SANFILIPPO JOHN B & SON (JBSS)·Q2 2026 Earnings Summary

John B. Sanfilippo Delivers 32% EPS Beat as Margin Expansion Offsets Volume Decline

January 30, 2026 · by Fintool AI Agent

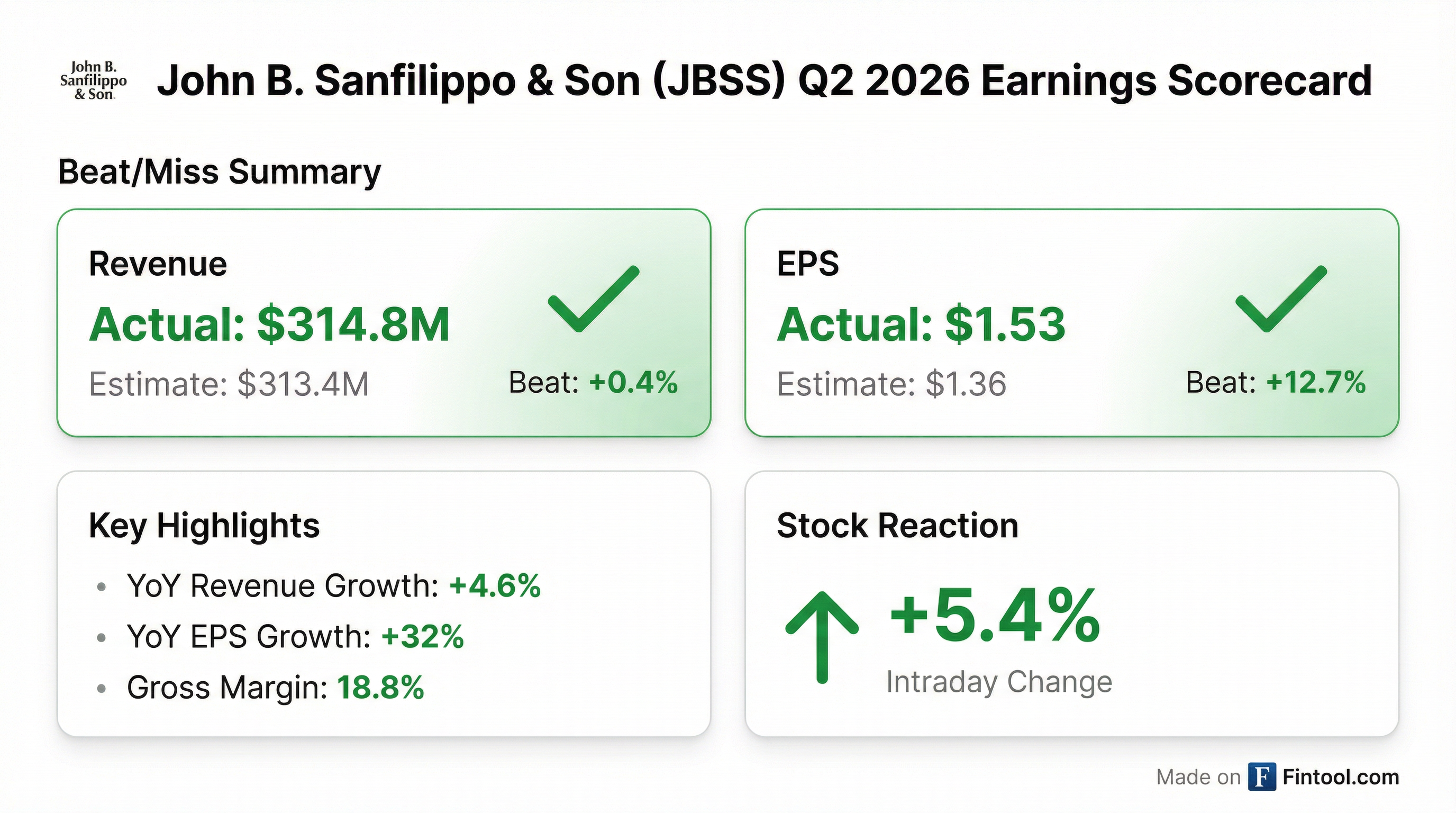

John B. Sanfilippo & Son, Inc. (JBSS) reported Q2 fiscal 2026 results that exceeded analyst expectations on both revenue and earnings, sending shares up 5.4% to near 52-week highs. The nut processor and snack food company delivered EPS of $1.53, beating consensus of $1.36 by 12.5%, while revenue of $314.8M edged past the $313.4M estimate.

The company demonstrated pricing power with a 15.8% increase in weighted average sales price per pound, though this came at the cost of a 9.7% decline in sales volume. CEO Jeffrey Sanfilippo characterized the results as "record-breaking top-line growth" while acknowledging the company continues to "navigate headwinds from shifting consumer behavior, emerging health and wellness trends, and elevated retail selling prices."

Did John B. Sanfilippo Beat Earnings?

Yes — JBSS delivered a double beat this quarter:

Values retrieved from S&P Global

The EPS beat was particularly impressive given the volume headwinds. Year-over-year, EPS grew 31.9% ($1.53 vs $1.16), significantly outpacing revenue growth of 4.6%. This earnings leverage came from three sources: better cost alignment with commodity prices, reduced manufacturing spending, and operational efficiencies across the organization.

What Did Management Guide?

