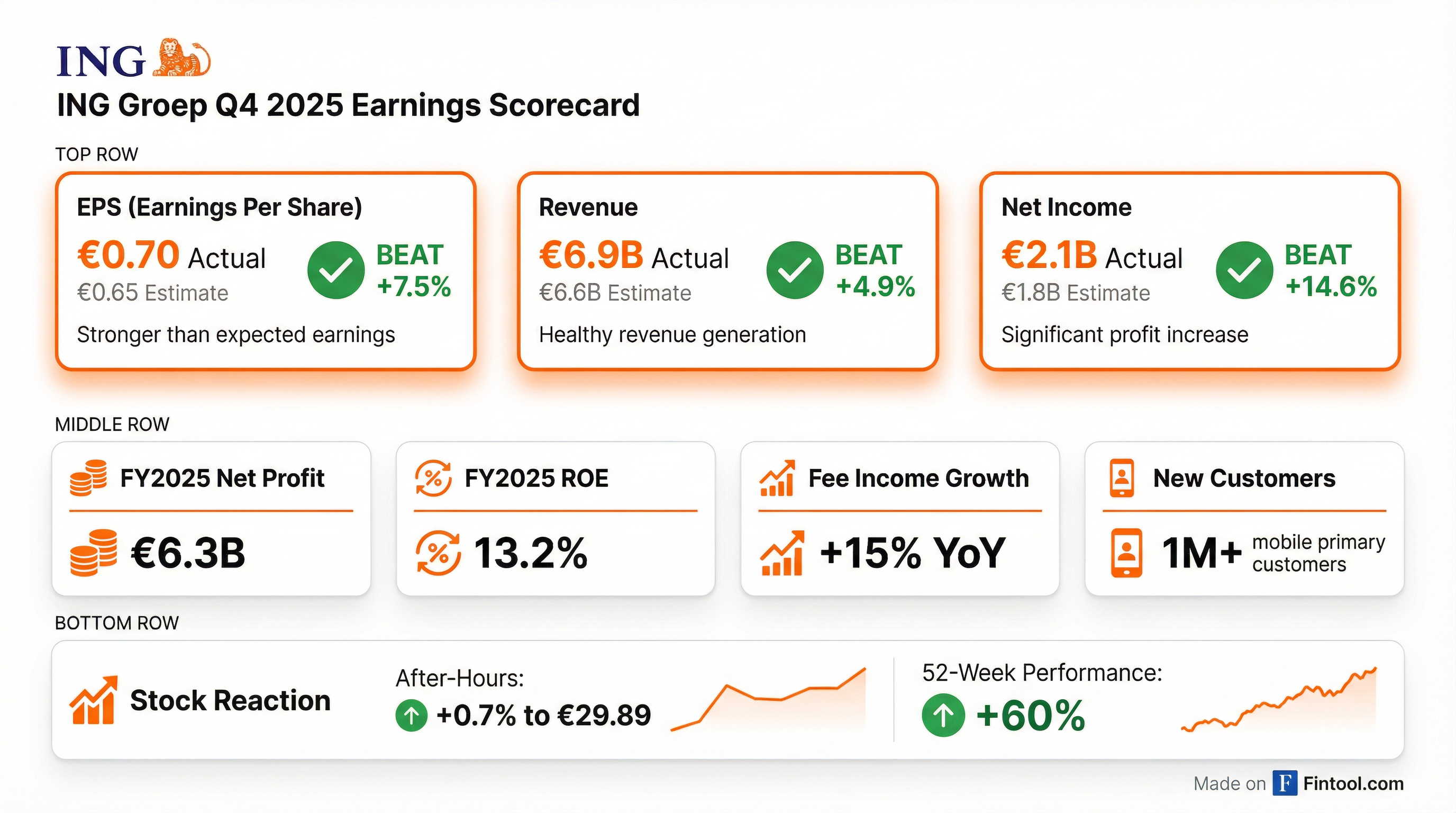

- ING reported strong financial results for 2025, including a 13.2% Return on Equity and over EUR 6.3 billion in net profit, supported by 15% fee income growth and EUR 15.3 billion in commercial Net Interest Income.

- The company demonstrated significant commercial momentum in 2025, adding over 1 million Mobile Primary Customers and achieving 8.3% loan book growth and 5.5% deposit book growth.

- For 2026, ING projects total income to reach around EUR 24 billion with fee income growing 5%-10%, and anticipates a Return on Tangible Equity (ROTE) of more than 14%, further increasing to more than 15% by 2027.

- The CET1 ratio stood at 13.1% after EUR 3.6 billion in additional distributions, and ING plans EUR 6 billion to EUR 8 billion in Holdco Senior and EUR 6 billion to EUR 8 billion in secured issuance for 2026.

- ING reported a 13.2% return on equity for 2025, exceeding guidance, with net profit over EUR 6.3 billion, driven by a record total income and strong commercial momentum including over 1 million new Mobile Primary Customers.

- The company's CET1 ratio decreased to 13.1% after an additional EUR 1.6 billion distribution, part of EUR 3.6 billion in total additional distributions, and proposed a final cash dividend of approximately 74 cents per ordinary share for 2025.

- For 2026, ING expects total income to reach around EUR 24 billion and projects ROTE to grow from 13.6% to over 14%, with total income exceeding EUR 25 billion and ROTE over 15% by 2027.

- ING plans to issue EUR 6 billion to EUR 8 billion of Holdco Senior and EUR 6 billion to EUR 8 billion in secured issuance in 2026, while amply meeting TLAC and MREL requirements with significant buffers.

