Earnings summaries and quarterly performance for Lightspeed Commerce.

Research analysts who have asked questions during Lightspeed Commerce earnings calls.

Dominic Ball

Redburn Atlantic

6 questions for LSPD

Josh Baer

Morgan Stanley

6 questions for LSPD

Thanos Moschopoulos

BMO Capital Markets

6 questions for LSPD

Trevor Williams

Jefferies LLC

6 questions for LSPD

Daniel Perlin

RBC Capital Markets

5 questions for LSPD

Raimo Lenschow

Barclays

5 questions for LSPD

Koji Ikeda

Bank of America

4 questions for LSPD

Tien-tsin Huang

JPMorgan Chase & Co.

4 questions for LSPD

Timothy Chiodo

UBS Group AG

4 questions for LSPD

Andrew Bauch

Wells Fargo & Company

3 questions for LSPD

Martin Toner

ATB Capital Markets

3 questions for LSPD

Andrew Harte

BTIG, LLC

2 questions for LSPD

John Shao

TD Cowen

2 questions for LSPD

Matt Coad

Truist Securities

2 questions for LSPD

Richard Tse

National Bank Financial

2 questions for LSPD

Todd Coupland

CIBC

2 questions for LSPD

Daniel Chan

TD Cowen

1 question for LSPD

James Burns

National Bank Financial

1 question for LSPD

Kevin Krishnaratne

Scotiabank

1 question for LSPD

Mike Stevens

National Bank Financial

1 question for LSPD

Suthan Sukumar

Stifel Financial Corp.

1 question for LSPD

Thomas Ingham

CIBC

1 question for LSPD

Yanxin Wang

JPMorgan Chase & Co.

1 question for LSPD

Recent press releases and 8-K filings for LSPD.

