Earnings summaries and quarterly performance for BrasilAgro - Brazilian Agricultural Real Estate.

Research analysts who have asked questions during BrasilAgro - Brazilian Agricultural Real Estate earnings calls.

Recent press releases and 8-K filings for LND.

BrasilAgro Reports Q2 2026 Financials and Operational Updates

LND

Earnings

New Projects/Investments

Guidance Update

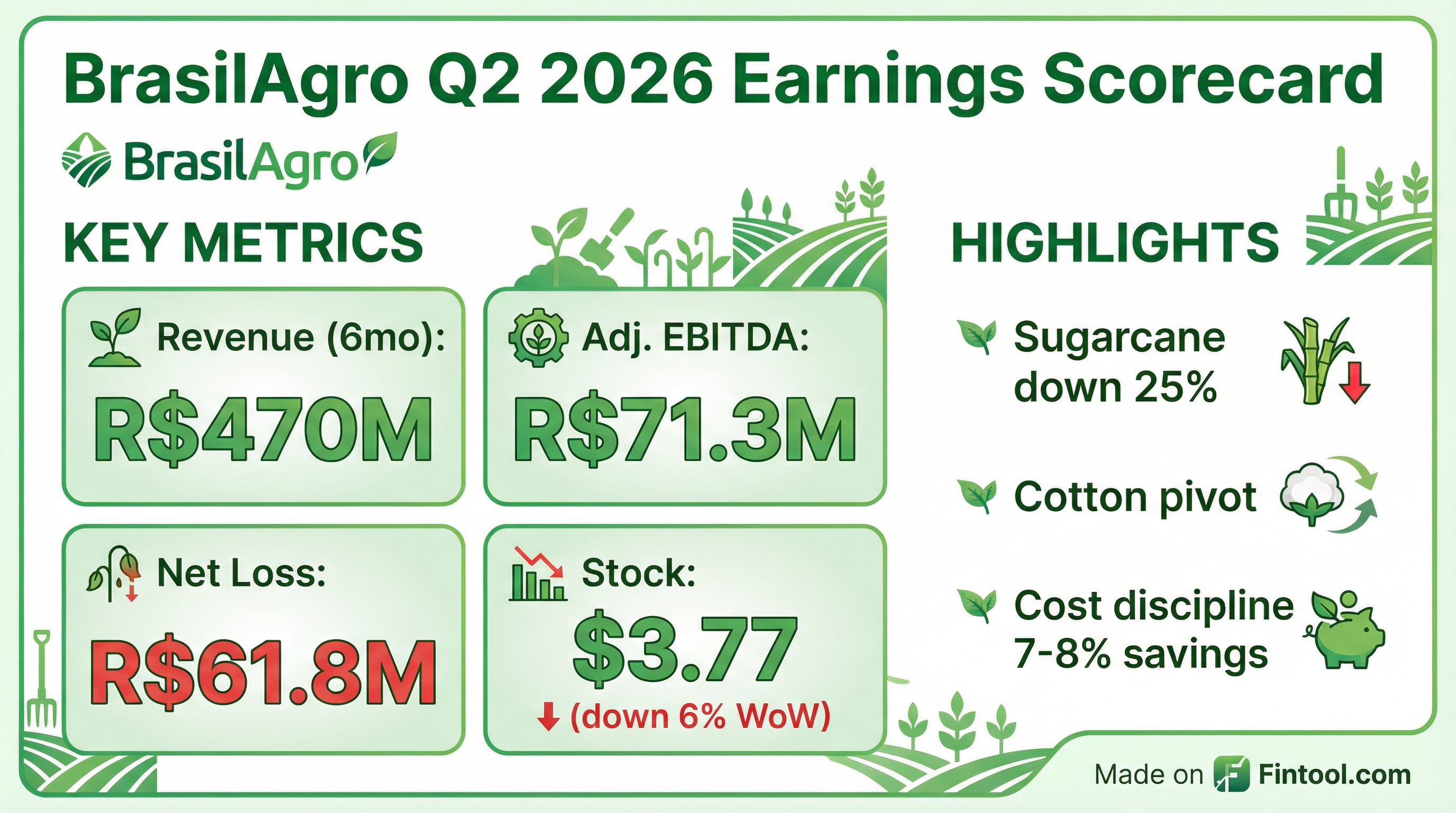

- For the first six months of Q2 2026, BrasilAgro reported revenue of R$470 million, an adjusted EBITDA of R$71.3 million, and a net loss of R$61.8 million. This loss compares to R$77 million in the same period of the previous year.

