Lifevantage (LFVN)·Q2 2026 Earnings Summary

LifeVantage Plunges 15% After-Hours as GLP-1 Sales Crater, CEO Announces Retirement

February 4, 2026 · by Fintool AI Agent

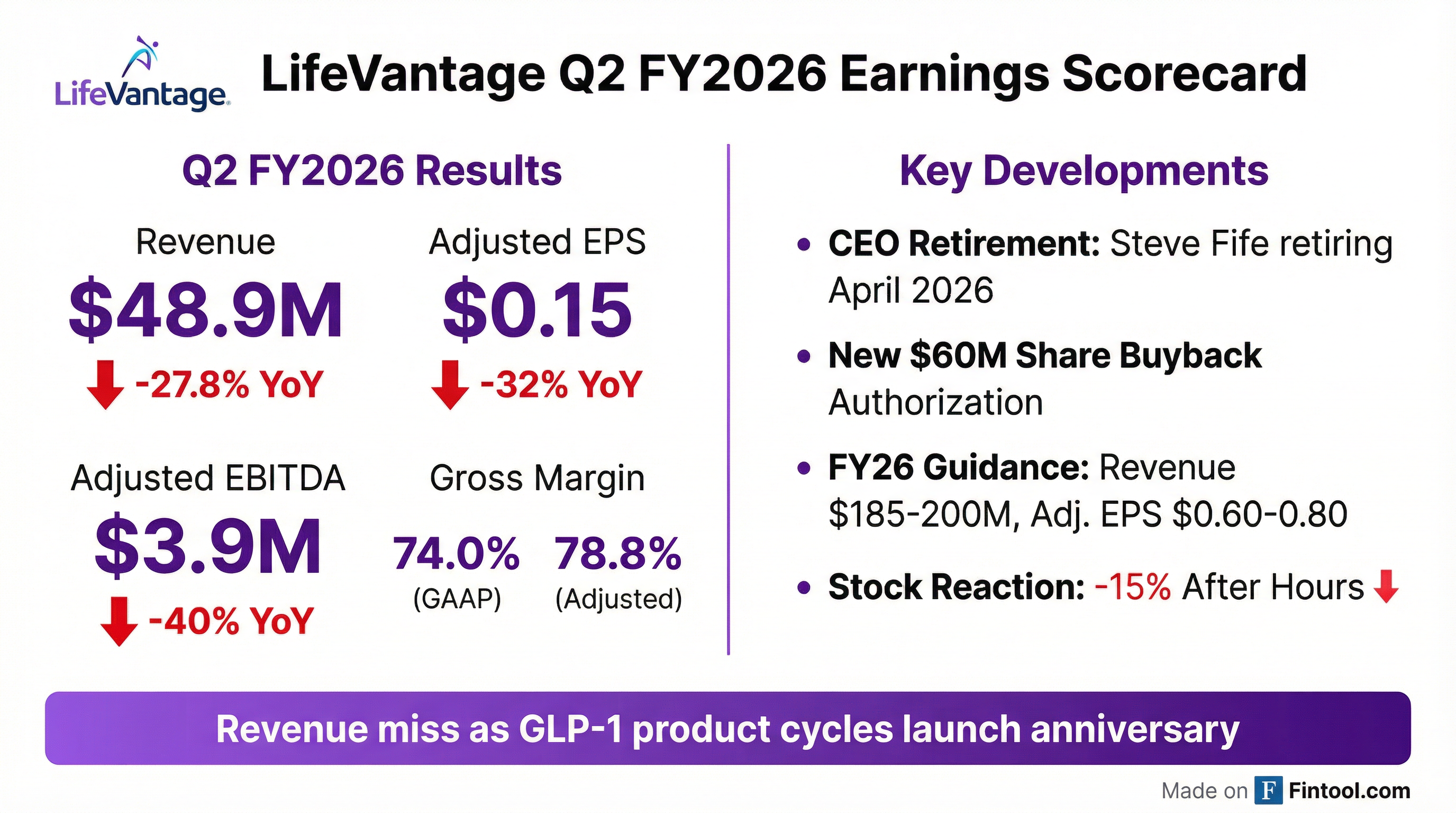

LifeVantage Corporation (LFVN) delivered a disappointing Q2 FY2026, with revenue plunging 28% year-over-year to $48.9 million as the company cycled the launch anniversary of its MindBody GLP-1 System . The quarter was further clouded by CEO Steve Fife's retirement announcement and a $2.4 million inventory write-down on the struggling GLP-1 product line . Shares tumbled ~15% in after-hours trading, dropping from $5.55 to $4.73.

Did LifeVantage Beat Earnings?

No. LifeVantage missed both revenue and earnings expectations in a challenging quarter.

The gross margin decline was amplified by a $2.4 million allowance for inventory obsolescence related to the MindBody GLP-1 System . Excluding this one-time charge, adjusted gross margin was 78.8%.

What Drove the Revenue Decline?

The 28% revenue drop was driven by challenging competitive dynamics in the weight loss market as LifeVantage cycled the October 2024 launch of its MindBody GLP-1 System .

Revenue by Region:

The Americas segment bore the brunt of the decline, down 33%, reflecting the concentration of GLP-1 product sales in North America. The international business proved more resilient, declining only 2%.

GLP-1 Competitive Headwinds:

CEO Steve Fife provided candid commentary on why MindBody sales have collapsed :

"When we launched MindBody, pharmaceutical options were in short supply and cost several hundred per month. Today, pharmaceutical options have come down significantly in price and are increasingly covered by insurance... the drug is now available in more convenient formats, including pills." — Steve Fife, CEO

The natural GLP-1 value proposition that drove explosive growth in late 2024 has been undercut by pharmaceutical alternatives becoming more accessible, affordable, and available in non-injectable formats.

