Earnings summaries and quarterly performance for MasterCraft Boat Holdings.

Executive leadership at MasterCraft Boat Holdings.

Board of directors at MasterCraft Boat Holdings.

Research analysts who have asked questions during MasterCraft Boat Holdings earnings calls.

Craig Kennison

Robert W. Baird & Co. Incorporated

9 questions for MCFT

Eric Wold

B. Riley Securities

8 questions for MCFT

Anna Glaessgen

B. Riley Securities

5 questions for MCFT

Joseph Altobello

Raymond James & Associates, Inc.

5 questions for MCFT

Noah Zatzkin

KeyBanc Capital Markets

5 questions for MCFT

Adam Fox

Truist Securities

2 questions for MCFT

Andrew Crum

Stifel, Nicolaus & Company, Incorporated

2 questions for MCFT

Gerrick Johnson

Seaport Research

2 questions for MCFT

Gregory Miller

Truist Securities

2 questions for MCFT

Martin Mitela

Raymond James & Associates, Inc.

2 questions for MCFT

Griffin Bryan

D.A. Davidson & Co.

1 question for MCFT

Kevin Condon

Robert W. Baird & Co. Incorporated

1 question for MCFT

Michael Swartz

Truist Securities

1 question for MCFT

Recent press releases and 8-K filings for MCFT.

- Monteverde & Associates PC is investigating MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) in connection with its merger with Marine Products Corporation.

- Upon the completion of the proposed transaction, MasterCraft shareholders are expected to own 66.5% of the combined company.

- MasterCraft Boat Holdings, Inc. (MCFT) has entered into an Agreement and Plan of Merger to acquire Marine Products Corporation.

- The acquisition is structured as a two-step merger and is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

- The MasterCraft Boat Holdings, Inc. Board of Directors has unanimously approved the merger and recommended stockholder approval for the Parent Common Share Issuance required for the transaction.

- Concurrently, MasterCraft Boat Holdings, Inc. also entered into a Stockholders Agreement, a Voting Agreement, and a Fifth Amendment to its Credit Agreement on February 5, 2026, in connection with the merger.

