Earnings summaries and quarterly performance for INTERNATIONAL PAPER CO /NEW/.

Executive leadership at INTERNATIONAL PAPER CO /NEW/.

Andy Silvernail

Chief Executive Officer

Clayton Ellis

Senior Vice President, Global Cellulose Fibers

James Royalty

Senior Vice President, Containerboard and Recycling

Joseph Saab

Senior Vice President, General Counsel and Corporate Secretary

Joy Roman

Senior Vice President, Chief People and Strategy Officer

Lance Loeffler

Chief Financial Officer

Timothy Nicholls

Executive Vice President and President, DS Smith

Tom Hamic

Executive Vice President and President, North American Packaging Solutions

Board of directors at INTERNATIONAL PAPER CO /NEW/.

Ahmet Dorduncu

Director

Anders Gustafsson

Director

Anton Vincent

Director

Christopher Connor

Lead Independent Director

Clinton Lewis Jr.

Director

David Robbie

Director

Jacqueline Hinman

Director

Jamie Beggs

Director

Kathryn Sullivan

Director

Scott Tozier

Director

Research analysts who have asked questions during INTERNATIONAL PAPER CO /NEW/ earnings calls.

Mark Weintraub

Seaport Research Partners

7 questions for IP

Charlie Muir-Sands

BNP Paribas

5 questions for IP

Matthew McKellar

RBC Capital Markets

5 questions for IP

Michael Roxland

Truist Securities

5 questions for IP

Philip Ng

Jefferies

5 questions for IP

George Staphos

Bank of America

4 questions for IP

Gabe Hajde

Wells Fargo & Company

3 questions for IP

Anojja Shah

UBS Group AG

2 questions for IP

Anthony Pettinari

Citigroup Inc.

2 questions for IP

Detlef Winckelmann

JPMorgan Chase & Co.

2 questions for IP

Mike Roxland

Truist Securities

2 questions for IP

Phil Ng

Jefferies Financial Group Inc.

2 questions for IP

Matt McKellar

RBC Capital Markets

1 question for IP

Recent press releases and 8-K filings for IP.

- International Paper will separate into two independent, publicly traded companies—one for North America and another for EMEA—with a spin-off of the combined EMEA Packaging business planned within 12–15 months.

- The move follows the 2025 acquisition of DS Smith and $23.6 billion in 2025 sales, but the company swung to a net loss due to transaction and integration costs.

- Andy Silvernail will remain chair and CEO of the North American unit, while Tim Nicholls will lead the EMEA packaging company, chaired by David Robbie.

- Investors reacted cautiously: shares fell 1.1% to 3,030 pence in London and rose 1.1% to $41.96 in New York pre-market; the stock is down 28% over the past 12 months and the market cap is about $21.9 billion.

- International Paper will spin off its EMEA Packaging business within 12–15 months, with a planned dual listing in London and New York; the transaction structure and tax treatment depend on final terms, and IP will retain a meaningful ownership stake (Tim Nicholls to serve as EMEA CEO).

- Pro forma FY 2025 standalone North America Packaging Solutions achieved net sales > $15 billion and adjusted EBITDA ≈ $2.3 billion.

- Q4 2025 North America adjusted EBITDA was $560 million, reflecting volume headwinds of $87 million, maintenance/outages of $41 million, and input cost benefits of $24 million.

- 2026 enterprise guidance targets net sales of $24.1 billion–$24.9 billion, adjusted EBITDA of $3.5 billion–$3.7 billion, free cash flow of $300 million–$500 million, and Q1 adj EBITDA of $740 million–$760 million.

- International Paper will spin off its EMEA Packaging business into a separate publicly traded company within 12–15 months, with IP retaining a meaningful stake and listings planned on the London and New York Stock Exchanges.

- Pro forma FY 2025 net sales: North America packaging > $15 billion and ~$2.3 billion of Adjusted EBITDA; EMEA packaging ~$8.5 billion net sales and ~$800 million of Adjusted EBITDA.

- Q4 2025 performance: North America Packaging Solutions delivered $560 million of Adjusted EBITDA (impacted by non-strategic exits, fewer shipping days, and maintenance outages) ; EMEA Packaging achieved $19 million of sequential EBITDA growth.

- 2026 outlook: enterprise net sales of $24.1–$24.9 billion, Adjusted EBITDA of $3.5–$3.7 billion, and free cash flow of $300–$500 million, excluding incremental pricing effects.

