BrasilAgro - Brazilian Agricultural Real Estate (LND)·Q2 2026 Earnings Summary

BrasilAgro Q2 2026 Earnings: Net Loss Narrows, Sugarcane Crisis Weighs

February 06, 2026 · by Fintool AI Agent

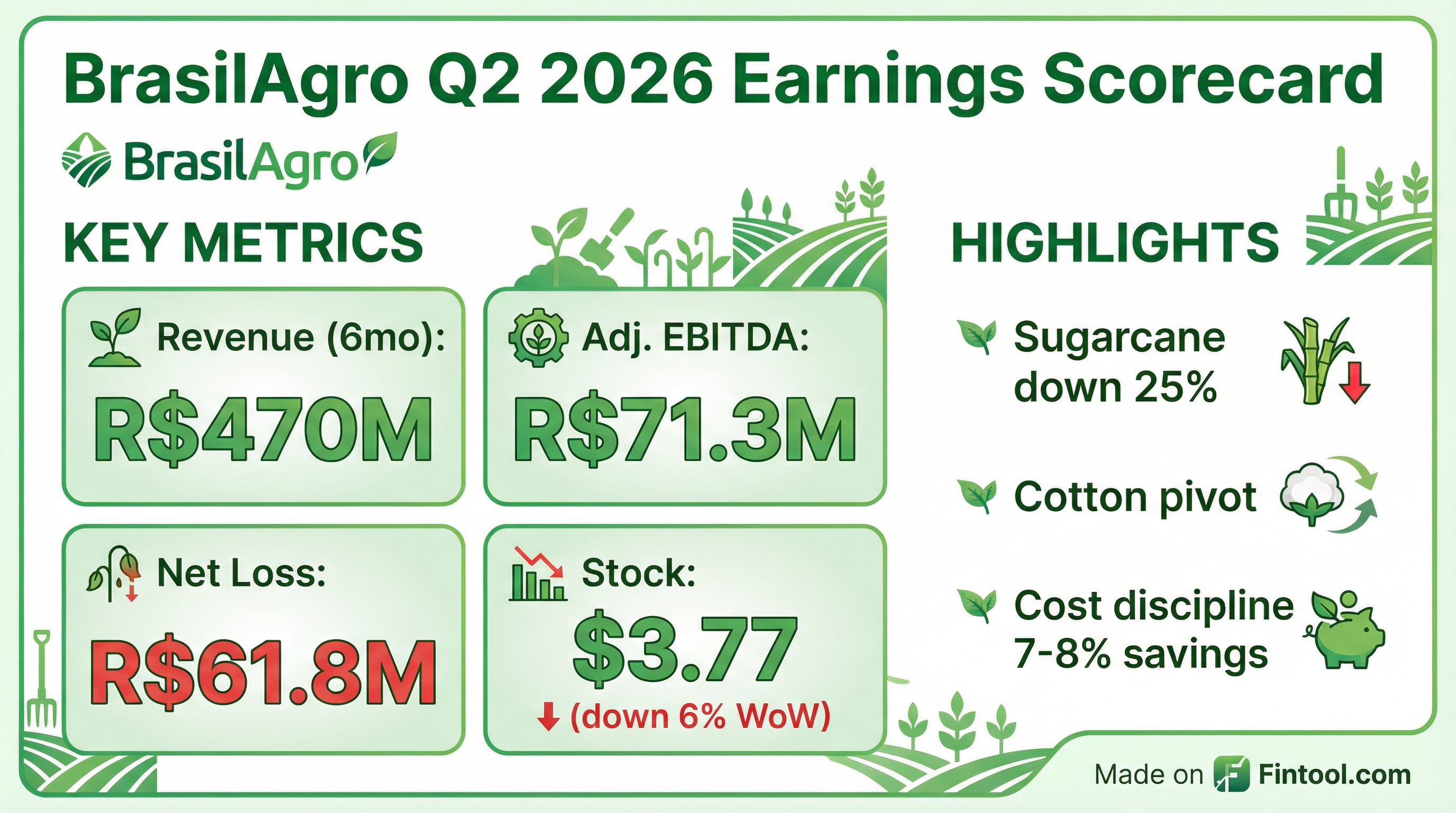

BrasilAgro (NYSE: LND) reported first-half FY2026 results with revenue of R$470 million and adjusted EBITDA of R$71.3 million. The net loss narrowed to R$61.8 million from R$77 million in the year-ago period, a 20% improvement despite severe sugarcane productivity challenges . The stock fell 6% week-over-week to $3.77, down 10% from its 52-week high of $4.20.

Did BrasilAgro Beat Earnings?

BrasilAgro's H1 FY2026 results showed mixed performance against expectations:

Revenue came in approximately 5% below consensus estimates, primarily driven by the sugarcane productivity shortfall. However, the narrowing of the net loss from R$77M to R$61.8M demonstrates operational improvement in other segments.

