Earnings summaries and quarterly performance for MARRIOTT INTERNATIONAL INC /MD/.

Executive leadership at MARRIOTT INTERNATIONAL INC /MD/.

Tony Capuano

President and Chief Executive Officer

Ben Breland

Chief Human Resources Officer and Executive Vice President, Global Operations Services

Jen Mason

Executive Vice President and Chief Financial Officer

Leeny Oberg

Chief Financial Officer and Executive Vice President, Development

Rena Reiss

Executive Vice President and General Counsel

Shawn Hill

Executive Vice President and Chief Development Officer

William Brown

Group President, United States and Canada

Board of directors at MARRIOTT INTERNATIONAL INC /MD/.

Aylwin Lewis

Director

Bella Goren

Director

David Marriott

Chairman of the Board

Debbie Marriott Harrison

Director

Debi Lee

Director

Fritz Henderson

Lead Independent Director

Grant Reid

Director

Horacio Rozanski

Director

Lauren Hobart

Director

Meg McCarthy

Director

Sean Tresvant

Director

Susan Schwab

Director

Research analysts who have asked questions during MARRIOTT INTERNATIONAL INC /MD/ earnings calls.

Brandt Montour

Barclays PLC

8 questions for MAR

Conor Cunningham

Melius Research

8 questions for MAR

David Katz

Jefferies Financial Group Inc.

8 questions for MAR

Shaun Kelley

Bank of America Merrill Lynch

8 questions for MAR

Stephen Grambling

Morgan Stanley

8 questions for MAR

Richard Clarke

Bernstein

7 questions for MAR

Duane Pfennigwerth

Evercore ISI

6 questions for MAR

Michael Bellisario

Robert W. Baird & Co.

6 questions for MAR

Robin Farley

UBS

6 questions for MAR

Smedes Rose

Citigroup

6 questions for MAR

Ari Klein

BMO Capital Markets

5 questions for MAR

Lizzie Dove

Goldman Sachs

5 questions for MAR

Patrick Scholes

Truist Financial Corporation

4 questions for MAR

Elizabeth Dove

Goldman Sachs

3 questions for MAR

Chad Beynon

Macquarie

2 questions for MAR

Daniel Politzer

Wells Fargo

2 questions for MAR

Dan Politzer

Wells Fargo

2 questions for MAR

Meredith Prichard Jensen

HSBC

2 questions for MAR

Trey Bowers

Wells Fargo & Company

2 questions for MAR

Aryeh Klein

BMO Capital Markets

1 question for MAR

Bennett Rose

Citigroup

1 question for MAR

Charles Scholes

Not Disclosed

1 question for MAR

Dan Poulter

JPMorgan Chase & Co.

1 question for MAR

Joseph Greff

JPMorgan Chase & Co.

1 question for MAR

Kevin Kopelman

TD Cowen

1 question for MAR

Steve Pizzella

Deutsche Bank

1 question for MAR

Recent press releases and 8-K filings for MAR.

- Marriott entered into a terms agreement with underwriters and issued $600 million 4.500% Series WW Notes due May 1, 2033 and $850 million 5.100% Series XX Notes due May 1, 2038, settling on February 20, 2026.

- The Notes pay interest semi-annually on May 1 and November 1, commencing November 1, 2026, and may be redeemed at the company’s option prior to maturity under specified call provisions.

- Net proceeds of approximately $1.425 billion will be used for general corporate purposes, including working capital, capital expenditures, acquisitions, share repurchases and debt repayment.

- China Mainland cloud infrastructure services market reached $13.4 billion in Q3 2025, up 24% YoY, marking a second consecutive quarter exceeding 20% growth.

- Alibaba Cloud increased its market share to 36%, maintaining its leadership for nine consecutive quarters.

- Huawei Cloud and Tencent Cloud held 16% and 9% of the market, respectively.