- International Paper to create two independent public packaging companies in North America (2025 net sales $15.2B) and EMEA (2025 net sales $8.5B)

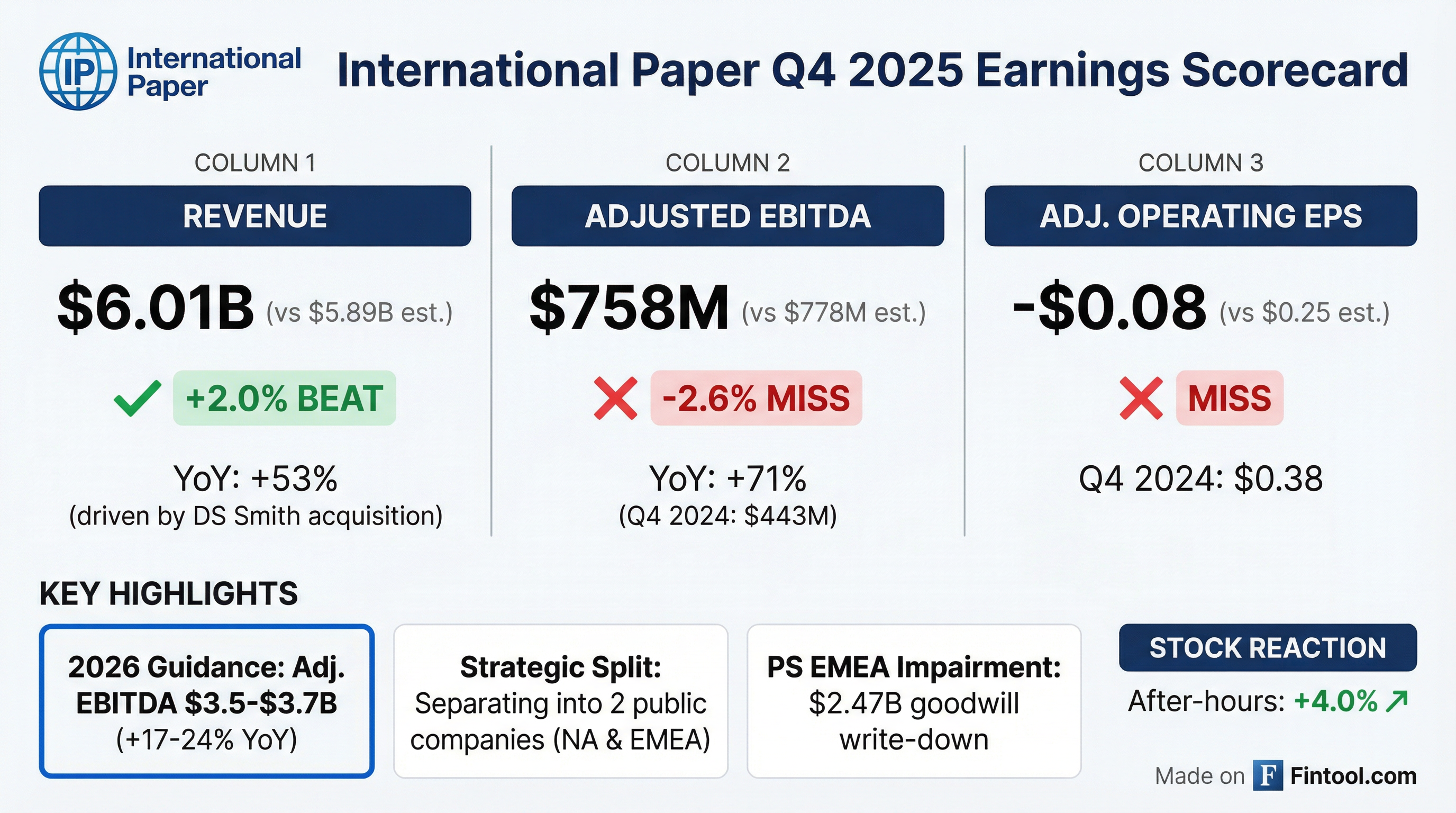

- Enterprise FY25 net sales $23.6B, adj. EBITDA $3.0B (12.6% margin), free cash flow $(159)MM; Q4 sales $6.0B, adj. EBITDA $758M (12.6% margin)

- North America Packaging delivered $2.3B adj. EBITDA (15.7% margin) on $15.2B net sales, up 37% YoY

- 2026 targets: total net sales $24.1–24.9B, adj. EBITDA $3.5–3.7B, and free cash flow $300–500MM

- International Paper will spin off its EMEA Packaging business into a separate publicly traded company (expected within 12–15 months), potentially tax-free, with listings on the London and New York Stock Exchanges.

