Earnings summaries and quarterly performance for LOUISIANA-PACIFIC.

Executive leadership at LOUISIANA-PACIFIC.

Brad Southern

Chief Executive Officer

Alan Haughie

Executive Vice President, Chief Financial Officer

Jason Ringblom

President

Leslie Davis

Vice President, Controller & Chief Accounting Officer

Nicole Daniel

Senior Vice President, General Counsel & Corporate Secretary

Tony Hamill

Senior Vice President, Chief Operating Officer

Board of directors at LOUISIANA-PACIFIC.

Dustan McCoy

Lead Independent Director

Jean-Michel Ribiéras

Director

Jose Bayardo

Director

Kelly Barrett

Director

Lizanne Gottung

Director

Nicholas Grasberger

Director

Ozey Horton

Director

Stephen Macadam

Director

Ty Silberhorn

Director

Research analysts who have asked questions during LOUISIANA-PACIFIC earnings calls.

Kurt Yinger

D.A. Davidson & Co.

7 questions for LPX

Mark Weintraub

Seaport Research Partners

7 questions for LPX

Steven Ramsey

Thompson Research Group

7 questions for LPX

Ketan Mamtora

BMO Capital Markets

6 questions for LPX

Susan Maklari

Goldman Sachs Group Inc.

6 questions for LPX

Matthew McKellar

RBC Capital Markets

5 questions for LPX

Michael Roxland

Truist Securities

5 questions for LPX

Sean Steuart

TD Securities

5 questions for LPX

George Staphos

Bank of America

3 questions for LPX

Brad Barton

Bank of America

2 questions for LPX

Kasia Strasky

TD Cowen

2 questions for LPX

Anika Dholakia

Barclays PLC

1 question for LPX

Anika Zylakia

Barclays

1 question for LPX

Jeffrey Stevenson

Loop Capital Markets LLC

1 question for LPX

Keaton Mamtora

BMO Capital Markets

1 question for LPX

Recent press releases and 8-K filings for LPX.

