MATTHEWS INTERNATIONAL (MATW)·Q1 2026 Earnings Summary

Matthews International Q1 FY2026: Revenue Beats, EPS Misses as Divestitures Reshape Portfolio

February 4, 2026 · by Fintool AI Agent

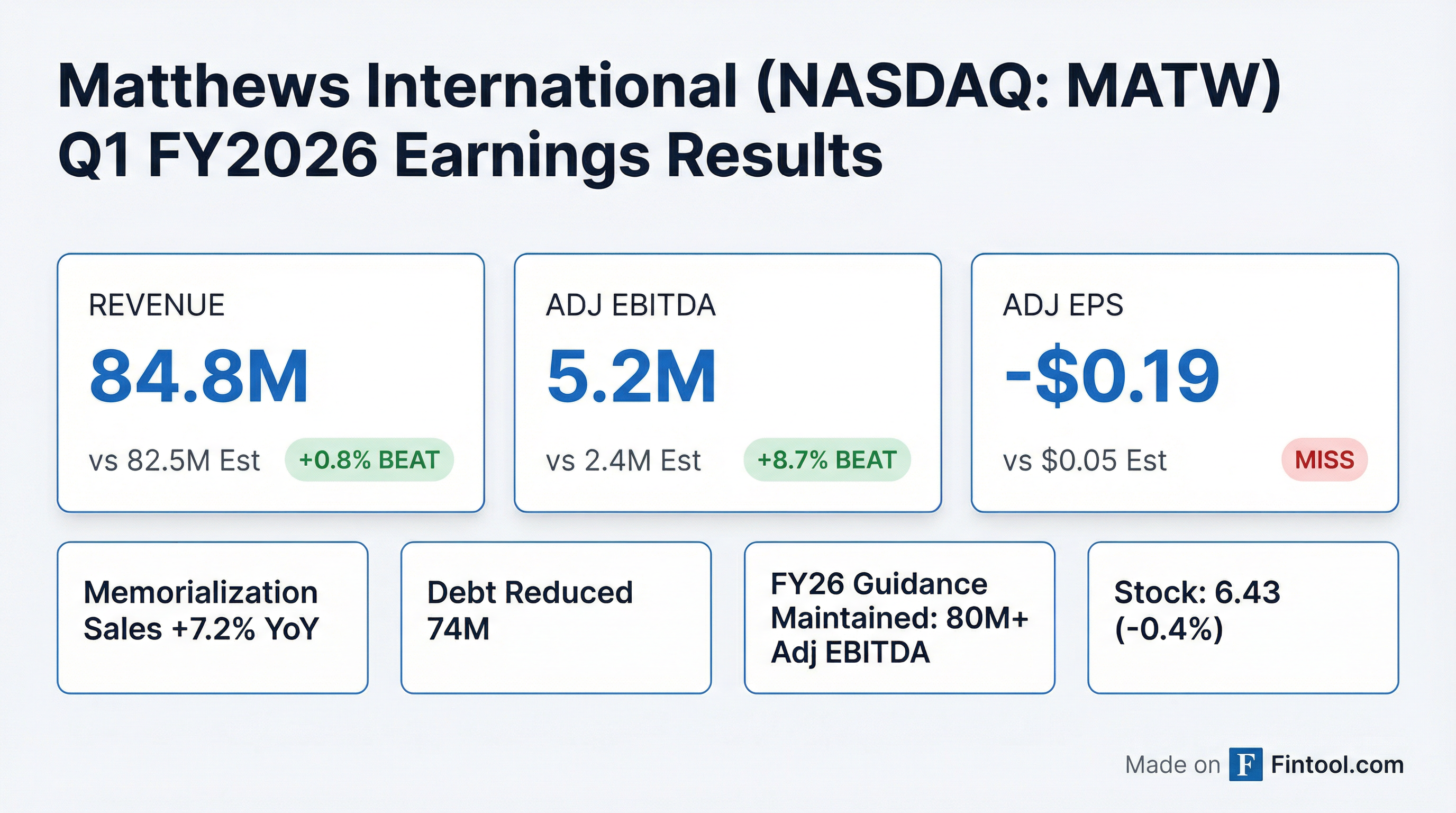

Matthews International (NASDAQ: MATW) reported Q1 FY2026 results, delivering a quarter CEO Joe Bartolacci characterized as "the successful execution of a strategic pivot." Revenue of $284M beat consensus by 0.8%, and adjusted EBITDA of $35.2M topped estimates, but adjusted EPS came in at -$0.19 versus $0.05 expected — a miss driven by Industrial Technologies losses and higher strategic costs.