Management did not provide explicit quantitative guidance but expressed "cautious optimism" for the back half of fiscal 2026, citing commercial momentum across multiple channels:

Positive Catalysts:

- New bar production scheduled to begin July 2026 — "a transformational time for our company"

- Consumer team secured new and expanded business with several customers

- Food service team expanding distribution with strategic partners

- Recent tariff reductions on imported nuts (primarily cashews) should help lower selling prices over time

Headwinds Acknowledged:

- Elevated retail prices weighing on volume

- Soft demand in certain bar categories (fruit and grain, granola)

- Consumer downsizing behavior impacting nuts and trail mix

How Did the Stock React?

JBSS shares jumped 5.4% on earnings day, trading at approximately $80 — within striking distance of the 52-week high of $81.35. The stock had been building momentum heading into the print, up from $70 at the start of January.

The positive reaction reflects investor appreciation for margin expansion despite volume pressures, plus excitement around the protein bar manufacturing initiative.

What Changed From Last Quarter?

Several notable shifts from Q1 2026:

Margin Improvement Continues: Gross margin expanded to 18.8% from 18.1% in Q1 2026 and 17.4% in Q2 2025, indicating the company is successfully passing through commodity costs and capturing operational efficiencies.

Bar Manufacturing Progress: Management noted 85% of new bar equipment is now on-site or in transit, up from earlier estimates. The July 2026 production start date remains on track.

Special Dividend: At the start of Q3, the company distributed a $1 per share special dividend — a new development signaling confidence in the balance sheet despite the major capex initiative.

Consumer Pricing Dynamics: Management indicated pricing passes through in 60-90 days after 6-month reviews with retailers, suggesting the lag between commodity costs and retail shelf prices is tightening.

Key Management Quotes

CEO Jeffrey Sanfilippo on the strategic pivot:

"This is a transformational time for our company. I'm excited about the future growth we will build with our customers, and I'm extremely proud of the hard work, dedication, and tenacity of the team members across our company who are so committed to our success."

On margin focus:

"At JBSS, we remain sharply focused on cost optimization while evolving our structure and processes to support sustainable growth. We are driving efficiency improvements across our operations, supply chain, pricing, trade spending, and formula development."

Segment Performance

Consumer Channel (-8.4% volume):

- Private brand sales down 7.9% driven by lower bar and nuts/trail mix volume

- Customer downsizing and reduced distribution at a major mass merchandiser

- Partially offset by new business wins with existing customers

Commercial Ingredients (-1.1% volume):

- Relatively flat, indicating stability in food service and B2B channels

Contract Manufacturing (-26.5% volume):

- Sharp decline due to reduced opportunistic granola volume at Lakeville facility

- Partially offset by increased snack nut sales to a customer added in the prior year

Branded Performance:

- Southern Style Nuts: +5% in pound shipments, driven by e-commerce growth

- Fisher Snack: -15% due to lost distribution and reduced promotions

- Orchard Valley Harvest: -42% due to discontinuation at a national specialty retailer

Capital Allocation

The company is executing a dual strategy of shareholder returns and growth investment:

Returns to Shareholders:

- $1 per share special dividend distributed at start of Q3

- Reflects "strong financial position and disciplined capital allocation strategy"

Growth Investment:

- One of the largest capex initiatives in company history

- Focus on protein-forward bar manufacturing capacity

- Equipment from European manufacturers, 85% now on-site or in transit

Balance Sheet:

- Inventories up 14.4% YoY due to higher commodity acquisition costs

- Interest expense down to $0.5M from $0.8M YoY

Risks and Concerns

Volume Pressure: The 9.7% decline in sales volume is concerning, particularly in the consumer channel where private brand is seeing broad-based weakness.

Bar Category Softness: Despite the investment in new bar manufacturing, the overall bar category (ex-protein) remains soft. Management noted fruit and grain and granola segments are experiencing industry-wide weakness.

Brand Vulnerability: Orchard Valley Harvest's 42% volume decline from a single customer discontinuation highlights concentration risk.

Commodity Volatility: While tariff reductions on cashews are a positive, the company remains exposed to commodity cost swings across all major nut types. Weighted average cost per pound increased 11.8% YoY.

Q&A Highlights

The Q&A session was brief with only one analyst question:

On Equipment Timeline (Hamed Khorsand, BWS Financial): COO Jasper Sanfilippo confirmed all remaining equipment from Europe is "either on water or getting created to come on the water." Engineers have visited European manufacturers multiple times and tested equipment on-site. Production is on track for July 2026.

On Pricing Pass-Through: Management indicated a typical 6-month price review cycle with most retailers, followed by 60-90 days to implement changes. This suggests the company can respond to commodity movements within 9 months.

Forward Catalysts

The Bottom Line

John B. Sanfilippo delivered a strong quarter that demonstrates the company's ability to navigate a challenging consumer environment through pricing discipline and operational efficiency. The 32% YoY EPS growth and 140 basis points of gross margin expansion more than offset the 9.7% volume decline.

The key question for investors is whether the July 2026 bar production launch can reignite volume growth. Management's "cautious optimism" reflects both the commercial momentum they're seeing and the execution risk inherent in a major manufacturing expansion. With shares trading near 52-week highs and a special dividend providing downside support, the stock appears to be pricing in successful execution.

Data sources: Company earnings call transcript, S&P Global estimates