Earnings summaries and quarterly performance for MICROCHIP TECHNOLOGY.

Executive leadership at MICROCHIP TECHNOLOGY.

Board of directors at MICROCHIP TECHNOLOGY.

Research analysts who have asked questions during MICROCHIP TECHNOLOGY earnings calls.

Blayne Curtis

Jefferies Financial Group

9 questions for MCHP

Vivek Arya

Bank of America Corporation

9 questions for MCHP

Harlan Sur

JPMorgan Chase & Co.

8 questions for MCHP

Harsh Kumar

Piper Sandler & Co.

7 questions for MCHP

Joshua Buchalter

TD Cowen

6 questions for MCHP

Timothy Arcuri

UBS

6 questions for MCHP

Vijay Rakesh

Mizuho

6 questions for MCHP

William Stein

Truist Securities

6 questions for MCHP

Chris Caso

Wolfe Research LLC

5 questions for MCHP

Tore Svanberg

Stifel Financial Corp.

5 questions for MCHP

Christopher Rolland

Susquehanna Financial Group

4 questions for MCHP

James Schneider

Goldman Sachs

4 questions for MCHP

Janet Ramkissoon

Quadra Capital

4 questions for MCHP

Joseph Moore

Morgan Stanley

4 questions for MCHP

Christopher Caso

Wolfe Research

3 questions for MCHP

Christopher Danely

Citigroup Inc.

3 questions for MCHP

Quinn Bolton

Needham & Company, LLC

3 questions for MCHP

Chris Danely

Citi

2 questions for MCHP

Chris Stanley

Citi

2 questions for MCHP

Craig Ellis

B. Riley Securities

2 questions for MCHP

Joe Quatrochi

Wells Fargo

2 questions for MCHP

Matthew Prisco

Cantor Fitzgerald

2 questions for MCHP

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for MCHP

Chris Casso

Wolfe Research

1 question for MCHP

Joe Moore

Morgan Stanley

1 question for MCHP

Recent press releases and 8-K filings for MCHP.

