Earnings summaries and quarterly performance for LAM RESEARCH.

Executive leadership at LAM RESEARCH.

Timothy M. Archer

President, Chief Executive Officer

Ava A. Harter

Senior Vice President, Chief Legal Officer and Secretary

Douglas R. Bettinger

Executive Vice President, Chief Financial Officer

Patrick J. Lord

Executive Vice President, Chief Operating Officer

Seshasayee (Sesha) Varadarajan

Senior Vice President, Global Products Group

Board of directors at LAM RESEARCH.

Abhijit Y. Talwalkar

Chair of the Board

Bethany J. Mayer

Director

Eric K. Brandt

Director

Ho Kyu Kang

Director

Ita M. Brennan

Director

John M. Dineen

Director

Jyoti K. Mehra

Director

Mark Fields

Director

Michael R. Cannon

Director

Sohail U. Ahmed

Director

Research analysts who have asked questions during LAM RESEARCH earnings calls.

Blayne Curtis

Jefferies Financial Group

6 questions for LRCX

Harlan Sur

JPMorgan Chase & Co.

6 questions for LRCX

Stacy Rasgon

Bernstein Research

6 questions for LRCX

Timothy Arcuri

UBS

6 questions for LRCX

Brian Chin

Stifel Financial Corp.

5 questions for LRCX

Vijay Rakesh

Mizuho

5 questions for LRCX

Atif Malik

Citigroup Inc.

4 questions for LRCX

CJ Muse

Cantor Fitzgerald

4 questions for LRCX

Krish Sankar

TD Cowen

4 questions for LRCX

Vivek Arya

Bank of America Corporation

4 questions for LRCX

Mehdi Hosseini

Susquehanna Financial Group

3 questions for LRCX

Thomas O’Malley

Barclays Capital

3 questions for LRCX

Timm Schulze-Melander

Rothschild & Co Redburn

3 questions for LRCX

Charles Shi

Needham & Company

2 questions for LRCX

Christopher Muse

Cantor Fitzgerald

2 questions for LRCX

Edward Yang

Oppenheimer & Co. Inc.

2 questions for LRCX

James Schneider

Goldman Sachs

2 questions for LRCX

Jim Schneider

Goldman Sachs

2 questions for LRCX

Joseph Moore

Morgan Stanley

2 questions for LRCX

Melissa Weathers

Deutsche Bank

2 questions for LRCX

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

2 questions for LRCX

Srinivas Pajjuri

Raymond James & Associates, Inc.

2 questions for LRCX

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for LRCX

Christopher Caso

Wolfe Research

1 question for LRCX

Joseph Quatrochi

Wells Fargo Securities, LLC

1 question for LRCX

Recent press releases and 8-K filings for LRCX.

