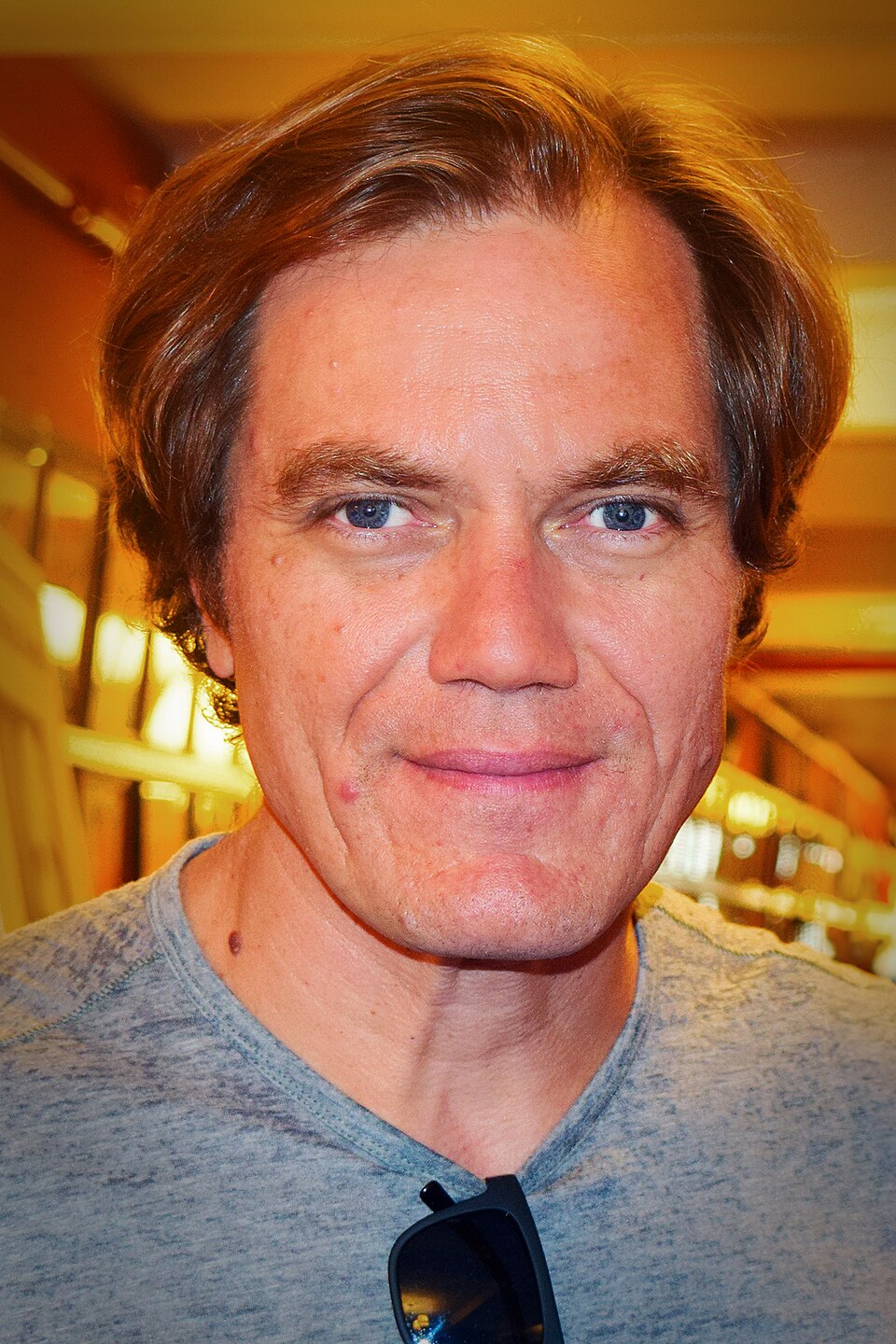

Thomas F. Shannon

About Thomas F. Shannon

Thomas F. Shannon is the founder, Chairman, Chief Executive Officer, and a director of Lucky Strike Entertainment. He has served on the board since 2021, is age 60, holds an MBA from the Darden School (University of Virginia), and is a graduate of American University . He founded Old Bowlero with the acquisition of Bowlmor Lanes in 1997 and grew the company into the world’s largest operator of bowling entertainment centers before the business combination that created Lucky Strike Entertainment . Management performance pay is tied to Company EBITDA; in fiscal 2025 EBITDA achieved 90% of goal and his annual plan payout was 53% of target, signaling pay-for-performance discipline .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Old Bowlero (predecessor to Lucky Strike Entertainment) | Founder; Chairman & CEO | 1997–2021 | Grew into the world’s largest operator of bowling entertainment centers |