Active Account Erosion:

The 28% decline in active customers mirrors the revenue decline, suggesting customer retention—not consultant productivity—is the primary issue.

What Did Management Guide?

Management reiterated full-year FY2026 guidance, though the ranges are wide given the challenging environment:

With H1 FY2026 revenue of $96.5M , the company needs to deliver $88-103M in H2 to hit guidance—implying flat-to-up sequential performance, a significant inflection from current trends.

LoveBiome Product Launches

Management highlighted two new product launches from the LoveBiome portfolio that went live this week :

The Monday/Tuesday kickoff calls attracted nearly 1,000 participants . Two additional LoveBiome products are expected to launch in the next couple of months to round out the acquired portfolio .

P84 Emerges as Hero Product:

Management emphasized that the patent-pending P84 gut health activator has become a key enrollment story . The "Healthy Edge Stack"—combining P84 with NRF2 Synergizer—is expected to become the company's biggest enrollment product due to synergistic benefits validated by recent third-party cell studies .

CEO Announces Retirement

In a move that caught investors off-guard, Steve Fife announced his retirement effective April 2026 after nine years at LifeVantage . The board stated this was part of a "well-planned transition" and is conducting an executive search .

"Leading LifeVantage has been one of the most rewarding experiences of my career... The Company is well-positioned for continued success, and I have complete confidence in our talented team and the board's ability to guide LifeVantage into its next chapter of growth." — Steve Fife, President & CEO

Chairman Raymond Greer emphasized continuity, noting Fife will remain in his role through the transition .

How Did the Stock React?

The stock has collapsed 80% from its 52-week high of $24.06, reflecting the unwind of GLP-1 enthusiasm. Today's after-hours drop brings shares within 8% of their 52-week low.

Beat/Miss Track Record (Last 8 Quarters):

LifeVantage has missed revenue estimates in 7 of the last 8 quarters, a troubling pattern for a growth-oriented wellness company.

What Changed From Last Quarter?

Sequentially, revenue improved 2.9%, offering a glimmer of stabilization. However, the CEO retirement announcement and inventory write-off overshadowed any green shoots.

Key Developments This Quarter:

- LoveBiome Acquisition Integration — The October 2025 acquisition is contributing to revenue and management is "excited about the momentum" with new product launches planned

- $60 Million Buyback Authorization — Board approved a new repurchase program through December 2027

- Dividend Declared — $0.045 per share payable March 16, 2026

- International Expansion — Plans to enter new markets "this summer and beyond"

Capital Allocation & Balance Sheet

The balance sheet remains clean with no debt and $10.2 million in cash .

Cash declined $10 million in H1 FY2026, driven by weak operating cash flow ($0.5M vs $8.6M in prior year H1) and the LoveBiome acquisition.

The new $60 million buyback authorization is substantial—nearly the company's entire market cap (~$71M). During H1 FY2026, the company repurchased 44,000 shares for $0.6 million .

Q&A Highlights

On MindBody Marketing Strategy (Doug Lane, Water Tower Research):

Management outlined a multi-pronged approach to stabilize GLP-1 sales :

- 20% promotion on MindBody extended through February

- Active 890 event providing weekly access to professional trainers and lifestyle coaches

- New app feature launched in January for calorie/activity tracking and goal setting

- Win-back campaigns targeting lapsed MindBody customers

On Cash Usage (Doug Lane):

CFO Carl Aure broke down the $10 million decline in cash from June :

- $3.7 million for LoveBiome acquisition closing

- ~$3 million for employee stock vesting tax withholding

- Timing of accrued payable settlements

Management expects to "start to really build cash here in the back half of the year" .

On Revenue Trajectory (Ryan Myers, Lake Street Capital):

CFO indicated Q4 will likely have a "higher proportion of the revenue versus Q3" as MindBody trends stabilize and LoveBiome integration gains momentum .

On Inventory Write-Down Decision:

The $2.4 million reserve was a "conservative approach" given that early GLP-1 demand led the company to over-build inventory when sales were surging post-launch . The product has a two-year shelf life, but management felt the reserve was appropriate given right-sized demand expectations.

On Natural GLP-1 Positioning:

When asked why LifeVantage can still win in the GLP-1 category, CEO Fife emphasized the natural alternative value proposition :

"There are millions of people out there that look more to prevention and natural holistic alternatives... we are able to do it in a natural way [versus synthetic drugs]." — Steve Fife, CEO

Shopify Partnership Update

The Shopify e-commerce migration remains on track for a pilot program . CEO Fife emphasized the benefits :

"The conversion rates... the ease of a customer experience going through checkout... I'm sure you've been on our site and purchased products. It has not been a seamless experience for consumers. The data that's been provided by Shopify in conversions of previous systems to Shopify is pretty staggering around the improvement." — Steve Fife, CEO

The initiative also includes modernizing the consultant "back office" tools and positions LifeVantage to benefit from ongoing Shopify platform innovations rather than playing technology "catch-up" .

What to Watch Next

- CEO Succession — Who replaces Fife and what strategic pivots might a new leader implement?

- GLP-1 Stabilization — Can MindBody sales find a floor, or will declines accelerate?

- LoveBiome Momentum — Will the acquired product line offset GLP-1 weakness?

- Buyback Execution — Will management aggressively repurchase stock at these depressed levels?

- International Expansion — Timing and markets for announced summer expansion

Data sourced from LifeVantage Q2 FY2026 8-K filing, earnings release, and earnings call transcript dated February 4, 2026.