Itau Unibanco Holding (ITUB)·Q4 2025 Earnings Summary

Itaú Unibanco Posts Record Efficiency as ROE Hits 27.3% in Brazil

February 05, 2026 · by Fintool AI Agent

Brazil's largest private bank delivered a strong Q4 2025, posting net income of BRL 12.3 billion (+13.2% YoY) and achieving record-low efficiency ratios . While revenue beat consensus by 0.6%, EPS came in just shy of estimates by 0.6%. The real story is the culmination of years of digital transformation now flowing through to operating leverage — expense growth guidance for 2026 is set below inflation .

Did Itaú Unibanco Beat Earnings?

Mixed result, but fundamentally strong. Revenue came in at $8.75B versus $8.69B expected (+0.6% beat), while EPS of $0.199 narrowly missed the $0.201 consensus (-0.6%).*

*Values retrieved from S&P Global

The slight EPS miss reflects timing and mix effects, particularly from year-end card portfolio seasonality where transactor (non-revolving) balances grew faster than revolving credit, temporarily compressing margins .

Full Year 2025 Performance

For the full year, Itaú delivered consolidated net income of BRL 46.8 billion — representing value creation of BRL 18.5 billion, double the BRL 9.3 billion created in 2021 .

What Did Management Guide for 2026?

