Lightspeed Commerce (LSPD)·Q3 2026 Earnings Summary

Lightspeed Beats on Revenue and EBITDA, Stock Pops 4% After-Hours

February 5, 2026 · by Fintool AI Agent

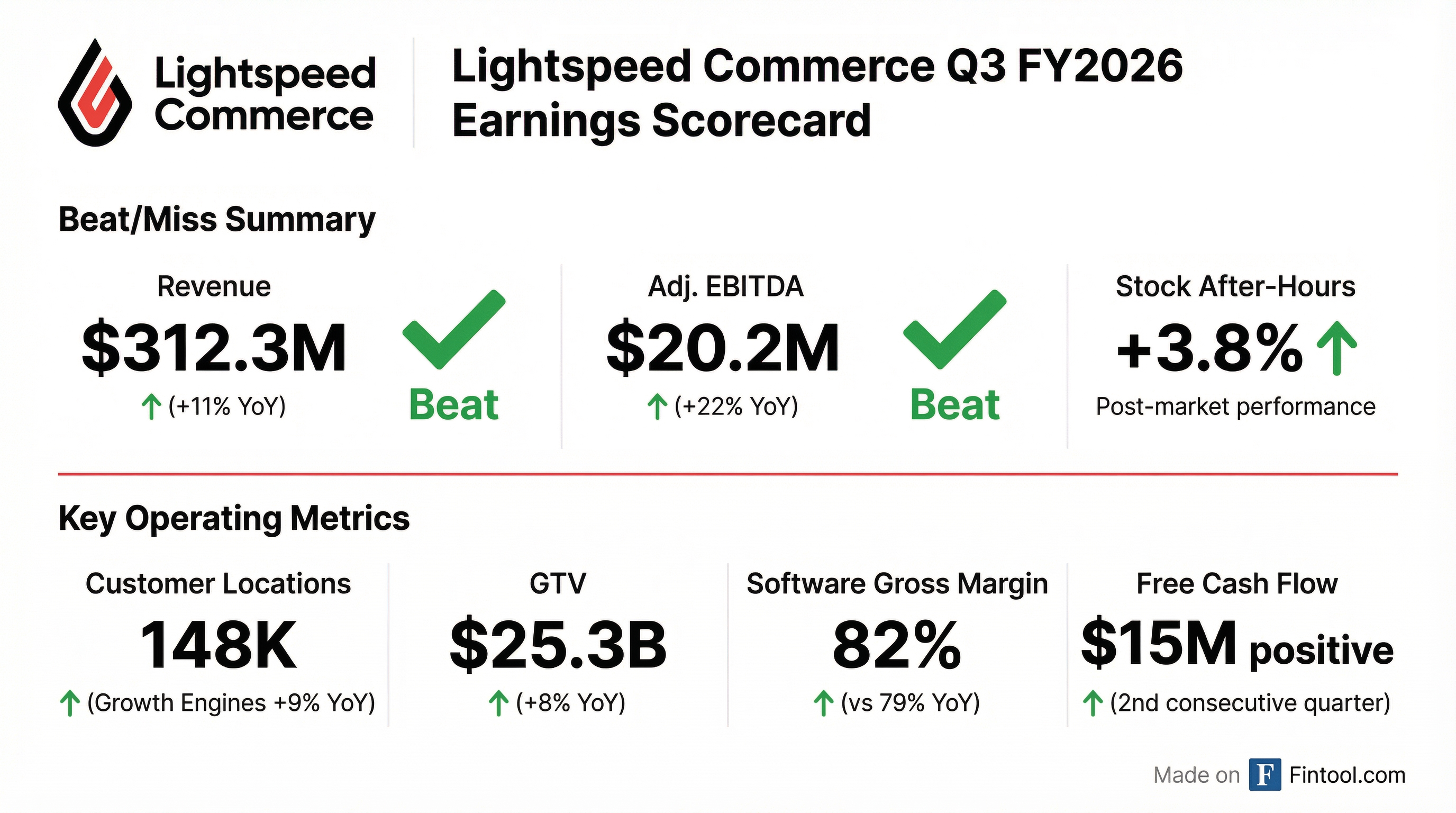

Lightspeed Commerce (NYSE: LSPD) delivered another beat-and-raise quarter, with Q3 FY2026 revenue of $312.3M (+11% YoY) exceeding guidance, adjusted EBITDA of $20.2M (+22% YoY) topping consensus, and positive free cash flow for the second consecutive quarter . The stock rose approximately 4% in after-hours trading to ~$10.48, following a close of $10.10.

