Earnings summaries and quarterly performance for SANFILIPPO JOHN B & SON.

Executive leadership at SANFILIPPO JOHN B & SON.

Jeffrey T. Sanfilippo

Chief Executive Officer

Frank S. Pellegrino

Chief Financial Officer, Executive Vice President, Finance and Administration and Treasurer

Jasper B. Sanfilippo, Jr.

Chief Operating Officer, President and Secretary

Julia A. Pronitcheva

Senior Vice President, Human Resources

Board of directors at SANFILIPPO JOHN B & SON.

Ellen C. Taaffe

Lead Independent Director

James A. Valentine

Director

James J. Sanfilippo

Director

John E. Sanfilippo

Director

Lisa A. Sanfilippo

Director

Mercedes Romero

Director

Michael J. Valentine

Director

Pamela Forbes Lieberman

Director

Research analysts who have asked questions during SANFILIPPO JOHN B & SON earnings calls.

Recent press releases and 8-K filings for JBSS.

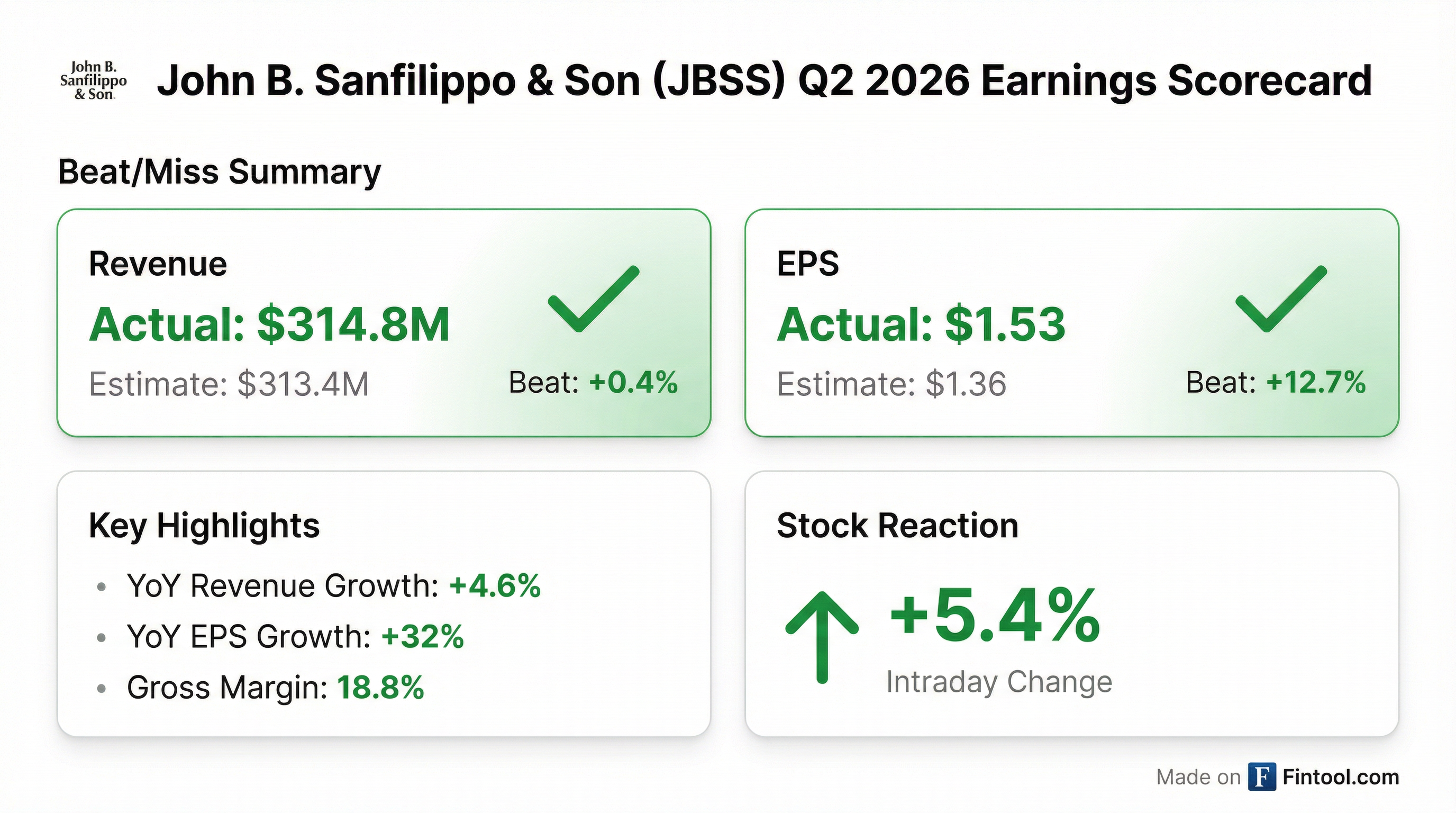

- John B. Sanfilippo and Son (JBSS) reported a 32% increase in diluted earnings per share to $1.53 and a 4.6% increase in net sales to $314.8 million for the second quarter of fiscal 2026, compared to the prior year.

- The increase in net sales was primarily driven by a 15.8% increase in the weighted average sales price per pound, which was partially offset by a 9.7% decline in sales volume.

- The company distributed a special dividend of $1 per share at the start of the third quarter and is undertaking significant capital expenditures, with 85% of new bar manufacturing equipment on-site or in transit, aiming for production in July 2026.

- JBSS is navigating headwinds such as elevated retail selling prices and shifting consumer behavior, which contributed to a decline in sales volume across consumer and contract manufacturing channels.

- John B. Sanfilippo and Son (JBSS) reported strong financial performance for Q2 fiscal 2026, with net sales increasing 4.6% to $314.8 million and diluted earnings per share rising 32% to $1.53 compared to the prior year.

- This growth was primarily driven by a 15.8% increase in weighted average sales price per pound due to higher commodity costs, though overall sales volume declined by 9.7%.

- The company initiated a special dividend of $1 per share at the start of Q3 and is progressing with significant capital expenditures, with 85% of new bar manufacturing equipment on-site or in transit for production to commence in July 2026.

- JBSS is actively managing headwinds from shifting consumer behavior and elevated retail prices by focusing on cost optimization, operational efficiencies, and strategic pricing actions, while also expanding its private brand bar business and branded distribution.

- John B. Sanfilippo and Son (JBSS) reported a 32% increase in diluted earnings per share to $1.53 for Q2 fiscal 2026, with net sales rising 4.6% to $314.8 million compared to Q2 fiscal 2025.

- The company distributed a special dividend of $1 per share at the start of Q3 fiscal 2026, reflecting its strong financial position.

- JBSS is progressing with its significant capital expenditure initiatives, with 85% of new bar manufacturing equipment on-site or in transit, and production is scheduled to begin in July 2026.

- Despite top-line growth, sales volume for Q2 2026 decreased 9.7%, primarily due to a reduction in opportunistic granola volume and lower private brand sales, influenced by higher retail prices and soft demand.

- John B. Sanfilippo & Son, Inc. reported a 31.9% increase in diluted EPS to $1.53 for the second quarter of fiscal 2026, with net sales rising 4.6% to $314.8 million despite a 9.7% decline in sales volume.

- For the six months ended December 25, 2025, diluted EPS increased 44.4% to $3.12, and net sales grew 6.3% to $613.5 million.

- Gross profit increased 13.2% to $59.2 million in Q2 2026, with the gross profit margin improving to 18.8% of net sales from 17.4% in the prior year.

- The company distributed a special dividend of $1.00 per share at the start of the third quarter and is making significant capital investments to enhance operational efficiency and expand production capacity.

- John B. Sanfilippo & Son, Inc. reported record-breaking net sales of $314.8 million for the fiscal 2026 second quarter, a 4.6% increase, and diluted EPS increased 31.9% to $1.53 per share.

- For the first six months of fiscal 2026, net sales increased 6.3% to $613.5 million, and diluted EPS rose 44.4% to $3.12.

- Gross profit increased 13.2% to $59.2 million for the quarter, with the gross profit margin improving to 18.8% of net sales.

- The company distributed a special dividend of $1.00 per share at the start of the third quarter and is undertaking significant capital expenditure initiatives to enhance operational efficiency and expand production capacity.

- Sales volume decreased 9.7% for the quarter due to factors like shifting consumer behavior and elevated retail prices, though reduced trade tariffs on imported nuts are expected to help lower selling prices and support future demand.

- John B. Sanfilippo & Son (JBSS) reported a strong start to its fiscal year with 8% sales growth and almost 59% EPS growth in Q1, following a record $358 million pounds sold and record EBITDA in FY 2025.

- The company is strategically shifting to become a snack company, identifying private label bars as its primary growth engine, with the private label bar business growing 27% in FY25.

- JBSS is investing in two new high-speed bar lines to capitalize on the significant growth potential in the private label bar category, where penetration is currently only 11% compared to 55% for snack, nut, and trail.

- In fiscal 2025, private label products constituted 83% of total sales, with the consumer channel representing 82% of the business.

- The company maintains a consistent dividend policy, paying a $0.90 regular dividend in calendar 2025 and supplementing it with special dividends, totaling over $40 per share in dividends since 2012.

- JBSS is strategically transitioning from a nut and trail-focused company to a broader snack company, with private label bars identified as the primary growth engine. This shift is supported by significant investments in new, high-speed bar manufacturing lines.

- The company reported a strong start to its fiscal year, with Q1 sales growing 8% and EPS growing almost 59% for the quarter ended September. In fiscal year 2025, EBITDA reached a record high.

- The private label bar business experienced 27% growth in FY25 , driven by a 2023 acquisition and innovation. Management sees substantial future growth potential, as private label bar penetration is currently only 11% in the market, indicating strong demand from retailers.

- JBSS maintains a strong focus on shareholder returns, having paid a $0.90 regular dividend in calendar 2025 and supplementing it with at least $1.50 per share in special dividends annually.

- John B. Sanfilippo & Son (JBSS) reported a strong start to its fiscal year, with Q1 sales growing 8% and EPS growing almost 59%. The company also achieved record sales of 358 million lbs and record EBITDA in FY 2025.

- JBSS is strategically shifting from a nut and trail-focused company to a snack company, with a significant focus on accelerating private label bar growth. This includes investments in new high-speed bar lines capable of producing 2,000-2,200 bars per minute.

- Private label products accounted for 83% of total net sales in fiscal 2025 , and the company sees substantial growth opportunities in the private label bar category, where penetration is currently 11% compared to 55% for snack, nut, and trail products.

- The company has a strong track record of returning value to shareholders, having paid over $40 per share in dividends since calendar year 2012, including a $0.90 regular dividend and at least $1.50 per share in special dividends in calendar 2025.

- For Q1 2026, JBSS reported a 59% improvement in diluted earnings per share and an 8.1% increase in net sales to $298.7 million, compared to $276.2 million in Q1 2025. Net income for the quarter was $18.7 million, or $1.59 per diluted share.

- The company's Board of Directors approved a special cash dividend of $1 per share on all issued and outstanding shares of common stock, which will return approximately $11.7 million to stockholders and be paid on December 30, 2025.

- While overall sales volume declined 0.7% due to a 5.1% decrease in the consumer distribution channel, sales volume increased 12.8% in the commercial ingredients channel and 18.4% in the contract manufacturing channel.

- JBSS is expanding its manufacturing footprint by leasing a 446,000 square foot facility in Elgin, Illinois, to install new production lines for its snack and protein bar business, with manufacturing scheduled to begin by the end of the fiscal year. The company continues to face challenges from significant nut commodity cost increases, with the weighted average cost per pound of broad nut and dried fruit increasing 24.8% year over year.

- John B. Sanfilippo & Son, Inc. (JBSS) announced a special cash dividend of $1.00 per share on all issued and outstanding shares of its Common Stock and Class A Common Stock.

- The special dividend will be paid on December 30, 2025, to stockholders of record as of the close of business on December 1, 2025.

- This dividend is expected to return approximately $11.7 million to Company stockholders.

- The company cited its financial performance over the last several quarters as the reason for the special dividend.

Quarterly earnings call transcripts for SANFILIPPO JOHN B & SON.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more