Earnings summaries and quarterly performance for MATTHEWS INTERNATIONAL.

Research analysts who have asked questions during MATTHEWS INTERNATIONAL earnings calls.

CR

Colin Rusch

Oppenheimer & Co. Inc.

10 questions for MATW

Also covers: AEVA, ALB, AMPX +25 more

JB

Justin Bergner

Gabelli Funds

10 questions for MATW

Also covers: AP, FSTR, GATX +1 more

Liam Burke

B. Riley Financial

8 questions for MATW

Also covers: ALTG, BWMN, CCEC +23 more

DM

Daniel Moore

CJS Securities, Inc.

4 questions for MATW

Also covers: BOWL, CHB, CVCO +18 more

DM

Dan Moore

B. Riley Securities

4 questions for MATW

Also covers: CHB, CVCO, CVLG +20 more

PL

Peter Lukas

CJS Securities

2 questions for MATW

Also covers: ACVA, BWXT, CENT +5 more

EK

Ethan Kalis

Bank of America

1 question for MATW

Stephen Percoco

Lark Research

1 question for MATW

Recent press releases and 8-K filings for MATW.

Matthews International Modifies Credit Facilities and Financial Covenants

MATW

Debt Issuance

Accounting Changes

- Matthews International Corporation entered into an Eighth Amendment to its Third Amended and Restated Loan Agreement on February 11, 2026, which reduced the aggregate principal amount available under the revolving credit facility from $750 million to $700 million.

- The amendment increased the aggregate principal amount available under the term loan facility to $150 million from $35 million, with a new maturity date of January 31, 2029, and allows for additional increases under the credit facility up to $250 million.

- New Interest Coverage Ratio covenants were established, requiring 2.50 to 1.00 for the quarter ending March 31, 2026, 2.75 to 1.00 for June 30, 2026, and 3.00 to 1.00 from September 30, 2026, onwards.

- The definition of EBIT, used in calculating the Leverage Ratio, was modified to include 50% of cash dividends or distributions paid to the US Borrower from the Propelis Joint Venture, subject to certain limitations.

Feb 17, 2026, 11:03 AM

Matthews Announces Transition in Controlling Equity Ownership and New Portfolio Managers

MATW

M&A

Management Change

- G. Paul Matthews and Mark Headley will acquire controlling ownership interest in Matthews International Capital Management, LLC, with other long-time partners also increasing their equity ownership.

- This ownership transition is subject to customary closing conditions, including board, regulatory, and shareholder approvals.

- Mark Headley has been named Portfolio Manager for the Matthews Pacific Tiger Fund and the Matthews Pacific Tiger Active ETF.

- Kathy Xu is joining Matthews as a Portfolio Manager in Hong Kong, effective March 9, 2026, to work alongside Mark Headley on the Pacific Tiger Fund and Active ETF.