- The net loss was significantly impacted by R$54.58 million in losses from sugarcane, primarily due to productivity issues stemming from events like ice and fire, and a decrease in the average sugar content (ATR).

- Operationally, the company has implemented telemetrics across all its Brazilian units to enhance efficiency and is strategically shifting its cotton production to irrigated areas for higher productivity, reducing reliance on dryland cotton.

- BrasilAgro's financial position includes a total debt of R$886 million and an equivalent cash position of R$73 million, resulting in net cash of R$802 million.

- Management anticipates a strong recovery in sugarcane productivity for the next harvest due to improved management and fertilization efforts , but expects unfavorable pricing for sugarcane and ethanol in the immediate next year, with optimism for the subsequent cycle.

15 hours ago

BrasilAgro Reports Q2 2026 Financial Results and Operational Updates

LND

Earnings

New Projects/Investments

Demand Weakening

- For the first six months, BrasilAgro reported revenue of $470 million reais, adjusted EBITDA of $71.3 million, and a loss of $61.8 million.

- Sugarcane was a significant detractor, impacting results by $54.58 million due to issues like frost, fire, and lower ATR levels. The company also noted a surplus in soy supply, with Brazil heading for a super harvest of 179-182 million tons, which is impacting prices.

- BrasilAgro has implemented telemetrics across all its operational units in Brazil for improved efficiency and achieved 7% to 8% savings in defensives and some inputs through effective purchasing strategies.

- As of June 30, 2025, the company had a debt of $886 million reais and net cash of $802 million reais, noting this period typically sees lower cash and higher debt due to input acquisitions.

- Strategically, the company is shifting cotton production to irrigated areas for higher productivity and accelerating sugarcane planting with a focus on management and fertilizers to improve future yields. BrasilAgro expects to be more buyers than sellers of land.

16 hours ago

BrasilAgro Reports First Half FY2026 Financials and Operational Updates

LND

Earnings

Guidance Update

New Projects/Investments

- For the first six months of the 2025-2026 fiscal year, BrasilAgro reported revenue of $470 million reais, an adjusted EBITDA of $71.3 million reais, and a loss of $61.8 million reais.

- The company anticipates a strong recovery in sugarcane productivity for the upcoming harvest, following challenges in the previous year, and has shifted its cotton strategy to focus on high-productivity irrigated areas.

- BrasilAgro has implemented telemetrics across all its Brazilian operational units, achieving 7-8% savings in defensives and inputs through strategic purchasing.

- Brazil is projected to have a super soy harvest of 179-182 million tons, which is currently impacting market prices.

16 hours ago

BrasilAgro Updates 2025/2026 Agricultural Operations Estimates

LND

Guidance Update

- BrasilAgro provided an update on its 2025/2026 harvest year agricultural operations estimates on February 5, 2026.

- The total planted area decreased by 2% compared to initial estimates, primarily due to strategic and budgetary adjustments in soybean and second-crop bean acreage.

- Despite irregular rainfall at the start of the cycle, the outlook for the 2025/26 crop year remains positive.

- The 2025 sugarcane harvest concluded with 1.7 million metric tons at 67.55 tons of cane per hectare (TCH), falling short of expectations due to factors including advanced field age and adverse weather.

- For the 2026 sugarcane crop, production is estimated at 2.1 million metric tons with a TCH of 79.51.

1 day ago

LND Reports Q1 2026 Financial Results with Net Loss Amidst Mark-to-Market Adjustments

LND

Earnings

Dividends

Guidance Update

- For Q1 2026, LND reported net revenue of BRL 286.6 million, an adjusted EBITDA of BRL 64 million, and a net loss of BRL 64.3 million. The net loss was significantly impacted by non-cash mark-to-market adjustments, including BRL 40 million for fair value updates and BRL 54 million for fair value releases on sugarcane and soy receivables.

- The company's strategy to carry soy to the second semester proved successful, with 56% of the current harvest sold at BRL 1,072. Sugarcane productivity (TCH) was affected by freezing events and a rigorous winter, but a significant recovery is anticipated for the next period due to improved rain conditions.

- LND reported a cash position of BRL 236 million and a total debt of BRL 895 million, leading to a net debt of BRL 658 million as of Q1 2026. The company also holds over BRL 650 million in receivables from farm sales, including 6 million sacks of soy with a present value of BRL 651 million.

- A dividend payment of BRL 75 million was approved by shareholders and is scheduled to commence on November 28th.

Nov 7, 2025, 1:00 PM

LND Reports Q1 2026 Net Loss Amidst Mark-to-Market Adjustments and Sugarcane Challenges

LND

Earnings

Dividends

New Projects/Investments

- For Q1 2026, LND reported net revenue of 286.6 million reais, an adjusted EBITDA of 64 million reais, and a net loss of 64.3 million reais. The net operational revenue was 302 million reais, which is 7% below the previous year.

- The quarter's results were significantly impacted by mark-to-market adjustments of sugarcane and soy receivables, with fair value updates for receivables totaling 40 million reais.

- Operational challenges included reduced sugarcane productivity due to adverse weather conditions and low sugar rates, while the company's strategy to sell soy in the second semester proved assertive, with 56% of the current harvest already sold at $10.72.

- The company holds over 650 million reais in receivables from farm sales and almost 6 million sacks of soy to be received, and has approved a 75 million reais dividend payment.

Nov 7, 2025, 1:00 PM

BrasilAgro Announces Q1 2026 Results

LND

Earnings

Dividends

Demand Weakening

- BrasilAgro reported a net loss of R$ 64.3 million and Adjusted EBITDA of R$ 64.3 million on net revenue of R$ 286.6 million for the first quarter ended September 30, 2025, a period traditionally weaker in revenue generation.

- The company expects to produce 20% more in the 2025/2026 grain and cotton season on the same planted area, with 34% of the soybean area sown as of September 30, 2025.

- Financial results were negatively impacted by a higher cost of debt and a R$ 40.0 million negative present value adjustment on farm sale receivables, primarily due to a decline in soybean prices from R$ 140.29 per bag in June 2025 to R$ 128.48 per bag in September 2025.

- In October 2025, the Annual Shareholders' Meeting approved the distribution of R$ 75.0 million in dividends, equivalent to R$ 0.75 per share, representing a 9.6% dividend yield.

Nov 7, 2025, 12:09 PM

BrasilAgro Updates 2025/2026 Agricultural Operations Estimates

LND

Guidance Update

- BrasilAgro has provided updated agricultural operations estimates for the 2025/2026 harvest year.

- For the 2025/26 harvest, soybean planted area is estimated to increase by 10% and soybean production by 2% compared to the 2024/25 realized figures.

- Sugarcane production for the 2025 harvest is projected at 1.7 million tons, representing a 22% decrease in tons harvested compared to the 2024 realized harvest, due to factors such as advanced cane field age, high temperatures, water deficit, frosts, pests, and a fire.

- Cattle raising estimates were adjusted following the sale of Fazenda Preferência in June 2025, leading to a projected 5% decrease in meat production (kg) for the 2025/26 harvest compared to the 2024/25 realized harvest.

- The company noted that inconsistent rainfall patterns could impact planting schedules and the second harvest.

Nov 7, 2025, 11:50 AM

BrasilAgro Reports Fiscal Year 2025 Results, Declares Dividends, and Allocates Funds to Reserves

LND

Earnings

Dividends

New Projects/Investments

- BrasilAgro reported a net income of BRL 138.0 million for the fiscal year ended June 30, 2025, representing a 39.2% decrease from the previous year, despite a 13.8% increase in Net Sales Revenue to BRL 877.4 million.

- The company proposed a total dividend payment of BRL 75.0 million, or BRL 0.75289521 per common share, for the fiscal year ended June 30, 2025, which represents 54.34% of net income. Shares will trade "ex-dividends" from October 23, 2025.

- Cash and cash equivalents decreased by 16% to BRL 142.9 million as of June 30, 2025, mainly due to debt amortization, dividend payments, and investments. BRL 56.1 million of the remaining net income will be allocated to the Investment and Expansion Reserve to fund future investments and expansion.

Sep 23, 2025, 1:15 PM

Quarterly earnings call transcripts for BrasilAgro - Brazilian Agricultural Real Estate.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more