| Lucky Strike Entertainment | Founder; Chairman & CEO; Director | 2021–present | Leads Board and management post-Business Combination |

Fixed Compensation

| Metric | FY 2024 | FY 2025 |

|---|---|---|

| Base Salary ($) | 1,386,000 | 1,386,000 |

| Target Bonus (% of Base) — Employment Agreement | 100% (max 200%) | 100% (max 200%) |

| Target Bonus (% of Base) — Annual Plan (2025) | — | 125% |

Notes:

- The employment agreement sets target and maximum annual bonuses at 100% and 200% of base salary, respectively; the compensation committee set the Annual Plan target at 125% for fiscal 2025 .

Performance Compensation

Short-Term Incentive (Annual Plan) — FY 2025

| Component | Threshold | Target | Maximum | Actual FY 2025 |

|---|---|---|---|---|

| EBITDA Performance Goal (% of target) | 85% | 100% | 125% | 90% |

| Payout (% of target) | 25% | 100% | 200% | 53% |

| Base Salary ($) | — | — | — | 1,386,000 |

| Final Payout ($) | — | — | — | 922,000 |

- Metric: Single metric, Company EBITDA .

- Governance: Compensation committee approved payouts in August 2025, paid September 2025 .

Long-Term Incentive and Option Awards

| Award | Shares | Strike | Vesting Schedule | Expiration | Status |

|---|---|---|---|---|---|

| Initial Option (Class A) | 6,781,250 | Tranche 1: $10; Tranche 2: $12; Tranche 3: $14; Tranche 4: $16; Tranche 5: $18 | Each tranche vests in equal one-third installments over 3 years from grant, staggered across the first–seventh anniversaries of Dec 15, 2021 | Dec 15, 2031 or earlier upon termination | Unvested forfeited on termination; fully vests if terminated without cause/for good reason during change-in-control period |

| Reallocated Option (Class B) | 482,784 | $10 | Fully vested at grant (Dec 15, 2021) | Dec 15, 2031 or earlier upon termination | Fully vested |

- Shannon is not eligible for new long-term equity grants until December 15, 2026 under his employment agreement .

Equity Ownership & Alignment

| Category | Detail |

|---|---|

| Class A shares beneficially owned | 6,432,747 (7.5% of Class A) |

| Class B shares beneficially owned | 74,803,290 (100.0% of Class B) |

| Total voting power | 89.4% of issued and outstanding common stock voting power |

| Shares outstanding (reference) | 81,720,160 Class A; 58,519,437 Class B; 117,087 Series A preferred |

| Hedging/Pledging policy | Hedging and pledging of Company securities prohibited unless pre-approved by the Chief Legal Officer or designee |

| Director stock ownership guidelines | Not disclosed in proxy |

Alignment signals:

- Extremely high voting control and Class B ownership align economic interests with long-term equity value .

- Corporate policy restricts hedging/pledging, reducing misalignment risk; no pledges disclosed .

