Earnings summaries and quarterly performance for LAM RESEARCH.

Executive leadership at LAM RESEARCH.

Timothy M. Archer

President, Chief Executive Officer

Ava A. Harter

Senior Vice President, Chief Legal Officer and Secretary

Douglas R. Bettinger

Executive Vice President, Chief Financial Officer

Patrick J. Lord

Executive Vice President, Chief Operating Officer

Seshasayee (Sesha) Varadarajan

Senior Vice President, Global Products Group

Board of directors at LAM RESEARCH.

Abhijit Y. Talwalkar

Chair of the Board

Bethany J. Mayer

Director

Eric K. Brandt

Director

Ho Kyu Kang

Director

Ita M. Brennan

Director

John M. Dineen

Director

Jyoti K. Mehra

Director

Mark Fields

Director

Michael R. Cannon

Director

Sohail U. Ahmed

Director

Research analysts who have asked questions during LAM RESEARCH earnings calls.

Blayne Curtis

Jefferies Financial Group

6 questions for LRCX

Harlan Sur

JPMorgan Chase & Co.

6 questions for LRCX

Stacy Rasgon

Bernstein Research

6 questions for LRCX

Timothy Arcuri

UBS

6 questions for LRCX

Brian Chin

Stifel Financial Corp.

5 questions for LRCX

Vijay Rakesh

Mizuho

5 questions for LRCX

Atif Malik

Citigroup Inc.

4 questions for LRCX

CJ Muse

Cantor Fitzgerald

4 questions for LRCX

Krish Sankar

TD Cowen

4 questions for LRCX

Vivek Arya

Bank of America Corporation

4 questions for LRCX

Mehdi Hosseini

Susquehanna Financial Group

3 questions for LRCX

Thomas O’Malley

Barclays Capital

3 questions for LRCX

Timm Schulze-Melander

Rothschild & Co Redburn

3 questions for LRCX

Charles Shi

Needham & Company

2 questions for LRCX

Christopher Muse

Cantor Fitzgerald

2 questions for LRCX

Edward Yang

Oppenheimer & Co. Inc.

2 questions for LRCX

James Schneider

Goldman Sachs

2 questions for LRCX

Jim Schneider

Goldman Sachs

2 questions for LRCX

Joseph Moore

Morgan Stanley

2 questions for LRCX

Melissa Weathers

Deutsche Bank

2 questions for LRCX

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

2 questions for LRCX

Srinivas Pajjuri

Raymond James & Associates, Inc.

2 questions for LRCX

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for LRCX

Christopher Caso

Wolfe Research

1 question for LRCX

Joseph Quatrochi

Wells Fargo Securities, LLC

1 question for LRCX

Recent press releases and 8-K filings for LRCX.

- SAM expansion: Lam’s share of total wafer fab equipment (WFE) investment rose from ~30% in 2024 to ~35% in 2025 and is projected to reach the high-30s percent range over the next few years, with a targeted 50% win rate of its addressable market.

- Foundry & logic outperformance: The foundry and logic segment grew 49% in 2025 and now represents 59% of equipment sales (vs. 60% memory four years ago), driven by R&D investments in gate-all-around, backside power, and advanced packaging.

- Strong industry demand: Lam forecasts 2026 WFE at $135 billion (↑23% YoY), led by leading-edge logic and DRAM, and cites clean-room constraints as an indicator for continued strength into 2027.

- Advanced packaging growth: With a $1 billion business in 2024, advanced packaging (TSV etch via Syndion and 3D plating via SABRE) is expected to grow >40% in 2026, driven by high-bandwidth memory stacking for AI compute.

- Stable annuity business: The Customer Support Business Group (~33% of revenue) covering spares, services, upgrades, and mature tools is highly profitable and cash-generative, with an installed chamber base aiming for 1.5× growth by 2028 through results-based service offerings.

- Demand surge: Industry WFE is expected to rise from $110 billion in 2025 to $135 billion in 2026 (+23%), driven by leading-edge foundry and AI-focused DRAM, with capacity constrained by clean-room availability and extended visibility into 2027.

- Strategic R&D investment: Post-COVID R&D spend doubled to capture architecture shifts (gate-all-around, backside power, CFET), helping Lam flip its equipment sales mix from 60% memory in 2021 to 59% foundry & logic in 2025 as SAM per wafer doubles on next-gen nodes.

- Product leadership in memory and packaging: Lam holds >50% share in conductor etch, is deploying its new Akara etch platform and ramping dry-resist tools into production, and dominates TSV steps (Syndion, SABRE) to support 40% advanced packaging growth in 2026.

- Margin and supply-chain execution: Maintaining ~49% gross margin, targeting 50% by 2027-28, while expanding its manufacturing footprint globally (notably Malaysia) and strengthening its supplier network to meet surging tool demand.

- Growing annuity business: The Customer Support Business Group—comprising spare parts, service, upgrades and Reliant mature tools—now represents ~⅓ of revenue with 102,000 installed chambers, delivering resilient margins, free cash flow and results-based service offerings.

- Since 2018, architecture transitions (3D NAND, gate-all-around, CFET, backside power) are driving SAM per wafer to double in foundry/logic and grow 1.7×–1.8× in DRAM/NAND, lifting Lam’s SAM as a percent of total WFE to the mid-30s% range and projected to the high-30s% by the late 2020s.

- Foundry & logic revenue surged 49% in 2025, flipping mix to 59% of equipment sales versus memory, reflecting R&D investments targeting leading-edge nodes.

- Industry WFE is forecast to rise from $110 bn in 2025 to $135 bn in 2026, driven by leading-edge logic and DRAM, with clean-room capacity constraints suggesting continued strength into 2027.

- Gross margin management aims for ~50% by 2027–2028, supported by pricing discipline, cost optimization and a global manufacturing footprint expansion (notably Malaysia) to shorten lead times.

- The Customer Support Business Group (CSBG) now represents ~1/3 of revenue, leveraging 102,000 installed chambers for annuity-like growth in spares, service, upgrades and mature Reliant equipment, with results-based service initiatives boosting per-tool revenue.

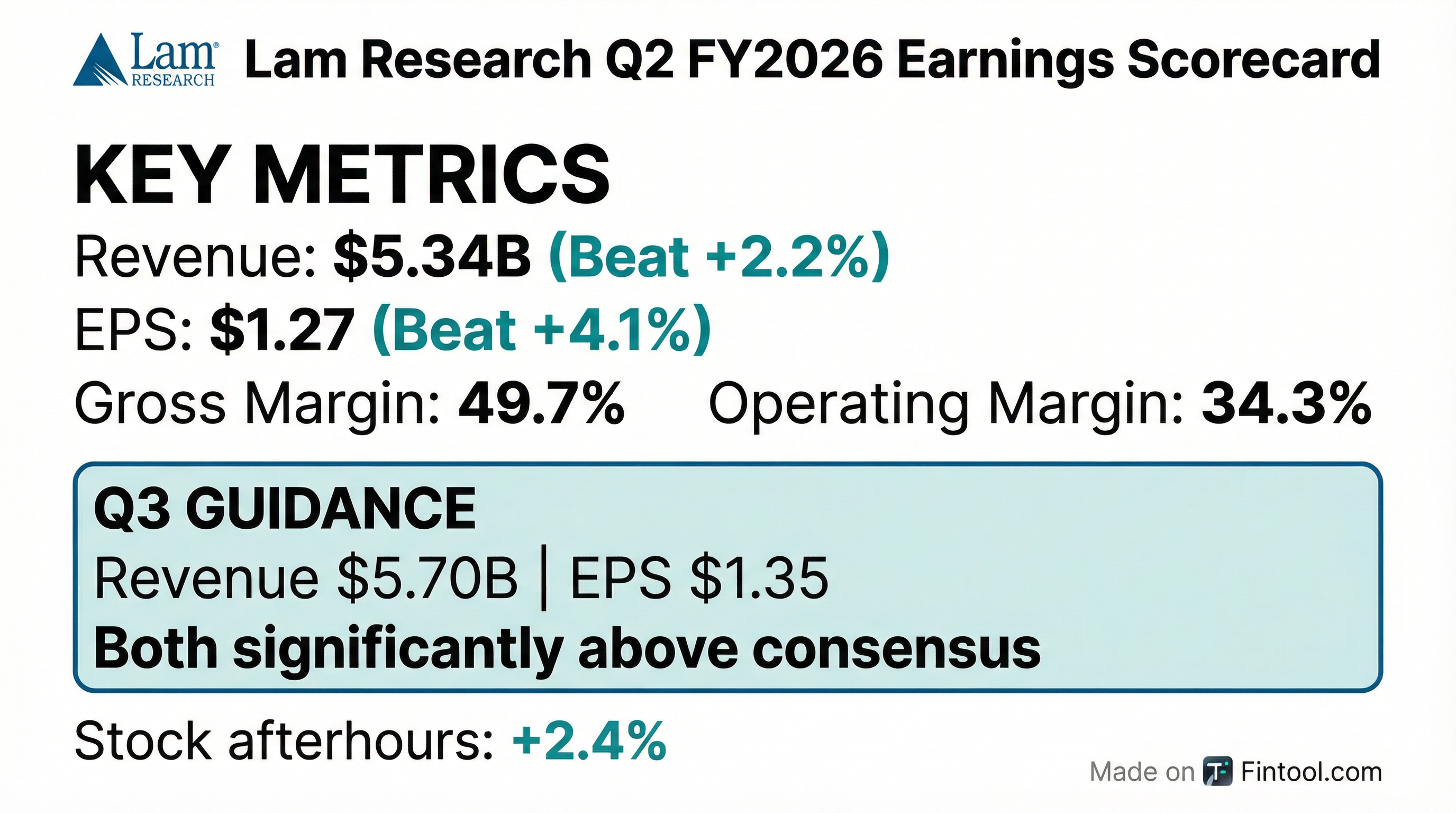

- Lam Research reported Q2 revenue of $5.34 billion and adjusted EPS of $1.27, with an adjusted gross margin near 49.7%, topping Wall Street estimates.

- On a GAAP basis, net income was $1.59 billion or $1.26 per share, and adjusted operating margin reached 34.3%.

- Systems revenue climbed to $3.36 billion and customer-support sales to $1.99 billion, with 35% of quarterly revenue derived from China.

- Management guided Q3 revenue to $5.7 billion (±$300 million), adjusted EPS of $1.35 (±$0.10), and gross margins near 49%, driven by AI workloads and memory demand.

- Record 2025 revenue of $20.6 B (+27% YoY) and Q4 revenue of $5.34 B, marking ten consecutive quarters of growth.

- Full-year gross margin of 49.9%, the highest since 2012, and diluted EPS of $4.89 (+49% YoY).

- Q1 2026 guidance: revenue of $5.7 B ± $300 M; gross margin of 49% ± 1 pp; EPS of $1.35 ± $0.10. 2026 WFE expected at ~$135 B, second-half weighted.

- Gained >1 pp share of WFE in 2025; served available market share in WFE expanded into the mid-30s%; advanced packaging business to grow >40% in 2026.

- Industry growth constrained by clean-room capacity, but AI-driven investments across DRAM, foundry logic, and NAND are expected to sustain robust demand.

- Revenue reached $4.0 billion in the December quarter, driven by $2.7 billion in product sales and $1.3 billion in services.

- Overall gross margin was 45%, with product margin at 48% and services margin at 38%.

- Operating income was $800 million (20% of revenue), with net income of $700 million and diluted EPS of $5.00.

- Q3 guidance projects revenue of $3.8 billion to $4.3 billion, gross margin of 44%–47%, operating margin of 18%–21%, and diluted EPS of $4.50–$5.50.

- Revenue was $5.34 billion, with GAAP gross margin of 49.6%, operating margin of 33.9%, and diluted EPS of $1.26 for the quarter ended December 28, 2025.

- On a non-GAAP basis, gross margin was 49.7%, operating margin was 34.3%, and diluted EPS was $1.27.

- Cash and equivalents totaled $6.18 billion at quarter end, and deferred revenue was $2.25 billion as of December 28, 2025.

- Q3 FY2026 guidance: revenue of $5.70 billion ± $300 million; GAAP gross margin of 49.0% ± 1%; operating margin of 33.9% ± 1%; diluted EPS of $1.35 ± $0.10.

- Lam Research delivered $5.34 B in revenue, a 49.6% U.S. GAAP gross margin, 33.9% operating margin, and $1.26 GAAP diluted EPS for the quarter ended December 28, 2025.

- On a non-GAAP basis, gross margin was 49.7% and diluted EPS was $1.27.

- Cash, cash equivalents and restricted cash totaled $6.2 B at quarter-end, down from $6.7 B at the end of the prior quarter.

- Deferred revenue declined to $2.25 B, excluding approximately $226 M of Japan shipments pending customer acceptance.

- For Q1 FY2026, the company forecasts $5.70 B ± $300 M in revenue, a 49.0% ± 1% gross margin, and $1.35 ± $0.10 EPS.

- 1H 2026 wafer fab equipment spending expected to be flat to modestly up, with growth accelerating in 2H 2026 due to infrastructure lead times and rising AI-driven demand.

- All three device segments—advanced foundry logic, DRAM, and NAND—offer significant growth from increased etch and deposition intensity, and Lam expects to capture over 50% of the resulting serviceable available market expansion.

- Customers are accelerating a $40 billion upgrade cycle to 2xx-layer NAND, with successive upgrades to 3xx and 4xx layers needed to meet enterprise SSD performance requirements.

- Advanced packaging revenue topped $1 billion in 2025; new product launches include the Aqara etch tool for precision conductor etch, molybdenum metallization transitions, and dry photoresist now in high-volume production.

- Financial model targets 50%+ gross margin by 2028 and 1.5× growth in the CSPG service business by 2028, driven by new tools, Asia factory network proximity, and advanced services like cobots.

- Lam forecasts the wafer fab equipment market to be flat to modestly up in H1 2026, accelerating in H2 2026, driven by AI-related demand across advanced foundry logic, DRAM (HBM), and NAND (enterprise SSD).

- All three device segments will see tremendous growth, with etch and deposition intensity expanding Lam's SAM from low 30s to high 30s by 2030, and Lam targeting over 50% share of the newly created SAM.

- The NAND upgrade cycle ($40 billion to reach 2xx layers) is expected to accelerate due to higher-than-anticipated bit demand, leading to continued upgrades to 300+ and 400+ layers.

- Key product innovations include the Aqara etch tool for precision 4F² DRAM and GAA logic etch, leadership in Moly metallization for NAND, and high-volume dry resist production in DRAM via a JSR partnership.

- The service business (CSPG) aims for 1.5× growth by 2028, leveraging spares, upgrades, Reliant equipment, and advanced services like cobots on the Sense.i platform for consistent tool maintenance.

Fintool News

In-depth analysis and coverage of LAM RESEARCH.

Quarterly earnings call transcripts for LAM RESEARCH.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more