The headline GAAP figure tells a different story: EPS of $1.39 versus a loss of $0.11 a year ago, powered by divestiture gains. The company achieved its leverage target of below 3x, reduced net debt to ~$500M, and expects $12M in annual interest savings from the $300M senior note redemption.

Did Matthews International Beat Earnings?

*Consensus estimates from S&P Global

The topline beat was modest but meaningful given the significant portfolio restructuring. Adjusted EBITDA margin improved despite the revenue decline from divestitures.

The adjusted EPS miss reflects ongoing challenges in Industrial Technologies, where the segment reported -$4.5M Adj EBITDA vs +$1.8M a year ago, driven by lower engineering sales.

What Changed From Last Quarter?

Several material developments this quarter:

1. Leverage Target Achieved — Below 3x

- Net debt reduced to ~$500M from $678M

- Warehouse automation sold for $225M (15x EBITDA, 11x after-tax)

- Saueressig European packaging exited for $41M total consideration

2. Debt Redemption — $12M Annual Savings

- Redeemed $300M of 8.625% Senior Secured Notes in January 2026

- Expected to increase annual cash flow by $12M

- "Reclaims capital that can now be deployed toward our dividend, internal innovation, and high-margin opportunities in memorialization"

3. Propelis Running Above Plan

- EBITDA run rate now "significantly higher than the $100M assumed at deal close"

- SAP migration will activate $20M in synergies

- Total synergy target exceeds $60M, much yet to be achieved

- Exit anticipated in 18-24 month window

4. Dodge Acquisition Highly Accretive

- Adjusted purchase price now closer to $50M (after asset sales, working capital reductions)

- EBITDA contribution over $12M = ~4x multiple

- Integration ahead of plan; commercial synergies just beginning

5. Axian Printhead Chip Debut

- Pack Expo launch generated "exceptionally strong" market response

- TAM expanded to $3B+ — now attracting thermal inkjet customers, not just CIJ

- 30-45 day shipment pause (electronic shielding added) now complete

6. Industrial Technologies Still Challenged

- Segment Adj EBITDA went negative: -$4.5M vs +$1.8M YoY

- Pipeline over $100M including $50M U.S. battery separator opportunity

- Samsung/LG publicly committing to DBE timelines (2028 full-scale production)

Segment Performance

Memorialization is now the clear earnings engine. Growth drivers:

- Dodge contribution: ~$10.4M revenue, cost synergies ahead of plan

- Higher casket and cemetery memorial volumes from active flu season

- Inflationary price realization

- Strong demand for mausoleum construction

Industrial Technologies remains the turnaround story. Management highlighted:

- Pipeline over $100M including $50M U.S. battery separator opportunity

- Orders expected to convert in H2 FY2026

- Axian printhead "exceptionally strong" Pack Expo response, TAM now $3B+

- Energy storage revenue guidance: $30-35M for FY2026

Brand Solutions now consists of Propelis (40% stake), reported on one-quarter lag:

- EBITDA run rate now "significantly higher" than $100M assumed at deal close

- SAP migration will unlock $20M synergies (part of $60M+ total target)

- Exit anticipated in 18-24 month window

How Did the Stock React?

MATW shares traded at $26.43 on the earnings release date, down 0.4% from the prior close. The muted reaction likely reflects:

- Mixed results (revenue beat, EPS miss)

- Divestiture gains were non-recurring and already announced

- FY26 guidance maintained (no raise despite beats)

The stock is up 43% from its 52-week low, reflecting investor confidence in the strategic transformation.

What Did Management Guide?

Management maintained FY2026 adjusted EBITDA guidance of at least $180 million, including their estimated 40% share of Propelis.

*FY2025 estimated based on quarterly data

Key guidance drivers:

- Memorialization: Full year contribution from Dodge acquisition expected to drive segment growth

- Industrial Technologies: Orders from battery electrode solutions anticipated in H2

- Propelis: On track for $60M synergies, with $20M coming from SAP migration alone

The strategic alternatives review remains ongoing, with management "principally focused on finding partnerships which will benefit shareholders by capturing the full value of our intellectual property."

Key Management Quotes

"Today, we aren't just reporting on a quarter, we are reporting on the successful execution of a strategic pivot. Over the last 12 months, we set a target to bring our leverage ratio below 3x. I am pleased to announce that following a series of actions, we've achieved our goal."

