Earnings summaries and quarterly performance for Ingredion.

Executive leadership at Ingredion.

James P. Zallie

President and Chief Executive Officer

Eric Seip

Senior Vice President, Global Operations, and Chief Supply Chain Officer

James Gray

Executive Vice President and Chief Financial Officer

Robert Ritchie

Senior Vice President, Food & Industrial Ingredients, US/Canada & Latin America

Tanya Jaeger de Foras

Senior Vice President, Chief Legal Officer, Corporate Secretary and Chief Compliance Officer

Board of directors at Ingredion.

Catherine A. Suever

Director

Charles V. Magro

Director

David B. Fischer

Director

Dwayne A. Wilson

Director

Gregory B. Kenny

Chair of the Board

Jorge A. Uribe

Director

Patricia Verduin

Director

Rhonda L. Jordan

Director

Stephan B. Tanda

Director

Victoria J. Reich

Director

Research analysts who have asked questions during Ingredion earnings calls.

Heather Jones

Heather Jones Research

6 questions for INGR

Kristen Owen

Oppenheimer & Co. Inc.

6 questions for INGR

Benjamin Theurer

Barclays Corporate & Investment Bank

5 questions for INGR

Pooran Sharma

Stephens Inc.

5 questions for INGR

Benjamin Mayhew

BMO Capital Markets

4 questions for INGR

James Cannon

UBS Securities

3 questions for INGR

Andrew Strelzik

BMO Capital Markets

2 questions for INGR

Joshua Spector

UBS

2 questions for INGR

Ben Theurer

Barclays

1 question for INGR

Josh Spector

UBS Group

1 question for INGR

Recent press releases and 8-K filings for INGR.

- Ingredion reported record results in 2025, including $950 million in cash from operations, with approximately half returned to shareholders, and record gross profit margins over 25%, up 120 basis points on the prior year.

- The company provided an updated long-term outlook through 2028, targeting net sales growth of 1% to 3%, mid-single digits operating income growth, and 7% to 9% adjusted EPS growth.

- Strategic growth is driven by the Texture and Healthful Solutions segment, where its solutions business grew 7.5% last year with 500 basis points of margin accretion, and clean label solutions grew 8% with 200 basis points of margin expansion in 2025.

- Ingredion is implementing an enterprise productivity program, expected to contribute over 1 point of operating income growth by 2028, and has consistently increased its annual dividend rate 11 times in the last 11 years.

- Ingredion reported record results in 2025, including $950 million in cash from operations and gross profit margins over 25%, while returning $435 million to shareholders.

- The company is a global leader in texture and the number one clean label producer, with the clean label segment growing 8% and expanding margins by 200 basis points in 2025.

- Strategic investments include $200 million in CapEx in the last year to support growth in areas like private label, which is seeing significant expansion.

- Ingredion's 2028 outlook projects net sales growth of 1% to 3%, mid-single digits operating income growth, and adjusted EPS growth of 7% to 9%.

- Ingredion reported a record year in 2025, achieving gross profit margins over 25% (up 120 basis points on prior year) and record earnings per share driven by its Texture and Healthful Solutions segment. The company returned $435 million to shareholders through dividends and share repurchases and averaged $1 billion in cash generation over the last three years.

- The company's solutions business, a part of the Texture and Healthful Solutions segment, surpassed $1 billion in net revenue, growing at 7.5%, and is 500 basis points margin accretive.

- Ingredion provided a long-term outlook (2025-2028) projecting net sales growth of 1% to 3%, mid-single-digit operating income growth, and adjusted EPS growth in the 7%-9% range.

- The U.S.-Canada segment is targeted to achieve $350 million in operating income by 2028, an increase from $315 million in 2025.

Ingredion reported strong financial performance in 2025, with key metrics detailed below:

| Metric | 2024 | 2025 |

|---|---|---|

| Non-GAAP adjusted diluted EPS ($USD) | $10.65 | $11.13 |

| Adjusted Return on Invested Capital (%) | 14.8% | 15.5% |

| Food & Industrial Ingredients Net Sales - LATAM ($USD Billions) | N/A | $2.4 |

| Food & Industrial Ingredients Segment Op Income Margin - LATAM (%) | N/A | 21% |

| Food & Industrial Ingredients Net Sales - U.S. & Canada ($USD Billions) | N/A | $2.0 |

| Food & Industrial Ingredients Segment Op Income Margin - U.S. & Canada (%) | N/A | 16% |

- The company is strategically focused on Texture & Healthful Solutions, a segment delivering above-market performance, and maintains a #1 position in Clean Label.

