MICROCHIP TECHNOLOGY (MCHP)·Q3 2026 Earnings Summary

Microchip Beats on EPS by 32%, Guides Q4 Above Street—Stock Falls in After-Hours

February 5, 2026 · by Fintool AI Agent

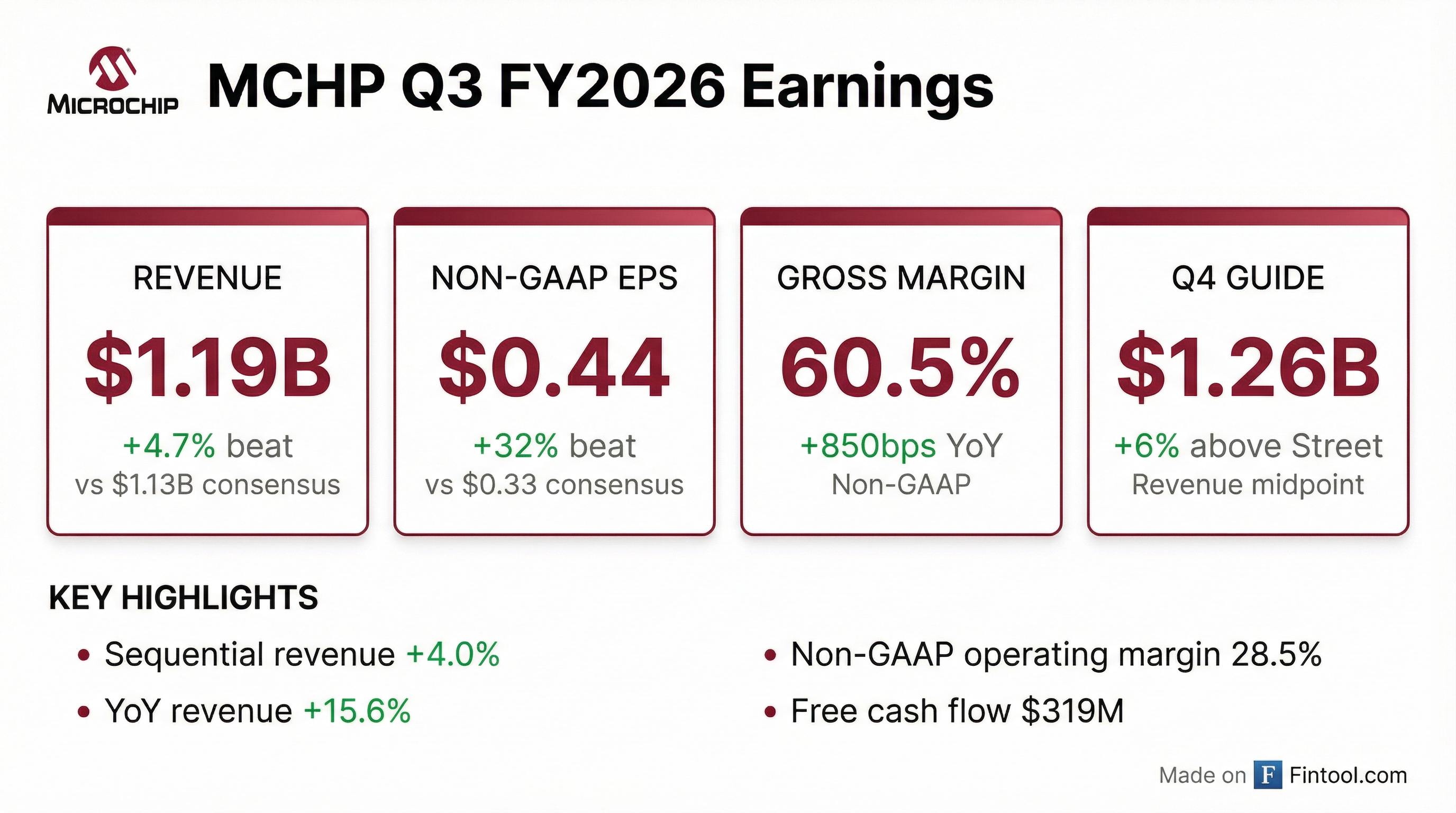

Microchip Technology (NASDAQ: MCHP) delivered a strong Q3 FY2026, beating revenue by 4.7% and crushing EPS estimates by 32% as its recovery accelerates. The company guided Q4 revenue 6% above consensus and announced three new PCIe Gen 6 design wins—including one expected to generate $100M+ in CY2027. Despite the bullish call, shares fell 3.5% in after-hours trading to $75.39, likely reflecting profit-taking after an 85% rally from 52-week lows.

Did Microchip Beat Earnings?

Yes—and it wasn't close. Microchip delivered one of its strongest beats in recent quarters:

*Values retrieved from S&P Global.

Revenue grew 4.0% sequentially and 15.6% year-over-year, well above original guidance. Non-GAAP operating profit grew faster than revenue, highlighting operational leverage.

What Did Management Guide?

Q4 FY2026 guidance came in meaningfully above Street expectations:

*Values retrieved from S&P Global.

CEO Steve Sanghi emphasized: "Our March quarter starting backlog is substantially better than the December quarter levels, and our booking momentum remains strong."

The midpoint implies 6.2% sequential growth and 29.8% year-over-year growth—a significant acceleration.

What Changed From Last Quarter?

The recovery is accelerating across multiple dimensions:

Margin Expansion Accelerating

CFO Eric Bjornholt noted: "Non-GAAP gross margins have expanded significantly from 52% in the March 2025 quarter to 60.5% this quarter, reflecting the cumulative impact of our operational improvements."

Management's long-term gross margin target is 65%.

Cash Flow and Debt

Bjornholt highlighted: "Our operating cash flow resumed covering our debt obligations and dividend payments. We remain focused on debt reduction as a priority."

Inventory and Distribution Normalization

