Earnings summaries and quarterly performance for Lifevantage.

Executive leadership at Lifevantage.

Steven R. Fife

President and Chief Executive Officer

Alissa Neufeld

General Counsel and Corporate Secretary

Carl Aure

Chief Financial Officer

Julie Boyster

Chief Marketing Officer

Kristen Cunningham

Chief Sales Officer

Michelle Oborn

Chief People Officer

Todd Thompson

Chief Information and Innovation Officer

Board of directors at Lifevantage.

Research analysts who have asked questions during Lifevantage earnings calls.

Douglas Lane

Water Tower Research

8 questions for LFVN

Ryan Meyers

Lake Street Capital Markets

2 questions for LFVN

Aaron Wukmir

Lake Street Capital Markets

1 question for LFVN

Alex Fuhrman

Craig-Hallum Capital Group LLC

1 question for LFVN

Recent press releases and 8-K filings for LFVN.

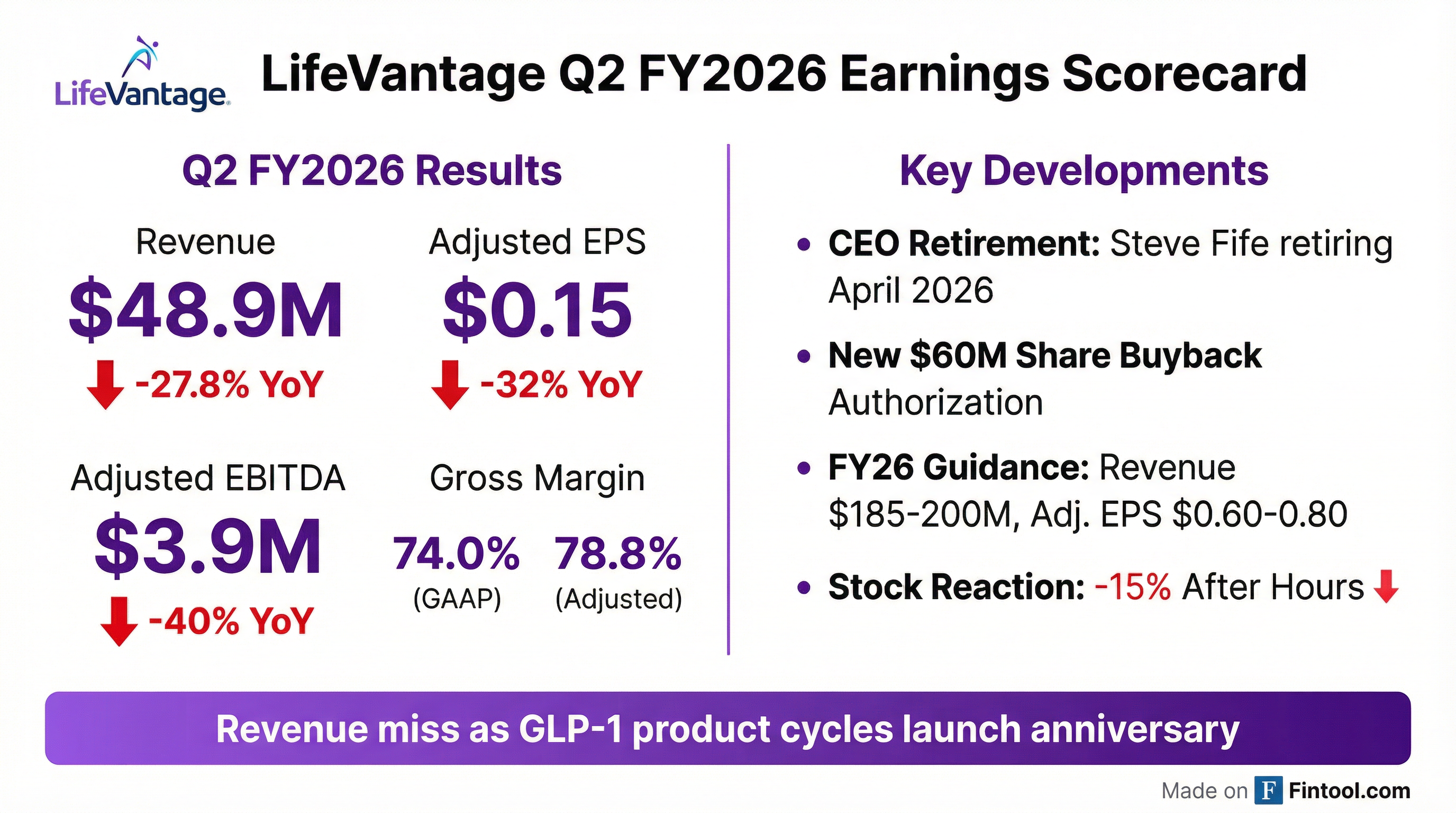

- LifeVantage reported net revenue of $48.9 million for Q2 Fiscal 2026, a 27.8% decrease compared to the prior year, primarily driven by a $16.2 million decline in MindBody GLP-1 System sales, though partially offset by $4.1 million from the LoveBiome product line.

- GAAP net income for the quarter was $0.3 million, or $0.02 per diluted share, while adjusted non-GAAP net income was $1.9 million, or $0.15 per diluted share.

- The company updated its Fiscal 2026 guidance, now expecting revenue in the range of $185 million to $200 million, Adjusted EBITDA between $15 million and $19 million, and adjusted earnings per share of $0.60 to $0.80.

- LifeVantage's board of directors approved a new $60 million share repurchase program and declared a quarterly cash dividend of $0.045 per share.

- Steve Fife, President and Chief Executive Officer, announced his planned retirement in April 2026.

- LifeVantage reported net revenue of $48.9 million for Q2 fiscal 2026, a 27.8% decrease compared to the prior year, primarily due to a $16.2 million decline in MindBody GLP-1 System sales, partially offset by $4.1 million from the LoveBiome product line.

- For the second quarter of fiscal 2026, GAAP net income was $0.3 million ($0.02 per diluted share), and adjusted non-GAAP net income was $1.9 million ($0.15 per diluted share).