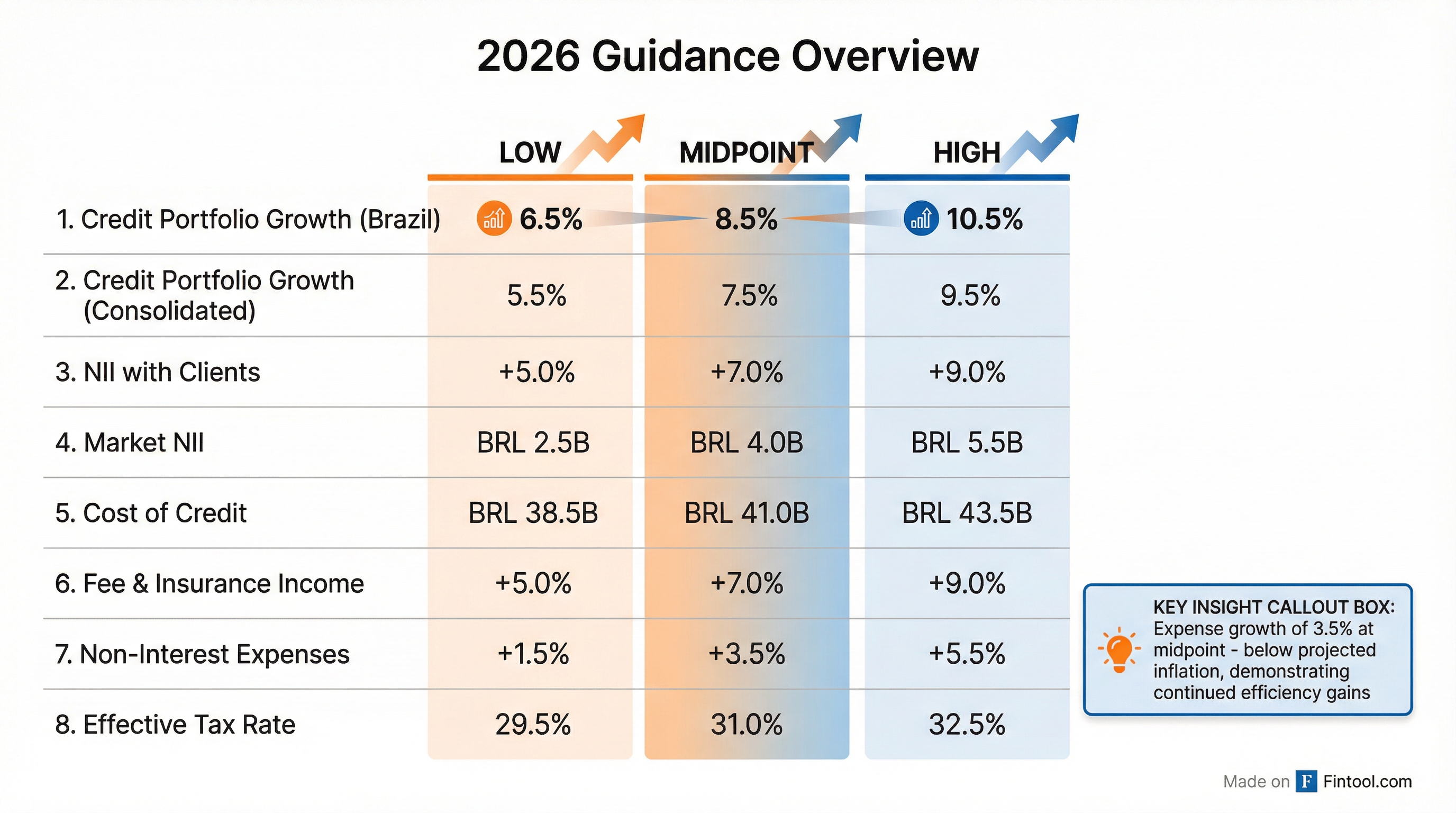

CEO Milton provided detailed 2026 guidance that implies continued profitability near current levels, with the key highlight being expense growth below inflation .

Key Guidance Points

Critical insight: The 3.5% expense growth midpoint is below projected IPCA inflation of ~4%, demonstrating the bank's ability to capture scalability benefits from its digital transformation . Milton emphasized this represents "not brute force cost cutting" but rather the fruits of years of platform modernization and data architecture investment .

Macro assumptions underlying guidance: GDP growth of 1.9%, year-end Selic at 12.75% (with rate cuts starting March), IPCA inflation converging to 4%, unemployment at 5.7%, and BRL/USD at 5.50 .

How Did the Stock React?

ITUB shares closed at $8.49 on February 4 (release day), down 1.85% amid broader market volatility. The stock recovered on February 5, rising 1.9% to $8.65 as the market digested the strong operating metrics.*

Over the past year, ITUB has gained ~83% from its 52-week low of $4.73 to current levels, outperforming the broader LatAm financials sector as the bank's efficiency story has gained recognition.*

*Values retrieved from S&P Global

What Changed From Last Quarter?

Record Efficiency Achievement

The efficiency ratio of 36.9% in Brazil represents the best level in the bank's history, down from 38.8% in 2024 and 44% in 2021 . Milton broke down the efficiency journey by segment:

- Benchmark segments (wholesale, reference businesses): Already at global standards of efficiency

- Scalable segments (retail individuals and SMEs): Moved from base 100 in 2024 to 94 in 2025, with continued improvement expected

This scalability is enabled by:

- 99% reduction in technology incidents

- 2,600% increase in delivery speed

- 45% reduction in unit transaction costs

Private Payroll Loan Leadership

Itaú regained leadership in Brazil's private sector payroll loan market (Consignado CLT), with the portfolio growing 27.5% QoQ and 36% YoY . This was achieved through a 100% digital origination channel with costs competitive with any fintech player .

Mortgage Market Share

The bank surpassed 50% market share in mortgage origination among private banks, with over BRL 33 billion originated in 2025 and portfolio reaching BRL 142 billion .

Key Management Quotes

On competitive positioning:

"We have enormous respect for all our competitors... We are a huge portfolio of businesses. Our capability to understand client needs, to be humble, to look outside all the time and understand that we might have people doing better things than we are, and we can do better and leapfrog forward, has been able to transform the organization." — Milton Maluhy Filho, CEO

On 2026 guidance philosophy:

"I wouldn't say it's a defensive guidance, but it's a realistic guidance due to the level of uncertainty we see in 2026. I hope you are right [that conditions allow faster growth]. If there is an opportunity, we'll be able to come back and say we are doing better." — Milton Maluhy Filho, CEO

On efficiency strategy:

"This is not about cost for cost's sake. Efficiency is a core guiding principle across the bank. We have been able to invest significantly in this transformation while delivering strong results and profitability, with revenue growth outpacing cost increases over the years." — Milton Maluhy Filho, CEO

Segment Performance

Loan Portfolio Composition

The total loan portfolio reached BRL 1,490.8 billion, up 6.3% QoQ and 6% YoY .

