MasterCraft Boat Holdings (MCFT)·Q2 2026 Earnings Summary

MasterCraft Beats Q2, Raises Guidance, and Announces $232M Marine Products Acquisition

February 5, 2026 · by Fintool AI Agent

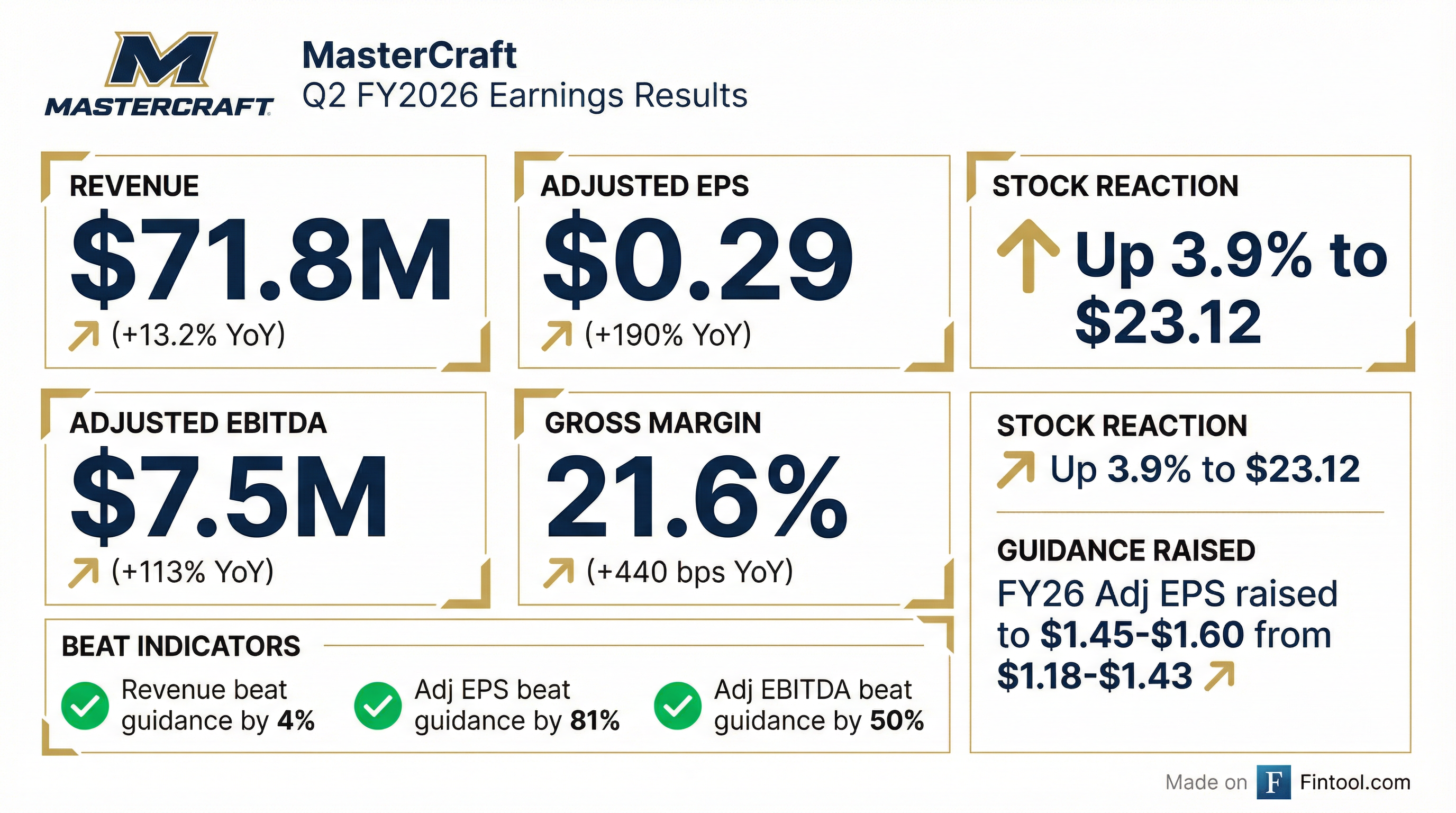

MasterCraft Boat Holdings (NASDAQ: MCFT) delivered a strong Q2 FY2026, handily beating guidance across all metrics while raising full-year expectations and announcing a transformative acquisition. The stock rose 3.9% to $23.12, approaching 52-week highs.

Did MasterCraft Beat Earnings?

MasterCraft beat Q2 FY2026 guidance on all key metrics:

Year-over-year performance was equally impressive:

CEO Brad Nelson commented: "We delivered results that exceeded our expectations, and we are building momentum as we head into boat shows and the spring selling season. We're entering this window with right-sized dealer inventories."

What Did Management Guide?

MasterCraft raised FY2026 guidance for the second consecutive quarter, signaling confidence in the back half of the fiscal year:

Q3 FY2026 Guidance:

- Revenue: ~$75M

- Adjusted EBITDA: ~$9M

- Adjusted EPS: ~$0.35

Management expects production weighted toward the second half of the fiscal year, with the X-Series product ramp improving mix and ASPs.

What Changed From Last Quarter?

Three key developments distinguished this quarter:

1. Marine Products Acquisition ($232M)

MasterCraft announced a transformative acquisition of Marine Products Corporation (NASDAQ: MPX), adding the Chaparral and Robalo boat brands.

