KIRBY (KEX)·Q4 2025 Earnings Summary

Kirby Q4 Earnings: EPS Beats, Stock Drops 8% Despite Improving Outlook

January 29, 2026 · by Fintool AI Agent

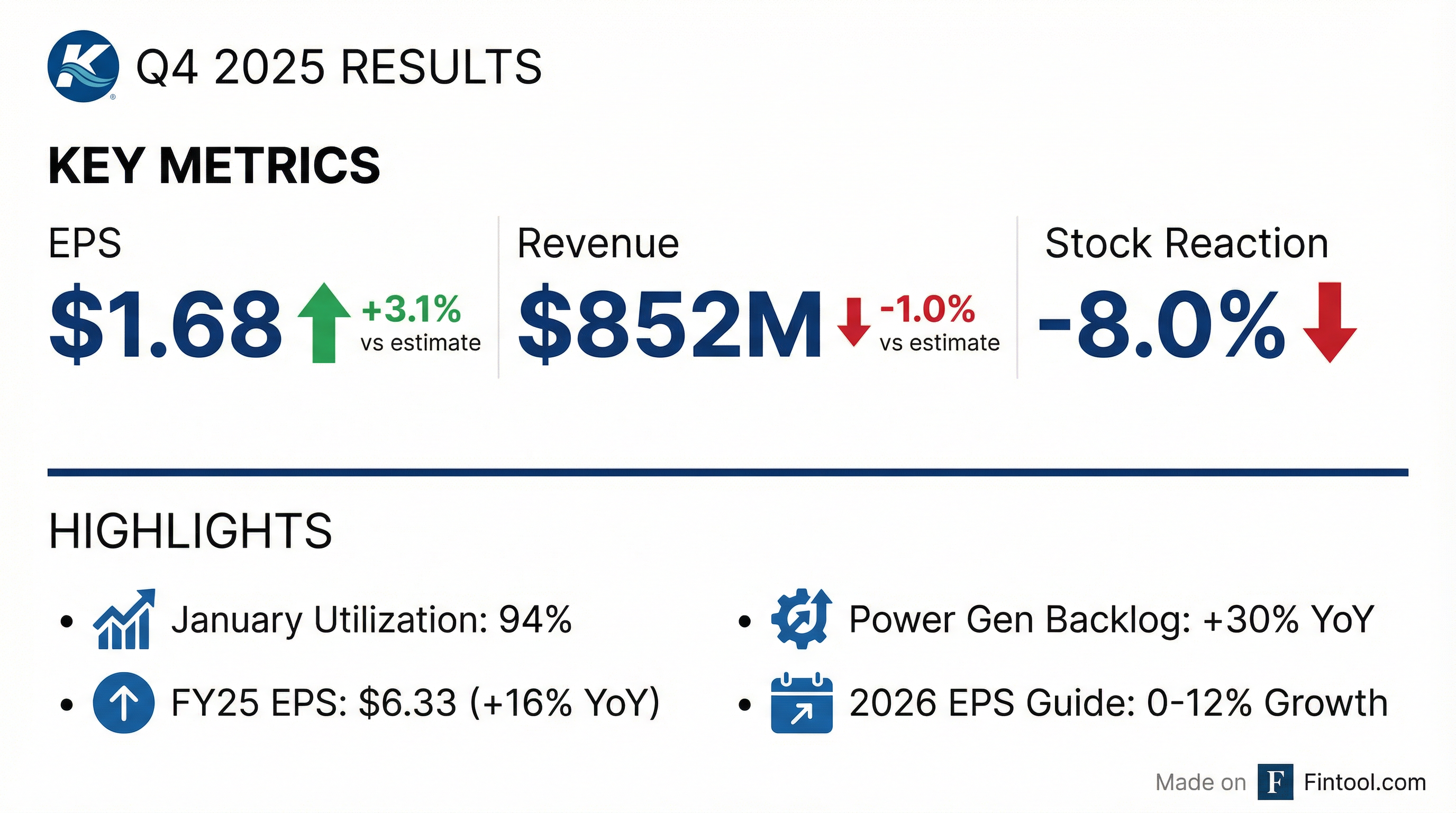

Kirby Corporation (NYSE: KEX), the largest tank barge operator in the United States, reported Q4 2025 results that beat on earnings but missed slightly on revenue. EPS of $1.68 topped estimates by 3.1%, while revenue of $852M fell short by 1.0%. Despite management's bullish commentary—including January utilization hitting 94% and spot rates rebounding—the stock dropped 8% as investors digested the revenue miss and broad 2026 EPS guidance range of 0-12% growth.