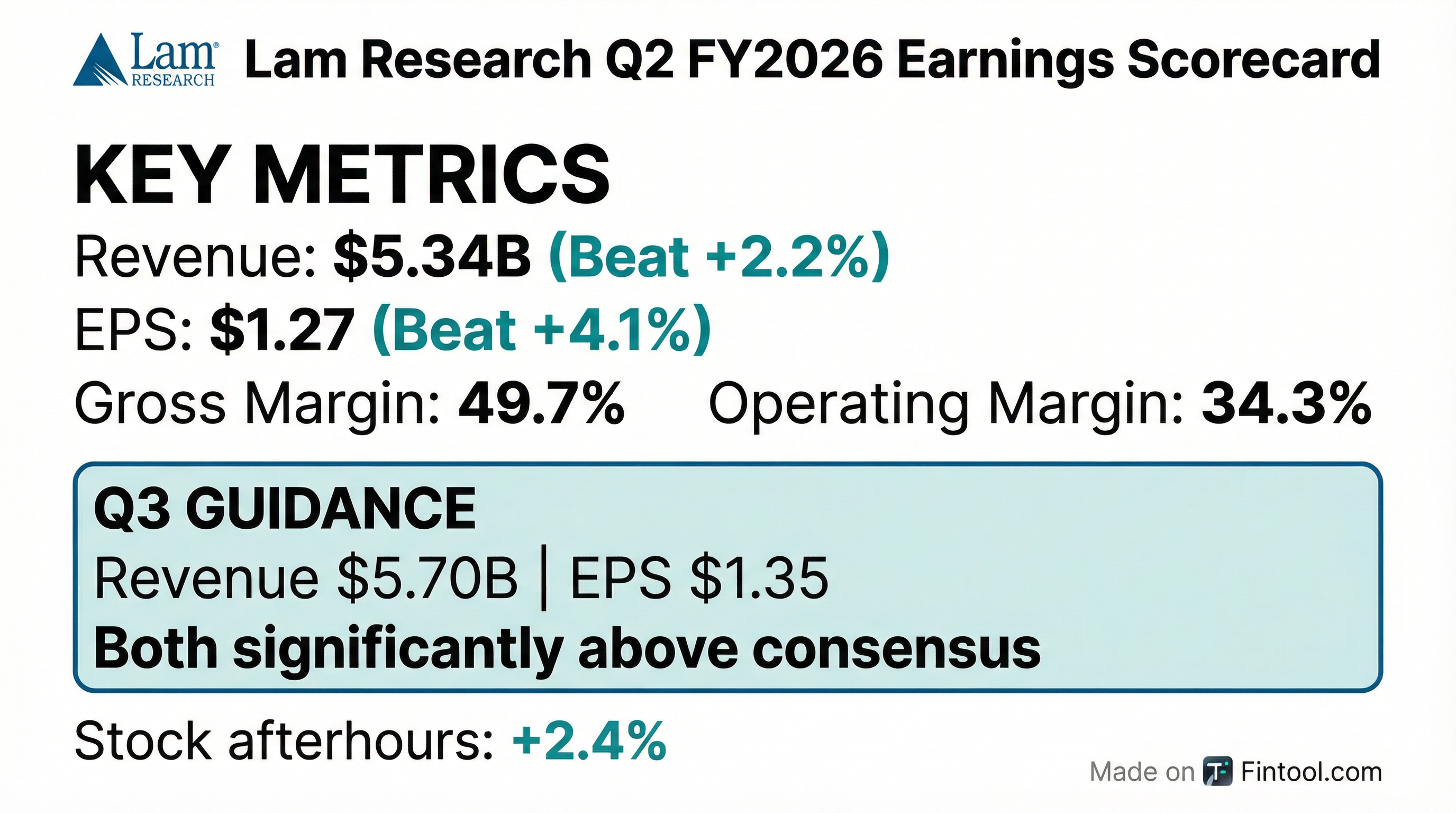

- Lam Research reported Q2 revenue of $5.34 billion and adjusted EPS of $1.27, with an adjusted gross margin near 49.7%, topping Wall Street estimates.

- On a GAAP basis, net income was $1.59 billion or $1.26 per share, and adjusted operating margin reached 34.3%.

- Systems revenue climbed to $3.36 billion and customer-support sales to $1.99 billion, with 35% of quarterly revenue derived from China.

- Management guided Q3 revenue to $5.7 billion (±$300 million), adjusted EPS of $1.35 (±$0.10), and gross margins near 49%, driven by AI workloads and memory demand.

- Record 2025 revenue of $20.6 B (+27% YoY) and Q4 revenue of $5.34 B, marking ten consecutive quarters of growth.

- Full-year gross margin of 49.9%, the highest since 2012, and diluted EPS of $4.89 (+49% YoY).

- Q1 2026 guidance: revenue of $5.7 B ± $300 M; gross margin of 49% ± 1 pp; EPS of $1.35 ± $0.10. 2026 WFE expected at ~$135 B, second-half weighted.

- Gained >1 pp share of WFE in 2025; served available market share in WFE expanded into the mid-30s%; advanced packaging business to grow >40% in 2026.

- Industry growth constrained by clean-room capacity, but AI-driven investments across DRAM, foundry logic, and NAND are expected to sustain robust demand.

- Revenue reached $4.0 billion in the December quarter, driven by $2.7 billion in product sales and $1.3 billion in services.

- Overall gross margin was 45%, with product margin at 48% and services margin at 38%.

- Operating income was $800 million (20% of revenue), with net income of $700 million and diluted EPS of $5.00.

- Q3 guidance projects revenue of $3.8 billion to $4.3 billion, gross margin of 44%–47%, operating margin of 18%–21%, and diluted EPS of $4.50–$5.50.

- Revenue was $5.34 billion, with GAAP gross margin of 49.6%, operating margin of 33.9%, and diluted EPS of $1.26 for the quarter ended December 28, 2025.

- On a non-GAAP basis, gross margin was 49.7%, operating margin was 34.3%, and diluted EPS was $1.27.

- Cash and equivalents totaled $6.18 billion at quarter end, and deferred revenue was $2.25 billion as of December 28, 2025.

- Q3 FY2026 guidance: revenue of $5.70 billion ± $300 million; GAAP gross margin of 49.0% ± 1%; operating margin of 33.9% ± 1%; diluted EPS of $1.35 ± $0.10.

- Lam Research delivered $5.34 B in revenue, a 49.6% U.S. GAAP gross margin, 33.9% operating margin, and $1.26 GAAP diluted EPS for the quarter ended December 28, 2025.

