Lumentum Holdings (LITE)·Q2 2026 Earnings Summary

Lumentum Crushes Q2 as AI Demand Sends EPS 19% Above Guide, Stock Surges 13%

February 3, 2026 · by Fintool AI Agent

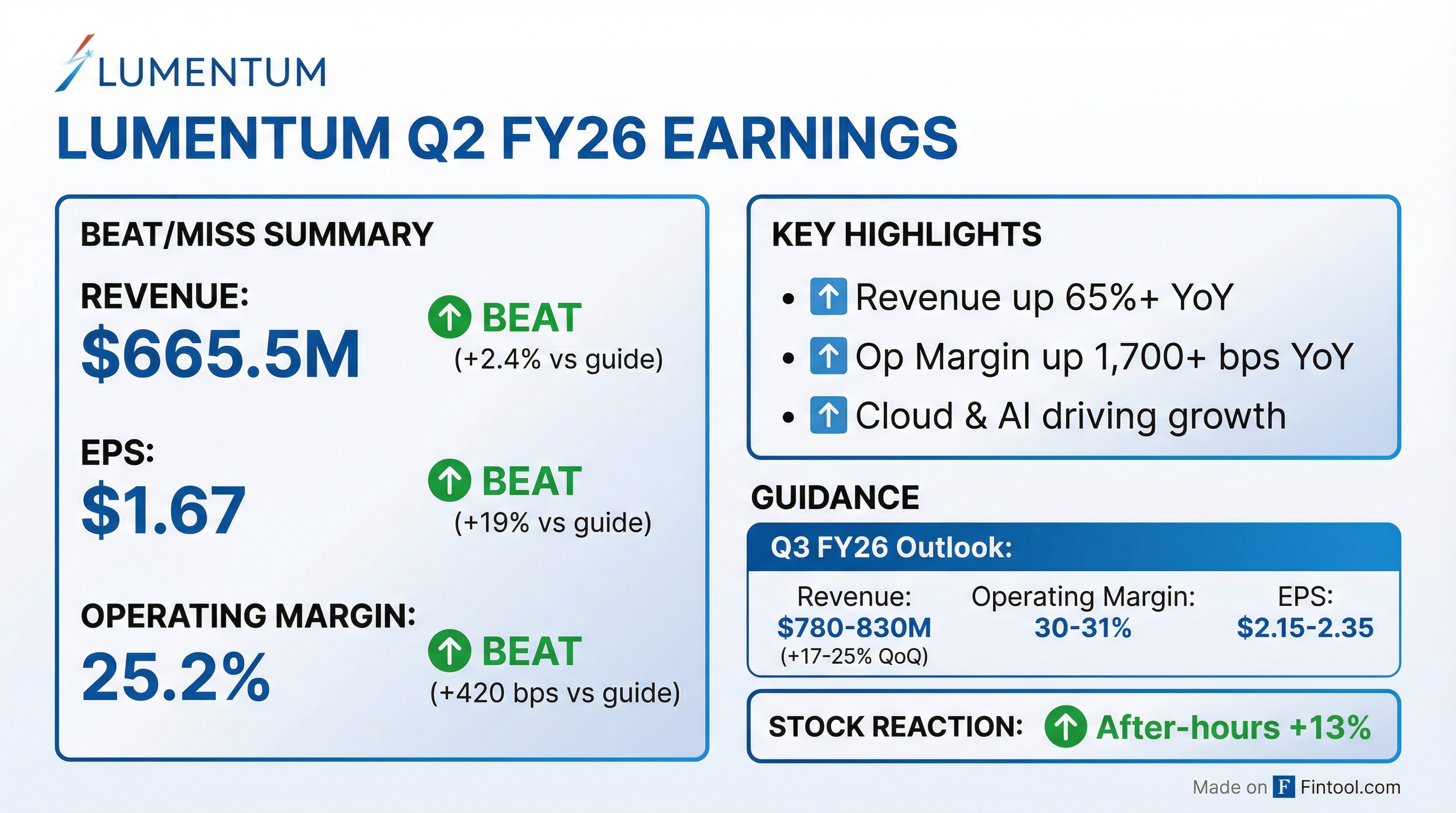

Lumentum delivered a blowout Q2 FY26 quarter, with revenue of $665.5M (+65% YoY) and non-GAAP EPS of $1.67 (+298% YoY), both significantly exceeding expectations . The optical components maker benefited from surging cloud and AI infrastructure demand, setting new company records across multiple product lines. The stock jumped 13% in after-hours trading to $489.60.

Did Lumentum Beat Earnings?

