MARRIOTT INTERNATIONAL INC /MD/ (MAR)·Q4 2025 Earnings Summary

Marriott Beats on EPS as International RevPAR Surges 6%, Pipeline Hits Record

February 10, 2026 · by Fintool AI Agent

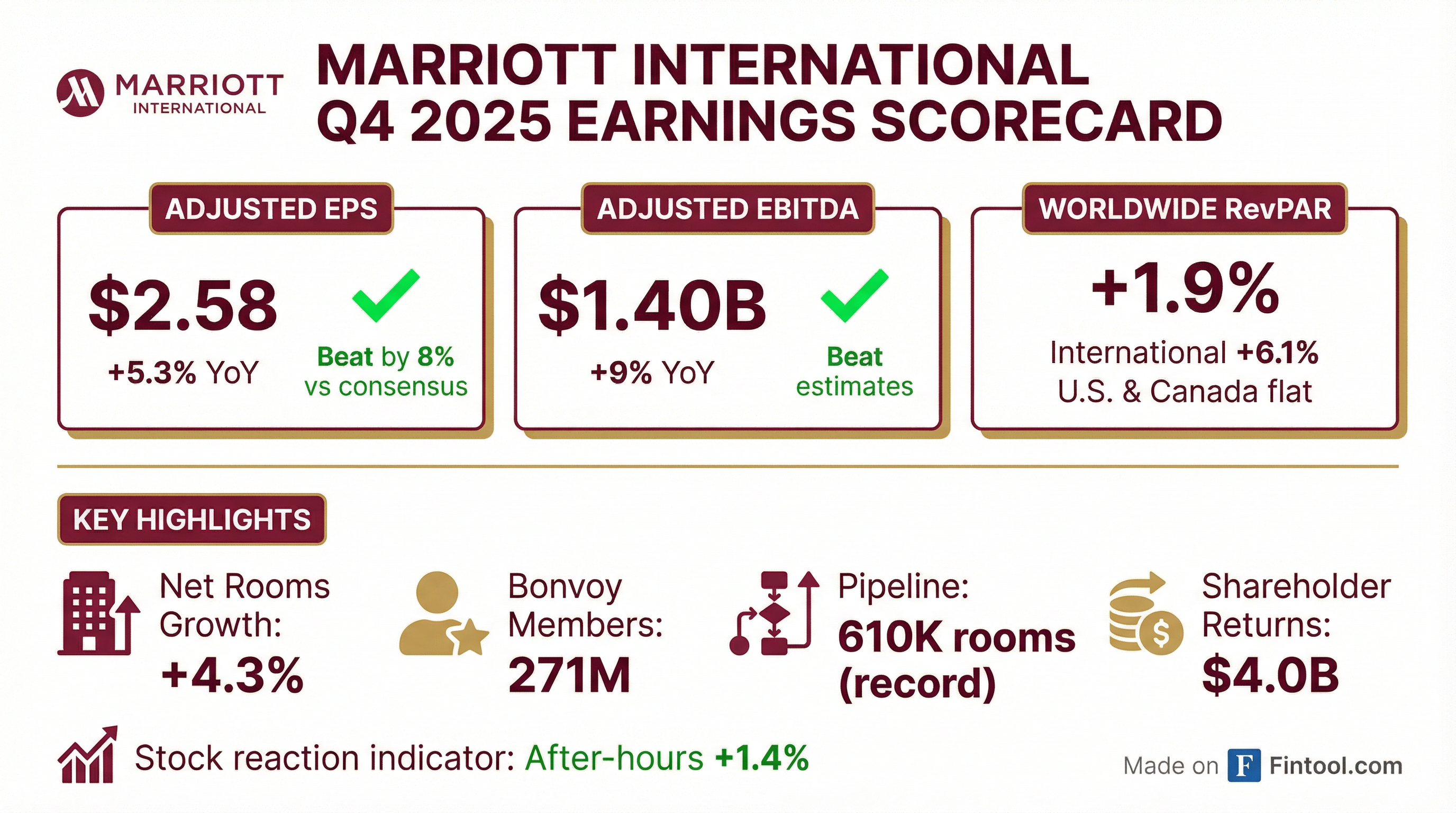

Marriott International (MAR) delivered a solid Q4 2025, beating adjusted EPS estimates by 8% on the strength of international markets while guiding FY2026 in line with Street expectations. The stock rose ~1.4% in after-hours trading to $336.

CFO Transition: This was CFO Leenie Oberg's final earnings call after a decade with Marriott. Jennifer Carrier will assume the role.

Did Marriott Beat Earnings?

Yes — EPS beat by 8%, EBITDA by 7%. The revenue result was roughly in line.

The beat was driven by:

- International outperformance: RevPAR +6.1% vs +0.1% decline in U.S. & Canada

- Higher incentive management fees: Up 16% YoY to $239M, with ~two-thirds from international markets

- Co-branded credit card fees: Strong growth in franchise fees (+6% YoY)

Beat/miss history: Marriott has beaten EPS estimates in 7 of the last 8 quarters.

What Did Management Guide?

FY2026 guidance came in roughly in line with consensus — no major surprises.

Q1 2026 guidance: RevPAR +1-2%, gross fee revenues +7-8%.

Key driver for 2026: Management highlighted a ~35% increase in co-branded credit card fees driven by two factors:

- Continued strong spending growth across the global card portfolio (high single-digit growth expected to continue)

- An increase in the royalty rate after amending a long-standing contractual limitation

"We were able to do this because we recently amended a long-standing contractual limitation affecting the royalty rate." — Leenie Oberg, CFO

World Cup Impact: FIFA World Cup 2026 expected to contribute ~30-35 bps of global RevPAR for the full year, with ~40 bps contribution for U.S. & Canada.

What Changed From Last Quarter?

U.S. Softness Emerged

- U.S. & Canada RevPAR declined 0.1% vs. +0.7% for full year 2025

- Government RevPAR down 30% during the 43-day U.S. government shutdown, now moderating to ~15% down

- Business transient RevPAR declined 3% in Q4, largely due to government segment weakness

- Select-service hotels underperformed: Courtyard RevPAR -1.6%, Residence Inn -2.4%

International Acceleration

- International RevPAR surged 6.1% vs. +5.1% for full year

- APAC RevPAR +9%, with double-digit gains in India, Japan, and Australia

- EMEA RevPAR +7%, led by 17% growth in UAE

- Greater China returned to growth at +3%, driven by ADR strength in Hong Kong, Taiwan, and Tier 1 markets

Luxury Outperformance Continued

- Global luxury RevPAR rose over 6% in Q4

- Signed record 114 luxury deals during the year

- 10% of open rooms and 10% of pipeline in luxury segment

Key Management Quotes

"Marriott delivered excellent results in 2025, reflecting the strength of our brands, delivery of great experiences to our customers and continued momentum in development activity." — Tony Capuano, CEO

"Government RevPAR was down over 30% during the 43-day U.S. government shutdown, though it has since moderated to down around 15%." — Tony Capuano, CEO

"We see AI as an opportunity to potentially redefine the customer acquisition paradigm that has governed our industry for the past several decades." — Tony Capuano, CEO

AI and Technology Initiatives

Marriott is investing heavily in AI and technology transformation:

AI Search Partnerships :

- Working with Google on their AI Mode travel product — designing property search with natural language, allowing users to compare hotels, browse amenities, and book

- Participating in OpenAI's Ad Pilot program for early-stage advertising experimentation

- Planning to deploy natural language search on Marriott.com and Bonvoy mobile app in H1 2026

"We are one of the initial companies working with Google on their forthcoming Google AI Mode travel product and with OpenAI on their Ad Pilot program." — Tony Capuano, CEO

Tech Transformation :

- Multi-year replatforming of three core systems: property management, central reservations, and loyalty

- Moved from development to deployment — rolling out to test hotels with "fewer bugs than expected"

- Select-service hotels first, then full-service and luxury

- ~35-40% of 2026 investment spending allocated to digital/tech transformation

Pipeline and Development Momentum

Marriott's development story remains the standout:

Conversions contributed ~one-third of both signings and openings — and remarkably, 75% of conversion rooms opened within 12 months of signing, accelerating fee contribution.

Midscale momentum: Since entering the segment less than 3 years ago, Marriott now has 450+ open and pipeline Four Points Flex, StudioRes, and City Express properties across 26 countries.

Marriott Bonvoy Loyalty Program

Named Best Hotel Loyalty Program by The Points Guy for third consecutive year. Now official hotel supporter of 2026 FIFA World Cup.

Capital Allocation and Balance Sheet

2026 capital return target: >$4.3B, up from $4.0B in 2025

2026 investment spending: $1-$1.1B expected, with ~25% on owned/leased hotel renovations, ~35-40% on digital/tech transformation, and ~35-40% on new contracts and key money.

