Earnings summaries and quarterly performance for Lucky Strike Entertainment.

Executive leadership at Lucky Strike Entertainment.

Board of directors at Lucky Strike Entertainment.

Research analysts covering Lucky Strike Entertainment.

Recent press releases and 8-K filings for LUCK.

Lucky Strike Entertainment Reports Q2 FY 2026 Results and Reaffirms Guidance

LUCK

Earnings

Guidance Update

Dividends

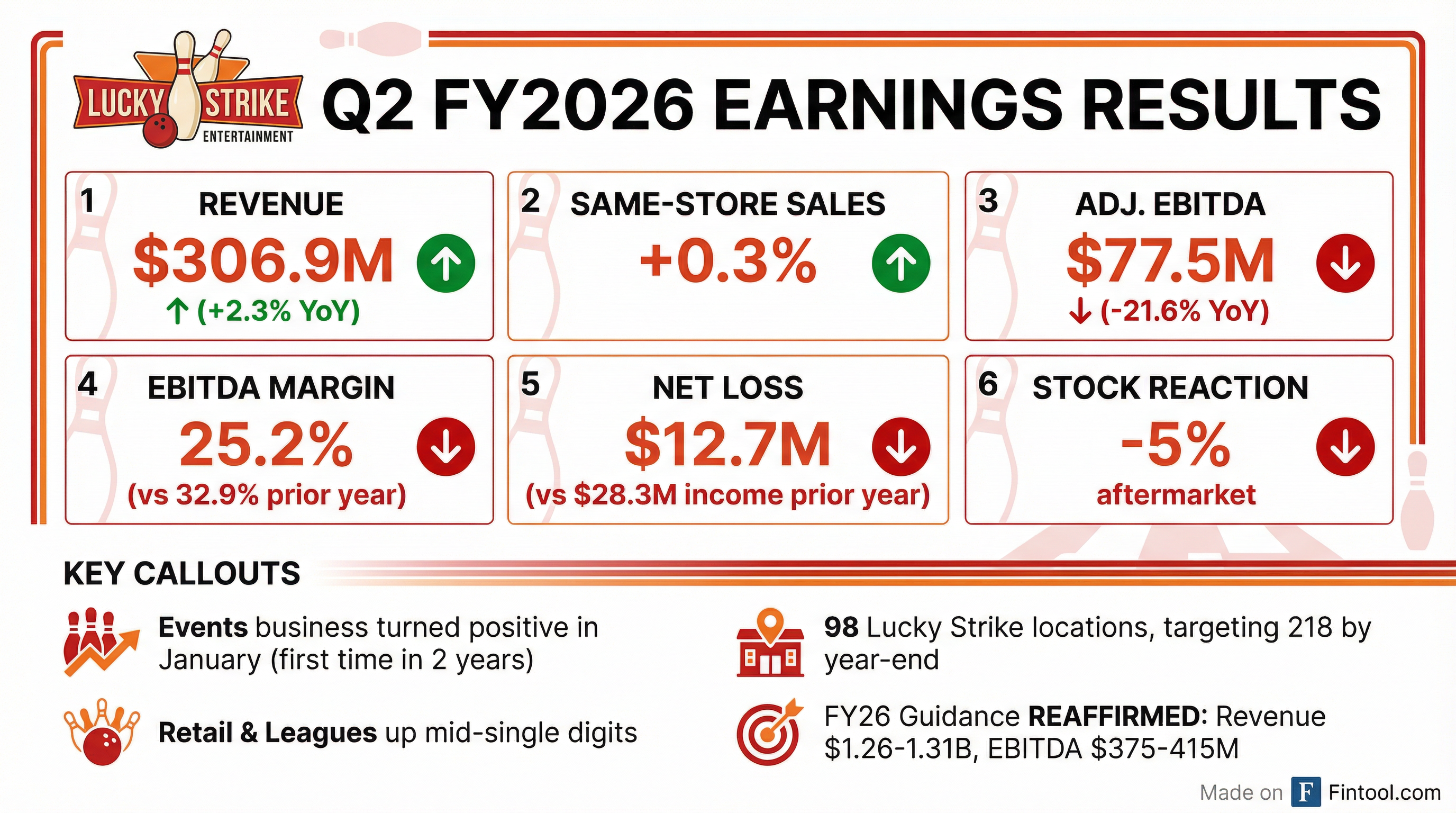

- Lucky Strike Entertainment reported a 2.3% increase in total revenue to $306.9 million for the second quarter of fiscal year 2026, which ended December 28, 2025, but experienced a net loss of $12.7 million compared to net income of $28.3 million in the prior year.

- Adjusted EBITDA decreased to $77.5 million from $98.8 million in the prior year, while Same Store Revenue increased by 0.3%.