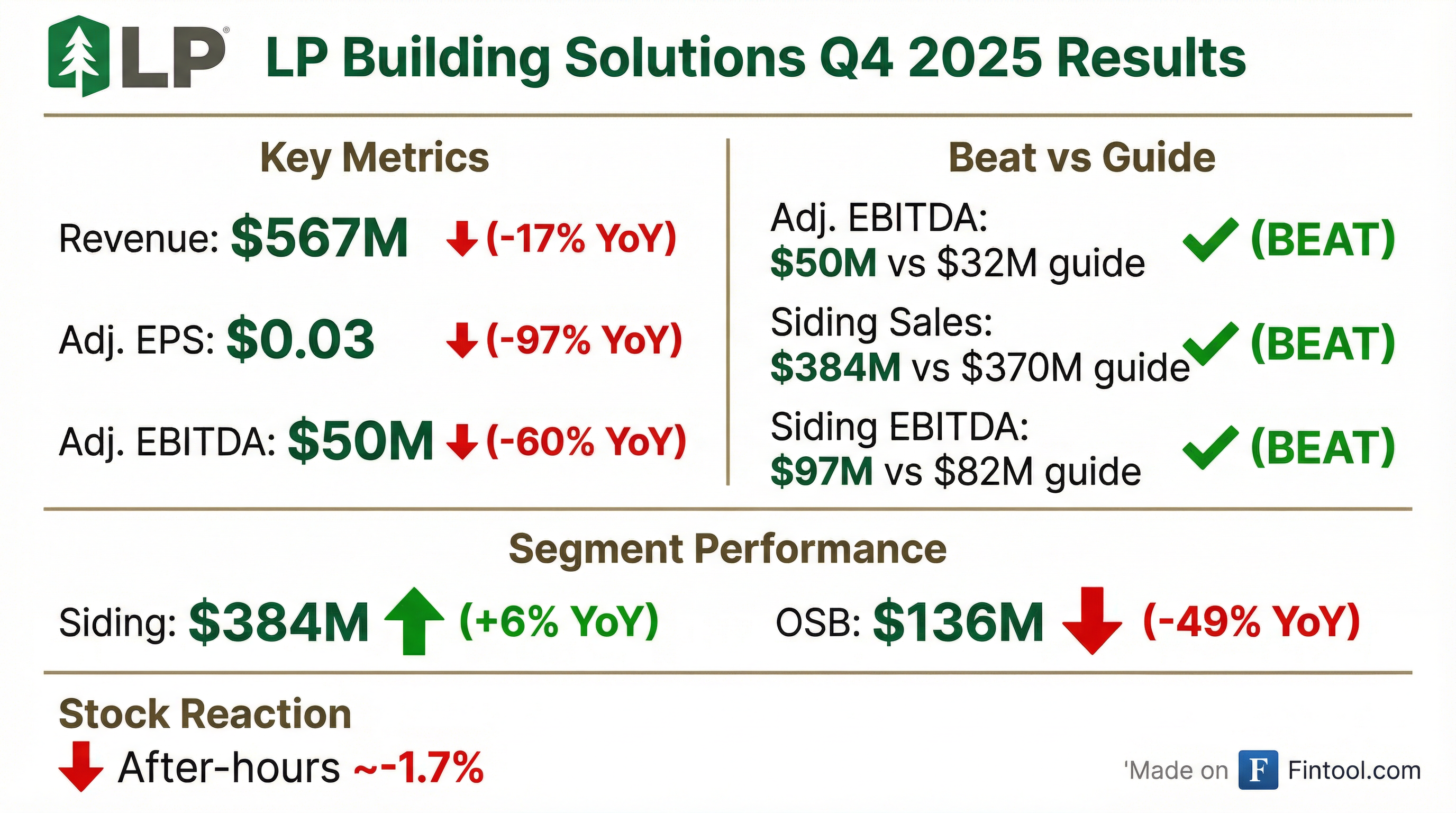

- LP Building Solutions reported Q4 2025 Net Sales of $567 million and Adjusted EBITDA of $50 million, representing declines of 17% and 60% respectively compared to Q4 2024. For the full year 2025, Net Sales were $2.7 billion and Adjusted EBITDA was $436 million, down 8% and 37% respectively from FY 2024.

- The Siding segment demonstrated strength, with sales growing 6% in Q4 2025 and 8% for the full year 2025. This segment achieved a 26% EBITDA margin in 2025.

- The company allocated $61 million to share repurchases in 2025 and reported $1 billion in total liquidity as of December 31, 2025.

- For full year 2026, LP Building Solutions projects Total LP Adjusted EBITDA of approximately $430 million, with Siding Revenue expected to be around $1.7 billion (approximately 2% growth) and Siding Adjusted EBITDA of about $450 million (approximately 26% margin).

- Louisiana-Pacific (LPX) reported Q4 2025 net sales of $567 million, EBITDA of $50 million, and adjusted diluted earnings per share of $0.03. For the full year 2025, net sales were $2.7 billion, EBITDA was $436 million, and adjusted earnings per share were $2.65.

- The Siding business achieved 8% revenue growth for the full year 2025 with a 26% EBITDA margin, driven by 4% higher net selling prices and 4% higher sales volumes, notably in the shed segment (up slightly more than 20%) and ExpertFinish (up 18%).

- The OSB segment recorded $7 million in EBITDA for the full year 2025, significantly impacted by multiyear price lows and unfavorable supply-demand dynamics in the fourth quarter.

- For Q1 2026, LPX anticipates Siding total volumes to be down 15%-20%, leading to a net sales decline of 11%-13% and an EBITDA margin between 23% and 25%, primarily due to elevated channel inventories and weaker shed activity.

- Full year 2026 guidance for Siding projects low single-digit net sales growth with an EBITDA margin of around 25%-26%, and the company plans $400 million in capital expenditures.

- Louisiana-Pacific (LPX) reported Q4 2025 net sales of $567 million, EBITDA of $50 million, and adjusted diluted earnings per share of $0.03. For the full year 2025, the company achieved $2.7 billion in net sales, $436 million of EBITDA, and adjusted EPS of $2.65.

- The Siding business grew 8% in revenue for FY 2025 with a 26% EBITDA margin, driven by higher net selling prices and sales volumes. ExpertFinish volumes jumped 35% in Q4 2025 and grew 18% for the full year.

- For Q1 2026, Siding net sales are projected to decline 11%-13% due to anticipated volume decreases of 15%-20%, though average selling prices are expected to be up 6-8 points. The OSB segment, which achieved $7 million in EBITDA for FY 2025, is expected to incur an EBITDA loss of $25 million to $30 million in Q1 2026.

- In FY 2025, LPX generated $382 million in operating cash flow and returned $139 million to investors through dividends and share repurchases. The company ended the year with $292 million in cash and over $1 billion in liquidity. Jason Ringblom succeeded Brad Southern as CEO.

- Louisiana-Pacific reported Q4 2025 net sales of $567 million, EBITDA of $50 million, and adjusted diluted earnings per share of $0.03. For the full year 2025, net sales were $2.7 billion, EBITDA was $436 million, and adjusted EPS was $2.65.

- The Siding business demonstrated resilience, growing 8% in revenue for the full year 2025 with a 26% EBITDA margin, driven by higher selling prices and volumes, particularly in ExpertFinish and the shed segment. In contrast, the OSB business experienced multiyear price lows in Q4 2025, leading to a $95 million year-over-year decrease in EBITDA for the quarter.

- For Q1 2026, LP anticipates Siding total volumes to be down 15%-20% year-over-year, with net sales down 11%-13% and an EBITDA margin between 23% and 25%. Full-year 2026 guidance for Siding projects net sales up low single digits and an EBITDA margin of around 25%-26%.