- The company updated its fiscal 2026 outlook, projecting revenue in the range of $185 million-$200 million, Adjusted EBITDA of $15 million-$19 million, and adjusted earnings per share of $0.60-$0.80.

- LifeVantage's board approved a new $60 million share repurchase program and declared a quarterly cash dividend of $0.045 per share.

- Steve Fife, President and Chief Executive Officer, announced his planned retirement in April 2026.

- LifeVantage reported net revenue of $48.9 million for the second quarter of fiscal 2026, a 27.8% decrease compared to the prior year, with GAAP net income of $0.3 million or $0.02 per diluted share.

- The decline in revenue was primarily due to a $16.2 million decrease in sales of the MindBody GLP-1 System, attributed to increased competition, though partially offset by $4.1 million in revenue from the LoveBiome product line. The company also recognized a $2.4 million one-time inventory reserve related to MindBody inventory.

- The company updated its fiscal 2026 outlook, now expecting revenue in the range of $185 million-$200 million, Adjusted EBITDA of $15 million-$19 million, and adjusted earnings per share of $0.60-$0.80 per fully diluted share.

- LifeVantage announced a new $60 million share repurchase program and a quarterly cash dividend of $0.045 per share.

- President and Chief Executive Officer Steve Fife announced his planned retirement in April 2026.

- LifeVantage reported Q2 Fiscal 2026 revenue of $48.9 million, a 27.8% decrease from the prior year period, with net income per diluted share of $0.02 and adjusted earnings per diluted share of $0.15 for the quarter ended December 31, 2025.

- President and CEO, Steve Fife, announced his decision to retire in April 2026, with the Board initiating an executive search for his successor.

- The company's Board of Directors approved a new $60 million share repurchase program in January 2026, replacing the previous authorization.

- LifeVantage provided Fiscal Year 2026 guidance, anticipating revenue between $185 million and $200 million, adjusted EBITDA of $15 million to $19 million, and adjusted EPS in the range of $0.60 to $0.80.

- LifeVantage reported revenue of $48.9 million for the second fiscal quarter ended December 31, 2025, representing a 27.8% decrease from the prior year period, but an increase of 2.9% sequentially from the first quarter.