What Drove the Sugarcane Crisis?

The quarter's biggest challenge was a 25% decline in sugarcane production, which management attributed to two significant events :

- Frost damage - An ice period in southeast São Paulo affected sugarcane plantations, stunting growth

- Fire destruction - A significant fire in São José required early harvest before sugarcane reached full maturity

The double impact hit both volume and quality:

- Production: Down to 970,000 tons from 1.3 million tons

- ATR (sugar content): Dropped to 131-132 kg/ton from 140 kg/ton, meaning less sugar per ton harvested

- Cost impact: Fixed costs spread over fewer tons pushed per-unit costs significantly higher

Sugarcane results went from R$78 million profit in H1 FY2025 to just R$20 million in H1 FY2026 — a R$58 million swing that accounts for nearly all of the operational pressure .

How Did the Stock React?

The stock began declining ahead of earnings, falling from $4.20 on January 27 to $3.77 by February 5, suggesting the market anticipated weaker results. The 6% weekly decline reflects investor concern about the sugarcane shortfall and ongoing commodity price headwinds.

What Did Management Guide?

Management provided a cautiously optimistic outlook for the remainder of FY2026:

Sugarcane Recovery Expected :

- Internode distribution looks "a lot better" than last year

- No prolonged heat waves damaging crops as in prior year

- Accelerated sugarcane planting in Maranhão unit with 2,600 additional hectares

- Better disease and pest control through telemetrics

Cotton Strategic Pivot :

- Exiting 100% of off-season cotton in Xingu region

- Focusing exclusively on irrigated areas in Bahia

- Target productivity of 370-380 kg/hectare in "Projeto Genio"

- Reduced area to manage capital costs in high interest rate environment

Commodity Hedging Position :

What Changed From Last Quarter?

Improvements:

- Net loss narrowed 20% YoY despite sugarcane headwinds

- Corn margins improved significantly due to ethanol plant proximity premiums

- 100% telemetrics coverage achieved across all 16 Brazilian units

- Input costs down 7-8% through smart currency and timing management

Deterioration:

- Sugarcane profit collapsed from R$78M to R$20M

- Soy market facing surplus with stocks over 50 million tons

- High interest rates in Brazil pressuring cost of capital

Key Management Quotes

On sugarcane recovery :

"We're a lot more optimistic because we see this year, the distribution of internodes is a lot better. Last year, despite having rain, we had a summer that was really hot. Plants stop above certain temperatures... We're not seeing this year."

On cost discipline :

"Costs are just like nails. We have to cut them every week... This has been leading to significant savings in defensives and in some inputs, about 7% or 8%, which is a lot if you talk about commodities."

On Brazil soy expansion limits :

"Last year, Brazil incorporated about 800,000 hectares of soy. So this year, everyone is saying we're going to incorporate maybe 400-500,000 hectares. In the next year, we're going to get back to incorporating what's basal — maybe 200-250,000 hectares per year."

Balance Sheet & Liquidity

Management noted this is the seasonal trough for cash and peak for debt, as input purchases are complete but harvest revenue hasn't yet come in . The R$686M in farm receivables provides substantial coverage for short-term obligations.

Risks & Concerns

-

Interest rate exposure: Management repeatedly flagged Brazil's high interest rates as "very significant" for operations and the broader agricultural sector

-

Sugarcane sector headwinds: Sugar prices dropped from $0.22-0.23/lb to near $0.15/lb, pressuring industry economics

-

Soy oversupply: Brazil heading for 179-182 million ton harvest with stocks over 50 million tons, keeping prices depressed

-

Judicial recovery trend: Farmers increasingly using judicial recovery rather than selling land, limiting market liquidity for acquisitions

Forward Catalysts

- Sugarcane harvest H2 FY2026: Recovery in productivity would validate management's optimistic commentary

- Interest rate cuts: Brazilian rate reduction would lower cost of capital across the portfolio

- Cattle price strength: Management noted Trump advisors discussing beef cost pressures, but supply remains tight

- Ethanol/sugar mix optimization: Plants shifting toward ethanol given sugar price weakness

Bottom Line

BrasilAgro delivered a mixed quarter with the net loss narrowing despite a sugarcane crisis that wiped out R$58M of segment profit. The company's diversification strategy is showing merit — corn outperformed on ethanol plant premiums while cost discipline saved 7-8% on inputs. However, the stock's 6% weekly decline reflects ongoing concerns about Brazil's high interest rates, soy oversupply, and execution risk on the sugarcane recovery. Management's optimism about H2 sugarcane productivity will be the key metric to watch.

Data sources: BrasilAgro Q2 FY2026 earnings call transcript, S&P Global Capital IQ