Earnings summaries and quarterly performance for MICROCHIP TECHNOLOGY.

Executive leadership at MICROCHIP TECHNOLOGY.

Board of directors at MICROCHIP TECHNOLOGY.

Research analysts who have asked questions during MICROCHIP TECHNOLOGY earnings calls.

Blayne Curtis

Jefferies Financial Group

9 questions for MCHP

Vivek Arya

Bank of America Corporation

9 questions for MCHP

Harlan Sur

JPMorgan Chase & Co.

8 questions for MCHP

Harsh Kumar

Piper Sandler & Co.

7 questions for MCHP

Joshua Buchalter

TD Cowen

6 questions for MCHP

Timothy Arcuri

UBS

6 questions for MCHP

Vijay Rakesh

Mizuho

6 questions for MCHP

William Stein

Truist Securities

6 questions for MCHP

Chris Caso

Wolfe Research LLC

5 questions for MCHP

Tore Svanberg

Stifel Financial Corp.

5 questions for MCHP

Christopher Rolland

Susquehanna Financial Group

4 questions for MCHP

James Schneider

Goldman Sachs

4 questions for MCHP

Janet Ramkissoon

Quadra Capital

4 questions for MCHP

Joseph Moore

Morgan Stanley

4 questions for MCHP

Christopher Caso

Wolfe Research

3 questions for MCHP

Christopher Danely

Citigroup Inc.

3 questions for MCHP

Quinn Bolton

Needham & Company, LLC

3 questions for MCHP

Chris Danely

Citi

2 questions for MCHP

Chris Stanley

Citi

2 questions for MCHP

Craig Ellis

B. Riley Securities

2 questions for MCHP

Joe Quatrochi

Wells Fargo

2 questions for MCHP

Matthew Prisco

Cantor Fitzgerald

2 questions for MCHP

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for MCHP

Chris Casso

Wolfe Research

1 question for MCHP

Joe Moore

Morgan Stanley

1 question for MCHP

Recent press releases and 8-K filings for MCHP.

- On February 9, 2026, Microchip Technology announced its intention to offer $600 million aggregate principal amount of convertible senior notes due 2030 in a private placement to qualified institutional buyers under Rule 144A, with an option for initial purchasers to acquire up to an additional $90 million.

- The notes will be senior, unsecured obligations bearing interest semi-annually in arrears, with the interest rate, conversion rate and other terms to be determined at pricing; upon conversion, Microchip may pay cash up to the principal amount and cash, shares or a combination thereof for the remainder.

- Microchip expects to use a portion of the net proceeds to fund capped call transactions and the remainder to repay outstanding commercial paper.

- J. Wood Capital Advisors, serving as financial advisor, intends to purchase up to $25 million of common stock concurrently with the offering, and capped call transactions are intended to reduce dilution on note conversion.

- Microchip reported that channel inventory has largely normalized, with December quarter book-to-bill above 1 and March quarter revenue guidance of +6.2%, exceeding the typical 2–3% seasonal growth forecast.

- Data center now represents 19% of FY revenue, driven by high-speed connectivity products including 3nm PCIe Gen6 switches, flash controllers, and HDD controllers.

- Automotive growth is increasingly driven by transitioning from legacy CAN to Ethernet (10BASE-T1S), PCIe switching, and the new Automotive SerDes Alliance (ASA) standard, positioning Microchip for long-cycle in-vehicle networking wins.

- The company reiterated a path to 65% gross margin, targeting a ~50 bps improvement in the March quarter and steady progress through calendar year 2026.

- With net debt/EBITDA at 4.18×, priority is on debt reduction and sustaining the dividend; no share buybacks are planned in the near term.

- Distribution normalized with $12 M sell-through/sell-in gap and book-to-bill >1, driving 6.2% QoQ growth guidance for March vs. typical 2–3%

- Data center accounts for ~19% of FY revenue, led by 3 nm Gen6 PCIe switches, flash controllers and HDD controllers—supporting both scale-up and scale-out deployments

- Automotive expansion beyond MCUs into touch controllers, car-access solutions and in-vehicle networking (CAN, LIN, MOST, 10BASE-T1S Ethernet) plus ASA standard and PCIe switches

- Manufacturing footprint is 37–40% internal/60% external; advanced-node lead times and substrate tightness create $50–51 M underutilization headwind, with gradual fab-loading planned toward a 65% gross-margin target

- Financial priorities: March quarter gross margin guided at 61% (+50 bps QoQ); net debt/EBITDA at 4.18×, focusing on debt paydown, dividend sustained and no buybacks near term

- Distribution channel largely normalized with a $12 million sell-in/sell-through gap, booking momentum with book-to-bill > 1, and 6.2% Q2-FY26 revenue growth guidance versus a typical 2–3% seasonal uptick.

- Data center now represents ~19% of FY2025 revenue, led by PCIe Gen 6 switches for high-speed connectivity and supporting flash/HDD controllers; FPGA sales are also expanding across defense, industrial, auto, and data center markets.

- Automotive is broadening beyond MCUs into in-vehicle networking (10BASE-T1S Ethernet, PCIe switches, Automotive SerDes Alliance), car-access systems, and touch interfaces, positioning connectivity as a key growth driver.

- Financial priorities shifted to debt reduction (net debt/EBITDA at 4.18x) with dividends maintained and share buybacks deferred; gross margin projected to improve toward 65% by next calendar year through mix and factory utilization gains.

- $800 M Offering: Microchip upsized its private Rule 144A offering of Convertible Senior Notes due 2030 from $600 M to $800 M, expected to settle on February 11, 2026, generating approximately $785.1 M in net proceeds.

- Terms: The notes are senior, unsecured, bear no regular interest or accretion, mature on February 15, 2030, and are redeemable at par starting February 20, 2029 under specified conditions.

- Conversion: Initial conversion rate of 9.5993 shares per $1,000 principal (≈$104.17 per share), representing a 40% premium to the February 9, 2026 closing price of $74.41.

- Use of Proceeds: Approximately $60.5 M allocated to capped call transactions; remaining net proceeds to repay commercial paper.

- Microchip intends a private offering of $600 million in Convertible Senior Notes due 2030, with an initial purchaser option for an additional $90 million.

- The notes will be senior, unsecured obligations with semi-annual interest payments; final interest and conversion terms to be set at pricing.

- Net proceeds will fund capped call transactions to limit dilution and repay outstanding commercial paper.

- J. Wood Capital Advisors LLC plans to purchase up to $25 million of common stock concurrently, while option counterparties will hedge via share purchases and derivatives, potentially affecting market price.

- The offering is exclusively to qualified institutional buyers under Rule 144A and the notes (and any shares upon conversion) are unregistered.

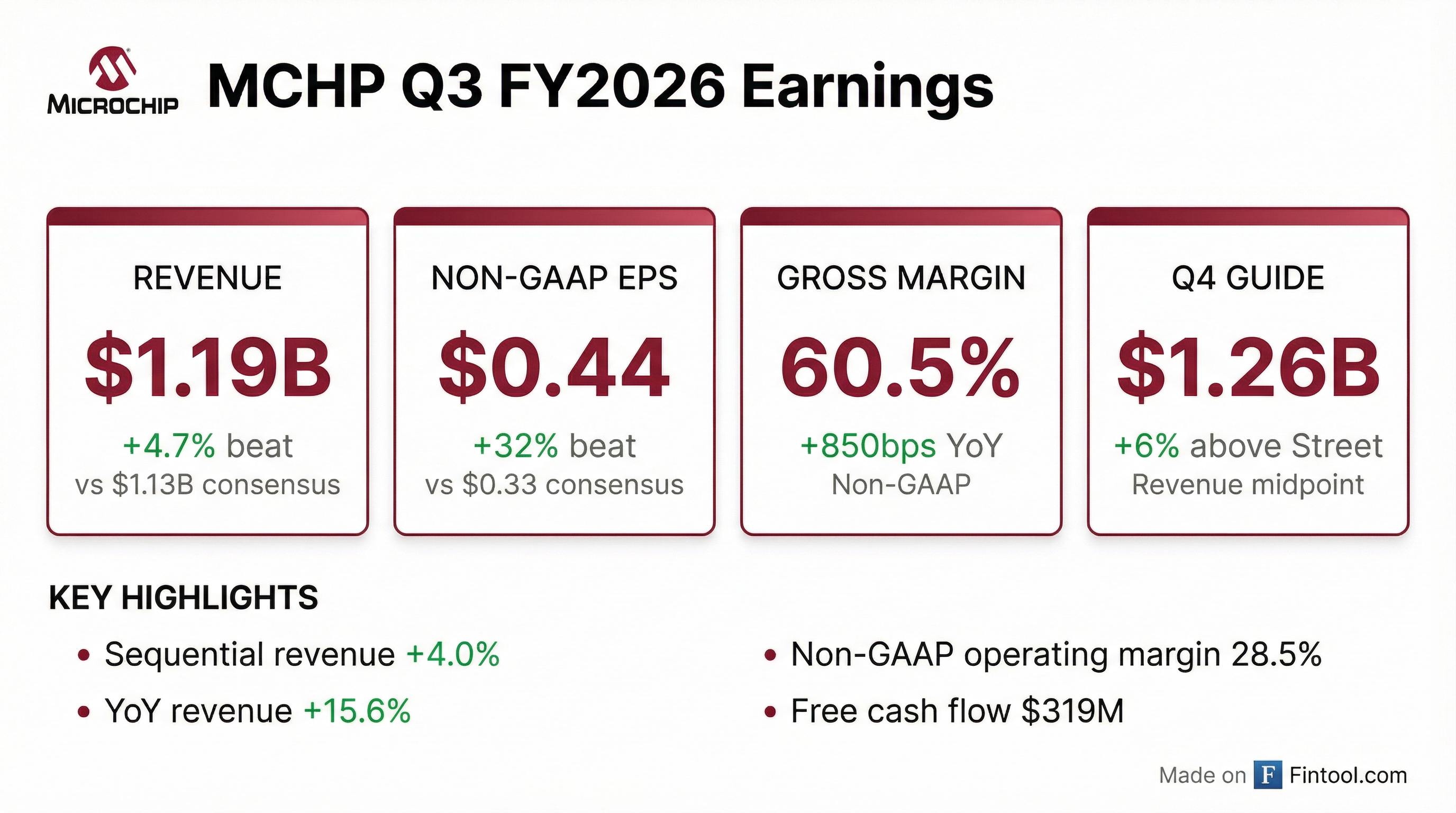

- Net sales were $1.186 billion, up 4% sequentially and 15.6% year-over-year; non-GAAP gross margin was 60.5% and non-GAAP EPS was $0.44.

- Operating cash flow was $341.4 million and adjusted free cash flow was $305.6 million; net debt to adjusted EBITDA improved to 4.18×.

- Q4 FY2026 guidance: net sales of $1.26 billion ± $20 million (+6.2% seq, +29.8% YoY), non-GAAP EPS of $0.48–$0.52, and gross margin of 60.5–61.5%.

- Announced three design wins for its Gen 6 PCIe switch, including a >$100 million revenue opportunity in calendar 2027.

- Net sales rose 4% sequentially and 15.6% year-over-year, with strength in networking, data center, FPGA and licensing businesses; distributor sell-in vs. sell-through gap narrowed to $11.7 million from $52.9 million, indicating inventory correction.

- Non-GAAP gross margin expanded 379 bps sequentially to 60.5%, and non-GAAP operating margin climbed 418 bps sequentially to 28.5%, driven by product mix and margin recovery.

- For the March quarter, the company guides net sales of $1.26 billion ± $20 million (midpoint + 6.2% sequential, + 29.8% YoY), non-GAAP gross margin of 60.5–61.5%, and non-GAAP EPS of $0.48–0.52.

- Book-to-bill remained above 1, with exceptionally strong December and January bookings; as of February 5, the June-quarter backlog exceeds the March-quarter backlog at the same point last cycle, signaling continued demand momentum and increasing lead-times.

- Q3 net sales grew 4% sequentially and 15.6% year-over-year; non-GAAP gross margin reached 60.5% (+379 bps seq) and non-GAAP operating margin was 28.5% (+418 bps seq).

- Cash flow from operations was $341.4 million, adjusted free cash flow $305.6 million; cash and investments totaled $250.7 million; net debt fell by $26 million, with net debt/EBITDA at 4.18×.

- Distribution inventories continued normalizing as sell-through outpaced sell-in by $11.7 million (vs. $52.9 million in Q2), supporting a book-to-bill ratio above 1.

- Q4 guidance: net sales of $1.26 billion ± $20 million (up 6.2% seq, 29.8% YoY); non-GAAP gross margin 60.5–61.5%; non-GAAP diluted EPS of $0.48–$0.52.

- Net sales of $1.186 billion, up 4.0% sequentially and 15.6% year-over-year for the quarter ended December 31, 2025.

- On a GAAP basis, gross profit of 59.6%, operating income of $151.7 million (12.8% of sales) and EPS of $0.06; on a Non-GAAP basis, gross profit of 60.5%, operating income of $337.8 million (28.5% of sales) and EPS of $0.44.

- Declared a quarterly cash dividend of $0.455 per share for the March quarter and returned $246.1 million to common stockholders in Q3.

- Fourth-quarter guidance: net sales of $1.240 – 1.280 billion (midpoint $1.260 billion, +6.2% sequential, +29.8% Y/Y) and Non-GAAP EPS of $0.48 – 0.52.

Quarterly earnings call transcripts for MICROCHIP TECHNOLOGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more