Earnings summaries and quarterly performance for Alphabet.

Executive leadership at Alphabet.

Sundar Pichai

Chief Executive Officer

Anat Ashkenazi

Senior Vice President, Chief Financial Officer

Kent Walker

President, Global Affairs; Chief Legal Officer and Secretary

Philipp Schindler

Senior Vice President, Chief Business Officer

Ruth Porat

President and Chief Investment Officer

Board of directors at Alphabet.

Research analysts who have asked questions during Alphabet earnings calls.

Brian Nowak

Morgan Stanley

4 questions for GOOGL

Douglas Anmuth

JPMorgan Chase & Co.

4 questions for GOOGL

Eric Sheridan

Goldman Sachs

4 questions for GOOGL

Ross Sandler

Barclays

4 questions for GOOGL

Justin Post

Bank of America Corporation

3 questions for GOOGL

Kenneth Gawrelski

Wells Fargo & Company

3 questions for GOOGL

Michael Nathanson

MoffettNathanson

3 questions for GOOGL

Mark Mahaney

Evercore ISI

2 questions for GOOGL

Mark Shmulik

Bernstein

2 questions for GOOGL

Stephen Ju

UBS

2 questions for GOOGL

Ronald Josey

Citigroup Inc.

1 question for GOOGL

Recent press releases and 8-K filings for GOOGL.

- The NRC granted TerraPower a construction permit for its Natrium sodium-cooled SMR—the first U.S. commercial non-light-water reactor approval in nearly a decade—with a 245 MW baseline output.

- Natrium combines a fast-neutron liquid-sodium reactor with a salt-based thermal-energy storage system that can briefly boost output to 500 MW for grid flexibility.

- TerraPower, founded by Bill Gates with partners including GE Hitachi, SK Innovation and KHNP, aims to bring the plant online around 2030–2032 adjacent to a retiring Wyoming coal plant, with estimated costs of roughly $4 billion and remaining regulatory, fuel and financing hurdles.

- The project has secured commercial commitments from hyperscalers (including a multi-reactor deal with Meta) to support a local energy transition, though safety and long-term waste management risks persist.