- Net income per diluted share was $0.02, and adjusted earnings per diluted share was $0.15 for the quarter, compared to $0.19 and $0.22, respectively, in the prior year period.

- Adjusted EBITDA was $3.9 million for the second fiscal quarter of 2026, down from $6.5 million in the comparable period of fiscal 2025. Gross profit as a percentage of revenue decreased to 74.0% from 80.5%, primarily due to a $2.4 million allowance for inventory obsolescence related to the MindBody GLP-1 System™.

- The company announced a new $60 million share repurchase program and declared a cash dividend of $0.045 per common share, payable on March 16, 2026.

- For fiscal year 2026, LifeVantage anticipates revenue in the range of $185 million to $200 million, adjusted EBITDA of $15 million to $19 million, and adjusted earnings per share between $0.60 and $0.80.

- LifeVantage (LFVN) emphasizes its "activation" product strategy, distinguishing itself from supplementation, and has an $80 million market cap.

- The company recently completed its first acquisition, LoveBiome, integrating its gut microbiome product P84 into a market projected to grow from $8 billion to $32 billion over eight years. The integration, including consultant retention and cross-selling, has exceeded expectations.

- LifeVantage operates in 20 countries with 50,000 independent consultants, with 78% of its revenue from North America, and has optimized its compensation plan to attract social sellers.

- Future capital allocation focuses on internal investments in technology (e.g., Shopify e-commerce platform) and international expansion, in addition to share repurchases and a dividend program.

- LifeVantage (LFVN) recently completed its first acquisition in over 15 years, acquiring LoveBiome to enter the rapidly growing gut microbiome market.

- The acquisition closed on October 1st (FY 2026) and was fully integrated by November 1st (FY 2026), with high consultant retention and cross-selling exceeding expectations.

- The gut health market, where LoveBiome's P84 product operates, is projected to grow from $8 billion to $32 billion over the next eight years.

- The company's product strategy focuses on "activation" rather than supplementation, aiming to restore the body's natural production capabilities, as seen with products like Protandim NRF2, collagen, and GLP-1.

- Capital allocation priorities include internal reinvestment in technology (e.g., a new Shopify e-commerce platform) and international expansion, alongside a history of share repurchases and a dividend program.

- LifeVantage (LFVN) has an $80 million market cap and its core strategy centers on "activation" products that stimulate the body's natural production, distinguishing it from supplementation.

- The company completed its first acquisition, LoveBiome, on October 1st, integrating its gut microbiome product (P84) and consultants, with high retention rates and cross-selling exceeding expectations.

- LifeVantage is expanding into new market segments, such as the $8 billion gut health market (projected to grow to $32 billion in eight years), with new products like P84, collagen, and GLP-1, diversifying beyond its core Protandim NRF2 product, which still represents over 50% of revenue.

- Capital allocation priorities include internal reinvestment, share repurchases, and a dividend program, with future investments planned for technology (Shopify) and international expansion.

- LifeVantage acquired LoveBiome, with the deal closing on October 1, 2025, and full integration by November 1, 2025, adding the P84 microbiome blend to its product portfolio.

- The company is investing in technology, with a Shopify partnership implementation expected to launch in 2026.

- LifeVantage plans further international expansion in 2026, following a successful launch in Iceland in 2025.

- For capital allocation in 2026, LifeVantage remains committed to share repurchases, with under $17 million remaining under the existing authorization, and maintaining its dividend.

- New study results for Protandim, P84, and MindBody will be announced at the January 2026 global kickoff.

- LifeVantage completed the LoveBiome acquisition, which officially closed on October 1, 2025, and achieved full integration of LoveBiome consultants into LifeVantage's compensation plan by November 1, 2025.

- The company is investing in its technology, including a partnership with Shopify for an e-commerce platform, with a launch anticipated in 2026.

- LifeVantage plans further international expansion in 2026, following its recent launch in Iceland in 2025.

- Management remains committed to share repurchases, with nearly $17 million remaining under the existing authorization and a 10b5-1 plan effective through June 30, 2025. They also remain committed to their dividend.

Fintool News

In-depth analysis and coverage of Lifevantage.

Quarterly earnings call transcripts for Lifevantage.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more