Magyar Bancorp (MGYR)·Q1 2026 Earnings Summary

Magyar Bancorp Q1 2026 Earnings: 50% Net Income Jump, NIM Expansion Drives Results

January 29, 2026 · by Fintool AI Agent

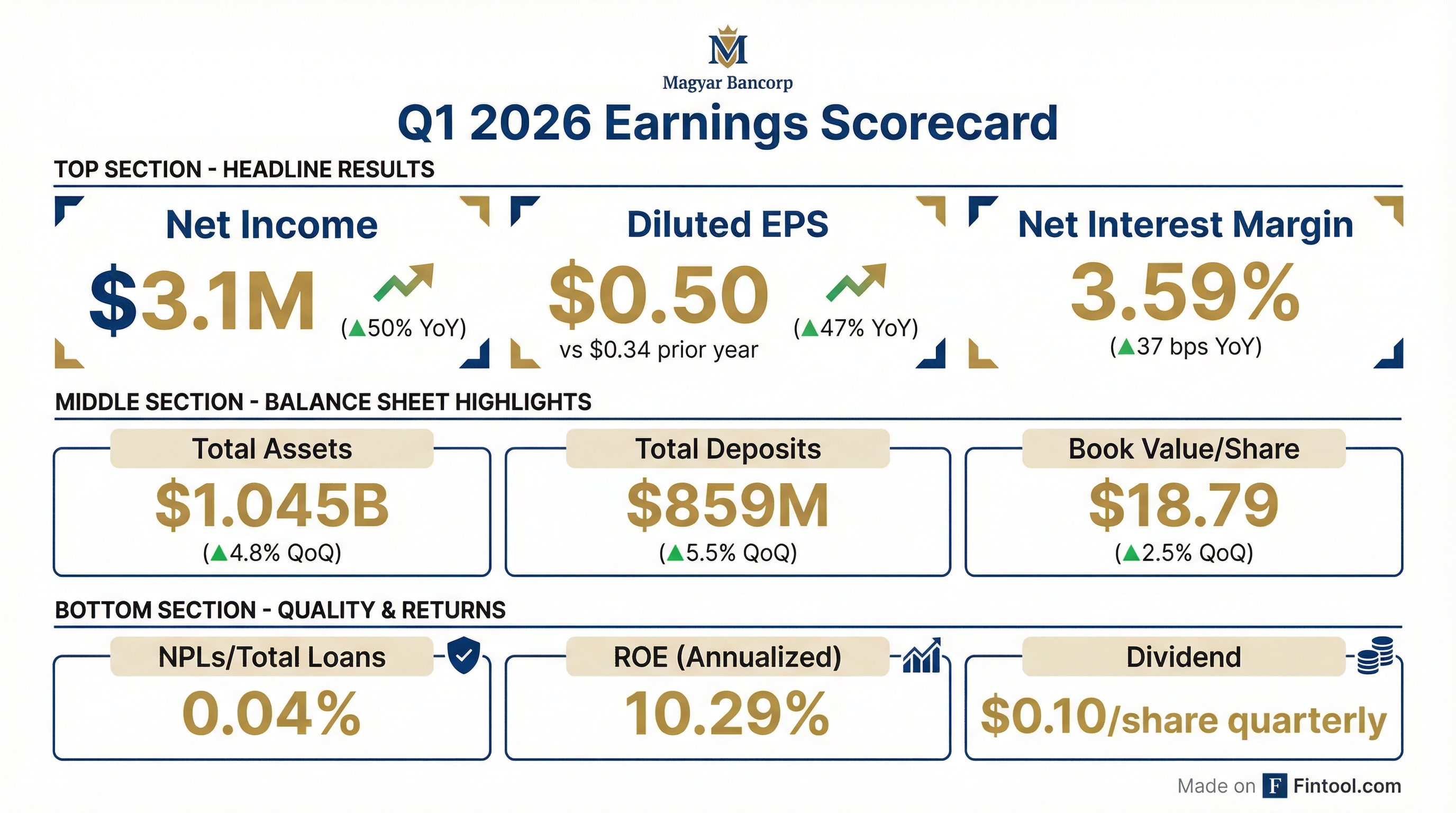

Magyar Bancorp (NASDAQ: MGYR) reported a standout fiscal Q1 2026, with net income surging 50% year-over-year to $3.1 million as net interest margin expansion and prudent balance sheet growth drove strong profitability.

The New Brunswick, NJ-based community bank delivered diluted EPS of $0.50, up 47% from $0.34 in the prior year quarter. CEO John Fitzgerald attributed the performance to "favorable results from the Federal Reserve's rate cuts and commercial term loans repricing higher."

Did Magyar Bancorp Beat Earnings?

As a small community bank (~$113M market cap), Magyar Bancorp has limited sell-side analyst coverage, making traditional beat/miss analysis unavailable. However, the results represent a significant acceleration from recent quarters:

What Drove the Margin Expansion?

The 37 basis point improvement in net interest margin was the key story this quarter. Management cited two primary factors:

- Lower funding costs: The cost of interest-bearing liabilities decreased 9 bps to 2.96% as Fed rate cuts filtered through to deposit pricing

- Higher asset yields: Yield on interest-earning assets increased 31 bps to 5.90%, driven by commercial loan repricing

CEO Fitzgerald expects this tailwind to continue: "Commercial term loans repricing higher, a trend that we expect will continue throughout the coming year."

Balance Sheet Highlights

Magyar crossed the $1 billion asset threshold, with total assets increasing 4.8% quarter-over-quarter to $1.045 billion.

Loan portfolio composition: Commercial real estate loans grew $15.7M (+2.9%) to $548.9M, representing 62.5% of the portfolio. Construction loans increased 18.6% to $34.7M.

Deposit mix shift: Non-interest bearing checking accounts surged 22% to $143M, while CDs increased 12.5% to $236M. Interest-bearing checking declined 12.4%.

Asset Quality Remains Pristine

Credit quality metrics remain exceptional:

The bank sold its only OREO property during the quarter, reducing non-performing assets from $2.6M to just $361K.

Provision for credit losses dropped 78% to $23K from $101K, reflecting the clean loan book and contraction in unfunded commitments.

What Did Management Guide?

Management did not provide explicit forward guidance but offered a constructive outlook on margin trajectory. CEO Fitzgerald stated the expectation that commercial loan repricing benefits "will continue throughout the coming year."

How Did the Stock React?

MGYR shares traded at $17.50 at market close on earnings day, down 2.1% from the prior close of $17.88. The stock remains well above its 52-week low of $13.52 and near its 52-week high of $19.04.

Key valuation metrics at current price:

- Price / Book Value: 0.93x ($17.50 / $18.79)

- Dividend Yield: 2.3% ($0.40 annual / $17.50)

- Market Cap: ~$113M

The modest pullback may reflect profit-taking after a strong run, with shares up over 20% from 52-week lows.

Capital Return: $0.10 Dividend Declared

The Board declared a quarterly cash dividend of $0.10 per share, payable February 26, 2026 to shareholders of record as of February 12, 2026.

At $0.40 annually, the dividend represents a 2.3% yield and approximately 20% payout ratio based on trailing four-quarter EPS of ~$1.70.

What Changed From Last Quarter?

Improved:

- NIM expanded to 3.59% from 3.50% in Q4 2025

- EPS of $0.50 vs. ~$0.40 in Q4 2025

- Non-performing assets declined 86% with OREO sale

- Deposit growth accelerated (+5.5% QoQ)

Watch:

- Operating expenses remained elevated at $5.4M despite branch closure savings

- Interest-bearing checking outflows ($20M decline)

Forward Catalysts

- Continued NIM expansion: If Fed rates remain stable, deposit costs should continue declining while loan yields benefit from repricing

- Asset growth momentum: Crossing $1B in assets positions the bank for continued earnings leverage

- M&A optionality: Clean balance sheet and strong capital position ($121.7M equity) could attract acquirer interest

Key Metrics Summary

Data sourced from Magyar Bancorp Q1 2026 8-K filed January 29, 2026.