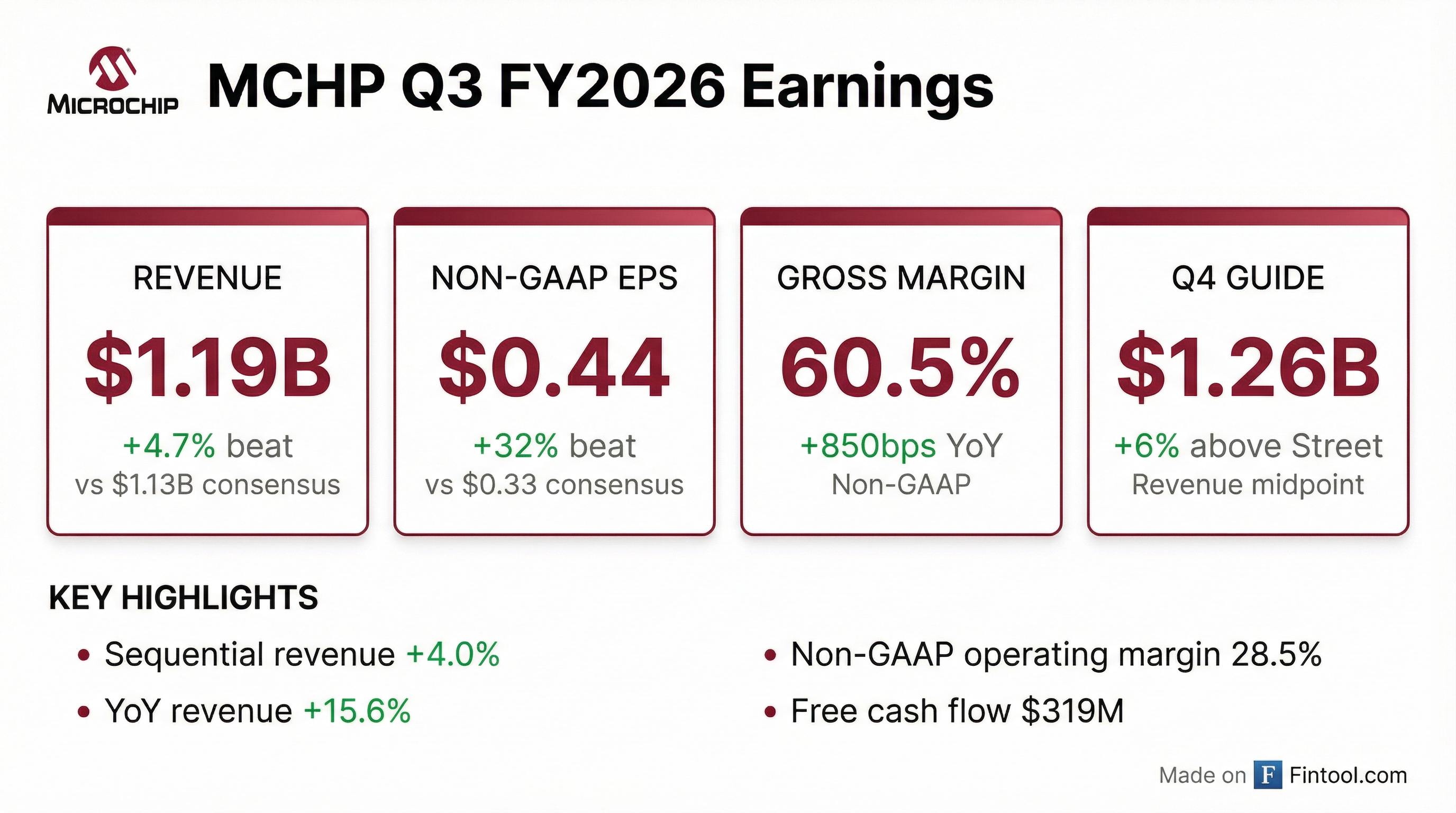

- Net sales were $1.186 billion, up 4% sequentially and 15.6% year-over-year; non-GAAP gross margin was 60.5% and non-GAAP EPS was $0.44.

- Operating cash flow was $341.4 million and adjusted free cash flow was $305.6 million; net debt to adjusted EBITDA improved to 4.18×.

- Q4 FY2026 guidance: net sales of $1.26 billion ± $20 million (+6.2% seq, +29.8% YoY), non-GAAP EPS of $0.48–$0.52, and gross margin of 60.5–61.5%.

- Announced three design wins for its Gen 6 PCIe switch, including a >$100 million revenue opportunity in calendar 2027.

- Net sales rose 4% sequentially and 15.6% year-over-year, with strength in networking, data center, FPGA and licensing businesses; distributor sell-in vs. sell-through gap narrowed to $11.7 million from $52.9 million, indicating inventory correction.

- Non-GAAP gross margin expanded 379 bps sequentially to 60.5%, and non-GAAP operating margin climbed 418 bps sequentially to 28.5%, driven by product mix and margin recovery.

- For the March quarter, the company guides net sales of $1.26 billion ± $20 million (midpoint + 6.2% sequential, + 29.8% YoY), non-GAAP gross margin of 60.5–61.5%, and non-GAAP EPS of $0.48–0.52.

- Book-to-bill remained above 1, with exceptionally strong December and January bookings; as of February 5, the June-quarter backlog exceeds the March-quarter backlog at the same point last cycle, signaling continued demand momentum and increasing lead-times.

- Q3 net sales grew 4% sequentially and 15.6% year-over-year; non-GAAP gross margin reached 60.5% (+379 bps seq) and non-GAAP operating margin was 28.5% (+418 bps seq).

- Cash flow from operations was $341.4 million, adjusted free cash flow $305.6 million; cash and investments totaled $250.7 million; net debt fell by $26 million, with net debt/EBITDA at 4.18×.

- Distribution inventories continued normalizing as sell-through outpaced sell-in by $11.7 million (vs. $52.9 million in Q2), supporting a book-to-bill ratio above 1.

- Q4 guidance: net sales of $1.26 billion ± $20 million (up 6.2% seq, 29.8% YoY); non-GAAP gross margin 60.5–61.5%; non-GAAP diluted EPS of $0.48–$0.52.

- Net sales of $1.186 billion, up 4.0% sequentially and 15.6% year-over-year for the quarter ended December 31, 2025.

- On a GAAP basis, gross profit of 59.6%, operating income of $151.7 million (12.8% of sales) and EPS of $0.06; on a Non-GAAP basis, gross profit of 60.5%, operating income of $337.8 million (28.5% of sales) and EPS of $0.44.

- Declared a quarterly cash dividend of $0.455 per share for the March quarter and returned $246.1 million to common stockholders in Q3.

- Fourth-quarter guidance: net sales of $1.240 – 1.280 billion (midpoint $1.260 billion, +6.2% sequential, +29.8% Y/Y) and Non-GAAP EPS of $0.48 – 0.52.

- Full qualification and production release of SST’s embedded SuperFlash Gen 4 (ESF4) on UMC’s 28HPC+ foundry process with Automotive Grade 1 capability.

- Key performance: –40 °C to +150 °C operating range, <12.5 ns read access, 100K+ endurance cycles, >10 years data retention at 125 °C, and only 1-bit ECC required.

- 32 Mb macro under AG1 conditions exhibited zero bit failures and 100% peak yield, confirming robust reliability.

- Collaboration yields fewer masking steps versus competing 28 nm HKMG eFlash solutions, delivering cost and manufacturing efficiency benefits.

- Microchip Technology raised its fiscal Q3 revenue outlook to $1.185 – $1.19 billion, above prior guidance, sending shares up over 4% in after-hours trading.

- The upgrade reflects a broad-based market recovery driven by inventory correction, strong December-quarter bookings, and new customer designs moving into production, improving the March-quarter starting backlog.

- Management noted a substantial decline in internal inventory and plans to ramp factory production to reduce inventory write-offs and under-utilization charges.

- Despite these operational gains, the company still faces multi-year challenges, including a 12.1% three-year revenue decline, 3.68% operating margin, and –4.39% net margin.

- Net sales expected at $1,185 million, above prior guidance of $1,109–1,149 million for Q3 FY2026.

- Substantial progress on nine-point recovery plan, with reduced internal inventory and planned factory ramp in the March quarter to lower under-utilization charges.

- CEO Steve Sanghi reports strong bookings, broad-based end-market recovery, and improved backlog entering the March quarter.

- No conference call scheduled; full Q3 FY2026 results will be announced on February 5, 2026.

- Microchip expects Q3 FY2026 net sales of $1,185 million, above its prior guidance of $1,109 million to $1,149 million.

- CEO Steve Sanghi highlighted a broad-based end-market recovery, strong December-quarter bookings, and a higher starting backlog for the March quarter.

- Progress on its nine-point recovery plan has cut internal inventory write-offs and will reduce under-utilization charges as factory ramps commence in the March quarter.

- No conference call will be held; fiscal Q3 2026 results are scheduled for release on February 5, 2026.

- Microchip is leveraging the AI tailwind in data centers with its 3 nm PCIe Gen 6 switch, upcoming Gen 6 retimers, and ChipLink software platform, alongside timing and secure-boot products, aiming for significant growth over the next five years.

- On the edge, the AI/ML group offers a model zoo for microcontrollers handling sensor tasks without accelerators, while FPGA accelerators serve vision systems; wired Ethernet (T1/T1S) connectivity is rapidly being adopted in robotics and Industry 4.0.

- Automotive and industrial inventory correction is nearing completion, evidenced by 199 days of inventory and short lead times; broad-based booking strength supports expectations for the March quarter to outpace the typical flat-to-up 1–2% seasonal trend.

- Data center & compute and aerospace & defense accounted for 19% and 18% of revenue last year; A&D growth is driven by hypersonics, satellites, and a next-generation octal RISC-V space computer under NASA contract, sampling in mid-2026.

- With 37% in-house wafer fab capacity (400 M undepreciated equipment), underutilization and inventory reserve run-offs are poised to boost gross margin toward the 65% target; free cash flow now covers the dividend, and the focus is on balance-sheet deleveraging before buybacks.

- Microchip is ramping its 3 nm PCIe Gen 6 switch and will introduce matching Gen 6 retimers next quarter, supported by its ChipLink software platform to accelerate Gen 6/Gen 7 deployments in AI data centers.

- On the edge, the newly formed AI/ML group provides a “Model Zoo” for microcontrollers and FPGAs—training and porting models for vibration, sound and battery management—with accelerators reserved for vision and optical inspection systems.

- Management sees broad-based booking strength across end markets and expects the March quarter to perform meaningfully above the typical 1–2 % seasonal growth rate, driven by backlog build.

- Inventory correction is underway: distribution inventories are lean, customer inventories are normalizing, and reducing inventory reserves should yield a $50 M quarterly benefit to gross margin over the next 3–4 quarters.

Quarterly earnings call transcripts for MICROCHIP TECHNOLOGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more