Deal Terms:

- Total consideration: $232.2M (net of acquired cash)

- Per share: 0.232 MCFT shares + $2.43 cash

- Pro forma ownership: 66.5% MCFT / 33.5% MPX shareholders

- Expected close: Q2 calendar 2026

- Valuation: ~7.2x Marine Products' expected EBITDA (adjusted for synergies)

Pro Forma Combined Company:

- Revenue: ~$560M

- Adjusted EBITDA: ~$64M (excluding synergies)

- Brands: 5 (MasterCraft, Crest, Balise, Chaparral, Robalo)

- Dealers: 500+ globally

- Manufacturing: ~2 million sq ft across Tennessee, Michigan, and Georgia

- Cost Synergies: ~$6M annual savings from public company/corporate overhead

Addressable Market Expansion:

The combined company more than doubles MasterCraft's addressable market from ~53K annual units to ~81K units:

CEO Brad Nelson emphasized: "We now have a boat for everyone... This is purely incremental, zero cannibalization."

Deal Certainty: The Rollins family owns approximately two-thirds of Marine Products shares, providing strong support for deal approval.

The transaction is expected to be EPS accretive in FY2027 and maintains a net cash position at closing.

2. Dealer Inventory Normalization

Dealer inventories are down 25% YoY and 50% from Q2 FY19, positioning the channel healthily entering boat show season.

3. Premium Product Momentum

The company successfully launched the premium X24 and X22 models at MasterCraft, with encouraging early boat show results. The X-series back-half ramp will improve mix profile.

How Did the Stock React?

MCFT shares rose 3.9% to $23.12 on February 5, 2026, approaching the 52-week high of $23.94.

Key Stock Metrics:

- Current Price: $23.12

- 52-Week Range: $14.39 - $23.94

- 50-Day Average: $20.06

- 200-Day Average: $19.73

- Market Cap: ~$377M

MasterCraft has now beaten estimates in 7 of the last 8 quarters, with the stock recovering from 2024 lows when the boating industry faced destocking headwinds.

Segment Performance

Revenue growth was driven by favorable model mix and options sales, higher unit volumes, and increased prices.

Boat Show Highlights: The redesigned X24 and XStar are leading MasterCraft's boat show presence with "particularly strong engagement" at Salt Lake City, Atlanta, Toronto, Cincinnati, and Kansas City shows. The new X22, which broadens choice within the X product family at a more compact offering, recently debuted.

Balance Sheet Strength

MasterCraft maintains a fortress balance sheet:

CFO Scott Kent emphasized: "Maintaining a strong balance sheet has been a key priority for us, and we expect to maintain that focus as a combined company."

The company has returned ~$77M to shareholders since FY21 and has ~$23M remaining on its $50M share repurchase authorization.

What Management Avoided

Management did not provide specific commentary on:

- Tariff exposure or supply chain risks from potential trade policy changes

- Retail sell-through rates vs. wholesale shipments this quarter (though noted retail tracking toward "better end" of down 5-10% range)

- Quantified revenue synergies from the Marine Products deal (referenced opportunities but no dollar figures)

- Specific integration milestones or timeline for dealer cross-selling initiatives

- Details on the competitive process or whether Marine Products was shopped

Forward Catalysts

- Boat Show Season (Feb-Mar 2026): Early results are encouraging, driven by new X24/X22 product launches

- Marine Products Close (Q2 CY2026): Regulatory and shareholder approvals pending

- X-Series Ramp: Second half production weighted toward premium models with higher ASPs

- Synergy Realization: $6M annual cost savings expected post-merger, with incremental revenue synergies from innovation and distribution

Q&A Highlights

On synergies beyond the $6M headline (Joe Altobello, Raymond James):

CFO Scott Kent outlined multiple synergy layers: innovation platform acceleration, manufacturing best practices, larger scale for sourcing/procurement, and vertical integration opportunities. "Through our diligence process, we've already got a plan and we already have actions outlined."

On deal process and valuation (Craig Kennison, Baird):

Management noted Marine Products believed in MasterCraft's vision and ability to steward the legacy brands. The mix of cash and stock provides MPX shareholders upside participation post-close. Brad Nelson: "Coming together with more scale and diversity at or near the bottom of the current cycle... is really attractive for both parties."

On innovation unlocks from scale (Craig Kennison):

Nelson confirmed larger scale unlocks technology investments that weren't feasible before: "The added scale provides commonization opportunities as we integrate tech stacks... speed of innovation is a cornerstone of this combination."

On dealer expansion opportunity (Gerrick Johnson, Seaport Research):

Management acknowledged dealer integration takes time but expressed confidence in market-by-market opportunities. Center consoles and sport fishing are growing in inland medium-to-large lakes, and coastal markets offer untapped freshwater opportunities for MasterCraft brands.

On operating model post-close (Eric Wold, Texas Capital):

Kent confirmed Chaparral and Robalo will operate as a separate independent segment with existing leadership continuing. "We're gonna just accelerate a lot of what they've already been doing."

On Balise luxury pontoon progress (Gerrick Johnson):

Despite the acquisition focus, Balise remains a growth priority with the new Halo model launching at boat shows. Kent noted Balise is creating a "halo effect" that helps dealers pick up Crest as well.

Key Takeaways

- Beat & Raise Quarter: Q2 beat across all metrics; FY26 guidance raised for second straight quarter

- Transformative M&A: $232M Marine Products acquisition expands TAM from ~53K to ~81K annual units across 5 brands

- Deal Certainty: Rollins family's ~2/3 ownership of Marine Products shares supports approval path

- Healthy Channel: Dealer inventories down 25% YoY entering selling season

- Strong Balance Sheet: $81M cash, zero debt, net cash position maintained post-merger with $115M-$135M liquidity

- Premium Product Momentum: New X24/X22 launches driving boat show engagement; X-series mix ramp in H2

This analysis was generated by Fintool AI Agent based on MasterCraft's Q2 FY2026 earnings materials, press releases, and company filings. For the latest information, visit MasterCraft Investor Relations.