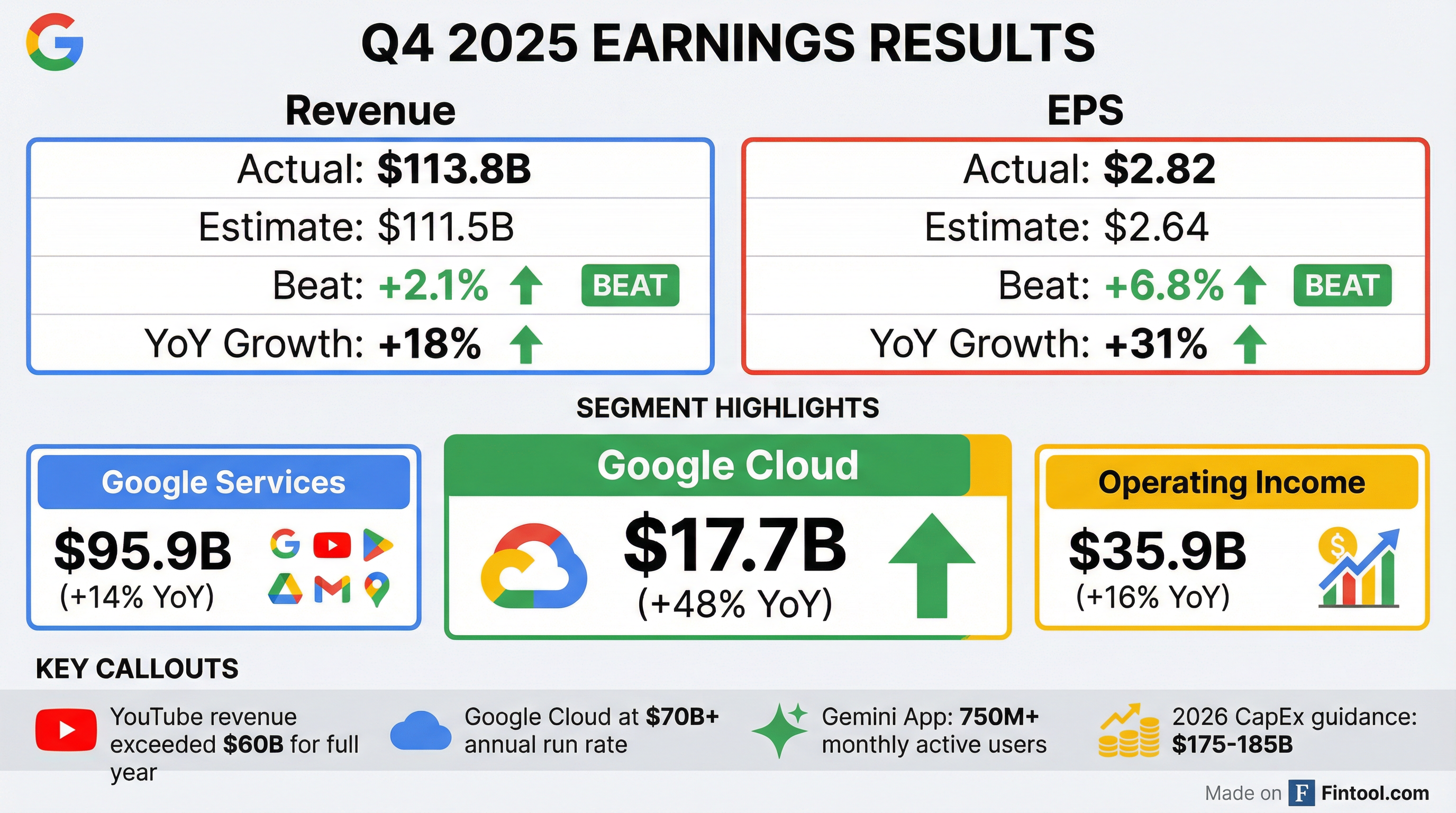

- Alphabet guides 2026 CapEx at $175–185 billion, nearly doubling from $91 billion in 2025 to scale AI infrastructure—data centers, TPUs, GPUs, and networking—with allocations reviewed continuously against demand and ROI targets.

- The company employs a rigorous ROI framework, assessing near-term versus long-term returns across Search, Cloud, Gemini and Other Bets, and reallocates compute and capital dynamically based on usage and efficiency metrics.

- Google Cloud exited Q4 with $17.7 billion in revenue (up 48% YoY) and a 30% operating margin, backed by over $240 billion in backlog, driven by expanded AI infrastructure and services.

- Search enhancements—including AI Overviews, AI Mode, Google Lens—have boosted query engagement and commercial traffic, while the Nano Banana image-generation tool attracted 20 million new Gemini subscribers in two weeks.

- Waymo has rolled out its autonomous “Driver” in 10 U.S. cities and plans to launch in 25 more over the next two years, prioritizing safety validation, regulatory compliance, and local partnerships for scalable deployment.

- CFO Anat Ashkenazi announced 2026 CapEx guidance of $175–185 billion, up from $91 billion in 2025, backed by a rigorous ROIC framework and continuous efficiency initiatives including in-house TPU optimization and AI-driven finance tools

- AI-first investments span generation 7 TPUs to Frontier models, fueling rapid productisation such as the Gemini app’s Nano Banana feature (20 million new subscribers in two weeks) and search enhancements (AI Overviews, AI Mode, Lens) that have increased query length, volume and monetization

- Google Cloud reported record Q4 2025 revenue of $17.7 billion (48% y/y growth), a $240 billion+ backlog and 30% operating margin, driven by AI infrastructure (over half of ML compute) and expansion among both new and existing customers

- Waymo expanded its Waymo Driver service to 10 U.S. cities (5 in 2025, 5 YTD) with plans for ~25 additional launches over two years, emphasizing safety (accident rates orders of magnitude below human drivers), regulatory alignment and a blend of asset-heavy rollouts and local partnerships

- Alphabet reaffirmed its AI-first strategy built on a “full stack” technical infrastructure—proprietary TPUs (7th generation), GPUs, data centers and networking—to support Search, YouTube, Cloud and Other Bets.

- CFO Anat Ashkenazi guided $175–185 billion of CapEx for the year (versus $91 billion in FY 2025), employing a rigorous ROI framework to allocate compute across Search, Cloud, Waymo and advanced research.

- Google Cloud exited Q4 at $17.7 billion in revenue, up 48% YoY, with a backlog exceeding $240 billion and a 30% operating margin, driven by AI infrastructure and services.

- Search innovations—AI Overviews, AI Mode and Google Lens—plus the viral “Nano Banana” image generator added 20 million Gemini subscribers in two weeks, boosting query engagement and monetization.

- Waymo expanded to 10 U.S. cities (five launched in 2025 and five in 2026) with plans for 25 additional markets over two years, emphasizing safety-first rollouts and a mix of asset-heavy builds and partnerships.

- Alphabet’s Google and Sea Ltd. will co-develop AI tools across Sea’s e-commerce (Shopee), gaming (Garena) and financial (Monee) businesses to drive workflow and commerce automation.