- ING achieved a 13.2% return on equity for 2025, surpassing its initial guidance, driven by robust commercial growth including 8.3% loan book growth and 5.5% deposit book growth, alongside a 15% increase in fee income.

- The company generated EUR 6.3 billion in net profit for 2025, significantly contributing to its capital, with the CET1 ratio standing at 13.1% in Q4 2025 after additional distributions.

- For 2026, ING projects total income to reach around EUR 24 billion and expects its return on tangible equity (ROTE) to grow to more than 14%, with total operating expenses anticipated to be between EUR 12.6 billion and EUR 12.8 billion.

- Looking ahead to 2027, total income is expected to exceed EUR 25 billion, with fee income surpassing EUR 5 billion, and ROTE projected to be more than 15%.

- In 2026, ING plans to issue between EUR 6 billion and EUR 8 billion of Holdco Senior and between EUR 6 billion and EUR 8 billion of secured issuance.

- ING Groep NV reported a full-year 2025 net result of €6,327 million and a return on equity of 13.2%.

- Total income for FY2025 increased to €23.0 billion, driven by a 15% rise in fee income to €4.6 billion.

- The company achieved net core lending growth of €57 billion (8%) and net core deposits growth of €38 billion (6%) in 2025, with a CET1 ratio of 13.1%.

- ING provided a strong outlook for 2026, expecting total income of around €24 billion and a Return on Tangible Equity (ROTE) of >14%, with an upgraded outlook of >15% for 2027.

- A final dividend of €0.736 per share for 2025 has been proposed, contributing to a total cash dividend of €3.2 billion for the year, alongside a €1.1 billion share buyback program.

- ING reported strong financial results for 2025, including a net profit of EUR 6.3 billion, a return on equity of 13.2%, and a capital ratio of 30.1%.

- The company experienced significant commercial growth in 2025, adding over 1 million primary customers (with 350,000 in Q4) , and achieving an 8% growth in its lending book (EUR 57 billion) and 6% growth in deposits (EUR 38 billion).

- Fee income grew by 15% to EUR 4.6 billion in 2025 , while the asset management and e-brokerage segment increased by 60% to EUR 278 billion compared to 2024.

- ING's sustainable finance efforts expanded, with mobilized volumes rising from EUR 140 billion to EUR 166 billion in 2025, and its renewable energy portfolio growing to EUR 9 billion, exceeding the EUR 7.5 billion target. The company also initiated a Significant Risk Transfer (SRT) strategy, which released 12 basis points and 0.2% on CET1 in 2025, with an anticipated 15-20 basis points release in 2026.

- ING reported a net profit of EUR 6.3 billion and a return on equity of 13.2% for 2025, with a capital ratio of 30.1%.

- The company significantly grew its primary customers by over 1 million in 2025, including 350,000 in the fourth quarter.

- The lending book expanded by EUR 57 billion (8%) and deposits grew by EUR 38 billion (6%) in 2025, while asset management and e-brokerage increased by 60% to EUR 278 billion.

- Fee income saw a 15% growth, reaching EUR 4.6 billion, though full-year expenses were 4% higher.

- ING reported strong commercial and financial results for 2025, achieving a net profit of EUR 6.3 billion, a return on equity of 13.2%, and a capital ratio of 30.1%.

- The company significantly expanded its customer base, adding over 1 million primary customers in 2025, and saw its lending book grow by 8% (EUR 57 billion) and deposits by 6% (EUR 38 billion).

- Fee income increased by 15% to EUR 4.6 billion, while assets in asset management and e-brokerage surged by 60% to EUR 278 billion compared to 2024.

- ING's Significant Risk Transfer (SRT) strategy contributed a 0.2% CET1 release (12 basis points) in 2025, with an anticipated 0.15%-0.20% release in 2026.

- The bank is also rapidly increasing its defense exposure, which now stands at at least EUR 2 billion from a near-zero base, with 40 to 50 projects in the pipeline.

- ING reported strong commercial growth in Q4 2025, adding over 1 million mobile primary customers for the year and achieving 8.3% loan growth, with fee income growing 15% for the full year.

- The company's Return on Equity for 2025 was 13.2%, exceeding guidance. ING provided an upgraded outlook for 2027, expecting total income to exceed EUR 25 billion and a Return on Equity of 15%, alongside a 2026 outlook for total income of around EUR 24 billion and ROE of 14%.

- ING maintains a focus on cost discipline and operational efficiency, leveraging Gen AI, and aims for a CET1 capital ratio of around 13% while committing to a 50% payout policy for shareholder returns.

- Ida Lerner has been appointed as the new CFO, succeeding Tanate Phutrakul, who was CFO until the AGM in April 2025.

- ING reported a strong Q4 and full year 2025, achieving a record total income for the third consecutive year and a Return on Equity of 13.2% for 2025.

- The company provided an upgraded outlook, projecting total income of around EUR 24 billion for 2026 and to exceed EUR 25 billion in 2027.

- For 2026, ING expects a Return on Equity of 14% and a Return on Tangible Equity higher than 14%, with these figures increasing to 15% and more than 15% respectively in 2027.

- Total operating expenses (excluding incidentals) are projected to be between EUR 12.6 billion and EUR 12.8 billion for 2026 and around EUR 13 billion for 2027, reflecting continued cost discipline.

- CFO Tanate Phutrakul will depart after the AGM in April 2026, with Ida Lerner mentioned as the new CFO.

Quarterly earnings call transcripts for ING GROEP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more