- North America delivered 37% year-over-year adjusted EBITDA growth in 2025 and expanded its adjusted EBITDA margin by 340 basis points, while enterprise adjusted EBITDA margin grew by 230 basis points amid transformational investments.

- Pro forma standalone 2025 results show Packaging Solutions North America with net sales >$15 billion and $2.3 billion Adjusted EBITDA, and EMEA Packaging with net sales ~$8.5 billion and $800 million Adjusted EBITDA.

- For full year 2026, International Paper targets enterprise net sales of $24.1 billion–$24.9 billion, Adjusted EBITDA of $3.5 billion–$3.7 billion, and free cash flow of $300 million–$500 million, with Q1 Adjusted EBITDA guidance of $740 million–$760 million (excluding price actions).

- International Paper will separate into two independent, publicly traded companies—Packaging Solutions North America and Packaging Solutions EMEA—through a separation expected to complete in 12–15 months, subject to customary conditions (see segment recast and separation plan).

- In Q4 2025, net sales were $6.01 billion, loss from continuing operations was $2.36 billion (including a $2.47 billion goodwill impairment), and adjusted EBITDA (non-GAAP) was $0.76 billion.

- For the full year 2025, net sales totaled $23.63 billion, adjusted EBITDA (non-GAAP) reached $2.98 billion, and free cash flow (non-GAAP) was $(0.16) billion.

- The company set 2026 targets of $3.5–$3.7 billion in adjusted EBITDA (non-GAAP) for the full year and $0.74–$0.76 billion for Q1 2026 (non-GAAP).

- Reported full-year 2025 net sales of $23.63 billion and a loss from continuing operations of $2.84 billion, which includes a $2.47 billion pre-tax goodwill impairment.

- Fourth quarter 2025 delivered net sales of $6.01 billion, a loss from continuing operations of $2.36 billion, and adjusted EBITDA of $0.76 billion.

- Announced plan to separate into two independent, publicly traded Packaging Solutions companies—North America and EMEA—expected to complete in 12–15 months.

- Issued 2026 financial targets of $3.5–$3.7 billion adjusted EBITDA for the full year and $0.74–$0.76 billion for the first quarter.

- International Paper will separate into two independent, publicly traded companies: one for its North American packaging business (combining legacy IP and DS Smith assets) and one for its EMEA packaging business (combining legacy DS Smith and IP assets).

- The move aims to establish region-specific leaders with focused management teams, tailored capital allocation, and distinct business models to maximize long-term value.

- The EMEA Packaging spin-off is expected to complete in 12–15 months, will list on both the LSE and NYSE, and International Paper intends to retain a significant ownership stake; U.S. tax treatment will depend on final transaction terms.

- Andy Silvernail will continue as Chairman and CEO of the North American company, while Tim Nicholls will lead the newly independent EMEA Packaging business.

- International Paper completed the sale of its Global Cellulose Fibers (GCF) business to funds affiliated with American Industrial Partners on January 23, 2026.

- The transaction was valued at $1.5 billion, including preferred stock with an aggregate initial liquidation preference of $190 million.

- The GCF segment generated $2.8 billion in revenue in 2024 (approximately $2.3 billion excluding closed mills) and comprises 3,300 employees, nine manufacturing facilities and eight regional offices globally.

- International Paper sold its Global Cellulose Fibers business to American Industrial Partners for $1.5 billion, including issuance of preferred stock with an initial liquidation preference of $190 million.

- The GCF segment generated $2.8 billion in revenue in 2024 (including closed mills) and $2.3 billion excluding closed mills.

- The divested operations comprise 3,300 employees, nine manufacturing facilities and eight regional offices worldwide.

Fintool News

In-depth analysis and coverage of INTERNATIONAL PAPER CO /NEW/.

Quarterly earnings call transcripts for INTERNATIONAL PAPER CO /NEW/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more