Services & Insurance

Fee and insurance revenue totaled BRL 15.6 billion, up 5.9% QoQ and 9.1% YoY .

- Acquiring (Rede): BRL 301 billion transacted volume (+16.8% QoQ, +22.8% YoY)

- Asset Management: BRL 4.1 trillion AUM/AUA, record net inflows of BRL 156 billion (+49% YoY)

- Insurance: Recurring earnings up 130% from 2021 to 2025, earned premiums growing 13% YoY

- Fixed Income Leadership: 26% market share, BRL 124 billion originated

Asset Quality Remains Strong

Delinquency metrics remained well-controlled, with individual NPLs reaching historically low levels .

Milton noted that Q3's corporate short-term delinquency spike (to 1%) was a single "well-known and widely reported case" that was sold, restructured, and removed from the balance sheet in Q4 .

2026 outlook: Management sees no material changes expected in delinquency indicators, though SME government-program portfolios may see temporary delays as grace periods expire — offset by strong collateralization .

Capital & Dividends

CET1 capital stood at 12.3% at year-end, with additional Tier 1 at 1.5% .

The bank distributed BRL 33.7 billion in 2025, representing a 72% payout ratio — up from 57.9% historically . This included accelerated dividend payments in December 2025 ahead of Q1 2026 regulatory capital events .

Leverage discussion: Milton indicated no plans to increase leverage in 2026 due to election-year uncertainty and rating agency constraints, though this remains a board-level discussion topic .

Q&A Highlights

On Competition from Fintechs

Analyst Tito Labarta (Goldman Sachs) asked what worries Milton about competitive dynamics. Response:

"Everything. I am paranoid here with competition, with the macro, with the level of service we deliver to our clients. This is what drives us." Milton emphasized human capital, culture, and execution capability as key differentiators, noting the bank can compete effectively across all segments due to modernized platforms and AI capabilities .

On Conservative Credit Growth Guidance

Analyst Jorge Kuri (Morgan Stanley) pressed on why guidance is only marginally higher than 2024 despite a better macro outlook. Milton cited election-year uncertainty, noting "the macro area has this view, but we know this is an election year in Brazil. Election brings volatility." He emphasized the bank's ability to react quickly if conditions improve .

On AI and Technology Investment

Milton described AI as "an agenda that is here to stay," highlighting the bank's advantage from years of data architecture modernization. The AI-powered "Itaú Amps" platform enables scalable client engagement with lower cost of service, allowing the bank to "accept more losses" and be more competitive .

On Mortgage Market Share (50%+ Among Private Banks)

The advantage stems from having the largest savings account deposit base among private banks, providing structural funding cost advantages for mortgage lending .

Forward Catalysts

- Interest rate cycle: Selic rate cuts expected to begin in March, potentially accelerating loan demand and improving payroll loan economics

- Private payroll expansion: With falling rates, ability to penetrate previously excluded customer segments due to rate caps

- Efficiency acceleration: Continued technology decommissioning of legacy systems over next few years will further reduce variable costs

- Insurance catch-up: Segment still in growth mode with "strong prospects ahead" per management

Risks to Monitor

- Election volatility: Brazilian elections could impact investor sentiment, FX, and interest rate trajectory

- Inflation persistence: If Selic cuts are delayed, pressure on corporate and individual borrowers could increase

- Government program funding: FGI (guarantee fund) recapitalization needed to maintain 2025-level SME lending volumes

- Capital markets uncertainty: Large corporate lending depends on capital markets activity, which management called "the cog in the wheel that is always in doubt"

Report generated by Fintool AI Agent. For the full earnings transcript, see ITUB Q4 2025 Transcript. View more on ITUB Research.