Earnings summaries and quarterly performance for IF Bancorp.

Research analysts covering IF Bancorp.

Recent press releases and 8-K filings for IROQ.

IF Bancorp Shareholders Approve Merger with ServBanc Holdco

IROQ

M&A

Proxy Vote Outcomes

- IF Bancorp, Inc. shareholders approved the pending merger with ServBanc Holdco, Inc. at a special meeting held on February 3, 2026.

- The merger is expected to close on March 12, 2026, subject to the satisfaction of customary closing conditions.

- Shareholders also approved a non-binding advisory resolution regarding compensation for named executive officers in connection with the merger.

3 days ago

IF Bancorp, Inc. Announces Q2 2026 Results and Merger Update

IROQ

Earnings

M&A

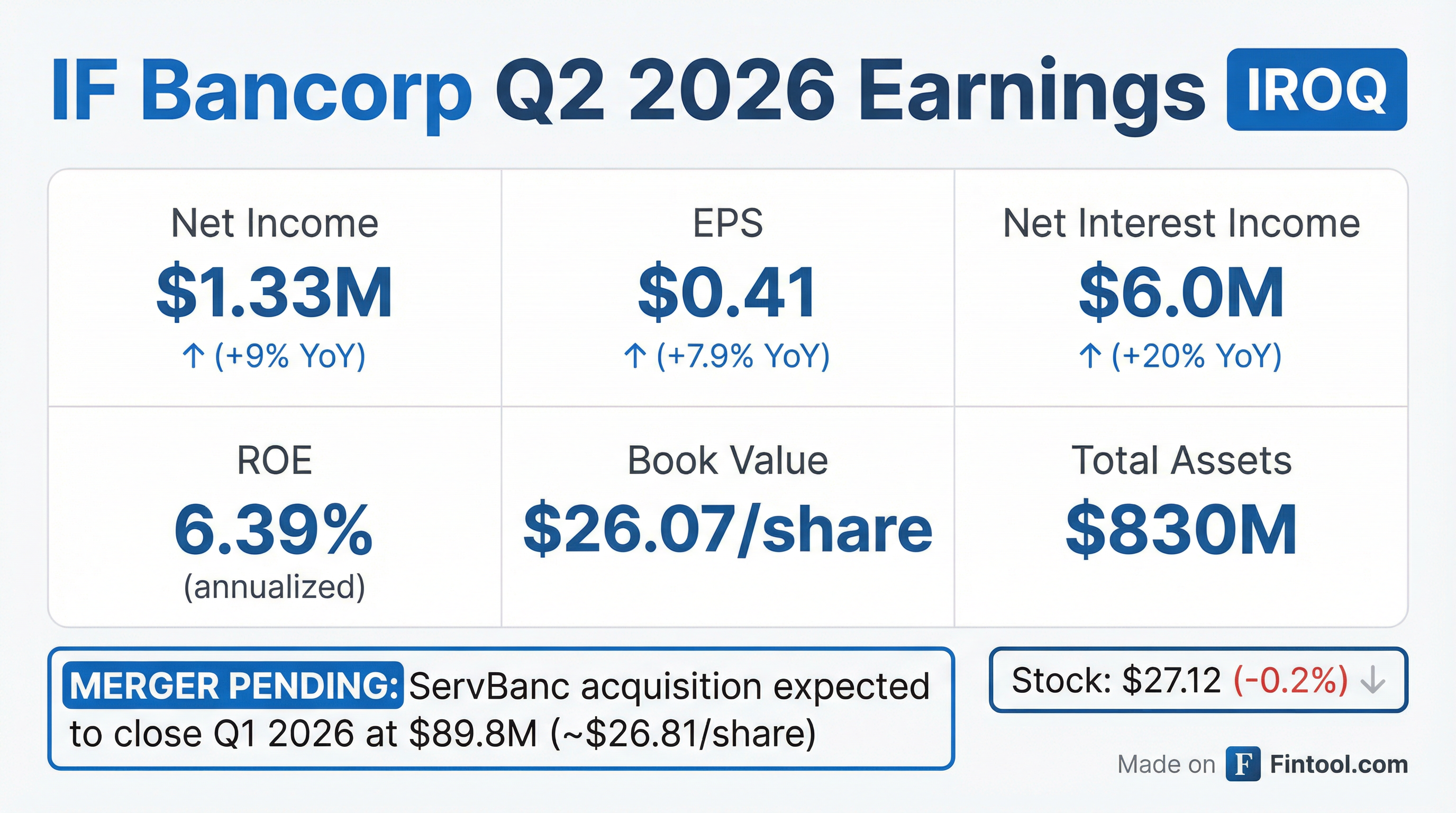

- For the second quarter of fiscal year 2026, ended December 31, 2025, IF Bancorp, Inc. reported net income of $1.3 million, or $0.41 per basic and diluted share.