Sanghi noted the narrowing sell-in/sell-through gap is "a sign that the distribution inventory has largely corrected."

How Did the Stock React?

Despite the strong beat and raised guidance, MCHP fell ~3.5% in after-hours trading:

The sell-off may reflect:

- Profit-taking: Stock has rallied 85% from its 52-week low of $34.13

- Macro caution: Management noted "maintaining a disciplined approach given the evolving macro environment"

- Expectations reset: Stock was near 52-week highs heading into the print

Key Business Highlights

PCIe Gen 6 Design Wins — Data Center Momentum

CEO Steve Sanghi announced three new PCI Express Gen 6 switch design wins on the call:

Sanghi emphasized: "We believe we are extremely well positioned with our Gen 6 PCIe switch, with it being the only 3 nanometer-based device currently sampling in hyperscaler and enterprise data center customers, beating our competitors in virtually every specification metric."

Management noted they are "working on some mega design wins" that could make the $100M win "look small."

Automotive Ethernet — Hyundai Motor Group Collaboration

The company announced a strategic collaboration with Hyundai Motor Group to integrate Microchip's 10BASE-T1S solutions into next-generation vehicle platforms.

VP Matthias Kaestner outlined the opportunity: "Ethernet, in particular the new 10BASE-T1S standard, has the potential to replace several billion automotive legacy connectivity nodes per year... The TAM for automotive and industrial Ethernet connectivity together represents tens of billions of dollars by 2030."

Design cycles are 18-24 months, with pilot production ramps expected in H2 2026 and further ramps into 2027.

Memory Business — Gaining Share

Sanghi revealed an unexpected tailwind: "High-bandwidth memory is really constrained... A lot of our competitors, especially in Asia, are moving that serial EE square capacity into the broader flash memory. And therefore, we're picking up market share."

This shortage "isn't going away anytime soon. It could be a couple year phenomena."