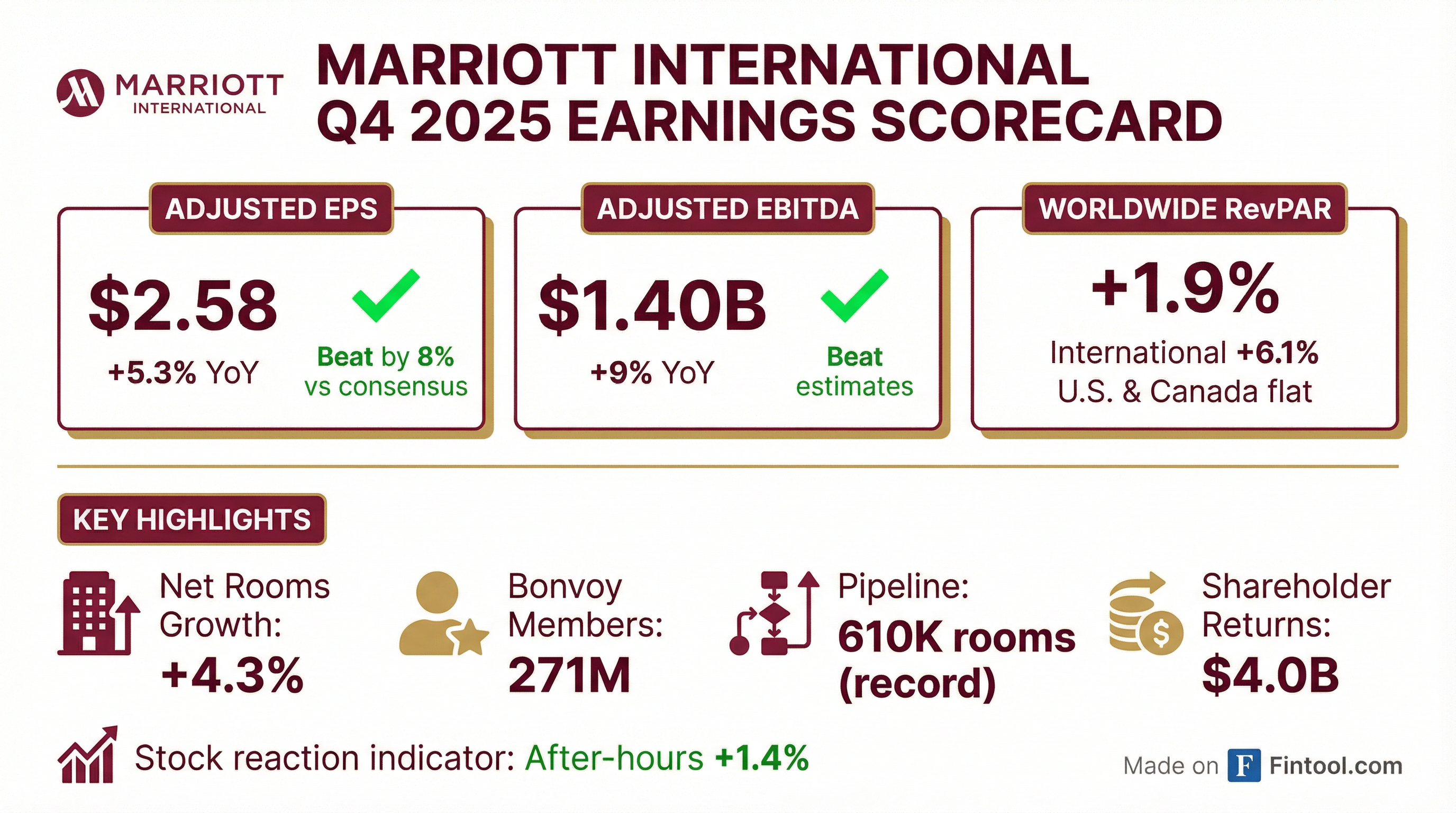

- Global RevPAR increased 1.9% in Q4 and 2% for the full year, with the U.S. & Canada up 0.7% and international markets rising over 5%.

- Q4 gross fee revenues rose 7% to $1.4 billion and adjusted EBITDA grew 9% to $1.4 billion; for 2025, gross fees were $5.4 billion (+5%) and adjusted EBITDA was $5.38 billion (+8%).

- 2026 guidance: net rooms growth of 4.5%–5%, global RevPAR growth of 1.5%–2.5%, gross fee revenues of $5.9 billion–$5.96 billion (+8%–10%), adjusted EBITDA of $5.8 billion–$5.9 billion, and adjusted EPS growth of 13%–15%.

- Shareholder returns: >$4 billion returned via dividends and buybacks in 2025; >$4.3 billion expected in 2026.

- Q4 2025 total gross fee revenues grew 7% to $1.4 billion and adjusted EBITDA rose 9% to $1.4 billion; for FY 2025, gross fee revenues increased 5% to $5.4 billion, adjusted EBITDA was $5.38 billion (+8%), and adjusted EPS reached $10.02 (+7%).

- Marriott Bonvoy added 43 million new members in 2025, lifting the loyalty base to 271 million, and the company signed a record 114 luxury deals while building a midscale pipeline of over 450 open and pipeline properties.

- 2026 guidance calls for 4.5–5% net rooms growth, 1.5–2.5% global RevPAR growth, gross fee revenues of $5.9–5.96 billion (+8–10%), adjusted EBITDA of $5.8–5.9 billion (+8–10%), EPS growth of 13–15%, and over $4.3 billion of shareholder returns.

- The company is deploying a multi-year technology transformation—upgrading property management, reservations, and loyalty platforms—and will roll out AI-powered natural language search on Marriott.com and the mobile app in H1 2026.

