Ingredion (INGR)·Q4 2025 Earnings Summary

Ingredion Q4 2025: Texture & Healthful Solutions Hits Record Profit Despite Overall Headwinds

February 03, 2026 · by Fintool AI Agent

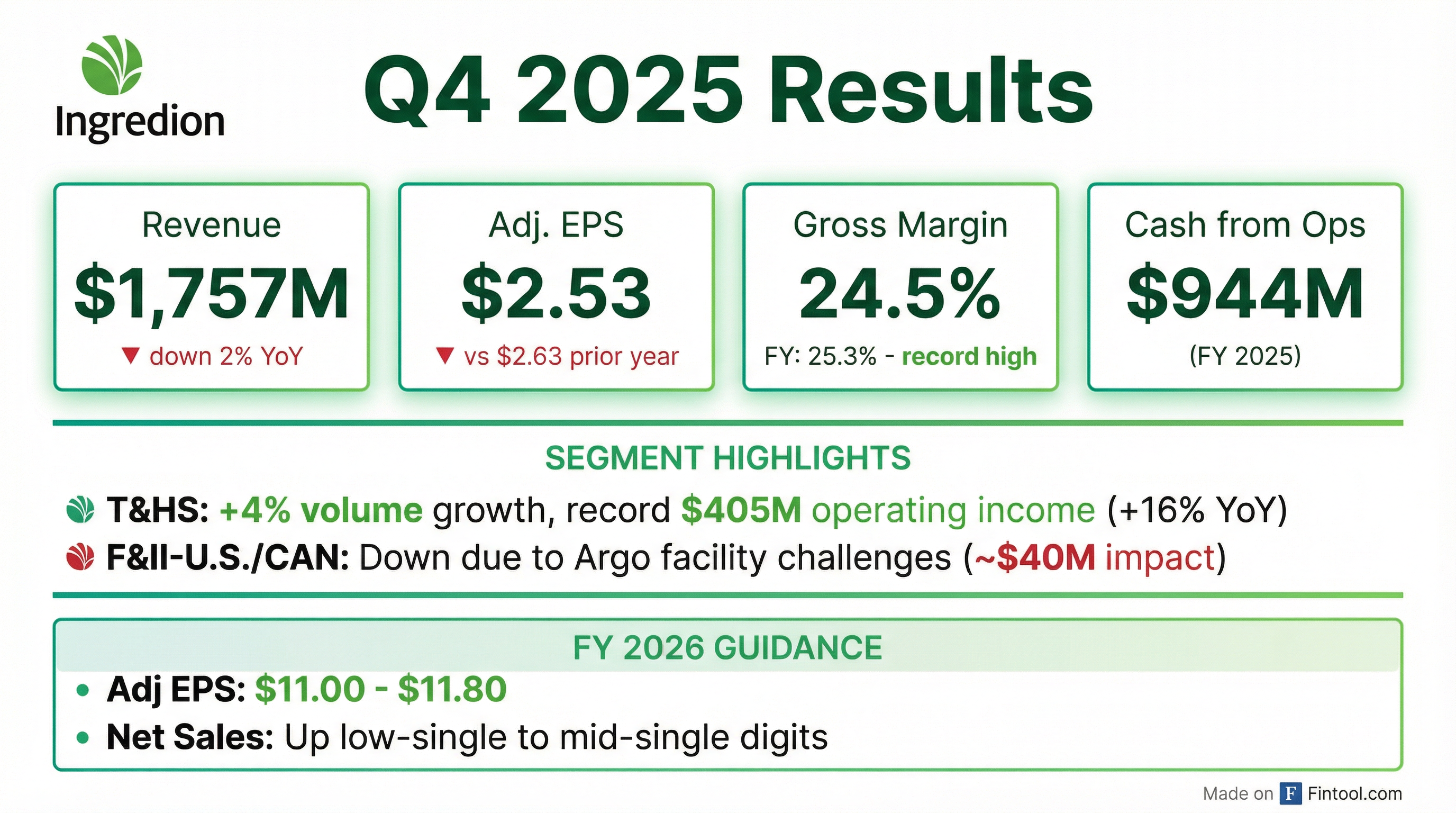

Ingredion reported mixed Q4 2025 results, with revenue and EPS both missing estimates while the high-margin Texture & Healthful Solutions segment delivered record profitability. Full-year adjusted EPS of $11.13 came in within the prior guidance range of $11.10-$11.30, but persistent operational issues at the Argo facility and softer demand weighed on the quarter.

