LAM RESEARCH (LRCX)·Q2 2026 Earnings Summary

Lam Research Crushes Estimates, Guides Q3 8.8% Above Street as WFE Hits $135B

January 28, 2026 · by Fintool AI Agent

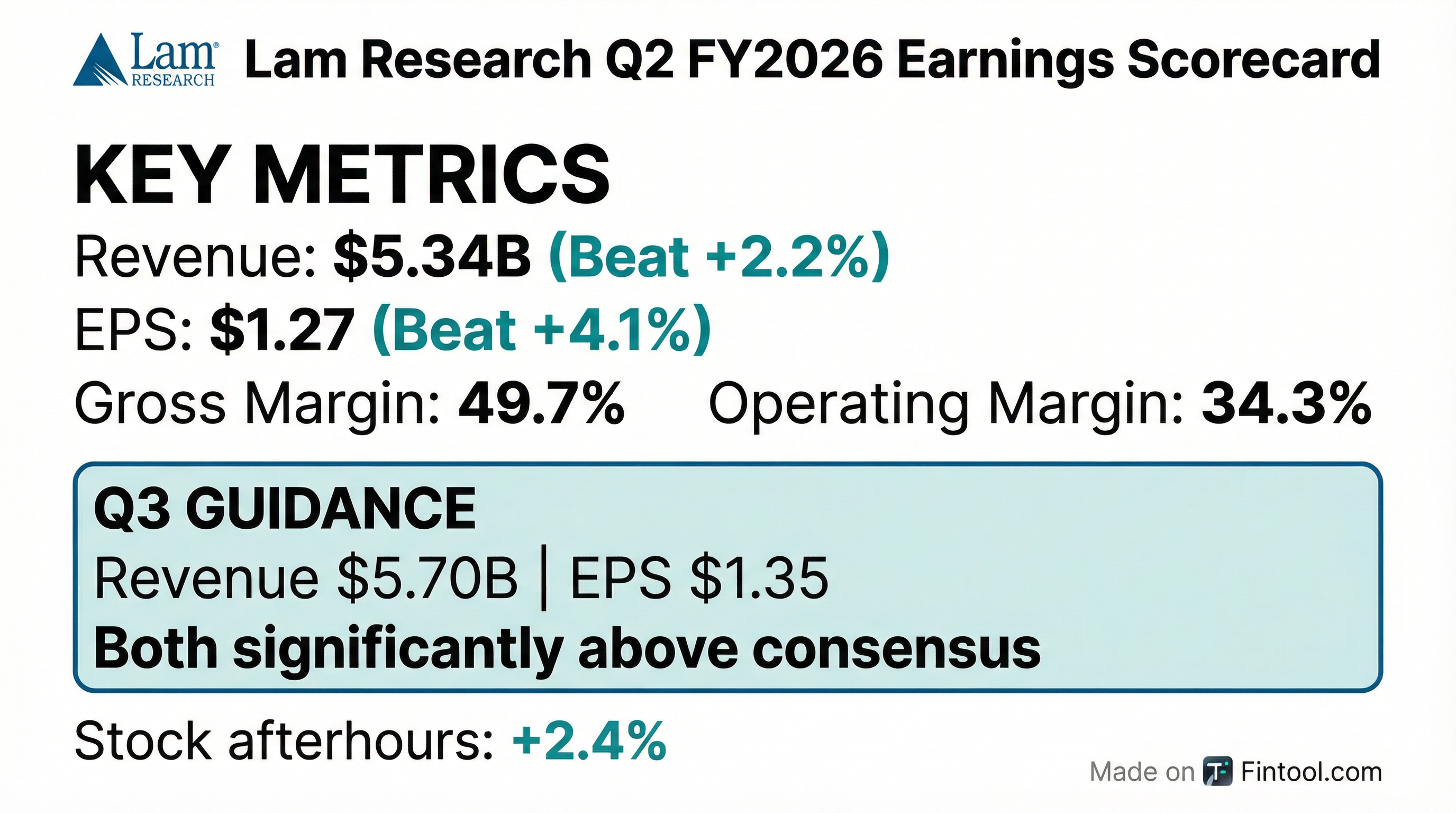

Lam Research capped a record calendar year with its eighth consecutive quarterly beat, posting Q2 FY2026 revenue of $5.34 billion and non-GAAP EPS of $1.27. The bigger story: management raised its 2026 WFE forecast to $135 billion (up 23% from 2025's $110 billion) and guided Q3 revenue nearly 9% above Street estimates, signaling that AI-driven semiconductor equipment demand is accelerating faster than expected.

CEO Tim Archer framed the results as validation of Lam's multi-year thesis: "We ended calendar year 2025 on a strong note... At our Investor Day event last year, we outlined our tremendous opportunity to expand our market and gain share at every successive technology node. Today, we are well on our way."

Did Lam Research Beat Earnings?

Yes — extending its streak to eight consecutive quarters. Both revenue and EPS exceeded consensus, though the magnitude of the beat was more modest than recent quarters.

*Values retrieved from S&P Global.

The company also delivered a record calendar year 2025, with revenue of $20.6 billion (up 27% YoY), operating profit of $7 billion (up 41% YoY), and diluted EPS of $4.89 (up 49% YoY).

What Did Management Guide?