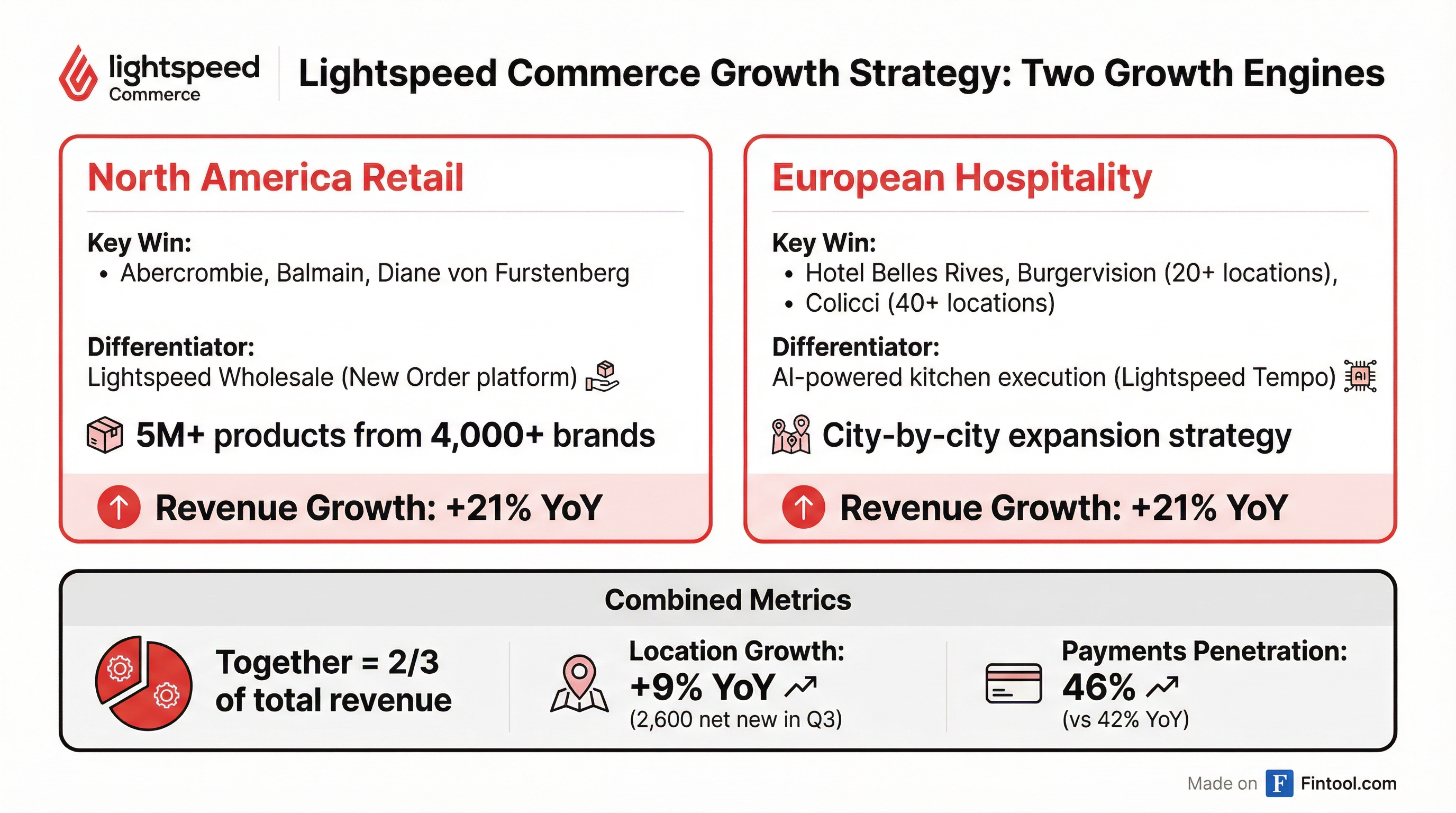

The company's dual-growth-engine strategy—North America Retail and European Hospitality—continues to gain traction, with these segments delivering 21% combined revenue growth and 9% location growth in the quarter . Management raised full-year guidance and announced a new Chief Revenue Officer to accelerate go-to-market execution .

Did Lightspeed Beat Earnings?

Yes—Lightspeed beat on all key metrics:

Revenue grew 11% year-over-year, driven by expanding customer locations, higher software ARPU, and increased payments penetration . Adjusted EBITDA grew 22% YoY to $20.2M, representing 15% of gross profit—approaching the company's 20% long-term target .

Beat Streak: Lightspeed has beaten revenue estimates in 5 consecutive quarters, demonstrating consistent execution against the strategic framework presented at Capital Markets Day.*

What Did Management Guide?

Management raised full-year FY2026 guidance across all metrics :

Guidance Context:

- Q4 is seasonally the weakest quarter (January-March), with GTV typically dropping 15-20%

- The company is lapping prior-year pricing actions, which will moderate software revenue growth

- Management is pulling forward incremental investment into Q4 where demand is outpacing expectations, particularly in retail outbound sales

What Changed From Last Quarter?

Location Growth Accelerated

Customer location growth in the growth engines accelerated to 9% YoY (from 7% in Q2, 5% in Q1, and 3% for all of FY2025) . The company added approximately 2,600 net new locations in the quarter, reaching ~148,000 total customer locations .

This acceleration comes from:

- 150 outbound sales reps now fully hired and ramping toward productivity

- Lightspeed Wholesale/New Order platform leading the outbound pitch for retail