— Joseph C. Bartolacci, President and CEO

"Between the rising equity value and our $50 million preferred, including PIK interest of 10%, we view Propelis as a significant cash in waiting event."

— Joseph C. Bartolacci, President and CEO

"Samsung recently identified the 2026, 2027 timeframe as a pivotal period. Their CEO also spoke of a battery super cycle, where a period of demand growth will enable their next-generation technology platform, including solid-state batteries, to reach full-scale mass production."

— Joseph C. Bartolacci, President and CEO

Q&A Highlights

Key insights from the analyst Q&A:

On Propelis Value & Exit (Colin Rusch, Oppenheimer):

- Propelis is now running "well over $100 million" EBITDA — significantly above the $100M assumed at deal close

- 18-24 month exit window anticipated

- Preferred equity repayment could begin "possibly as soon as Q3"

On Memorialization (Dan Moore, CJS Securities):

- January was a difficult month due to weather, but expected to pick up in Feb/March

- Dodge adjusted purchase price now closer to $50M with $12M+ EBITDA contribution = ~4x multiple

- "We think we can make some highly accretive transactions" — M&A pipeline active

On Energy Solutions (Dan Moore, CJS Securities):

- Pipeline includes $50M U.S. battery separator line opportunity (passed technical efficacy)

- Several other opportunities totaling ~$50M in pipeline

- LG targeting full-scale DBE commercial production by 2028

On Axian/XIJ Product (Joe Bartolacci):

- 30-45 day shipment pause now complete (added electronic shielding)

- TAM expanded to over $3 billion — seeing interest from thermal inkjet customers, not just CIJ

- Strong pipeline from Pack Expo debut

On Pension (Joe Bartolacci):

- Pension liabilities now below $10M vs. $300M+ (with $125M unfunded) just a few years ago

- "Pretty proud of what we've had to do to get down there"

On Copper/Bronze Pricing (Liam Burke, B. Riley):

- Buy out about 6 months of copper inventory

- Price increases passed through but "moving faster than our price increases sometimes"

Balance Sheet & Capital Allocation

Leverage target achieved: Management set a goal 12 months ago to bring leverage below 3x — now complete.

$12M annual interest savings: Early redemption of $300M of 8.625% senior notes in January 2026 expected to boost annual cash flow by $12M.

Pension transformation: Liabilities now below $10M vs. $300M+ (with $125M unfunded) just a few years ago.

Dividend increased 2% to $0.255/share, payable February 23, 2026.

Risks and Concerns

1. Industrial Technologies Turnaround Uncertain

- "Timing of orders in our energy business is somewhat out of our control"

- North America and Europe battery capacity demand has slowed

- H2 order conversion is management expectation, not confirmed

2. Near-Term DBE Expectations Decreased

- "Our near-term expectations for the dry battery electrode market has decreased"

- Market pivoting toward chemistries where DBE provides greatest advantage

- LG/Samsung targeting 2028 for full-scale commercial production

3. January Weather Impact on Memorialization

- Month of January was "difficult" due to weather

- Management expects pickup in February/March

- "People still need to be buried, still need to be celebrated"

4. Copper/Bronze Pricing Pressure

- Copper prices moving faster than price increases

- Buy out ~6 months of inventory

- Opportunistic buying helps but doesn't fully offset

5. Elevated Tax Rate

- Foreign losses with no tax benefit impacted adjusted EPS

Forward Catalysts

The Bottom Line

As CEO Bartolacci put it: "Today, we aren't just reporting on a quarter, we are reporting on the successful execution of a strategic pivot." The company achieved its leverage target of below 3x, reduced net debt to ~$500M, and expects $12M in annual interest savings.

The Memorialization business is firing on all cylinders — Dodge is tracking to a 4x EBITDA multiple, volumes are growing from flu season demand, and mausoleum construction is strong. Meanwhile, Propelis is running above the $100M EBITDA assumed at deal close, with an 18-24 month exit window representing a "significant cash in waiting event."

The challenge remains Industrial Technologies, where management acknowledged "near-term expectations for the dry battery electrode market has decreased." However, with a $100M+ pipeline including a $50M U.S. opportunity that passed technical efficacy, and Samsung/LG publicly committing to 2028 commercial production, the long-term thesis remains intact.

For investors, the key questions are: (1) When will DBE orders convert? (2) When will Propelis preferred repayment begin? (3) Can Axian gain commercial traction at the $3B+ expanded TAM?

Earnings call: February 4, 2026 at 9:00 AM ET.

Related Links: