Earnings summaries and quarterly performance for KIRBY.

Executive leadership at KIRBY.

David Grzebinski

Chief Executive Officer

Amy Husted

Executive Vice President, General Counsel and Secretary

Christian O’Neil

President and Chief Operating Officer

Raj Kumar

Executive Vice President and Chief Financial Officer

Scott Miller

Vice President and Chief Information Officer

Board of directors at KIRBY.

Research analysts who have asked questions during KIRBY earnings calls.

Ken Hoexter

BofA Securities

7 questions for KEX

Scott Group

Wolfe Research

7 questions for KEX

Sherif Elmaghrabi

BTIG

6 questions for KEX

Jonathan Chappell

Evercore ISI

5 questions for KEX

Reed Seay

Stephens Inc.

5 questions for KEX

Greg Wasikowski

Webber Research & Advisory

4 questions for KEX

Gregory Wasikowski

Webber Research & Advisory LLC

3 questions for KEX

Benjamin Nolan

Stifel

2 questions for KEX

Ben Moore

Citigroup

2 questions for KEX

Daniel Imbro

Stephens Inc.

2 questions for KEX

Gregory Lewis

BTIG, LLC

2 questions for KEX

Ariel Rosa

Citigroup

1 question for KEX

Bascome Majors

Susquehanna Financial Group

1 question for KEX

John Daniel

Daniel Energy Partners

1 question for KEX

Recent press releases and 8-K filings for KEX.

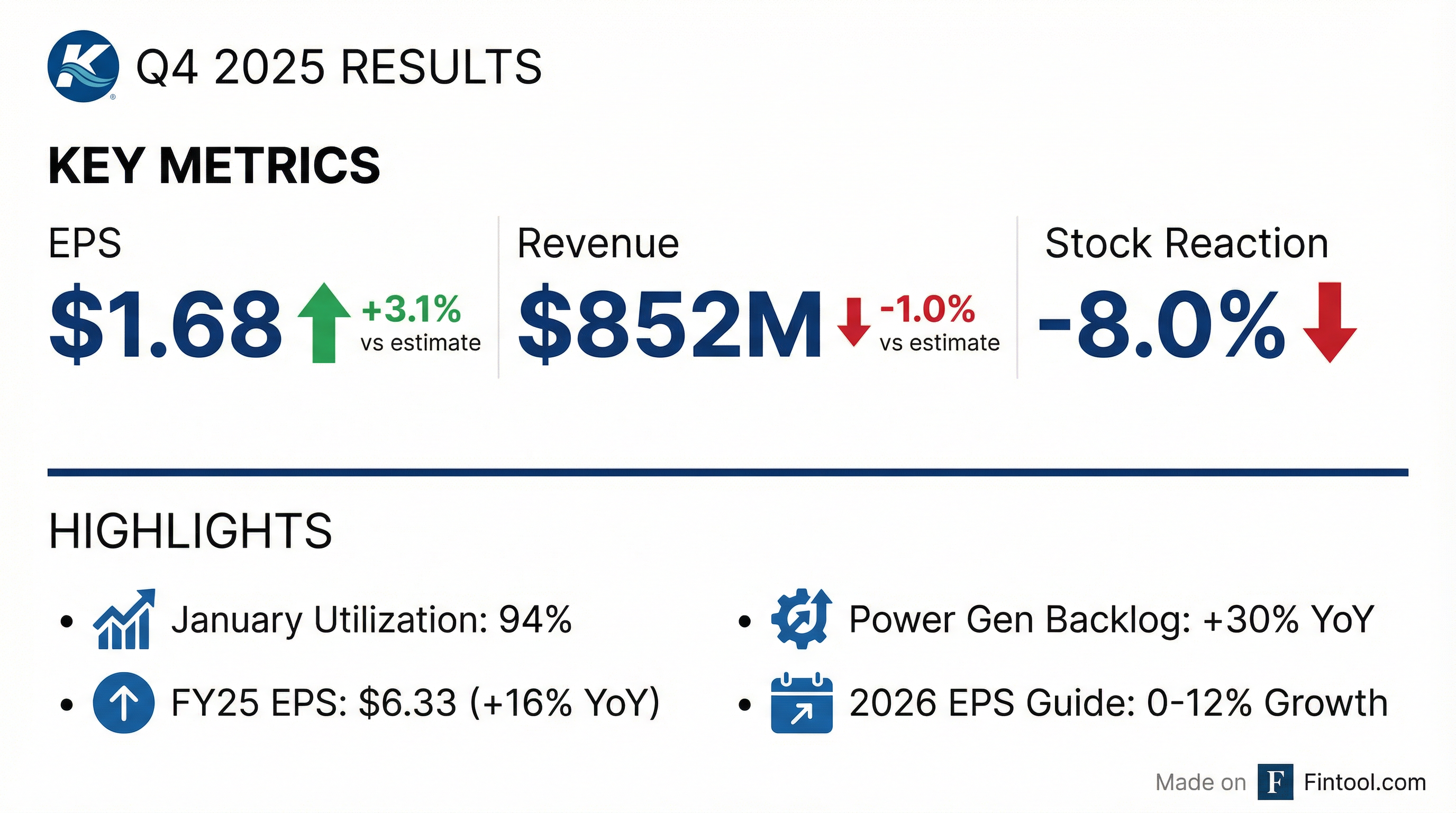

- Kirby Corporation reported net earnings attributable to Kirby of $91.8 million, or $1.68 per share, on consolidated revenues of $851.8 million for the fourth quarter ended December 31, 2025. For the full year 2025, net earnings were $354.6 million, or $6.33 per share, on $3.4 billion in consolidated revenues.

- For 2026, the company expects earnings per share to be flat to up 12% year-over-year. Kirby also projects net cash provided from operating activities of $575 million to $675 million and capital spending between $220 million to $260 million.

- In Q4 2025, Marine Transportation revenues were $481.7 million with a 20.8% operating margin, while Distribution and Services revenues were $370.1 million with an 8.1% operating margin, significantly boosted by 47% year-over-year growth in power generation revenues.

- The company reported Adjusted EBITDA of $203.1 million for Q4 2025 and repurchased $101.6 million of stock during the quarter. As of December 31, 2025, cash and cash equivalents stood at $78.8 million, with a debt-to-capitalization ratio of 21.4%.

- Kirby Corporation achieved a record year in 2025, generating $406 million in free cash flow, returning capital to shareholders with over $100 million in share repurchases, and reducing debt by $130 million.

- The company anticipates steady growth and solid financial performance in 2026, projecting year-over-year earnings growth and operating cash flow ranging from $575 million to $675 million.

- In Q4 2025, the Marine Transportation segment reported $482 million in revenues and $100 million in operating income, while the Distribution and Services segment posted $370 million in revenues and $30 million in operating income, significantly boosted by a 47% year-over-year increase in power generation revenues.

- Market conditions are improving, with inland barge utilization exiting 2025 near 90% and coastal utilization in the mid-to-high 90% range, further supported by inland spot prices being a good 10% above term.

- Kirby (KEX) reported a record year in 2025, generating $406 million in free cash flow and ending Q4 2025 with $542 million in total available liquidity and a 21.4% debt-to-cap ratio.

- In Q4 2025, the company returned capital to shareholders with over $100 million in share repurchases and strengthened its balance sheet by paying down $130 million in debt.

- For Q4 2025, the Marine Transportation segment reported $482 million in revenue and $100 million in operating income (low 20% margin), while the Distribution and Services segment reported $370 million in revenue and $30 million in operating income (8.1% margin).

- Kirby anticipates consistent year-over-year earnings growth in 2026, with expected operating cash flow ranging from $575 million to $675 million and capital expenditures between $220 million and $260 million.

- The Power Generation business is expected to be a core engine of growth for the Distribution and Services segment in 2026, offsetting weakness in other areas like oil and gas.

- Kirby (KEX) reported Q4 2025 revenues of $851.8 million and diluted earnings per share of $1.68, marking a 6% year-over-year increase in revenue and a 127% increase in EPS. For the full year 2025, revenues reached $3,364.1 million and EPS was $6.33.

- The company achieved solid execution and cost discipline in Q4 2025, which helped mitigate the impact of weather challenges in marine transportation and seasonal slowness in distribution and services.

- In Q4 2025, Kirby repurchased $102 million of stock and reduced debt by $130 million, enhancing its balance sheet.

- Free cash flow generation for Q4 2025 was $265 million, contributing to a total of $406 million for the full year 2025.

- For 2026, Kirby expects steady growth, with projected capital expenditures between $220 million and $260 million. Marine Transportation anticipates low-to-mid-single-digit revenue growth, while Distribution & Services expects flat to slightly higher revenues, primarily driven by strong power generation growth.

- Kirby Corporation achieved a record year in 2025, generating over $400 million in free cash flow and strengthening its balance sheet by paying down $130 million in debt while repurchasing over $100 million in shares during Q4 2025.

- In Q4 2025, the Marine Transportation segment achieved $482 million in revenues and $100 million in operating income, with the Distribution and Services segment reporting $370 million in revenues and $30 million in operating income.