- City-by-city expansion in key European hospitality markets

New Customer Mix

CEO Dax Dasilva broke down the source of new locations :

- 1/3 brand new businesses

- 1/3 switching from competing cloud vendors

- 1/3 migrating from legacy systems

Second Consecutive Quarter of Positive Free Cash Flow

Free cash flow reached $15M in Q3, up from negative $0.5M in the prior year quarter . The company expects to generate positive free cash flow for the full fiscal year—a significant milestone .

Software Gross Margins Hit 82%

Software gross margins improved to 82% from 79% a year ago, driven by :

- Cloud vendor consolidation and better rates with Google/AWS

- AI deployment reducing support and service delivery costs

- Organizational restructuring

CFO Asha Bakshani stated: "We feel that over 80% margins on the software line is a sustainable place to be for us."

How Are the Growth Engines Performing?

The two growth engines—North America Retail and European Hospitality—now represent two-thirds of total revenue and are driving the company's transformation :

Key Q3 Wins:

- Retail: Balmain, Diane von Furstenberg, Dickies (Lightspeed Wholesale), Abercrombie (migrated POS for unified wholesale ordering)

- Hospitality: Hotel Belles Rives (French Riviera), Quai des Artistes (Monaco), Burgervision (20+ locations, Germany), Colicci (40+ locations, UK)

What About the Efficiency Markets?

The "efficiency portfolio" (markets outside the two growth engines) is performing in line with targets :

- Software and payments revenue: flat to slightly up YoY

- Gross profit: up YoY

- Payments penetration: increased to 35% (from 32% YoY)

- Churn: well-managed, total locations up ~2,000 company-wide

The strategy here is to maintain the revenue base through module attachment and financial services expansion, not pursue aggressive new business .

