Earnings summaries and quarterly performance for Magyar Bancorp.

Executive leadership at Magyar Bancorp.

Board of directors at Magyar Bancorp.

Research analysts covering Magyar Bancorp.

Recent press releases and 8-K filings for MGYR.

Magyar Bancorp, Inc. Announces Strong Q1 2026 Financial Results and Dividend

MGYR

Earnings

Dividends

Revenue Acceleration/Inflection

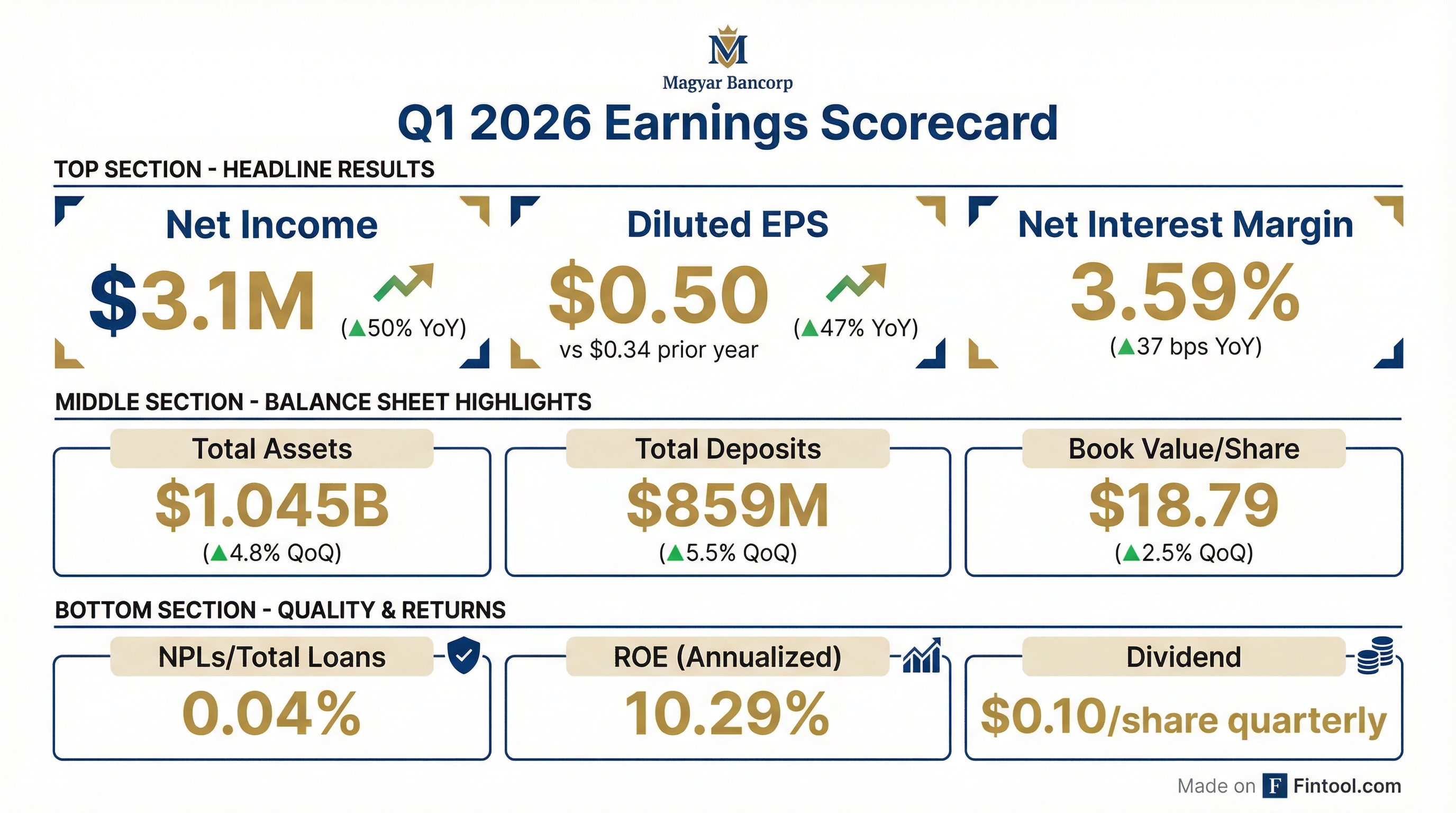

- Magyar Bancorp, Inc. reported a 50% increase in net income to $3.1 million for the three months ended December 31, 2025, compared to $2.1 million in the prior year period. Basic earnings per share were $0.51 and diluted earnings per share were $0.50 for the quarter.

- The company's Board of Directors declared a quarterly cash dividend of $0.10 per share, payable on February 26, 2026, to stockholders of record as of February 12, 2026.

- Net interest margin increased by 37 basis points to 3.59% for the quarter ended December 31, 2025, up from 3.22% in the prior year period.

- Total assets grew by 4.8% to $1.045 billion at December 31, 2025, from $997.7 million at September 30, 2025. Total deposits increased by 5.5% to $859.1 million at December 31, 2025.

- Non-performing loans decreased by 20.0% to $361 thousand at December 31, 2025, and book value per share increased to $18.79 from $18.34 at September 30, 2025.

Jan 29, 2026, 9:01 PM

Magyar Bancorp Announces First Quarter Financial Results and Declares Dividend

MGYR

Earnings

Dividends

Revenue Acceleration/Inflection

- Magyar Bancorp reported a 50% increase in net income to $3.1 million for the three months ended December 31, 2025, up from $2.1 million for the three months ended December 31, 2024.

- Basic earnings per share were $0.51 for the three months ended December 31, 2025, compared to $0.34 for the same period in 2024.

- The Board of Directors declared a quarterly cash dividend of $0.10 per share, which will be paid on February 26, 2026.

- The company's net interest margin increased by 37 basis points to 3.59% for the quarter ended December 31, 2025, from 3.22% for the quarter ended December 31, 2024.