Did Ingredion Beat Earnings?

No — INGR missed on both revenue and EPS in Q4:

For the full year, results were mixed:

The gross margin expansion to 25.3% represents a new company record, marking the third consecutive year of improvement.

What's Driving the Segment Divergence?

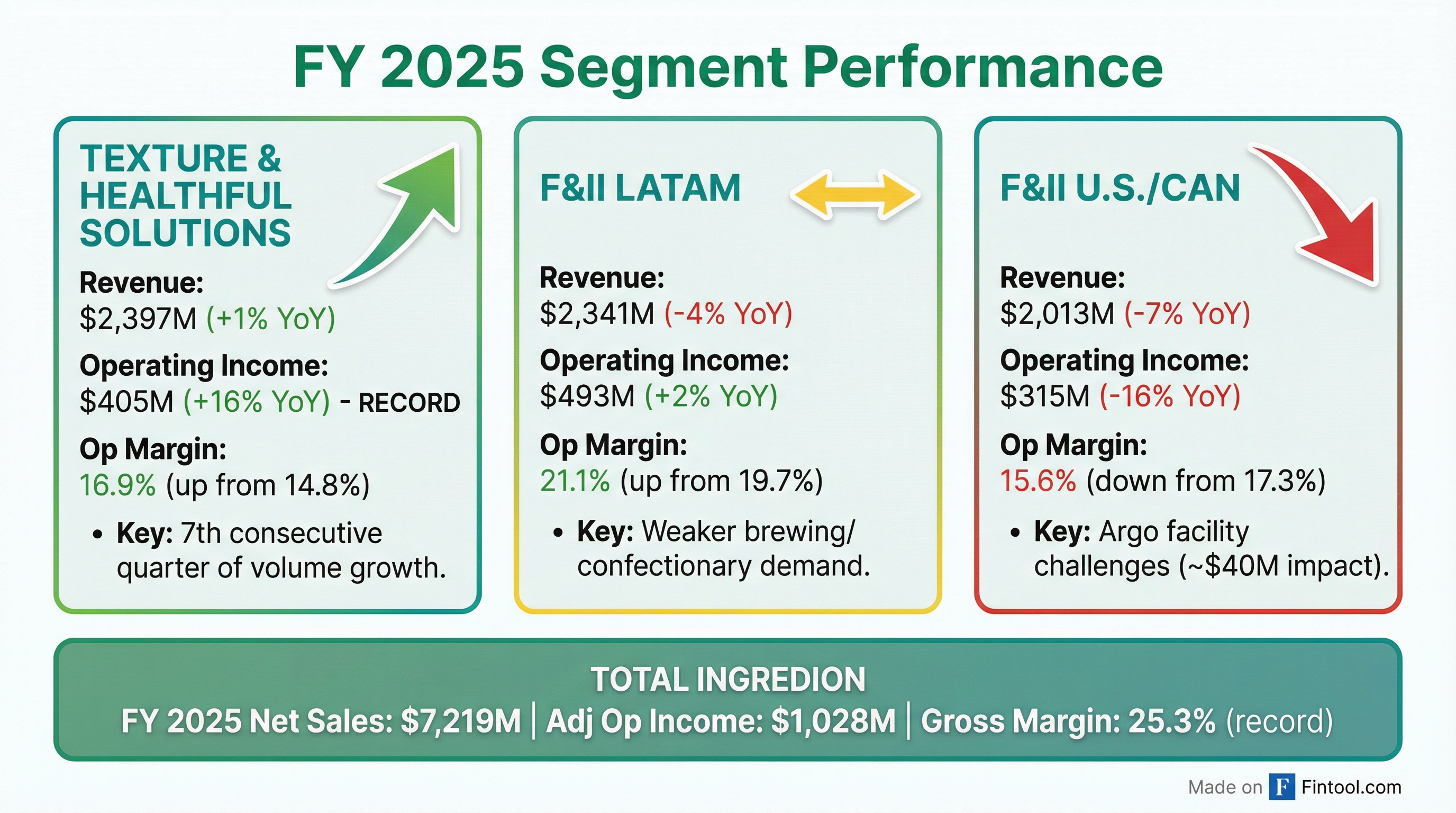

The story of Q4 and FY 2025 is a tale of two businesses: the specialty-focused T&HS segment thriving while the commoditized F&II segments struggled.

Texture & Healthful Solutions: The Bright Spot

T&HS delivered its 7th consecutive quarter of volume growth (+4% in Q4) and posted record operating income of $405M for the full year, up 16% YoY.

Key drivers:

- Clean label ingredient sales grew double-digits in U.S./Canada in Q4 and full year

- Solutions sales growth outpaced the segment's overall growth

- Record quarterly sales for pea protein isolate business in Q4, with production doubled vs prior year

- Completed Belcamp facility expansion adding ~$30M revenue capacity for blending solutions

- Indianapolis modernization project went live, lowering specialty starch costs and expanding capacity

F&II—U.S./Canada: Argo Challenges Persist

The U.S./Canada segment remained the problem child, with operating income down 16% for the full year to $315M.

The culprits:

- Argo facility operational setbacks — estimated $40M negative impact in 2025 from higher maintenance costs, lower yields, and fixed cost absorption

- Lower co-product values realized

- Weak industry sweetener volumes due to lower food and beverage demand

- Q4 net sales down 9%, with 7% volume decline

Management noted recovery plans are underway and expect meaningful improvement in 2026.

F&II—LATAM: Steady Despite Headwinds

LATAM delivered $493M in operating income (+2% YoY) with margin expansion to 21.1% from 19.7%, despite a 4% revenue decline.

- Brewing volume improved sequentially in Q4

- Confectionary and paper/corrugating volumes remained weak

- Modest food ingredient growth

What Did Management Guide for 2026?

Ingredion provided the following FY 2026 outlook:

Guidance reflects tariff levels in effect as of January 31, 2026. Management noted very little impact from new U.S. tariffs as most products are made and sold locally.

Segment Outlook for 2026:

Q1 2026 Warning: Management expects Q1 net sales to be down low-single digits with operating income down mid-double-digits.

How Did the Stock React?

The stock is trading 17% below its 52-week high, reflecting concerns about the ongoing Argo facility issues and softer demand environment. The weak Q1 2026 guidance (operating income down mid-double-digits) may pressure shares in the near term.

What Changed From Last Quarter?

Positives:

- Gross margin hit record 25.3% (was 25.1% at Q3) — third consecutive year of improvement

- Cost Compete program delivered $59M run-rate savings, exceeding targets

- Pea protein business doubled production and achieved record quarterly sales

- Capacity investments completed — Belcamp and Indianapolis facilities operational

Concerns:

- Argo recovery slower than expected — $40M impact estimated for 2025, recovery plans underway

- Q1 2026 guided down significantly — operating income down mid-double-digits

- Working capital consumed $75M in 2025 vs contributing $396M in 2024

Capital Allocation & Shareholder Returns

FY 2025 cash from operations came in at $944M, within the updated guidance range of $800-$900M. Capital allocation:

Management noted that cash flow from operations will "continue at these levels" in 2026, guiding to $820-$940M.

Strategic Priorities for 2026

Management outlined key strategic pillars:

-

Profitable Growth — Solutions including clean label ingredients gaining momentum, outpacing T&HS segment growth in H2 2025

-

Innovation — Leveraging rising raw material costs (especially cocoa) driving customer reformulation demand; improving sugar reduction taste modulation capabilities

-

Operational Excellence — Introducing "Enterprise Productivity" as a new strategic pillar to drive long-term effectiveness and cost efficiency; closed three plants to optimize manufacturing network

What to Watch Going Forward

Argo Facility Recovery: The $40M headwind from operational challenges needs to reverse. Management stated recovery plans are underway — watch for progress updates in Q1.

Q1 2026 Execution: With operating income guided down mid-double-digits, any upside surprise could restore confidence.

T&HS Momentum: The premium segment continues to outperform. Watch for sustained volume growth and margin expansion.

Tariff Developments: Guidance reflects tariffs as of Jan 31, 2026. Any escalation could impact results despite localized manufacturing footprint.

Upcoming Events

- CAGNY 2026 — Orlando, February 17

- JP Morgan Consumer Ingredients Forum — London, March 10

- BNP Paribas Exane Consumer Ingredients Conference — London, March 10-11

Read the full Q4 2025 Earnings Slides | View INGR Company Profile