Lumentum delivered a decisive beat across all metrics:

*Values retrieved from S&P Global

The magnitude of the EPS beat (+$0.26 above consensus) was driven by structural improvements in both gross and operating margins. Non-GAAP gross margin expanded to 42.5% from 39.4% in Q1 FY26 and 32.3% in Q2 FY25 .

This marks the eighth consecutive quarter of EPS beats for Lumentum, with the company consistently exceeding expectations as cloud and AI demand accelerates.

What Did Management Guide?

Q3 FY26 guidance came in well above expectations, signaling continued acceleration:

The guidance midpoint of $805M revenue represents an impressive 85%+ year-over-year increase . Management previously projected crossing $750M quarterly revenue by mid-2026, but now expects to "comfortably surpass that milestone next quarter" .

Q3 Revenue Breakdown:

- Approximately two-thirds of sequential growth from Components (laser chips, assemblies)

- Remaining one-third from Systems (transceivers, OCS)

What Changed From Last Quarter?

Several key developments drove the upside:

Components Segment Acceleration:

- Revenue up 17% QoQ and 68% YoY to $443.7M, now representing 66.7% of total revenue

- Set new company records in 100G and 200G EML shipments

- 200G EMLs contributed ~10% of datacom chip revenue

- Eighth straight sequential quarter of growth in narrow linewidth lasers for DCI

- Company record quarter in pump lasers for scale-across and sub-sea applications

Systems Segment Ramp:

- Revenue up 43% QoQ and 60% YoY to $221.8M

- Set company record for cloud transceiver shipments

- Optical Circuit Switch (OCS) shipments exceeded $10M quarterly run rate

- OCS backlog now exceeds $400 million, driven by "extraordinary customer demand"

- Manufacturing readiness for OCS proceeding ahead of plan

Margin Transformation: Non-GAAP operating margin expanded from 7.5% in Q2 FY25 to 25.2% in Q2 FY26—a 1,730 basis point improvement . Gross margin reached 42.5%, up 310 bps sequentially and 1,020 bps YoY, driven by:

- Better manufacturing utilization across majority of product lines

- Increased pricing on select products

- Favorable product mix shift toward data center laser chips

- Improved transceiver yields and lower scrap rates

How Did the Stock React?

The stock hit an intraday 52-week high of $464 during the regular session before the earnings release, suggesting some pre-earnings anticipation. After-hours trading pushed shares to new all-time highs above $489.

Over the past 52 weeks, LITE shares have gained over 400%, driven by consistent earnings beats and the AI infrastructure buildout theme.

Segment Breakdown

The Systems segment is gaining share of the revenue mix as cloud transceiver ramps accelerate. Components remains the larger segment but continues to grow strongly on EML and laser shipments.

Balance Sheet Strength

Cash position increased by $33.5M sequentially, reflecting strong cash generation as margins expand. The company has significant liquidity to fund capacity expansion.

Forward Catalysts

Management highlighted several growth drivers for the coming quarters:

-

Optical Circuit Switches (OCS): Backlog has "surged well past $400 million," with the majority slated for shipment in H2 CY2026 . OCS cleared the $10M quarterly run rate a quarter ahead of schedule, with momentum accelerating from all three customers .

-

Co-Packaged Optics (CPO) - Scale-Out: Lumentum secured an additional multi-hundred-million-dollar purchase order for ultra-high-power lasers, with shipments expected in H1 CY2027 . Near-term, management expects ~$50M in CPO revenue in Q4 CY2025 .

-

CPO - Scale-Up (NEW): A potential "generational game-changer" as optics begins replacing copper for ultra-short-reach connections within racks. Management expects first scale-up CPO shipments by late CY2027 .

-

External Light Source (ELS) Modules: New opportunity to expand from standalone laser chips to pluggable ELS modules, which would provide 2-2.5x content gain and diversify the customer base .

-

Cloud Transceivers: Now on a "sustainable growth trajectory" with transceiver revenue growing ~$50M sequentially . The $1B run rate cap may be exceeded due to strong demand, with 1.6T shipments accelerating faster than expected .

-

200G EMLs: Ramping quickly with ~5% unit volume contributing ~10% of datacom chip revenue, targeting 25% mix by CY year-end with ~2:1 ASP uplift .