- The firms will explore an agentic shopping prototype integrating Shopee and Google services, potentially boosting Shopee listings’ visibility in Google’s Gemini search results.

- Garena will adopt Google’s AI to enhance player experiences and accelerate game development, while Monee may pilot agent-managed payment experiences via Google’s open-source Agent Payments Protocol (AP2).

- The deal builds on prior Shopee–YouTube shopping collaborations and underscores competitive pressure in Southeast Asia’s e-commerce AI race, where Shopee held about 52% market share in 2024.

- Alphabet issued $20 billion of U.S. senior notes and £5.5 billion of sterling notes in a multi-currency, multi-tranche offering to bolster liquidity and support long-term investments.

- The debt comprises U.S. notes maturing from 2029 to 2066 with coupons of 3.700%–5.750%, and sterling notes from 2029 to 2126 carrying coupons up to 6.125%.

- Proceeds will fund an aggressive capital plan, including $180 billion invested in AI data centers in 2025 and higher spending planned for 2026, which may pressure near-term margins and free cash flow.

- Analysts maintain a Buy/Outperform consensus with a $395 price target but flag execution and earnings risks from the 2026 investment ramp.

- On February 13, 2026, Alphabet completed concurrent underwritten offerings of $20 billion of U.S. dollar-denominated senior notes and £5.5 billion of Sterling-denominated senior notes under its Form S-3 registration (File No. 333-286752).

- The Sterling notes included five tranches: £750 M at 4.125% due 2029, £1.25 B at 4.625% due 2032, £1.25 B at 5.500% due 2041, £1.25 B at 5.875% due 2058, and £1.00 B at 6.125% due 2126.

- The U.S. notes comprised seven tranches: $2.5 B at 3.700% due 2029, $3.0 B at 4.100% due 2031, $3.0 B at 4.400% due 2033, $4.25 B at 4.800% due 2036, $1.5 B at 5.500% due 2046, $4.0 B at 5.650% due 2056, and $1.75 B at 5.750% due 2066.

- All notes were issued under the Indenture dated February 12, 2016, with The Bank of New York Mellon Trust Company, N.A. acting as trustee.

- European Commission unconditionally approved Alphabet’s $32 billion acquisition of cloud security firm Wiz, finding no competition concerns and noting credible alternative providers.

- Google Cloud’s IaaS revenue reached $11.45 billion in 2023, or 8.2% of an estimated $140 billion market (Amazon 39%, Microsoft 23%).

- The deal, Alphabet’s largest-ever acquisition, still requires final approvals in Australia, South Africa, Turkey, and Israel.

- The transaction is expected to generate NIS 10 billion (~$3.2 billion) in tax proceeds for Israel, with Wiz’s 1,800 employees to remain in place post-close.

- Alphabet has launched a $20 billion multi-tranche, multicurrency bond offering, drawing over $100 billion of orders and featuring maturities into the mid-2060s.

- Proceeds will accelerate AI-related capital spending, allocating 40% to data centers and network capacity and the remainder to servers and specialized AI chips.

- The issuance underpins an expected rise in capital expenditures to $185 billion in 2026, nearly double the prior year’s level.

- Bonds will be issued in U.S. dollars, British pounds, and Swiss francs, with the 2066 tranche priced at a 1.2 percentage point premium over comparable U.S. Treasuries.

- Alphabet expects to nearly double its investment spending to $180 billion, above analyst forecasts of under $119 billion, raising concerns about AI buildout costs.

- U.S. stocks slid, with the S&P 500 down 1.1–1.2% and the Dow and Nasdaq off 1–1.6%, as weak jobs data weighed on markets.

- Bitcoin plunged 50% from its October peak, including a 13% single-day drop, reflecting structural shifts in derivatives and synthetic supply.

- Planned layoffs jumped 205% to 108,435 in January, the highest since 2009; tech sector cuts totaled 22,291, and UPS planned 31,243 reductions.

Fintool News

In-depth analysis and coverage of Alphabet.

Waymo Expands to 10 US Cities in Largest Single-Day Robotaxi Rollout

Three Silicon Valley Engineers Charged With Stealing Google, Qualcomm Trade Secrets for Iran

New York Pulls Robotaxi Expansion Plan in Blow to Waymo's $16 Billion Growth Bet

Google and Sea Ltd Partner to Build 'Agentic AI' Shopping Prototype for Shopee

SpaceX and xAI Enter Secret $100M Pentagon Contest for Autonomous Drone Swarms

Alphabet Launches $15 Billion Bond Sale to Fund AI Buildout, Including Ultra-Rare 100-Year Debt

Quarterly earnings call transcripts for Alphabet.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more