- The company reaffirmed its fiscal year 2026 guidance, expecting total revenue growth of 5% to 9% (total revenue of $1,260M to $1,310M) and Adjusted EBITDA of $375M to $415M.

- A quarterly cash dividend of $0.06 per common share was declared for the third quarter of fiscal year 2026, payable on March 6, 2026.

2 days ago

Lucky Strike Entertainment Reports Q1 FY 2026 Results, Reaffirms Guidance, and Increases Dividend

LUCK

Earnings

Guidance Update

Dividends

- Lucky Strike Entertainment reported Q1 FY 2026 total revenue of $292.3 million, a 12.3% increase year-over-year, with a net loss of $13.8 million and Adjusted EBITDA of $72.7 million for the quarter ended September 28, 2025.

- The company reaffirmed its fiscal year 2026 guidance, projecting total revenue between $1,260 million and $1,310 million (a 5% to 9% growth) and Adjusted EBITDA between $375 million and $415 million.

- Lucky Strike Entertainment declared a quarterly cash dividend of $0.06 per common share for the second quarter of fiscal year 2026, representing an approximate 9% increase over the prior regular quarterly dividend.

- In September 2025, the company refinanced its credit facility, entering into a new $1.2 billion term loan and issuing $500 million in senior secured notes, extending debt maturity to 2032 and increasing its revolving credit commitment to $425 million.

- From June 30, 2025, through November 4, 2025, Lucky Strike Entertainment acquired three family entertainment centers and one water park, bringing its total operating locations to 369.

Nov 4, 2025, 9:07 PM

Lucky Strike Entertainment Subsidiary Completes Senior Secured Notes Offering and Debt Refinancing

LUCK

Debt Issuance

- On September 22, 2025, Kingpin Holdings Intermediate LLC, a subsidiary of Lucky Strike Entertainment Corporation, completed an offering of $500.0 million aggregate principal amount of 7.250% senior secured notes due 2032.

- The notes bear interest at 7.250% per annum, payable semi-annually beginning April 15, 2026, and will mature on October 15, 2032.

- The net proceeds from this notes offering, along with proceeds from a New Term Loan Facility, were used to repay in full the Issuer's existing credit agreement, which included $1.28 billion outstanding under an existing first lien term loan and $230.0 million outstanding under a 364-day bridge loan.

Sep 23, 2025, 10:06 AM

Lucky Strike Entertainment Announces Pricing of Senior Secured Notes and Refinancing

LUCK

Debt Issuance

- Lucky Strike Entertainment Corporation's subsidiary, Kingpin Intermediate Holdings LLC, has priced an offering of $500 million aggregate principal amount of 7.250% senior secured notes due 2032. The notes will be sold at 100% of the principal amount.

- The company also allocated a $1,200 million New Term Loan Facility maturing in 2032, with interest expected to accrue at Term SOFR +3.25% per annum, stepping down to Term SOFR +3.00%. The allocated size for this facility was increased from the previously announced $1,000 million.

- The net proceeds from the notes offering, the New Term Loan Facility, and a refinanced revolving credit facility (expected to include commitments of approximately $425 million) are anticipated to be used to refinance existing term loan facilities and revolving credit facility.

- The closing of the Notes offering is expected to occur around September 22, 2025.

Sep 17, 2025, 1:58 AM

Lucky Strike Entertainment Reports Fourth Quarter and Full Year Fiscal Year 2025 Results

LUCK

Earnings

Guidance Update

Share Buyback

- Lucky Strike Entertainment reported a 6.1% increase in total revenue to $301.2 million for the fourth quarter of fiscal year 2025, and a 4.0% increase to $1,201.3 million for the full fiscal year 2025, which ended on June 29, 2025. The company posted a net loss of $74.7 million in Q4 2025 and a net loss of $10.0 million for the full fiscal year 2025. Adjusted EBITDA for Q4 2025 was $88.7 million and $367.7 million for the full fiscal year.

- For fiscal year 2026, the company is guiding for Total Revenue Growth of 5% to 9%, with projected total revenue between $1,260 million and $1,310 million, and Adjusted EBITDA between $375 million and $415 million.

- Lucky Strike Entertainment repurchased 0.8 million shares of Class A common stock for approximately $7 million from March 31, 2025, through June 29, 2025, and a total of 6.8 million shares for approximately $72 million for the full fiscal year 2025. A quarterly cash dividend of $0.055 per share was declared for the first quarter of fiscal year 2026, payable on September 12, 2025.

- The company added 14 locations during fiscal year 2025, bringing the total number of locations in operation to 370 as of August 28, 2025.

Aug 28, 2025, 11:32 AM

Quarterly earnings call transcripts for Lucky Strike Entertainment.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more