- Total assets increased by 4.8% to $1.045 billion at December 31, 2025, from $997.7 million at September 30, 2025.

Jan 29, 2026, 9:01 PM

Magyar Bancorp Announces Fiscal Fourth Quarter and Year-End 2025 Financial Results and Quarterly Dividend

MGYR

Earnings

Dividends

Revenue Acceleration/Inflection

- Magyar Bancorp reported net income of $2.5 million for the three months ended September 30, 2025, and $9.8 million for the fiscal year ended September 30, 2025, representing a 25.4% increase in annual net income compared to the prior year.

- Basic earnings per share were $0.41 for the three months ended September 30, 2025, and $1.57 for the fiscal year ended September 30, 2025.

- The Board of Directors declared a quarterly cash dividend of $0.08 per share, payable on November 25, 2025, to stockholders of record as of November 13, 2025.

- The company achieved record earnings for the fiscal year, driven by a 20 basis point increase in net interest margin and 10% growth in the loan portfolio. Total assets increased 4.8% to $997.7 million and total equity increased 7.5% to $118.8 million for the year ended September 30, 2025.

Oct 30, 2025, 8:03 PM

Magyar Bancorp Announces Fiscal Fourth Quarter and Year-End 2025 Financial Results

MGYR

Earnings

Dividends

Revenue Acceleration/Inflection

- Magyar Bancorp reported record net income of $9.8 million for the fiscal year ended September 30, 2025, a 25% increase from $7.8 million in the prior year, with basic earnings per share rising to $1.57 from $1.23.

- The company's Board of Directors declared a quarterly cash dividend of $0.08 per share, payable on November 25, 2025.

- Net interest margin increased by 20 basis points to 3.34% for the fiscal year ended September 30, 2025, and the loan portfolio grew 9.9% to $858.9 million.

- Total assets increased 4.8% to $997.7 million and total equity increased 7.5% to $118.8 million at September 30, 2025, compared to September 30, 2024, resulting in a book value per share of $18.34.

Oct 30, 2025, 8:01 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more