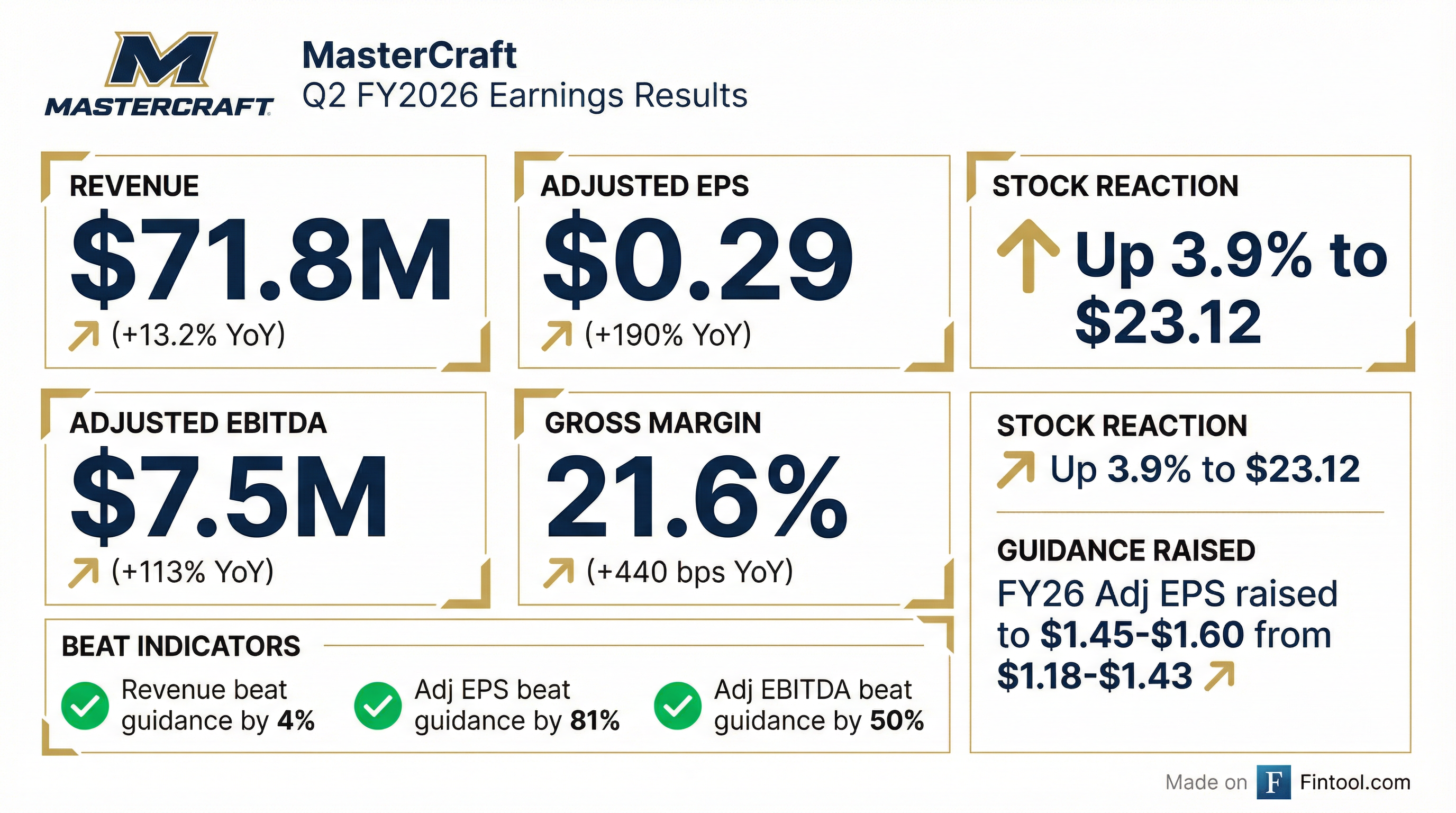

- MasterCraft Boat Holdings reported Q2 fiscal 2026 net sales of $71.8 million, a 13.2% increase year-over-year, and adjusted diluted EPS of $0.29.

- The company raised its full-year fiscal 2026 guidance, now projecting consolidated net sales between $300 million and $310 million, adjusted EBITDA between $36 million and $39 million, and adjusted EPS between $1.45 and $1.60.

- MasterCraft Boat Holdings entered a definitive agreement to combine with Marine Products Corporation, where Marine Products shareholders will receive 0.232 shares of MasterCraft stock and $2.43 in cash per share.

- This $232.2 million transaction is expected to close in calendar Q2 2026, with MasterCraft shareholders owning 66.5% of the combined company.

- The combination is anticipated to yield approximately $6 million in annual cost savings and be accretive to adjusted EPS in fiscal 2027, forming a diversified marine platform with no debt post-close.

- MasterCraft Boat Holdings reported Q2 fiscal 2026 net sales of $71.8 million, a 13.2% increase year-over-year, and adjusted EBITDA of $7.5 million, up from $3.5 million in the prior year, resulting in an adjusted EBITDA margin of 10.4%.

- The company raised its full-year fiscal 2026 guidance, now expecting consolidated net sales between $300 million and $310 million, adjusted EBITDA between $36 million and $39 million, and adjusted earnings per share between $1.45 and $1.60.

- MasterCraft Boat Holdings entered into a definitive agreement to combine with Marine Products Corporation, with MasterCraft shareholders owning 66.5% and Marine Products shareholders owning 33.5% of the combined company.

- Marine Products Corporation shareholders are expected to receive 0.232 shares of MasterCraft Boat Holdings stock and $2.43 of cash per Marine Products Corporation share, representing a total cash consideration of $86 million and a transaction value of $232.2 million.

- The transaction is expected to close in calendar Q2 of 2026 and is anticipated to achieve approximately $6 million in annual cost savings by eliminating Marine Products' public company costs and corporate overhead.

- MasterCraft Boat Holdings, Inc. (MCFT) reported strong financial results for Q2 FY26, with net sales of $71.8 million, representing a 13.2% increase from Q2 FY25, and diluted adjusted net income per share of $0.29, up $0.19 per share from Q2 FY25.

- The company provided FY 2026 guidance, projecting net sales between $300 million and $310 million and adjusted diluted EPS between $1.45 and $1.60.

- MCFT announced a proposed acquisition of Marine Products, with Marine Products shareholders set to receive 0.232 MasterCraft Boat Holdings, Inc. shares and $2.43 in cash consideration per Marine Products share, valuing the transaction at $232.2 million net of acquired cash.

- The combined company is expected to achieve pro forma combined net sales of approximately $560 million and adjusted EBITDA of approximately $64 million for FY 2026, excluding cost savings and synergies, and the transaction is anticipated to be accretive to adjusted EPS in Fiscal 2027.