- Jason Ringblom succeeded Brad Southern as CEO. The company plans $400 million in capital expenditures for 2026 and returned $139 million to investors in 2025 through dividends and share repurchases.

- LP Building Solutions reported a net loss of $(8) million or $(0.11) per diluted share for Q4 2025, and net income of $146 million or $2.08 per diluted share for the full year 2025, reflecting significant year-over-year declines in profitability.

- Consolidated net sales decreased by $114 million to $567 million in Q4 2025 and by $233 million to $2.7 billion for the full year 2025, primarily due to a substantial decrease in Oriented Strand Board (OSB) net sales, partially offset by an increase in Siding net sales.

- The company provided a Q1 2026 outlook for Consolidated Adjusted EBITDA of $50 million and a full year 2026 outlook for Consolidated Adjusted EBITDA of $430 million, with projected full year 2026 capital expenditures of ~$400 million.

- LPX increased its quarterly cash dividend to $0.30 per share for Q1 2026, a 7% increase from the previous $0.28 per share, and repurchased $61 million of common shares during 2025.

- LP Building Solutions reported a net loss of $(8) million on $567 million in consolidated net sales for Q4 2025, and net income of $146 million on $2.7 billion in consolidated net sales for the full year 2025.

- In 2025, Siding net sales increased 8% to $1.7 billion, while OSB net sales decreased by $352 million to $832 million, reflecting divergent segment performance.

- The company provided a Q1 2026 Consolidated Adjusted EBITDA outlook of $50 million and a full-year 2026 outlook of $430 million, with capital expenditures projected at ~$400 million for the full year.

- LP invested $291 million in capital expenditures and repurchased $61 million of common shares in 2025, and announced a 7% increase in its quarterly cash dividend to $0.30 per share for Q1 2026.

- LPX reported Q3 2025 total sales were down 8% year-over-year and EBITDA was $82 million, primarily impacted by an extended trough in OSB prices.

- The company updated its full-year 2025 total company EBITDA guidance to $420 million and increased its full-year Siding EBITDA margin guide to about 26%.

- CEO Brad Southern announced his retirement in February, with President Jason Ringblum named as his successor.

- LPX is exploring the conversion of its Maniwaki, Quebec OSB mill to Siding production, potentially offering additional capacity with greater capital efficiency, and has consequently cut its CapEx guidance.

- Siding sales revenue increased 5% in Q3 2025, driven by price and mix, including a 17% year-over-year increase in ExpertFinish volumes, and the company announced a 3%-4% net price increase for 2026.

- LP Building Solutions reported Q3 2025 Net Sales of $663 million and Adjusted EBITDA of $82 million, with Adjusted Diluted EPS at $0.36.

- Siding sales increased by 5% in Q3 2025, while the OSB segment recorded net sales of $179 million and an Adjusted EBITDA of $(27) million.

- For the full year 2025, the company projects Total LP Adjusted EBITDA of ~$420 million and Total Capital Expenditures of ~$315 million.

- As of September 30, 2025, LP Building Solutions had 70 million shares outstanding and $1.1 billion in total liquidity.

- Louisiana-Pacific Corporation reported consolidated net sales decreased by $59 million to $663 million and net income was $9 million, a decrease of $82 million, for the third quarter of 2025 compared to the prior-year period.

- In Q3 2025, Siding net sales increased by 5% to $443 million, while Oriented Strand Board (OSB) net sales decreased by $74 million to $179 million.

- For the first nine months of 2025, consolidated net sales decreased by $119 million to $2.1 billion, and net income was $154 million, a decrease of $204 million year-over-year.

- The company reaffirmed its full-year 2025 Siding Adjusted EBITDA guidance of ~$430 million and provided a Consolidated Adjusted EBITDA guidance of ~$420 million.

- During the third quarter of 2025, LP invested $84 million in capital expenditures and paid $19 million in cash dividends, with total liquidity at $1.1 billion as of September 30, 2025.

- LP Building Solutions reported Q3 2025 consolidated net sales of $663 million, a decrease of $59 million compared to the prior-year period, with net income at $9 million and Adjusted EBITDA at $82 million.

- In Q3 2025, Siding net sales increased by $22 million (5%) to $443 million, primarily due to higher selling prices, while Oriented Strand Board (OSB) net sales decreased by $74 million to $179 million, driven by lower prices.

- For the full year 2025, the company reaffirms guidance for Siding Adjusted EBITDA of approximately $430 million and projects consolidated Adjusted EBITDA of approximately $420 million.

- The company generated $89 million in cash provided by operating activities and invested $84 million in capital expenditures during Q3 2025, maintaining total liquidity of $1.1 billion as of September 30, 2025.

Quarterly earnings call transcripts for LOUISIANA-PACIFIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more