Capital Allocation — Debt Paydown Priority

Management was candid about their capital allocation strategy shift:

"We are honestly spooked by this last cycle, how difficult this cycle was and how close we came with a high level of debt... We're going to be bringing down debt for quite some time and keep the dividend flat and not do any buyback till the debt has come down significantly." — CEO Steve Sanghi

Q&A Highlights

"Book-to-Bill Well Above One"

The booking momentum is accelerating rapidly:

- Book-to-bill ratio was "well above one" in Q3, resulting in a "much higher backlog" entering Q4

- January bookings were "extremely strong" — "uncharacteristic" strength for a month that typically starts slow

- June quarter backlog is already higher today than March backlog was at the same point (Nov 5 vs Feb 5)

- Customers "kept booking parts through the holidays" — Thanksgiving, Christmas, and New Year didn't slow momentum

Lead Times and Supply Constraints

The supply/demand balance is tightening:

Sanghi noted: "Relatively soon, in a quarter or so, we'll be facing a situation where customer is more worried about availability than price."

Inventory Normalization Complete

- Distribution inventory at 28 days — now in "normal" range

- Sell-in vs sell-through gap shrank to only $11.7M (down from $52.9M in Q2) — "a sign that the distribution inventory has largely corrected"

- Inventory reserves expected to normalize in Q4

- Underutilization charges (~$50M) will take "a couple year process" to fully work off

Path to 65% Gross Margin

CFO Eric Bjornholt provided gross margin guidance:

"I don't want the Street to get ahead of where they should be... it would not be our expectation that this next fiscal year, that we can get to that mid-sixties. I think it's gonna be steady growth from where we're at."

Two drivers for margin expansion: (1) underutilization coming down as factories ramp, and (2) mix richening as high-margin products (PCIe, FPGA, networking) grow faster.

Aerospace & Defense Tailwinds

Sanghi highlighted multiple A&D growth vectors:

- U.S. defense budget — "one of the largest... Microchip is in every offensive and defensive weapon"

- European NATO expansion — countries "doubling or tripling their defense budget"

- Commercial aerospace — Boeing MAX production ramping

- Space — SpaceX, other new space companies, India's lunar mission all use Microchip products

Beat/Miss History

Microchip has beaten EPS estimates in 7 of the last 9 quarters:

*Values retrieved from S&P Global.

Forward Catalysts

- PCIe Gen 6 data center ramp — $100M+ design win going to production Q1 2027, with "mega design wins" in pipeline

- Automotive Ethernet adoption — Hyundai Motor Group collaboration, pilot production H2 2026

- June quarter — Backlog already higher than March was at same point; management "fairly optimistic"

- Gross margin expansion — Steady progress toward 65% through mix enrichment and utilization

- Memory market share gains — Competitors shifting capacity creates multi-year tailwind

- A&D strength — NATO expansion, Boeing MAX ramp, space exploration driving demand

Risks Flagged

- Pricing pressure relief delayed: Lead times still "relatively in check" — restocking hasn't begun yet

- Capacity constraints spreading: Substrates, subcontracting, advanced node foundry all tightening

- High leverage: Net debt/EBITDA at 4.18x limits capital flexibility

- Utilization headwind: $50M+ quarterly underutilization charges will take "couple years" to work off

- Chinese New Year unknown: Management watching for demand impact next week

The Bottom Line

Microchip delivered an impressive Q3 with revenue and EPS beats, guided Q4 well above consensus, and is now clearly in upcycle mode. The earnings call was unambiguously bullish:

- Bookings accelerating through holidays and into January

- June backlog already ahead of March at the same point

- Lead times tightening with constraints spreading

- Three new PCIe Gen 6 wins including a $100M+ opportunity

- Hyundai Motor Group partnership for automotive Ethernet

The after-hours selloff appears driven by profit-taking rather than fundamental concerns. Management's candid admission of being "spooked" by the last cycle's leverage suggests a more conservative balance sheet approach going forward—debt reduction will take priority over buybacks.

Watch for the June quarter guide (likely April/May) to confirm whether this momentum sustains through Chinese New Year.

Earnings call completed February 5, 2026. Full transcript available