Employment Terms

| Term | Key Provision |

|---|---|

| Agreement origin/term | Effective at Business Combination; initial term through Dec 15, 2024 with automatic 1-year renewals unless 90-day non-renewal notice; no non-renewal provided |

| Current base salary | $1,386,000 for fiscal 2025 (initial $1,274,000 subject to annual review) |

| Target/Max annual bonus | 100% / 200% of base salary per agreement; committee set Annual Plan 125% target for FY25 |

| Perquisites | Corporate Aircraft Policy permits up to 77 hours of non-business use per year |

| Severance (no cause/good reason) | 12 months of base + target bonus paid monthly; prorated annual bonus based on actual performance; up to 18 months COBRA premiums |

| Change-in-control severance | 2x base + target bonus lump sum; annual bonus at least target prorated; full acceleration of all equity awards; up to 18 months COBRA premiums; requires termination during change-in-control period |

| Restrictive covenants | Confidentiality, non-competition, invention assignment, and non-solicitation |

Board Governance

| Item | Detail |

|---|---|

| Board size | Authorized size nine; directors elected annually |

| Shannon independence | Not independent (Chairman of the Board) |

| Committees | Audit, Compensation, Nominating & Corporate Governance; all fully independent |

| Lead Independent Director | John A. Young |

| Meeting cadence & attendance | Board: 4 meetings; each committee: 4 meetings; each director attended ≥75% |

| Board leadership | Chairman-led board; Lead Director presides over executive sessions and liaises with independent directors |

| Controlled company status | Company is a “controlled company”; majority independent board and fully independent committees maintained |

| Director compensation | Non-employee director retainers: $85,000 base; Audit Chair $25,000; Compensation Chair $20,000; Nominating Chair $15,000; Lead Director $40,000; annual RSU grants $130,000; Shannon does not receive additional compensation for Board service |

Compensation Structure Analysis

- Year-over-year mix: Salary flat at $1.386M; non-equity incentive declined from $1.49M (FY24) to $0.922M (FY25) amid 90% EBITDA achievement and 53% payout; “All Other” increased to $181,551 (FY25) from $108,921 (FY24) .

- Long-term equity: No new LTI awards through Dec 15, 2026 under his agreement, limiting near-term dilution and equity grant-driven selling pressure .

- Performance metrics: Single-metric EBITDA plan with explicit threshold/target/max and mechanical payout scaling; committee maintained independent oversight and used Mercer as consultant for compensation matters in FY25 .

Director Compensation

| Component | FY 2025 Amount |

|---|---|

| Non-Employee Director Base Retainer (cash) | $85,000 |

| Audit Committee Chair | $25,000 |

| Compensation Committee Chair | $20,000 |

| Nominating & Corporate Governance Chair | $15,000 |

| Lead Independent Director | $40,000 |

| Annual Director RSU Grant (fair value) | $130,000 |

| Shannon Board Fees | No additional compensation as Chairman/CEO |

Performance Compensation — Detailed Mechanics

| Metric | Weighting | Target | Actual | Payout | Vesting |

|---|---|---|---|---|---|

| Company EBITDA (Annual Plan FY25) | 100% | 100% of EBITDA goal | 90% | 53% of target | N/A (cash) |

| Options (Initial Option Tranches) | N/A | Tranche exercise prices: $10/$12/$14/$16/$18 | N/A | N/A | Each tranche vests in equal one-third installments across specified anniversary years from Dec 15, 2021 |

Employment & Contracts — Change-of-Control Economics

- Double-trigger construct: Termination without cause/for good reason during the change-in-control period required; benefits include 2x base + target bonus lump sum, annual bonus at least target prorated, full acceleration of all equity, and up to 18 months premium reimbursement .

- Standard severance (non-CIC): 1x base + target bonus paid monthly, prorated annual bonus based on actual performance, and up to 18 months premium reimbursement .

Investment Implications

- Alignment: Extraordinary voting control (89.4%) and Class B ownership align CEO interests with long-term equity value; corporate prohibitions on hedging/pledging mitigate misalignment, with no pledges disclosed .

- Pay-for-performance: FY25 payout at 53% on 90% EBITDA achievement demonstrates formulaic discipline; risk of overpay moderated by single-metric structure and fully independent compensation committee with external consultant support .

- Overhang/selling pressure: Lack of new LTI awards until Dec 2026 reduces near-term equity grant-driven selling pressure; legacy option tranches with $10–$18 strikes keep upside tightly linked to sustained share-price appreciation .

- Governance: Dual role (CEO + Chairman) is counterbalanced by Lead Independent Director, fully independent committees, and majority independent board despite controlled company status; still a governance consideration for minority holders in change-of-control scenarios given robust CIC benefits and full equity acceleration .