- Ingredion plans to achieve 100 basis points of incremental operating income margin expansion over the next three years through Enterprise Productivity initiatives and anticipates over $1 billion in capital investment during the same period.

- Capital allocation priorities include a plan to repurchase at least $100 million in shares in FY2026 and a consistent dividend, having increased it for 11 consecutive years.

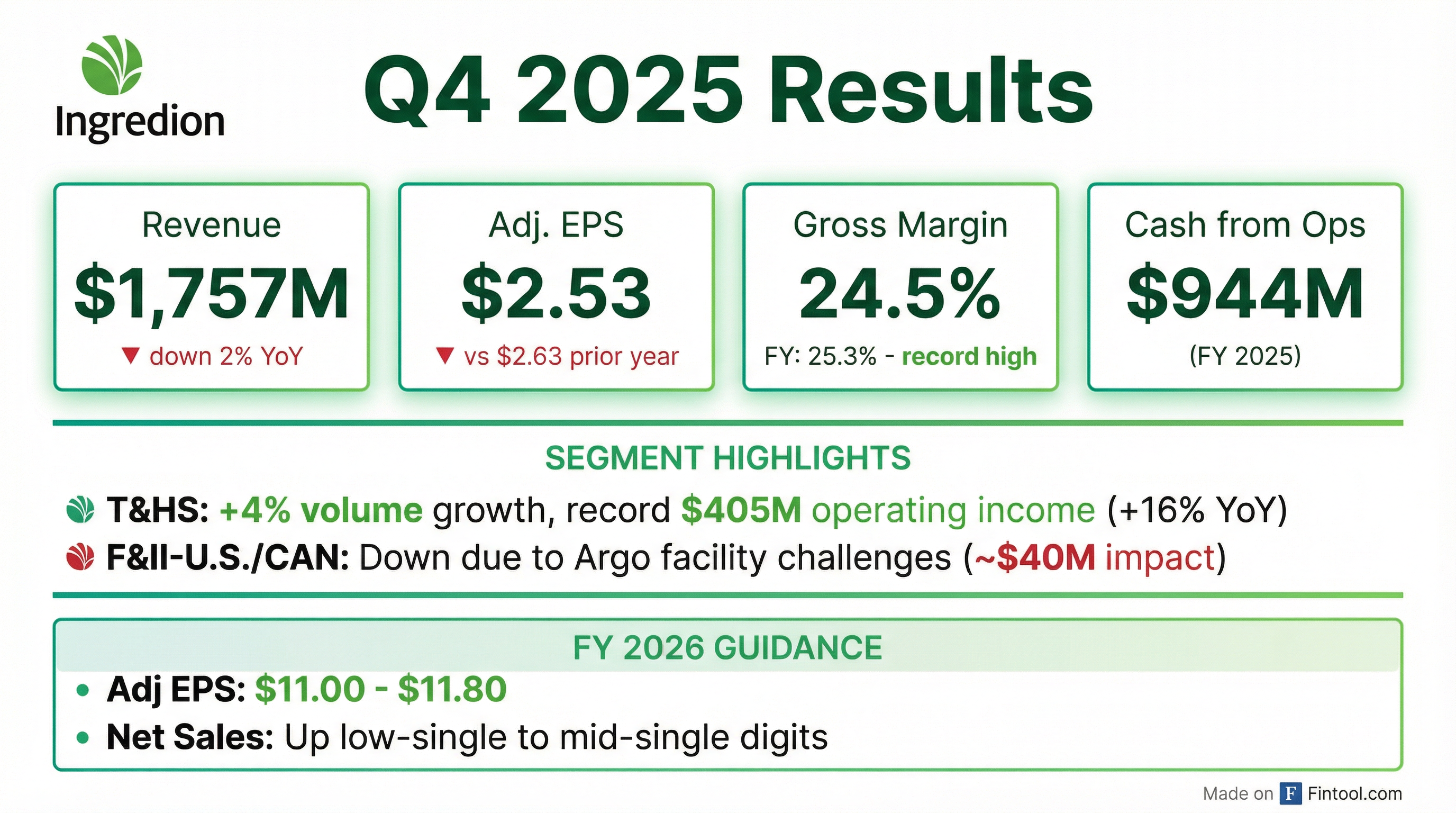

- Ingredion reported full-year 2025 adjusted diluted EPS of $11.13 and net sales of $7,219 million, representing a 3% decrease compared to 2024.

- The Texture & Healthful Solutions (T&HS) segment demonstrated continued strength with 4% sales growth, while the Food & Industrial Ingredients (F&II) – U.S./Canada segment faced significant operational challenges and decreased demand.