Feb 13, 2026, 11:55 AM

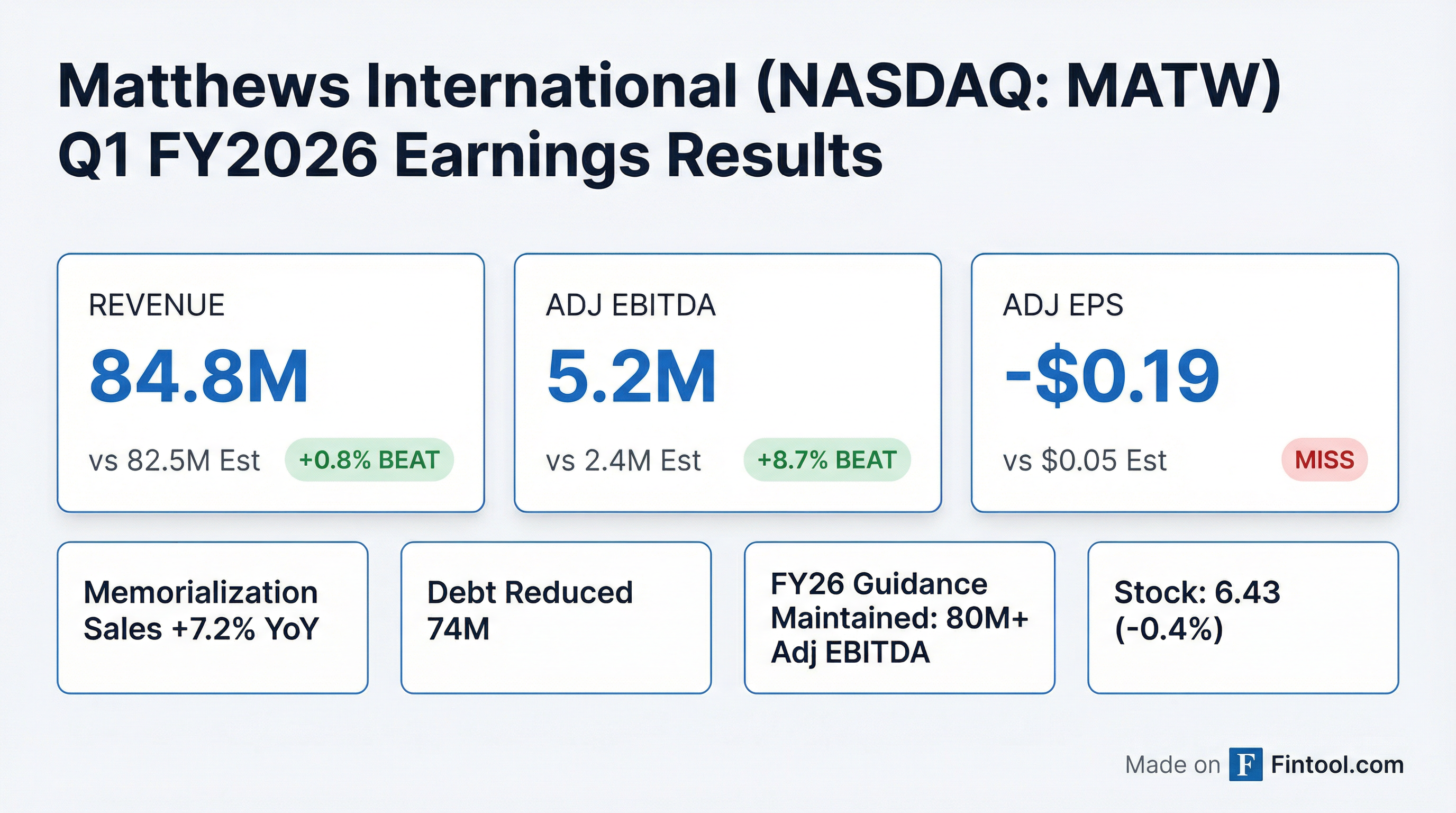

Matthews International Reports Q1 2026 Results and Strategic Balance Sheet Improvements

MATW

Earnings

M&A

Guidance Update

- Matthews International Corporation reported Q1 2026 net income of $43.6 million or $1.39 per share, and Adjusted EBITDA of $35.2 million. Total revenues were $285 million, primarily impacted by divestitures.

- The company significantly improved its balance sheet, reducing its leverage ratio to below 3x and net debt to approximately $500 million. This was achieved through the sale of its warehouse automation business for $225 million and Saueressig for $41 million, alongside the early redemption of $300 million in senior secured notes, which is expected to reduce annual interest expense by $12 million.

- For fiscal year 2026, the company projects Adjusted EBITDA of at least $180 million, including its 40% interest in Propelis, from which it anticipates receiving preferred equity repayment possibly as soon as Q3.

- The Memorialization segment demonstrated strong performance with sales increasing 7% year-over-year to $204.2 million and Adjusted EBITDA reaching $38.9 million, boosted by the Dodge acquisition and favorable market conditions.

Feb 4, 2026, 2:00 PM

Matthews International Reports Q1 2026 Results, Achieves Debt Reduction Target

MATW

Earnings

Guidance Update

M&A

- Matthews International reported Q1 2026 consolidated sales of $285 million and Adjusted EBITDA of $35.2 million, reflecting divestitures, while net income was $43.6 million, or $1.39 per share.

- The company successfully reduced net debt to approximately $500 million, bringing its leverage ratio below 3x, through the sale of its warehouse automation business for $225 million and Saueressig for $41 million, and the early redemption of $300 million in senior secured notes, which is expected to reduce annual interest expense by $12 million.

- The Memorialization segment's sales increased 7% year-over-year to $204.2 million, partly due to the Dodge acquisition.

- For fiscal 2026, Matthews expects Adjusted EBITDA guidance to be at least $180 million, including its 40% interest in Propelis, which is outperforming expectations with an EBITDA run rate significantly higher than the assumed $100 million.

Feb 4, 2026, 2:00 PM

Matthews International Reports Q1 Fiscal 2026 Results and Achieves Debt Reduction Goal

MATW

Earnings

M&A

Debt Issuance

- Matthews International reported Q1 Fiscal 2026 net income of $43.6 million ($1.39 per share) and consolidated sales of $285 million, with adjusted EBITDA of $35.2 million.

- The company achieved its goal of reducing its leverage ratio to below 3x and net debt to approximately $500 million. This was driven by the sale of its warehouse automation business for $225 million and Saueressig for $41 million, alongside the early redemption of $300 million in senior secured notes, projected to reduce annual interest expense by $12 million.

- For fiscal 2026, the company anticipates adjusted EBITDA of at least $180 million, including its 40% interest in Propelis, which is outperforming expectations and may provide preferred equity repayment by Q3.