The guidance was the headline. Lam's Q3 outlook came in significantly above consensus across all metrics:

*Values retrieved from S&P Global.

CFO Doug Bettinger was explicit about the trajectory: "As I sit here right now, I think we're gonna see growth every quarter from the previous quarter... it ends up being a second half-weighted year, both from a WFE standpoint and from our revenue."

How Did the Stock React?

LRCX surged 6.7% in after-hours trading to $255.70, up from the regular session close of $239.58. The stock had already rallied 7.4% over the three sessions leading into earnings, with shares up nearly 50% from the start of 2025.

What Changed From Last Quarter?

WFE Forecast Raised to $135B

The most significant update: Lam now expects 2026 WFE spending of approximately $135 billion, up from ~$110 billion in 2025. Growth is constrained by clean room space shortages, which management believes sets up 2027 for another strong year.

Segment Mix Shift to Foundry

Foundry surged to 59% of systems revenue, up from 35% a year ago — underscoring Lam's successful pivot to leading-edge logic.

Geographic Mix

China remained the largest region at 35% (down from 43% in Q1), with Korea surging to 20% (up from 15%). Management expects China WFE to be roughly flat YoY in 2026, meaning it will become a smaller percentage of Lam's revenue as other regions grow faster.

Share Gains Continuing

Lam expanded its SAM share of WFE to the mid-30s% range in 2025 and is targeting the high-30s% over time. Ship share of WFE grew by over 1 percentage point year-on-year, with the installed base now exceeding 100,000 chambers.

Q&A Highlights

The analyst Q&A revealed several important insights:

On Clean Room Constraints:

"It's hard for us to put a number on it... the industry seems to be sold out for most of what it's supplying, and everybody's talking about these multi-year agreements that they're working on." — Doug Bettinger

On 2026 Trajectory:

"I think we're gonna see growth every quarter from the previous quarter. March probably grows, June from that, September from that, and it ends up being a second half-weighted year." — Doug Bettinger

On Share Gains:

"Do we plan to sustain or increase share? The answer is we plan to increase our share of WFE again this year... if it's technology-driven, as it looks like it will be, we will continue to expand SAM, gain share of WFE." — Tim Archer

On NAND Greenfield Capacity:

"Because of the clean room space constraints, it's probably... 2027, 2028, when clean room space is sufficiently available such that they can invest in additional NAND capacity in a big way." — Tim Archer

On New NAND Use Cases:

"This is an expansion... related to the AI inference and kind of the expansion of TB cache. This is beyond the projections that we would have given back at Investor Day a year ago." — Tim Archer

Key Growth Drivers

Advanced Packaging +40%

Lam expects its advanced packaging business to grow more than 40% in 2026, outperforming overall WFE growth. The company is the market leader in electroplating and TSV etch for HBM, which is critical for the transition to HBM4 and 16-layer stacking.

Acara Momentum

The Acara conductor etch system doubled its installed base over the past year, with production tool-of-record wins for EUV and high aspect ratio etch applications. Management expects applications using Acara to grow ~2x in gate-all-around devices and ~3x in DRAM at the 1D node.

NAND Recovery Accelerating

The $40 billion NAND upgrade opportunity is materializing faster than expected, with new AI inference use cases creating incremental demand. Management noted that for every 2-3 million accelerators sold, NAND bit demand increases by approximately 1 percentage point.

Moly ALD Leadership

Lam has exclusive production wins in ALD Molybdenum for NAND, positioning it for multi-year share gains as the industry transitions to new interconnect materials.

Beat/Miss History (8 Quarters)

*Values retrieved from S&P Global. EPS reflects Non-GAAP normalized figures.

Eight consecutive beats on both revenue and EPS — remarkable consistency in a cyclical industry.

Capital Allocation

Lam returned 85% of free cash flow to shareholders in calendar 2025 and plans to maintain at least that level going forward.

The company repurchased 39 million shares in calendar 2025 at an average price of $104 per share.

Forward Catalysts

Near-term (1-2 quarters):

- Q3 guidance execution against elevated expectations

- China mix normalization (moving toward low-30s% or high-20s%)

- NAND technology conversions continuing

Medium-term (3-4 quarters):

- Gate-all-around adoption acceleration below 2nm

- Advanced packaging capacity expansions (40%+ growth expected)

- HBM4 production ramp

- New Arizona facility contribution

Long-term:

- $40B NAND equipment upgrade cycle accelerating

- Moly adoption expanding across interconnect layers

- Backside power deposition inflection

- 4F² DRAM transition (late decade)

The Bottom Line

Lam Research delivered its eighth consecutive beat-and-raise quarter, capping a record calendar year with $20.6 billion in revenue and $4.89 in EPS. The Q3 guidance was the highlight — revenue 8.8% above consensus and EPS 15.5% above signals management confidence that AI-driven semiconductor equipment demand is accelerating.

The strategic thesis is playing out exactly as management outlined at Investor Day: every technology node expansion and share gains. SAM moved to the mid-30s%, with high-30s% in sight. The $135 billion WFE forecast for 2026 (despite clean room constraints) suggests the industry upcycle has further to run.

Key question going forward: How sustainable is the current demand environment? Management's answer was unequivocal: "We have better visibility into the following year than I think I can ever remember" — a notable statement for a cyclical business.

View LRCX Company Page | Read Q2 2026 Earnings Call Transcript