- The company returned $211 million in dividends and repurchased $224 million of common stock to shareholders in 2025.

- For 2026, Ingredion forecasts adjusted diluted EPS between $11.00 and $11.80 and projects operating cash flow between $820 million and $940 million.

- Ingredion achieved record full-year results in 2025, with reported diluted EPS of $11.18 and adjusted diluted EPS of $11.13, despite a 3% decrease in net sales to $7,219 million.

- The Texture & Healthful Solutions segment demonstrated solid performance with 4% sales growth in Q4 2025 and a 16% increase in full-year operating income to $405 million, while Food & Industrial Ingredients – LATAM also contributed positively.

- The Food & Industrial Ingredients – USA/Canada segment faced operational challenges and weaker demand, leading to a 16% decline in full-year operating income to $315 million.

- For the full-year 2026, Ingredion anticipates reported and adjusted EPS to be between $11.00 and $11.80, with net sales projected to grow in the low to mid-single digits and operating income in the low single digits.

- In 2025, the company returned value to shareholders by paying $211 million in dividends and repurchasing 1.8 million common shares for $224 million.

- Ingredion reported full-year 2025 diluted EPS of $11.18 and adjusted diluted EPS of $11.13, compared to $9.71 and $10.65 in 2024, respectively.

- Net sales for full-year 2025 decreased by 3% to $7,219 million compared to 2024.

- Full-year 2025 reported operating income increased by 15% to $1,016 million, while adjusted operating income increased by 1% to $1,028 million.

- The company generated $944 million in operating cash flow for full-year 2025 and returned $435 million to shareholders, including $224 million in share repurchases.

- For full-year 2026, Ingredion forecasts reported and adjusted EPS in the range of $11.00 to $11.80.

- Ingredion reported full-year 2025 adjusted diluted EPS of $11.13, an increase from $10.65 in 2024, while net sales decreased 3% to $7,219 million.

- Reported operating income for full-year 2025 increased 15% to $1,016 million, and adjusted operating income increased 1% to $1,028 million compared to 2024.

- The company returned $435 million to shareholders in 2025, comprising $211 million in dividends and $224 million in share repurchases.

- Operating cash flow for 2025 was $944 million, a decrease from $1,436 million in 2024, primarily reflecting increased investment in working capital.

- For full-year 2026, Ingredion projects reported and adjusted diluted EPS to be between $11.00 and $11.80, with net sales expected to achieve low to mid-single-digit growth.

- Ingredion (INGR) reported FY 2025 Net Sales of $7,219 million, a 3% decrease year-over-year, with Adjusted Operating Income of $1,028 million (up 1%) and Adjusted Diluted EPS of $11.13 (up 4.5%).

- For Q4 2025, Net Sales were $1,757 million, down 2% from Q4 2024, and Adjusted Diluted EPS was $2.53, a decrease from $2.63 in the prior year quarter.

- The Texture & Healthful Solutions segment showed strong momentum, achieving its 7th consecutive quarter of sales volume growth (+4%) in Q4 2025 and record adjusted operating income of $405 million for FY 2025, a 16% increase.

- The Food & Industrial Ingredients—U.S./CAN segment experienced persistent operational challenges at its Argo facility, contributing to a -7% net sales volume change in Q4 2025 and an estimated ~$40 million impact on FY 2025 operating income.

- For full-year 2026, the company anticipates net sales to be up low to mid-single-digits, adjusted operating income to be up low single-digits, and Adjusted EPS to be between $11.00 and $11.80.

- Ingredion reported full-year 2025 net sales of $7.2 billion, a 3% decrease year-over-year, but achieved record full-year operating income and earnings per share growth, with gross margins expanding to over 25%.

- The Texture and Healthful Solutions segment demonstrated strong performance, with Q4 2025 volume growth of 4% and full-year 2025 operating income up 16%, notably driven by the protein fortification business which saw over 40% net sales growth.

- The Food and Industrial Ingredients US/Canada segment faced significant operational challenges at its Argo facility, leading to an estimated $16 million loss impact in Q4 2025 and a total $40 million impact for the full year 2025.

- For 2026, the company projects net sales to increase by low single digits to mid-single digits and adjusted EPS to be in the range of $11-$11.80, while committing to at least $100 million in share repurchases.

- Ingredion exceeded its cost-to-compete savings target, delivering $59 million in run rate savings in 2025, and announced the retirement of CFO Jim Gray effective March 31, 2026.

Fintool News

In-depth analysis and coverage of Ingredion.

Quarterly earnings call transcripts for Ingredion.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more