Lucky Strike Entertainment (LUCK)·Q2 2026 Earnings Summary

Lucky Strike Entertainment Q2 FY26: Revenue Beats as Events Business Finally Inflects, But Margin Pressure Sends Stock Lower

February 4, 2026 · by Fintool AI Agent

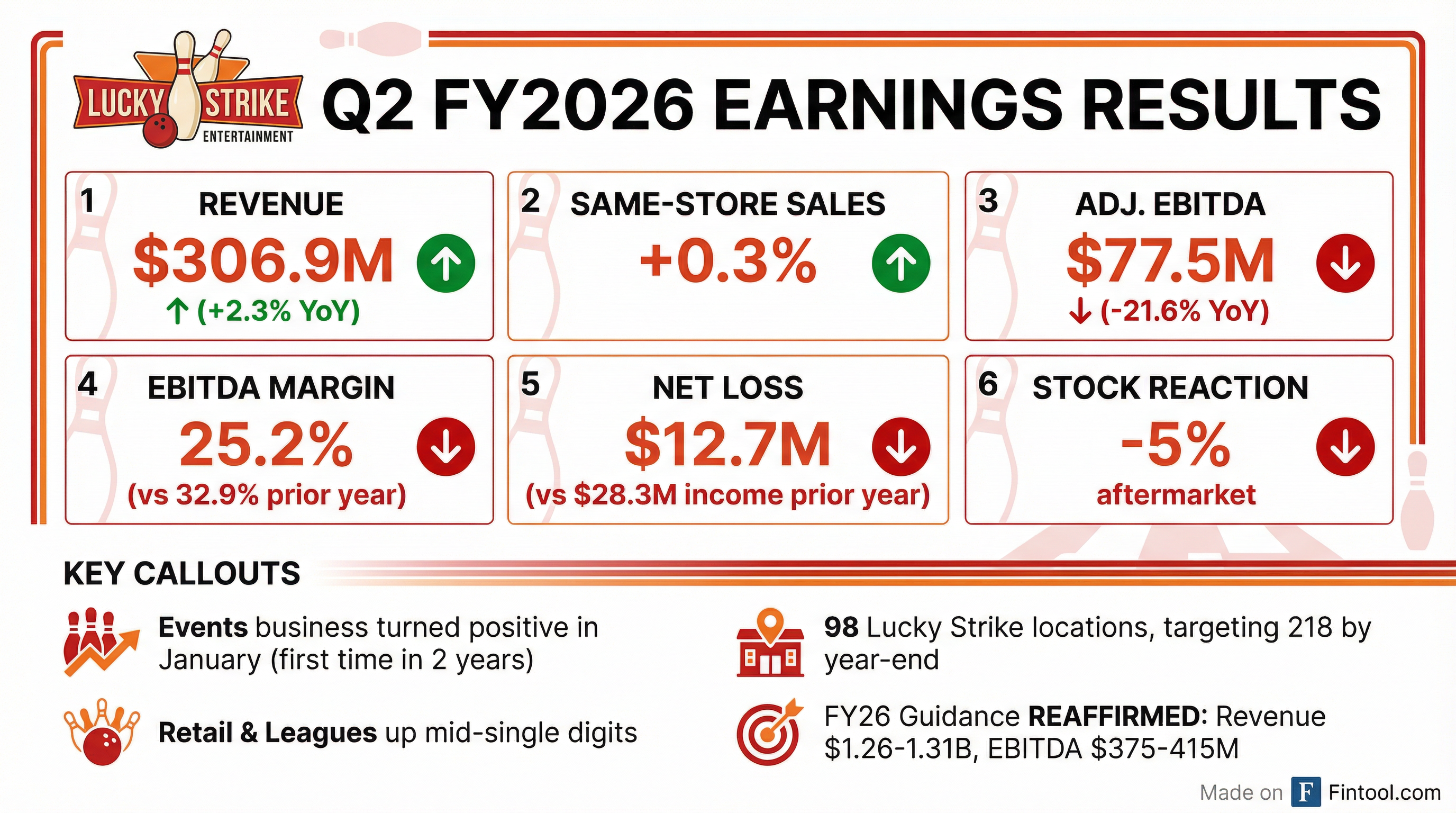

Lucky Strike Entertainment (LUCK) reported Q2 FY2026 results that marked a turning point for the business — same-store sales returned to positive territory for the first time in years, and the troubled events business finally showed signs of life. Revenue grew 2.3% to $306.9 million, beating expectations. However, the investments required to achieve this turnaround came at a cost: Adjusted EBITDA declined 21.6% to $77.5 million, and EBITDA margin compressed 770 basis points to 25.2%.

The stock fell approximately 5% in aftermarket trading as investors weighed the top-line progress against the margin pressure and questioned whether management can deliver on reaffirmed full-year guidance.

Did Lucky Strike Beat Earnings?

Revenue: Beat. Lucky Strike delivered $306.9 million in revenue, up 2.3% year-over-year from $300.1 million. Same-store revenue grew 0.3%, marking a positive inflection after several quarters of negative comps.

EPS: Beat. The company reported a net loss of $12.7 million, or -$0.06 per share, versus consensus expectations of approximately -$0.15 per share.

EBITDA: Miss. Adjusted EBITDA of $77.5 million came in below the prior year's $98.8 million (-21.6%), with margin compressing to 25.2% from 32.9%.