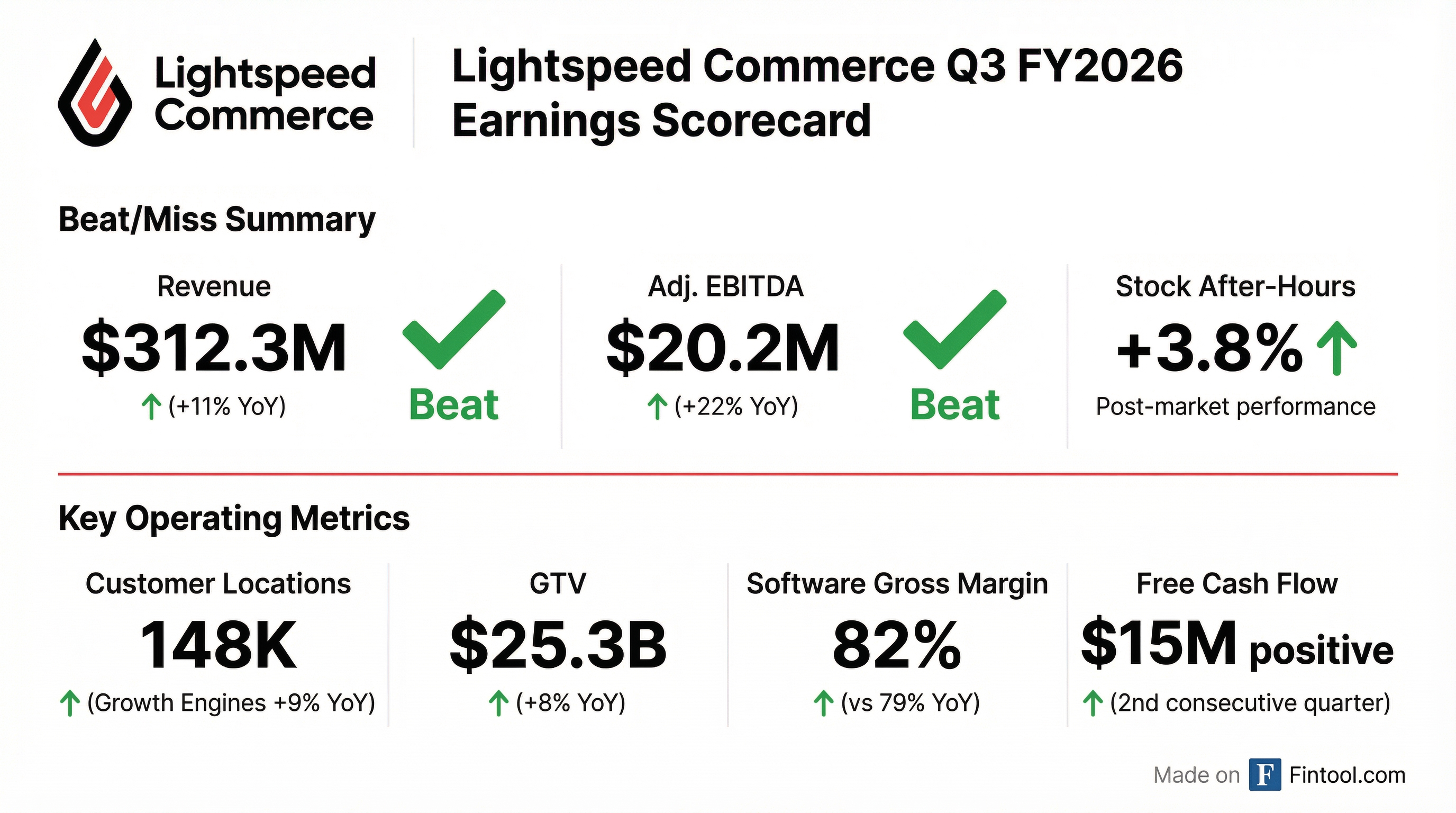

- Lightspeed reported strong Q3 2026 results, with revenue of $312.3 million and Adjusted EBITDA of $20.2 million, both exceeding outlook. The company achieved its second consecutive quarter of positive Free Cash Flow at $50 million and expects positive Free Cash Flow for the full fiscal year.

- The strategic focus on North America Retail and European Hospitality growth engines drove 21% year-over-year revenue growth and a 9% year-over-year increase in customer locations, adding approximately 2,600 net new locations. Total customer locations reached approximately 148,000.

- Software gross margins improved to 82% from 79% a year ago, considered sustainable above 80%. Total monthly ARPU increased 11% year-over-year to $660.

- Lightspeed raised its guidance for fiscal Q4 2026 and the full fiscal year 2026. For Q4, revenue is expected between $280 million and $284 million, and Adjusted EBITDA at $50 million. For FY 2026, revenue is projected between $1.216 billion and $1.22 billion, and Adjusted EBITDA at $72 million.

- The company ended Q3 with $479 million in cash. Gabriel Benavides was appointed Chief Revenue Officer, and J.D. Saint-Martin will step down as President in March.

- Lightspeed reported Q3 2026 total revenue of $312.3 million, an 11% year-over-year increase, exceeding its outlook. Adjusted EBITDA grew 22% year-over-year to $20.2 million, and the company achieved $15 million in positive free cash flow for the second consecutive quarter.

- The company's focus on North America Retail and European Hospitality (growth engines) drove 21% year-over-year revenue growth and added approximately 2,600 net new customer locations, resulting in a 9% year-over-year increase in ending location count to approximately 148,000.

- Total gross profit increased 15% year-over-year, with a total gross margin of 43% (up from 41% last year). Software gross margins were 82%, and transaction-based gross margins improved to 31%.

- Lightspeed raised its guidance for Q4 2026, expecting revenue of $280 million-$284 million and Adjusted EBITDA of approximately $50 million. For fiscal year 2026, revenue is projected at $1.216 billion-$1.22 billion and Adjusted EBITDA at approximately $72 million.

- Lightspeed reported strong Q3 2026 financial results, with total revenue increasing 11% to $312.3 million and adjusted EBITDA growing 22% to $20.2 million, both exceeding outlook.

- The company achieved its second consecutive quarter of positive free cash flow, reaching $50 million in Q3 2026, and anticipates generating positive free cash flow for the full fiscal year.

- Strategic focus on North America retail and European hospitality growth engines yielded 21% year-over-year revenue growth and a 9% year-over-year increase in customer locations, adding approximately 2,600 net new locations.

- Software gross margins improved to 82% (up from 79% last year) due to cost efficiencies and AI deployment, while total shares outstanding decreased 10% year-over-year following $179 million in share repurchases.

- Lightspeed Commerce Inc. reported total revenues of $312,346 thousand for the three months ended December 31, 2025, marking an 11.5% increase year-over-year. For the nine months ended December 31, 2025, total revenues grew 13.7% to $936,251 thousand.

- The company recorded a net loss of $(33,578) thousand for the three months ended December 31, 2025, with a net loss per share of $(0.24). The net loss for the nine months ended December 31, 2025, was $(115,845) thousand, or $(0.83) per share.

- Adjusted EBITDA reached $20,178 thousand for the three months ended December 31, 2025, and $57,393 thousand for the nine months ended December 31, 2025. Adjusted Income per Share was $0.15 for the quarter and $0.36 for the nine-month period.

- Gross profit increased by 15% to $133,577 thousand for the three months ended December 31, 2025, with the gross profit margin improving from 41% to 43% compared to the prior year period.

- Cash flows from operating activities for the nine months ended December 31, 2025, were $66.8 million, a significant improvement from cash flows used in operating activities of $22.8 million in the prior year period.

- Lightspeed Commerce Inc. reported Q3 2026 revenue of $312.3 million, an 11% increase year-over-year, and gross profit of $133.6 million, up 15% year-over-year.

- For Q3 2026, the company recorded a net loss of ($33.6) million or ($0.24) per share, while Adjusted Income was $20.2 million or $0.15 per share, and Adjusted EBITDA reached $20.2 million.

- Operational highlights for Q3 2026 include the addition of ~2,600 net Customer Locations, bringing the total to ~148,000, and a Gross Transaction Volume (GTV) of $25.3 billion, an 8% increase year-over-year.

- The company raised its Fiscal 2026 outlook, now expecting full-year revenue between $1,216 million and $1,220 million, gross profit between $523 million and $525 million, and Adjusted EBITDA of approximately $72 million, with an expectation of positive Free Cash Flow.

- Lightspeed reported Q3 Fiscal 2026 revenue of $312.3 million, an 11% increase year-over-year, exceeding its outlook, with gross profit of $133.6 million (up 15% year-over-year) and Adjusted EBITDA of $20.2 million for the three months ended December 31, 2025.

- The company generated positive cash flow from operating activities of $28.9 million and Adjusted Free Cash Flow of $14.9 million in the quarter.

- Lightspeed raised its full-year Fiscal 2026 outlook, now projecting revenue of $1,216 million to $1,220 million, gross profit of $523 million to $525 million, and Adjusted EBITDA of $72 million.

- Key growth engines in retail (North America) and hospitality (Europe) saw 21% year-over-year revenue growth and 16% GTV growth, adding approximately 2,600 net Customer Locations in the quarter.

- Lightspeed Commerce Inc. announced the appointment of Gabriel Benavides as Chief Revenue Officer (CRO) on November 13, 2025, to accelerate profitable growth and expand software and payments ARPU globally.

- Benavides brings over 20 years of international go-to-market leadership, including helping Medallia scale to a $6 billion market valuation and increasing its annual revenue by approximately 10x.

- Additionally, President JD Saint-Martin will step down after six years with the company, remaining until March 31, 2026, for a smooth transition.

- The company noted it has delivered two consecutive quarters of exceeding revenue and gross profit outlook.

- Lightspeed Commerce Inc. has appointed Gabriel Benavides as Chief Revenue Officer (CRO), effective November 13, 2025.

- Benavides brings over 20 years of international go-to-market leadership, having previously served as CRO at Contentsquare and Executive Vice President and CRO at Medallia, where he helped increase annual revenue approximately 10x and achieve a $6 billion market valuation.

- As CRO, Benavides will oversee global revenue generation, aligning sales, customer success, marketing, and channel partnerships to drive stronger go-to-market execution and accelerate outbound performance.

- This appointment aligns with Lightspeed's strategy for sustained, profitable expansion and follows two consecutive quarters of exceeding revenue and gross profit outlook.

- President JD Saint-Martin will step down after six years with the company, remaining until March 31, 2026, to ensure a smooth transition.

- Lightspeed reported a strong Q2 2026, with revenues, gross profit, and adjusted EBITDA coming in above outlook. The company delivered $21 million in adjusted EBITDA, a 53% year-over-year increase, and achieved $18 million in positive free cash flow, up significantly from $1.6 million in the same quarter last year.

- Total revenue grew 15%, driven by a 9% year-over-year increase in software revenue to $93.5 million and a 17% year-over-year increase in transaction-based revenue to $215.8 million. Software ARPU also increased 10%.

- The company's strategic focus on North American retail and European hospitality growth engines is yielding results, with customer locations in these segments up 7% year-over-year and GTV up 15% year-over-year. Outbound bookings in these engines nearly tripled year-over-year.

- Lightspeed is raising its fiscal year 2026 outlook, now expecting revenue growth of at least 12% year-over-year, gross profit growth of at least 15% year-over-year, and adjusted EBITDA of at least $70 million. The company also expects to generate break-even or better adjusted free cash flow for the full fiscal year.

- The company ended Q2 with approximately $463 million in cash and has approximately $200 million remaining under its share repurchase authorization, which contributed to a 10% reduction in total shares outstanding year-over-year.

- Lightspeed Commerce Inc. reported total revenues of $318,963 thousand for the three months ended September 30, 2025, marking a 15.1% increase year-over-year, primarily driven by a 17% rise in transaction-based revenue and a 9% increase in subscription revenue.

- Despite a net loss of $(32,700) thousand for the quarter, the company's Adjusted EBITDA grew to $21,339 thousand and Adjusted Income increased to $22,218 thousand for the three months ended September 30, 2025.

- Cash flows from operating activities showed significant improvement, turning positive at $25,541 thousand for the three months ended September 30, 2025, compared to a negative $(11,311) thousand in the prior year period.

- The company engaged in substantial share repurchases, spending $86,238 thousand on shares repurchased and cancelled and $30,208 thousand on shares repurchased for the settlement of non-treasury RSUs during the six months ended September 30, 2025.

Quarterly earnings call transcripts for Lightspeed Commerce.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more