- The pending merger with ServBanc Holdco, Inc., an all-cash transaction valued at approximately $89.8 million, remains on track for a first quarter 2026 close.

- As of December 31, 2025, total assets were $830.4 million, deposits were $649.6 million, and stockholders' equity increased to $87.4 million.

Jan 30, 2026, 9:34 PM

IF Bancorp Announces Second Quarter Fiscal Year 2026 Results and Merger Update

IROQ

Earnings

M&A

- IF Bancorp, Inc. reported net income of $1.3 million ($0.41 per share) for the three months ended December 31, 2025, and $2.7 million ($0.84 per share) for the six months ended December 31, 2025, representing an increase compared to the prior year periods.

- The company's pending merger with ServBanc is on track for a first-quarter 2026 close, with the transaction valued at approximately $89.8 million.

- Total assets decreased to $830.4 million at December 31, 2025, from $887.7 million at June 30, 2025, primarily due to a $59.3 million withdrawal of public entity deposits.

- Net interest income increased to $6.0 million for the three months ended December 31, 2025, from $5.0 million in the prior year, while noninterest expense rose to $5.5 million mainly due to professional services related to the merger.

Jan 30, 2026, 9:15 PM

Monteverde & Associates PC Investigates IF Bancorp's Sale to ServBanc Holdco, Inc.

IROQ

M&A

Legal Proceedings

Takeover Bid

- Monteverde & Associates PC is investigating the sale of IF Bancorp, Inc. (NASDAQ:IROQ) to ServBanc Holdco, Inc.

- Under the terms of the proposed transaction, IF Bancorp shareholders are expected to receive $27.20 in cash per share of common stock.

Dec 9, 2025, 8:18 PM

IF Bancorp, Inc. Announces First Quarter Fiscal Year 2026 Results

IROQ

Earnings

Revenue Acceleration/Inflection

- IF Bancorp, Inc. reported net income of $1.4 million, or $0.43 per basic and diluted share, for the three months ended September 30, 2025, an increase from $633,000, or $0.20 per basic and diluted share, for the same period in 2024.

- Net interest income increased to $6.2 million for the three months ended September 30, 2025, up from $4.8 million for the three months ended September 30, 2024, driven by an expansion of the net interest margin.

- Total assets decreased to $862.3 million at September 30, 2025, from $887.7 million at June 30, 2025, primarily due to a $41.0 million decrease in deposits to $680.3 million, largely due to a $59.3 million withdrawal by a public entity.

- Stockholders' equity increased to $84.5 million at September 30, 2025, from $81.8 million at June 30, 2025, primarily due to a decrease in accumulated other comprehensive loss and net income.

Oct 31, 2025, 9:14 PM

IF Bancorp Reports Increased Net Income for Q1 FY2026

IROQ

Earnings

New Projects/Investments

- IF Bancorp, Inc. announced net income of $1.4 million, or $0.43 per basic and diluted share, for the three months ended September 30, 2025, a significant increase from $633,000, or $0.20 per share, for the same period in 2024.

- Net interest income rose to $6.2 million for the quarter ended September 30, 2025, compared to $4.8 million for the three months ended September 30, 2024, driven by an expansion of the net interest margin.

- CEO Walter H. Hasselbring stated that the quarterly results are improving profitability and highlighted a strategic alliance with ServBank.

- Total assets were $862.3 million at September 30, 2025, down from $887.7 million at June 30, 2025. Deposits decreased to $680.3 million from $721.3 million, primarily due to a $59.3 million withdrawal of public entity deposits.

- Stockholders' equity increased to $84.5 million at September 30, 2025, from $81.8 million at June 30, 2025.

Oct 31, 2025, 8:15 PM

IF Bancorp, Inc. announces agreement to merge with ServBanc Holdco, Inc.

IROQ

M&A

- ServBanc Holdco, Inc. and IF Bancorp, Inc. have entered into a definitive agreement for ServBanc Holdco and its subsidiary Servbank to acquire IF Bancorp and its subsidiary Iroquois Federal.

- IF Bancorp shareholders will receive approximately $27.20 per share in cash, totaling $89.8 million, subject to certain adjustments based on the company's Tangible Common Equity at closing.

- The transaction is subject to regulatory approval, IF Bancorp shareholder approval, and other conditions, with an expected closing in the first quarter of 2026.

- All outstanding and unvested restricted stock awards of IF Bancorp will automatically vest in full and be entitled to receive the merger consideration.

- IF Bancorp has indefinitely postponed its 2025 annual shareholder meeting, anticipating it will not be convened if the merger is completed.

Oct 30, 2025, 1:32 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more