What Did Management Guide?

Guidance reaffirmed. Lucky Strike maintained its FY2026 outlook provided in August 2025:

CFO Bobby Lavan acknowledged the guidance requires a significant back-half acceleration but expressed confidence based on:

- Easy comps ahead — The events business was a major drag in H2 FY25, providing favorable comparisons

- January momentum — Strong double-digit same-store sales in January (despite $5M weather impact from snowstorm)

- Seasonal lift from water parks — Raging Waters (California), Wet 'n Wild Emerald Pointe (North Carolina), and Raging Waves (Illinois) will contribute meaningful EBITDA in Q3-Q4

Management expects "material margin growth in Q4" as water parks and Boomers FECs shift from off-season drags to peak-season contributors.

How Did the Stock React?

Lucky Strike shares closed at $7.33 on February 4, up 1.5% during the regular session, but fell approximately 5% to $6.96 in aftermarket trading following the earnings release. The stock is down 45% from its 52-week high of $13.25.

The negative aftermarket reaction likely reflects concerns about: (1) the significant margin compression, (2) skepticism about back-half guidance achievability, and (3) elevated leverage with net debt of $1.7 billion.

What Changed From Last Quarter?

Events Business Turnaround — The Big Story

The events business, which had been "a $300 million drag on results for the past two years," finally inflected positive in January 2026. This is the first positive same-store events sales result in nearly two years.

What drove the turnaround:

- Dynamic pricing implementation — In September, management built out reporting systems that revealed events were tracking down double-digits. They implemented dynamic pricing (e.g., no discounts for Thursday nights at Times Square in December) and brought performance "all the way back."

- Marketing partnership — Increased coordination between events team and marketing helped drive kids' birthday parties and consumer events.

CFO Bobby Lavan: "We chased price for two years. If you called us and you wanted a discount, we would give it to you. Now, discounts are an important part of any sort of location-based entertainment company... But if you call for a Thursday at Times Square in December, we shouldn't give you a discount 'cause demand is greater than the supply."

Investments Weighed on Margins

Management made deliberate investments during Q2 that drove the margin compression:

Not all investments delivered expected ROI — particularly incremental labor. Management has committed to a "more balanced approach" going forward with higher return thresholds.

Segment Performance

Revenue by category showed steady performance across the portfolio:

Retail performance: Same-store retail comp was +1.7%, with retail food up 10.9% but retail alcohol down 4.7%. Non-alcoholic beverages grew 26.2%, helping offset alcohol weakness.

Zero-proof strategy working: Craft Lemonades launched earlier in the year has a run rate over $5 million. The company plans to introduce Dirty Soda programming and Boba drinks to experiential properties.

Server tablets driving attach rates: Now deployed at 125 locations with average check size up 7%. Expanding to 160 locations by March.

Lucky Strike Brand Conversion Update

The company now operates approximately 98 Lucky Strike locations, up from prior quarters, with a goal to reach 218 by end of calendar 2026. The Bowlero brand will be sunset by year-end, leaving a streamlined two-brand portfolio: Lucky Strike (experiential) and AMF (value).

Rebrand economics: Conversions have delivered "strong lifts." The 30 rebrands completed in Q2 are "bearing fruit."

CEO Tom Shannon emphasized that reaching critical mass will unlock marketing efficiencies: "When you get to 15 Lucky Strikes in the market, you're able to [do meaningful marketing], and you're also able to do that on a national basis... I think the returns will accelerate."

Water Parks and FECs — Key Margin Catalyst

Management is betting heavily on seasonal assets to deliver H2 margin expansion:

Recent acquisition: Raging Waters, the largest water park in California, closed in January.

Peak season expectations: Wet 'n Wild Emerald Pointe (NC), Raging Waters (CA), and Raging Waves (IL) — all among the largest water parks in their respective states — will contribute "significant EBITDA in Q3-Q4."

Boomers FEC performance: Legacy Boomers locations are up 25% in revenue over the past two weeks following capital investments.

CEO Shannon on park investments: "When the guest comes, they're gonna see something they haven't seen in a long time, and that is a really refreshed, really appealing, and upscale water park. Where we've made the investments, we've seen the return. I think we've seen a better return than we would've reasonably expected or even hoped for."

Balance Sheet and Liquidity

Leverage remains elevated but manageable:

The increase in debt reflects the Raging Waters acquisition. Management noted $95 million in acquisitions completed this fiscal year.

Capital allocation shift: The company has "materially reduced both maintenance and growth capital expenditures over the past 18 months, strengthening free cash flow."

Dividend: $0.06 per share quarterly dividend declared, payable March 6, 2026.

What to Watch Going Forward

Key catalysts:

- March-May: Water park season pass sales (last year: $13M; targeting meaningfully higher)

- May-September: Peak water park season — will determine whether margin expansion materializes

- Calendar 2026: Lucky Strike rebrand completion to ~218 locations

Key risks:

- Weather sensitivity (snowstorm cost $5M in January alone)

- Elevated leverage (Net Debt/EBITDA ~7x based on LTM EBITDA)

- Execution risk on summer water park performance

- Consumer discretionary spending in uncertain macro environment

Historical Financial Trends

*Values retrieved from S&P Global

This analysis was generated by Fintool AI Agent based on Lucky Strike Entertainment's Q2 FY2026 earnings release, conference call transcript, and SEC filings published on February 4, 2026.