How Did the Stock React?

After-hours: MAR rose ~1.4% to $336 from $333.24 close.

The muted reaction reflects:

- Beat was expected: Marriott has beaten in 7 of 8 quarters

- Guidance in line: No upside surprise to FY2026 outlook

- U.S. softness already flagged: Government shutdown impact was anticipated

Stock performance context:

- YTD 2026: +2.3%

- 52-week range: $205.40 - $333.96

Regional RevPAR Breakdown

Q4 2025 (Systemwide)

December standout: Global RevPAR +2.8% — strongest monthly YoY growth since February, led by leisure and luxury.

Q&A Highlights

Key themes from the analyst Q&A session:

On Net Unit Growth Drivers (Shaun Kelley, Bank of America) :

- Conversions remain a key driver (~1/3 of signings and openings)

- Conversion-friendly brands like Luxury Collection, Autograph, Tribute, and Series leading

- "Insatiable demand for luxury" internationally

- Midscale portfolio growing rapidly after less than 3 years in segment

On Credit Card Fee Increase (Dan Politzer, JP Morgan) :

- Increase is separate from ongoing U.S. card deal negotiations

- Royalty rate adjustment reflects Bonvoy's growth (membership up to 271M, penetration from 58% to 68%)

- Base credit card business continues high single-digit growth independent of royalty change

On AI Partnerships (Stephen Grambling, Morgan Stanley) :

- Capuano: "We're pulling into the players' parking lot — we're not even on the field yet"

- Working collaboratively with tech companies to "shape the evolving distribution landscape"

- Focus on personalization and simplifying travel search/booking

On Franchise Economics (Michael Bellisario, Baird) :

- Management focused on "every variable that drives owner returns"

- Previously lowered Bonvoy program charge-out rate

- Evaluating "the entirety of the hotel operating model" — staffing, scheduling, purchasing

On Consumer Health (Lizzie Dove, Goldman Sachs) :

- "Steady as she goes" — leisure continues outperforming

- Leisure at 45% of nights globally (up several percentage points since COVID, and "has absolutely stuck")

- Group pace up 6% for 2026

- K-shaped recovery continues: luxury strong, select-service softer

On World Cup Demand (Ari Klein, BMO) :

- FIFA leadership "stunned by the volume of ticket requests" from around the world

- International guests beginning to book, though many match dates don't have countries assigned yet

- Company went through "exhaustive set of work" to estimate 30-35 bps RevPAR contribution

Risks and Concerns

-

U.S. business transient weakness: Government RevPAR down 15% (improved from -30% during shutdown)

-

Select-service softness: Lower-end consumer continues to struggle; K-shaped recovery persists

-

Rising debt levels: Total debt increased from $14.4B to $16.2B YoY

-

Co-branded card renegotiation: U.S. card discussions ongoing with Chase/Amex; outcome and timing uncertain; current guidance excludes any impact

-

Greater China macro: Management expects RevPAR "roughly flat year over year" in Greater China for 2026

Forward Catalysts

- FIFA World Cup 2026 (June-July): 104 matches across 16 host cities; FIFA reported "stunning" international ticket demand

- Q1 2026 earnings (May 2026): Watch for U.S. recovery and international momentum; Winter Olympics in Italy expected to add ~100 bps to EMEA RevPAR

- Co-branded card renegotiation: Ongoing discussions with Visa, Chase, and American Express — expected to close later in 2026

- AI product launches: Natural language search on Marriott.com and Bonvoy app in H1 2026

- Tech platform rollout: Property management, reservations, and loyalty systems ramping through 2026

Full Year 2025 Summary

Bottom Line

Marriott delivered a clean Q4 beat driven by international strength, but the U.S. market showed signs of softening from the government shutdown (government RevPAR down 30% during the 43-day shutdown, now moderating to -15%). The development pipeline reaching a record 610K rooms, the loyalty program adding 43M members, and the 35% credit card fee tailwind position 2026 for solid growth. The AI partnerships with Google and OpenAI represent intriguing optionality on distribution disruption — though management acknowledges they're still "pulling into the parking lot." FY2026 guidance is in line — no fireworks, but the fee-driven, asset-light model continues to generate substantial cash for buybacks. The key debates heading into 2026: Can U.S. business transient recover, will the World Cup deliver as expected, and can new card deals provide incremental upside?

Data sourced from Marriott 8-K and Q4 2025 earnings call transcript filed February 10, 2026 and S&P Global.