- For 2026, the company anticipates consistent year-over-year earnings growth, with operating cash flow projected between $575 million and $675 million and capital expenditures in the $220 million-$260 million range.

- Market conditions for Marine Transportation are improving, with Inland Marine barge utilization exiting 2025 near 90% and spot prices 10% above term. The Distribution and Services segment expects power generation to drive growth, offsetting a projected double-digit revenue decline in oil and gas.

- Kirby Corporation reported net earnings attributable to Kirby of $92.5 million, or $1.65 per share, for the third quarter ended September 30, 2025, marking a 6% increase year-over-year. Consolidated revenues for the quarter reached $871.2 million, compared to $831.1 million in the 2024 third quarter.

- The company repurchased 1,314,009 shares for $120.0 million in Q3 2025 and an additional 428,955 shares for $36 million so far in Q4 2025.

- Performance varied across segments: coastal marine maintained strong market fundamentals with barge utilization in the mid to high-90% range and operating margins around 20%. The power generation market within distribution and services saw revenues increase 56% year-over-year, contributing to segment margins of 11%.

- In contrast, inland marine experienced near-term softness with average barge utilization in the mid-80% range and declining spot market rates, although improvements are already being observed in the fourth quarter.

- For the full year 2025, Kirby anticipates net cash provided from operating activities to be between $620 million and $720 million, with capital spending projected to range from $260 million to $290 million.

- Kirby (KEX) reported Q3 2025 revenues of $871.2 million and earnings per share of $1.65, representing a 6% year-over-year increase in EPS.

- The Power Generation segment was a significant growth driver, with revenues increasing 56% year-over-year and operating income rising 96% year-over-year, primarily due to strong demand from data centers and prime power customers.

- The company generated $160 million in free cash flow during Q3 2025 and repurchased $120 million of its stock in the same quarter.

- For the full year 2025, Kirby expects cash flow from operations to range between $620 million and $720 million, with capital expenditures projected to be between $260 million and $290 million.

- Kirby Corporation reported Q3 2025 earnings per share of $1.65, a 6% increase year-over-year, driven by robust customer demand in power generation and disciplined operational execution.

- The Marine Transportation segment generated $485 million in revenues and an 18.3% operating margin in Q3 2025, experiencing near-term softness in inland marine (utilization in mid 80% range) but continued strength in coastal marine (utilization in mid to high 90% range).

- The Distribution and Services segment delivered $386 million in revenues and an 11% operating margin for Q3 2025, largely fueled by power generation, which saw revenues increase 56% year-over-year and operating income rise 96% year-over-year.

- As of September 30, 2025, the company maintained a strong balance sheet with $47 million in cash, $1.05 billion in total debt, and a net debt to EBITDA ratio of 1.3x, having repurchased $120 million of stock in Q3 and an additional $40 million since quarter-end.

- Management anticipates 2025 will be a record earnings year and expects modest improvement in inland revenues and margins in Q4, continued robust coastal conditions, and plans to allocate significant Q4 free cash flow towards share repurchases.

- Kirby (KEX) reported Q3 2025 earnings per share of $1.65, marking a 6% increase year over year.

- The Marine Transportation segment achieved $485 million in revenue and an 18.3% operating margin, while the Distribution and Services segment generated $386 million in revenue with an 11% operating margin, notably driven by 56% year-over-year revenue growth in power generation.

- As of September 30, 2025, the company maintained a strong balance sheet with $47 million in cash, ~$1.05 billion in total debt, and a net debt to EBITDA ratio of 1.3 times. Free cash flow for Q3 2025 was $160 million.

- Kirby repurchased $120 million of stock in Q3 2025 and an additional $40 million post-quarter. The company projects 2025 to be a record earnings year, with full-year earnings expected at the low end of its previous guidance range.

- Kirby Corporation reported Q3 2025 earnings per share of $1.65, representing a 6% increase year over year.

- The Coastal Marine Transportation segment maintained strong fundamentals, with barge utilization consistently in the mid to high 90% range and term contract renewals increasing in the mid teens year over year, achieving operating margins around 20%.

- The Distribution and Services segment delivered solid growth, particularly in Power Generation, where revenues were up 56% year over year and operating income increased 96% year over year, driven by robust demand from data centers and prime power customers.

- The Inland Marine Transportation business experienced near-term softness in Q3 2025, with barge utilization averaging in the mid 80% range and spot market rates declining in the low to mid single digits. However, market conditions are showing signs of improvement, with current utility reported at 87.6%.

- As of September 30, 2025, Kirby's balance sheet remained strong with $47 million in cash and $1.05 billion in total debt, and the company repurchased $120 million of stock in Q3 2025 at an average price of $91.

Quarterly earnings call transcripts for KIRBY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more