- The Memorialization segment's sales increased 7% year-over-year to $204.2 million, boosted by the Dodge acquisition and higher casket volumes. Conversely, Industrial Technologies sales declined 14% to $69 million, mainly due to lower energy solutions sales and divestitures.

Feb 4, 2026, 2:00 PM

Matthews International Corporation Announces Q1 2026 Results

MATW

Earnings

Guidance Update

M&A

- Matthews International Corporation reported Q1 2026 sales of $284.8 million, diluted earnings per share of $1.39, and adjusted EBITDA of $35.2 million.

- The company significantly reduced its outstanding debt by $174 million in Q1 2026, primarily utilizing proceeds from the divestiture of the Warehouse business on December 31, 2025, and the SGK Business on May 1, 2025.

- The Memorialization segment's sales increased due to the acquisition of The Dodge Company, while the Industrial Technologies segment's adjusted EBITDA decreased due to lower engineering sales and customer delays.

- Matthews is maintaining its fiscal 2026 adjusted EBITDA guidance of at least $180 million, which includes its estimated 40% share of Propelis and income from preferred equity investment.

Feb 4, 2026, 2:00 PM

Matthews International Reports Strong Q1 2026 GAAP EPS Driven by Divestitures and Debt Reduction

MATW

Earnings

M&A

Guidance Update

- Matthews International Corporation reported GAAP diluted earnings per share of $1.39 for the fiscal 2026 first quarter, a significant improvement from a loss of $0.11 a year ago, primarily driven by a net gain on divestitures.

- The company reduced its consolidated outstanding debt by $174 million during the quarter, including the redemption of $300 million of 8.625% Notes due 2027, following cash proceeds of $225.4 million from the sale of the warehouse automation business.

- Total sales for Q1 2026 were $284.8 million, a decrease from $401.8 million in Q1 2025, largely due to divestitures, though the Memorialization segment reported higher sales of $204.2 million.

- Adjusted EBITDA for the quarter was $35.2 million, down from $40.0 million in the prior year, and non-GAAP adjusted EPS was $(0.19) compared to $0.14 in Q1 2025.

- Matthews International is maintaining its fiscal 2026 outlook for adjusted EBITDA of at least $180 million.

Feb 4, 2026, 1:31 PM

Matthews International Reports Strong Fiscal 2026 First Quarter Results and Debt Reduction

MATW

Earnings

Guidance Update

M&A

- Matthews International reported GAAP earnings per share of $1.39 for the fiscal 2026 first quarter, a significant improvement from a loss of $0.11 a year ago.

- The company reduced its consolidated outstanding debt by $174 million and redeemed $300 million of 8.625% Notes due 2027, primarily utilizing proceeds from the divestiture of its warehouse automation business, which generated $225.4 million in cash.

- The Memorialization segment reported higher sales and adjusted EBITDA for the quarter, while the Industrial Technologies segment experienced a sales decline due to challenges including the Tesla dispute.

- Matthews International maintained its fiscal 2026 outlook for adjusted EBITDA of at least $180 million.

Feb 3, 2026, 9:15 PM

Matthews International Reaches Agreement with Barington Capital

MATW

Board Change

Legal Proceedings

Proxy Vote Outcomes

- Matthews International Corporation (MATW) reached an agreement with Barington Capital and its affiliates on January 15, 2026, resolving a potential proxy contest.

- Under the agreement, Barington Capital will withdraw its proposed director nominations for the 2026 annual meeting of shareholders.

- The Barington Parties have committed to vote their beneficially owned shares in accordance with the Board's recommendations on all proposals, with certain exceptions, from the agreement date through the Company's 2028 annual meeting of shareholders.

- The agreement also includes standstill provisions and other restrictions on the Barington Parties, and MATW will make a one-time lump sum payment to reimburse Barington Equity for certain fees and expenses.

Jan 15, 2026, 9:31 PM

Matthews International Reaches Agreement with Barington Capital

MATW

Board Change

Proxy Vote Outcomes

- Matthews International Corporation has reached an agreement with Barington Capital, resulting in Barington's withdrawal of its previously submitted director nominations.

- The agreement follows engagement between the parties on topics including Matthews' ongoing strategic review and corporate governance enhancements.

- Matthews' President and CEO, Joseph C. Bartolacci, noted that the company has taken decisive steps over the past 12 months to simplify its business mix, strengthen its balance sheet, and enhance its board composition and corporate governance.

- Barington's Chairman, President and CEO, James A. Mitarotonda, stated that Matthews' continuing strategic review, value creation plan, and corporate governance changes are critical for achieving greater near- and long-term value for all shareholders.

Jan 15, 2026, 9:15 PM

Quarterly earnings call transcripts for MATTHEWS INTERNATIONAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more