Did Kirby Beat Earnings?

Q4 2025: EPS beat, revenue slight miss. Kirby delivered adjusted EPS of $1.68, beating consensus of $1.63 by 3.1%. Revenue of $852M (Marine $482M + D&S $370M) missed the $860.7M estimate by 1.0%. The EPS beat was driven by exceptional cost control that offset weather-related operating challenges and seasonal slowness in Distribution & Services.

Full Year 2025: Record earnings. FY 2025 EPS of $6.33 surged 16% YoY from $5.46, while revenue of $3.36B increased 3% from $3.27B. Free cash flow exceeded $400M for the second consecutive year.

How Did the Stock React?

Kirby shares dropped 8.0% to $117.88, falling from a previous close of $128.13. The stock opened at $127.94 but sold off throughout the day despite management's constructive outlook.

Why the selloff despite decent results?

- Broad guidance range: 0-12% EPS growth range "wide enough to drive a barge through" per analyst Ken Hoexter

- Q4 term contract renewals down: Low single digits decline on 30% of the inland portfolio

- Position unwind: Stock had rallied 61% from 52-week low of $79.52 heading into earnings

The selloff appears overdone given management's bullish real-time commentary on utilization and rates.

What Did Management Say on the Call?

The earnings call Q&A revealed several bullish data points that counter the market's negative reaction:

January Utilization Surged to 94%

"We were 94% this morning, so utility is tight." — Christian O'Neil, President & COO

This represents a significant improvement from mid-to-high 80s utilization in Q4 and supports the low-90% utilization guidance for full year 2026.

Spot Rates Rebounding

"The good news is that we've already seen spot prices retrace and are probably up more so far in January than they were down in the fourth quarter." — David Grzebinski, CEO

Spot rates rebounded low-to-mid single digits sequentially in January, after declining low single digits in Q4. Spot prices are currently running approximately 10% above term contract rates—a healthy spread that signals constructive market conditions.

Venezuelan Crude: Potential Upside Catalyst

Management spent considerable time discussing Venezuelan crude imports as a potential demand driver:

"Venezuelan crude in large volumes in the Gulf of Mexico has historically been a really good story for us barge guys. Heavy crude produces bottom of the barrel residuals that have to move by barge." — Christian O'Neil

Key points on Venezuela:

- Heavy crude creates more intermediate products requiring barge transport

- Some refiners already taking positions on thermal fluid/hot oil equipment

- Discounted pricing makes refiners more profitable, which benefits Kirby

- Still "early innings"—volumes haven't materially arrived yet

Chemicals: "Closer to a Bottom"

"If we got a little upturn in chemicals, we could be extremely tight very quickly." — David Grzebinski

Management noted European chemical plant closures are bullish for U.S. production, while improving housing and auto markets could drive demand. Chemical customers have had a "tough several years" but appear near bottom.

What Did Management Guide for 2026?

Kirby provided comprehensive 2026 guidance with a notable EPS growth range:

Corporate Guidance

Why Such a Wide EPS Range?

CEO David Grzebinski explained the 0-12% range drivers:

"Power gen deliveries are a big part of it. The OEMs still are supply chain constrained... The cadence of power gen deliveries is a big part of it. And then to a lesser extent is the inland market and how much pricing improves throughout the year."

Marine Transportation 2026 Outlook

Rate holiday recovery: Management confirmed that pricing concessions given to large customers in 2025 during their austerity periods will "come back in 2026."

Distribution & Services 2026 Outlook

Full year D&S revenues expected flat to slightly higher with mid-to-high single digit operating margins.

Power Generation: The Growth Engine

Power generation continues to drive D&S growth, now representing 52% of segment revenue.

Backlog Acceleration

"Sequentially, backlog was up 11%. And year-over-year, our backlog was up about 30%." — David Grzebinski

Behind-the-Meter vs. Backup Power Margins

Management provided key color on margin dynamics between product types:

Backup diesel generators (data centers):

- Lower margin — "the whole market knows what every engine costs"

- Limited markup ability on commodity engines

- High single-digit margins

Behind-the-meter power systems (24/7 prime power):

- Higher margin — "highly engineered product" with integrated power distribution

- More value-add components (advanced power distribution, control systems)

- Service opportunity with 24/7 running equipment

"Part of our margin progression for 2026 is lower margins in the first half when we're shipping a lot of backup power, and then the second half is when some of our behind the meter backlog will start to ship."

Gas Turbines: 2027 Revenue Opportunity

"We are working actively right now packaging some larger gas turbines. But those are revenues in 2027. And then, assuming that goes well, it could become very meaningful in 2028 and 2029."

AI Demand Is Real

"This power need is real. All these AI and data center guys are actually generating real cash flow. It's a lot different than the dot-com era, when they didn't have cash flow."

Segment Performance Detail

Marine Transportation: Margins Expand Despite Weather

Marine Transportation contributed 57% of Q4 revenue at $482M, up 3% YoY. Operating margin expanded to low 20% range despite 82% sequential increase in weather delay days.

Inland (79% of marine revenues):

- Barge utilization averaged mid-to-high 80%, exited near 90%

- 30% of term contracts repriced in Q4, down low single digits

- 70% term contracts (59% time charters, 41% COA)

- Fleet: 1,105 barges, 24.5M barrels capacity

Coastal (21% of marine revenues):

- Revenue up 22% YoY on pricing strength

- Utilization in mid-to-high 90%, 100% term contracts

- Operating margin ~20%

Supply Side: Constructive Dynamics

New build economics remain unfavorable:

"Even if they were to build, it would take three years from kind of deciding to build."

Distribution & Services: Power Gen Offsets Oil & Gas Decline

D&S revenue of $370M grew 10% YoY but declined 4% sequentially due to year-end slowdowns. Operating margin of 8.1% was down from 11.0% in Q3.

Capital Allocation and Balance Sheet

M&A outlook: Management is "constructive on where we think M&A might go" with conversations "more frequent." Bolt-on opportunities in inland (~$100M deals) and D&S service capabilities (<$50M deals) are the focus.

Risks and Concerns

-

Cost inflation persists: Medical costs trending higher, mariner wage pressure from tight labor market

-

Q1 seasonality: Winter weather, including Illinois River ice, will pressure Q1 results

-

Power gen lumpiness: OEM supply constraints create quarter-to-quarter volatility

-

Venezuelan crude timing: Potential upside, but "we haven't seen the volumes yet"

-

Oil & gas structural decline: Continued double-digit revenue decline expected in 2026

The Bottom Line

Kirby delivered solid Q4 results capped by a record FY25, but the stock's 8% drop reflects investor concern over the wide 2026 guidance range and Q4 rate softness. However, the market may be overlooking management's real-time bullish indicators: 94% utilization in January, spot rates rebounding, and a 30% YoY increase in power gen backlog.

Bull case: January utilization at 94% validates improving fundamentals, Venezuelan crude upside not priced in, power generation backlog accelerating, retirements outpacing newbuilds, stock now cheaper after 8% selloff.

Bear case: Wide guidance range suggests uncertainty, medical/labor inflation eating into margins, oil & gas drag continues, stock had rallied significantly into earnings.

At $117.88, Kirby trades at ~18.6x trailing earnings with management expecting "steady earnings growth" in 2026. For investors who believe the rate and utilization trends disclosed on the call, today's selloff may present an opportunity.

Kirby Corporation reports quarterly earnings approximately one month after quarter-end. The company operates the largest inland tank barge fleet in the United States, transporting petrochemicals, refined products, and agricultural chemicals.

Related: KEX Company Profile | Q3 2025 Earnings | Latest Transcript