- On a non-GAAP basis, gross margin was 49.7% and diluted EPS was $1.27.

- Cash, cash equivalents and restricted cash totaled $6.2 B at quarter-end, down from $6.7 B at the end of the prior quarter.

- Deferred revenue declined to $2.25 B, excluding approximately $226 M of Japan shipments pending customer acceptance.

- For Q1 FY2026, the company forecasts $5.70 B ± $300 M in revenue, a 49.0% ± 1% gross margin, and $1.35 ± $0.10 EPS.

- 1H 2026 wafer fab equipment spending expected to be flat to modestly up, with growth accelerating in 2H 2026 due to infrastructure lead times and rising AI-driven demand.

- All three device segments—advanced foundry logic, DRAM, and NAND—offer significant growth from increased etch and deposition intensity, and Lam expects to capture over 50% of the resulting serviceable available market expansion.

- Customers are accelerating a $40 billion upgrade cycle to 2xx-layer NAND, with successive upgrades to 3xx and 4xx layers needed to meet enterprise SSD performance requirements.

- Advanced packaging revenue topped $1 billion in 2025; new product launches include the Aqara etch tool for precision conductor etch, molybdenum metallization transitions, and dry photoresist now in high-volume production.

- Financial model targets 50%+ gross margin by 2028 and 1.5× growth in the CSPG service business by 2028, driven by new tools, Asia factory network proximity, and advanced services like cobots.

- Lam forecasts the wafer fab equipment market to be flat to modestly up in H1 2026, accelerating in H2 2026, driven by AI-related demand across advanced foundry logic, DRAM (HBM), and NAND (enterprise SSD).

- All three device segments will see tremendous growth, with etch and deposition intensity expanding Lam's SAM from low 30s to high 30s by 2030, and Lam targeting over 50% share of the newly created SAM.

- The NAND upgrade cycle ($40 billion to reach 2xx layers) is expected to accelerate due to higher-than-anticipated bit demand, leading to continued upgrades to 300+ and 400+ layers.

- Key product innovations include the Aqara etch tool for precision 4F² DRAM and GAA logic etch, leadership in Moly metallization for NAND, and high-volume dry resist production in DRAM via a JSR partnership.

- The service business (CSPG) aims for 1.5× growth by 2028, leveraging spares, upgrades, Reliant equipment, and advanced services like cobots on the Sense.i platform for consistent tool maintenance.

- Lam expects semiconductor capital equipment spending to be flat to modestly up in H1 2026, with stronger growth in H2 driven by advanced foundry logic, DRAM, and NAND technologies that enable AI, supporting a secular SAM expansion through rising Etch & Dep intensity.

- Management reaffirmed a $40 billion multi-year plan to upgrade the existing 3D NAND installed base to higher layer counts, noting that accelerating bit-demand growth will drive faster cycles of subsequent upgrades.

- The company is capturing >50% share of newly created SAM from device verticalization and material transitions, and its advanced packaging business—integrated with Gate-All-Around—will exceed $3 billion in revenue this year.

- Innovations in service and tool intelligence—cobots for repeatable maintenance coupled with the Sense.i platform—are key to CSPG growth, while Lam targets 50% gross margin by 2028 through enhanced tool performance, local manufacturing, and value-based pricing.

- Fabric8Labs closed a $50 million funding round led by NEA and Intel Capital, with participation from Lam Capital (Lam Research’s corporate venture arm) and other investors.

- Proceeds will boost U.S. production capacity from 5 million to 22 million components per year, targeting thermal management, RF/wireless, and power electronics markets.

- The company’s patented Electrochemical Additive Manufacturing (ECAM) process delivers room-temperature, high-resolution 3D metal parts without extensive post-processing.

- Fabric8Labs’ U.S. facilities are ISO 9001 certified and ITAR registered, enabling seamless scale-up from prototyping to high-volume production.

- Lam delivered record revenues of $5.3 billion, gross margin of 50.6%, and operating margin of 35%, with revenue up 3% sequentially.

- Systems revenue mix: foundry 60%, memory 34% (non-volatile memory 18%, DRAM 16%), and logic & other 6%.

- Regional breakdown: China 43%, Taiwan 19%, and Korea 15% of total revenue.

- Q2 guidance: revenue of $5.2 billion ± $300 million, gross margin 48.5% ± 1%, operating margin 33% ± 1%, and EPS $1.15 ± $0.10.

- Capital returns: $990 million in share buybacks, $292 million in dividends, with $6.5 billion remaining authorization.

Fintool News

In-depth analysis and coverage of LAM RESEARCH.

Quarterly earnings call transcripts for LAM RESEARCH.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more