- Global portfolio reached 1.78 million rooms at year-end with a record 610 000-room pipeline; net room growth for 2026 is expected at 4.5%–5%.

- Full-year 2025 global RevPAR rose 2%, led by international up 5% and U.S./Canada up 0.7%; Q4 RevPAR increased 1.9%, with APAC up 9% and EMEA up 7%.

- Q4 2025 gross fee revenues grew 7% to $1.4 billion and Adjusted EBITDA rose 9% to $1.4 billion; full-year gross fee revenues were $5.4 billion (+5%) and adjusted EPS was $10.02 (+7%).

- 2026 guidance includes 1.5%–2.5% global RevPAR growth, 8%–10% fee revenue increase to $5.9 billion–$5.96 billion, 8%–10% Adjusted EBITDA growth to $5.8 billion–$5.9 billion, and 13%–15% EPS growth.

- Returned over $4 billion to shareholders in 2025 through dividends and buybacks; plans > $4.3 billion of capital returns in 2026.

- Marriott reported Q4 revenue of $6.69 billion and adjusted EPS of $2.58, with global RevPAR up 1.9% and net rooms growth of over 4% for the year.

- The company guided fiscal 2026 adjusted EPS of $11.32–$11.57, net room growth of 4.5–5%, investment spending of $1.0–$1.1 billion, and a tax rate near 26–26.5%.

- Marriott’s asset-light, fee-driven model spans about 1.8 million rooms across ~30 brands, with 98% of rooms under managed or franchised contracts and 62% located in North America.

- Management plans capital returns in excess of $4.3 billion, building on more than $4 billion returned to shareholders in 2025.

- Q4 reported diluted EPS of $1.65 and adjusted diluted EPS of $2.58; net income of $445 M and adjusted net income of $695 M

- Worldwide RevPAR rose 1.9% in Q4 and 2.0% for full-year 2025; international RevPAR +6.1% (U.S. & Canada −0.1% in Q4)

- Adjusted EBITDA of $1,402 M in Q4 (+9% YoY) and $5,383 M for FY 2025 (+8% YoY)

- Returned over $4.0 B to shareholders in 2025 through dividends and repurchases; Q4 buybacks of 3.5 M shares for $1.0 B, and 12.1 M shares for $3.3 B in the full year

- 2026 outlook: RevPAR growth of 1.5–2.5%, net rooms +4.5–5%, adjusted EBITDA +8–10%, and over $4.3 B of capital returns

- Fourth quarter RevPAR rose 1.9% worldwide (Intl +6.1%, U.S. & Canada –0.1%), and full-year RevPAR increased 2.0% globally (Intl +5.1%, U.S. & Canada +0.7%)

- Reported diluted EPS was $1.65 (adjusted $2.58) in Q4; full-year diluted EPS of $9.51 (adjusted $10.02)

- Reported net income for Q4 was $445 million (adjusted $695 million); FY net income $2,601 million (adjusted $2,742 million)

- Returned over $4.0 billion to shareholders in 2025; 2026 outlook includes 1.5–2.5% RevPAR growth, 4.5–5% net rooms growth, 8–10% adjusted EBITDA growth, and > $4.3 billion of capital returns

- Marriott added over 700 properties and nearly 100,000 rooms, achieving 4.3% net rooms growth in 2025 and grew its pipeline by ~5.7% to ~610,000 rooms.

- Completed the acquisition of citizenM, adding 35 hotels and 9,000 rooms, and launched the Series by Marriott brand with 37 properties opened in India by end-2025.

- Hilton added nearly 800 hotels (~100,000 rooms) for 6.7% net unit growth, signed over 1,000 hotels (~140,000 rooms), and has more than 3,700 hotels (~520,000 rooms) under development.

- Hilton forecasts 6–7% net unit growth in 2026, noting roughly 20% of global rooms under construction will join its system and introducing Apartment Collection (bookable 1H 2026) and Outset Collection (>60 hotels in development).

- Marriott grew net rooms by 4.3% in 2025, adding over 700 properties and nearly 100,000 rooms.

- Ended 2025 with approximately 610,000 rooms in the development pipeline (up 5.7% YoY) after signing nearly 1,200 organic deals (163,000 rooms).

- Completed the acquisition of citizenM in July, integrating 35 hotels and nearly 9,000 rooms, and launched Series by Marriott with 37 properties (2,600 rooms) in India.

- Broadened luxury and residential offerings with a record 114 luxury deals (15,301 rooms) and 55 branded residential deals, closing the year with 296 luxury pipeline hotels (~60,000 rooms) and 149 open residences.

Quarterly earnings call transcripts for MARRIOTT INTERNATIONAL INC /MD/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more