- The transaction, which has been unanimously approved by the Boards of Directors of both companies, is expected to close in the second quarter of calendar 2026, pending customary closing conditions, including regulatory and shareholder approvals.

- MasterCraft Boat Holdings reported strong fiscal Q2 2026 results, with net sales increasing 13.2% year-over-year to $71.8 million and adjusted EBITDA rising to $7.5 million.

- The company raised its full-year fiscal 2026 guidance, now expecting consolidated net sales between $300 million and $310 million, adjusted EBITDA between $36 million and $39 million, and adjusted EPS between $1.45 and $1.60.

- MasterCraft Boat Holdings announced a definitive agreement to combine with Marine Products Corporation, a transaction valued at $232.2 million.

- Under the terms, Marine Products shareholders will receive 0.232 shares of MasterCraft stock and $2.43 in cash per share, with MasterCraft shareholders owning 66.5% of the combined entity.

- The combination is expected to generate approximately $6 million in annual cost savings and be accretive to adjusted EPS in fiscal 2027, expanding the company's market reach and product offerings across five brands and over 500 dealers.

- MasterCraft Boat Holdings, Inc. reported net sales of $71.8 million for the fiscal second quarter ended December 28, 2025, a 13.2% increase from the prior-year period, with Adjusted Net Income of $4.7 million, or $0.29 per diluted share.

- The company announced the acquisition of Marine Products Corporation in a cash and stock transaction valued at approximately $232.2 million, net of acquired cash. Marine Products shareholders will receive $2.43 per share in cash and 0.232 shares of MasterCraft common stock.

- The acquisition is expected to close in the second calendar quarter of 2026 and is anticipated to be accretive to adjusted EPS in Fiscal 2027.

- MasterCraft raised its full-year fiscal 2026 guidance, now expecting consolidated net sales between $300 million and $310 million, Adjusted EBITDA between $36 million and $39 million, and Adjusted Earnings per share between $1.45 and $1.60.

- MasterCraft Boat Holdings, Inc. (MCFT) announced it will acquire Marine Products Corporation (MPX) in a cash and stock transaction valued at approximately $232.2 million, net of acquired cash.

- Marine Products shareholders will receive $2.43 per share in cash and 0.232 shares of MasterCraft common stock for each share they own, implying a value of $7.79 per Marine Products share based on MasterCraft's closing share price of $23.12 on February 4, 2026.

- The transaction is expected to be accretive to Adjusted EPS in Fiscal 2027 and is anticipated to close in the second calendar quarter of 2026.

- On a pro forma basis for the twelve months ending June 30, 2026, the combined company is expected to generate net sales of approximately $560 million and adjusted EBITDA of approximately $64 million.

- MasterCraft Boat Holdings, Inc. reported net sales of $71.8 million for its fiscal 2026 second quarter ended December 28, 2025, an increase of 13.2% from the comparable prior-year period.

- Income from continuing operations for the quarter was $2.5 million, or $0.15 per diluted share, significantly up from $0.4 million, or $0.03 per diluted share, in the prior-year period.

- The company announced it has entered into a definitive agreement to acquire Marine Products Corporation in a cash and stock transaction, which is expected to close in the second calendar quarter of 2026.

- MasterCraft is raising its full-year fiscal 2026 guidance, now expecting consolidated net sales between $300 million and $310 million, Adjusted EBITDA between $36 million and $39 million, and Adjusted Earnings per share between $1.45 and $1.60.

- MasterCraft Boat Holdings Inc. reported Q1 2026 net sales of $69 million, a 5.6% increase year-over-year, and adjusted EBITDA of $6.7 million, up from $3.8 million in the prior year, with a 9.7% margin.

- The company raised its full-year fiscal 2026 guidance, now expecting consolidated net sales between $295 million and $310 million, adjusted EBITDA between $30 million and $35 million, and adjusted earnings per share between $1.18 and $1.43.

- MasterCraft launched the X24, the first model of the all-new X family, and introduced the Conquest SE and the Halo in its pontoon segment, contributing to strong dealer and consumer response.

- The company repurchased over 100,000 shares totaling $2.3 million in Q1 2026, reflecting its commitment to returning capital to shareholders, and ended the quarter with $67.3 million in cash and short-term investments and no debt.

- Despite continued retail variability and an industry-wide decline, MasterCraft maintains its expectation for the MasterCraft segment's retail to be down 5% to 10% for the full year, while gaining market share in Q1.

Quarterly earnings call transcripts for MasterCraft Boat Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more