How Did the Stock React?

The stock has been volatile over the past year, trading in a wide range. The positive after-hours reaction reflects relief on continued execution and the raised guidance.*

What About AI?

Management emphasized AI as both a product differentiator and cost efficiency driver:

Product Innovation:

- Launched Lightspeed AI with agentic capabilities for retail and hospitality

- Retail: inventory insights, best-seller identification, optimization recommendations

- Hospitality: kitchen execution, pacing intelligence (Lightspeed Tempo)

Competitive Moat: When asked about AI disruption concerns, Dax Dasilva highlighted Lightspeed's proprietary data advantages :

- Payments transaction data for analytics

- Wholesale data from the New Order platform (5M+ products, 4,000+ brands)

- Network effects from aggregated merchant data across geographies

"There's a supply all the way to consumer workflow that's incomparable, and we're going to be able to do agentic workflows across that because nobody does that span from consumer to merchant to wholesale supplier." — Dax Dasilva, CEO

Cost Efficiency:

- High percentage of frontline support now handled by AI chat

- No significant margin impact from deploying AI features; software margins remain 80%+

Capital Allocation Update

Share Repurchases:

- $179M in shares repurchased and canceled over the last 12 months

- Total shares outstanding down 10% YoY

- ~$200M remaining under $400M board authorization

- FY2026 buyback program exhausted (limited to 10% of public float annually); intend to renew for FY2027

Lightspeed Capital:

- $106M in merchant cash advances outstanding

- Revenue grew 34% YoY

- Default rates remain in low single digits

- Typical remittance period now ~7 months

- High gross margin business (~100%) with meaningfully lower churn for customers who take capital

M&A: Small tuck-in acquisitions remain possible to accelerate product development, but large-scale acquisitions are not a strategic priority .

Key Leadership Changes

- Gabriel Benavides appointed Chief Revenue Officer in November, with two decades of experience scaling global sales organizations

- J.D. Saint-Martin stepping down as President in March after six years; credited with building the foundation for the company's transformation

Q&A Highlights

On pricing strategy (Martin Toner, ATB Capital): Most future software ARPU uplift will come from evolving pricing and packaging as new modules are released, rather than broad price hikes. The company has completed the large back-book price action and is now focused on moving customers to higher-tier bundles .

On annual contracts (Trevor Williams, Jefferies): Retail North America now has ~50% annual contracts vs 25% a few quarters ago. Annual contracts result in modest upfront discounts but attract higher-quality merchants with lower churn and higher lifetime value .

On hardware margins (Trevor Williams, Jefferies): Negative hardware margins (~-50-60%) are due to discounts and incentives to drive new business, particularly free payment terminals. Management focuses on total net take from each customer rather than individual line items .

Forward Catalysts

- FY2027 Guidance (May 2026): Detailed guidance expected with Q4 results

- Outbound Sales Productivity: 150 reps now hired; productivity ramp through FY2027

- Lightspeed Wholesale Expansion: Continued vertical penetration in apparel, footwear, sport and outdoor

- Partnership Acceleration: Distribution deals in EMEA Hospitality; ERP partnerships (e.g., NetSuite) in retail

- Share Repurchase Renewal: Expected renewal of buyback program for FY2027

Historical Financial Trends

*Values retrieved from S&P Global

Risk Factors

- Seasonal Q4 weakness: January-March is historically the lowest GTV quarter

- Price increase lapping: Software revenue growth will moderate as prior pricing actions are fully lapped

- Macro sensitivity: SMB and mid-market merchants remain exposed to consumer spending trends

- Competition: Toast, Shopify, Square, and legacy POS providers continue to compete aggressively

Report generated by Fintool AI Agent on February 5, 2026. For the full earnings call transcript, see LSPD Q3 2026 Transcript.