Capacity & Pricing Power

Lumentum's supply-demand dynamics remain highly favorable:

Indium Phosphide Fab Expansion:

- Already achieved ~20% capacity increase in Q2 (of 40% target), ahead of schedule

- Additional capacity coming over the next 2 quarters through Sagamihara (Japan)

- Line of sight to further capacity in H2 CY2026 from Caswell (UK) and Takao (Japan) fabs

Supply-Demand Imbalance:

- Still undershipping customer demand by ~30%

- Even as capacity increases, the gap is "incrementally up" due to accelerating demand

- "Tremendous pressure" on operations team to squeeze capacity

Long-Term Agreements (LTAs):

- All EML capacity spoken for through CY2027 under LTAs

- Customers coming back asking for more capacity beyond LTA commitments, enabling "incremental pricing discussions"

- LTAs eliminate quarterly price-down negotiations; prices holding or increasing

Price Increases:

- Price increases starting to flow through more meaningfully in Q3 FY26 guide

- Differential 200G EMLs (coming to market) offer "significant price" and additional margin tailwind

Q&A Highlights

Key analyst questions and management responses:

On OCS Momentum (Simon Leopold, Raymond James):

- Backlog now "well in excess of $400 million," mostly shipping in Q1-Q2 fiscal 2027

- Calendar Q4 exit rate expected "quite a bit higher" than previously guided $100M

- Three customers making up the backlog, all increasing demands "rather significantly"

On Fab Capacity (Samik Chatterjee, J.P. Morgan):

- Front-loaded expansion: ~20% in Q2 vs. 40% originally expected over 3 quarters

- New fabs under "active investigation" - looking at acquisition or creative use of current fabs

On Transceiver Business (Samik Chatterjee, J.P. Morgan):

- $1B annual cap "will be a challenge" to maintain; seeing "appreciable growth in demand"

- 1.6T margins "significantly better" than 800G, enabling more order acceptance

- CW laser integration pushed out 2-3 months (to late Q2/early Q3)

On 1.6T Transition (Ryan Koontz, Needham):

- 1.6T "definitely stronger than 90 days ago," accelerating faster than expected

- Silicon photonics expected to be majority at 1.6T, but absolute EML units still growing

- Lumentum now in "lead pack" for 1.6T transceivers after improving design cycle execution

On CPO and Scale-Up (Vijay Rakesh, Mizuho; Papa Sylla, Citi):

- Scale-out CPO: ~$50M expected in Q4 CY2025, then multi-hundred-million order kicking in H1 CY2027

- Scale-up CPO: Brand new market opportunity, first shipments late CY2027

- ELS modules provide 2-2.5x content gain vs. standalone lasers

On Manufacturing Strategy (George Notter, Wolfe Research):

- Pivoting toward more contract manufacturing to address capacity constraints

- Hired new backend operations leader from Jabil to accelerate CM partnerships

- Consolidating manufacturing into Nava (Thailand) facility while clearing China floor space

Risks and Concerns

From the forward-looking statements and Q&A, key risks include:

- Capacity execution: Demand outstripping supply by ~30%, creating execution risk on fab expansion and CM partnerships

- Transceiver margin headwind: Still a margin drag despite improvements; 1.6T better than 800G but below corporate average

- Industrial market softness: Shipments "roughly flat" with "persistent cyclical softness" in broader industrial market

- Manufacturing complexity: Ramping OCS, CPO, transceivers, and EMLs simultaneously creates operational complexity

- Customer concentration: Heavy reliance on hyperscale cloud customers (though diversifying)

- Macro and geopolitical: Trade restrictions, tariffs, and export controls could impact costs and component availability

Historical Earnings Trend

Lumentum has delivered eight consecutive earnings beats since Q4 FY24, with the turnaround accelerating dramatically as AI-driven demand materialized.

Key Management Quotes

"Lumentum delivered a standout second quarter with over 65% year-over-year revenue growth and non-GAAP operating margin increasing by greater than 1,700 basis points. We are now recognized as a foundational engine of the AI revolution. Virtually every AI network is powered by Lumentum technology." — Michael Hurlston, CEO

"While our Q2 results and Q3 guidance reflect meaningful contributions from cloud transceivers, we are only just beginning to unlock the massive potential of OCS and CPO... A fourth growth driver is taking shape, one poised to be a generational game-changer for the industry: optical scale-up." — Michael Hurlston, CEO

"Our position across OCS, optical scale-out, and optical scale-up is the envy of the industry. We continue to believe that our current performance is only a precursor of things to come." — Michael Hurlston, CEO

The Bottom Line

Lumentum's Q2 FY26 results and Q3 guidance confirm the company is a primary beneficiary of the AI infrastructure buildout. With revenue growth reaccelerating to 65%+ YoY, margins expanding dramatically, and multiple product ramps ahead (OCS, CPO, 200G EMLs), the growth story remains intact. The 13% after-hours surge reflects investor confidence in the sustainability of this trajectory.

Related Links: