Mawson Infrastructure Group (MIGI)·Q4 2025 Earnings Summary

Mawson Infrastructure Q4 2025 Earnings: Significant Miss, Revenue Collapses 79%

February 6, 2026 · by Fintool AI Agent

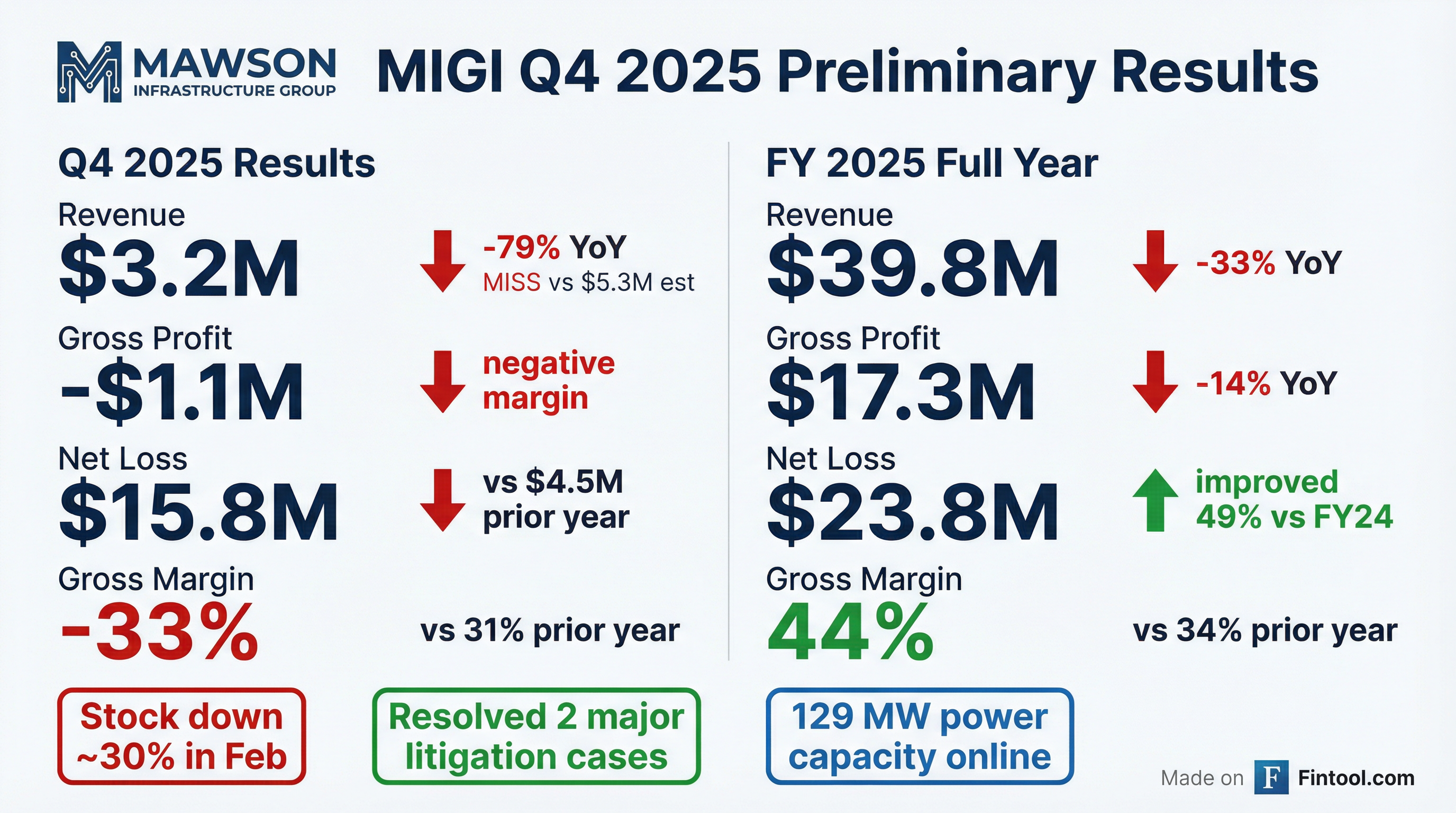

Mawson Infrastructure Group (NASDAQ: MIGI) released preliminary Q4 2025 results showing a sharp deterioration in financial performance. Revenue plunged 79% YoY to approximately $3.2M, missing the $5.3M consensus estimate by 40% . Gross margin turned deeply negative at -33%, compared to positive 31% in the year-ago quarter . The stock traded down sharply following the announcement, with shares near 52-week lows around $2.87.

Did Mawson Beat Earnings?

No. This was a significant miss across all key metrics.

The dramatic revenue decline reflects the challenging economics of Bitcoin mining following the April 2024 halving, combined with customer churn in the colocation/hosting business. Cost of revenues declined less rapidly than revenue (-59% vs -79%), causing gross margin to flip negative .

What About Full Year 2025?

Full year 2025 results show a mixed picture — revenue declined but margin structure improved:

Key drivers of improved net loss:

- Reduction in operating expenses from lower depreciation/amortization and stock-based compensation

- Absence of the $12.4M deconsolidation loss that occurred in 2024

Revenue Trend: 8 Quarters

Q3 2025 was a bright spot — the only profitable quarter — driven by improved gross margins above 60%. However, Q4 2025 saw a sharp reversal with revenue collapsing and costs exceeding revenue.

What Did Management Say About Settlements?

Mawson announced the resolution of two significant legal disputes :

-

Ionic Digital Mining Settlement: Resolved claims brought by Ionic against Mawson and two subsidiaries related to a co-location agreement

-

Customer Hosting Dispute: Settled a separate customer dispute over a hosting arrangement

Management Quote:

"We are pleased to move forward from these pending cases and significantly reduce Mawson's potential liability. The clarity we now have on the future strength of our balance sheet will allow us to focus on driving operational execution and long-term growth for Mawson." — Kaliste Saloom, Interim CEO

Mawson made no admission of liability or wrongdoing in either settlement. Terms remain confidential.

How Did the Stock React?

The stock has been under severe pressure:

The current price of $2.87 is near the 52-week low of $2.74. Market cap has shrunk to approximately $2.8M, making MIGI a micro-cap stock.

What Changed From Last Quarter?

Q3 2025 was arguably Mawson's best quarter in recent memory:

- Revenue: $7.7M (vs $3.2M in Q4)

- Gross Margin: 65% (vs -33% in Q4)

- Net Income: +$0.3M profit (vs $15.8M loss in Q4)

What went wrong in Q4:

- Revenue plunged 58% sequentially ($7.7M → $3.2M)

- Costs did not decline proportionally, flipping gross margin negative

- One-time charges or write-downs likely contributed to the outsized net loss

The CEO noted at the January 2026 conference that they were "working on year-end close" but did not have numbers to share .

Governance & Activist Concerns

Mawson is navigating significant governance challenges:

-

Poison Pill Adopted (Feb 2): Limited Duration Stockholder Rights Agreement to protect against hostile accumulation

-

Securities Law Complaint (Jan 20): Filed complaint against certain shareholders for "alleged improper accumulation and disclosure practices"

-

Adversary Proceeding (Dec 29): Filed claims in bankruptcy court against parties who filed an involuntary petition against Mawson in 2024 (dismissed with prejudice Nov 2025)

-

Endeavor Group Conflict: Proxy filings indicate ongoing activist pressure from Endeavor Group

AI/HPC Pivot: Strategic Direction

Despite the weak Q4 results, management is positioning Mawson as an AI/HPC infrastructure play:

Key Assets:

- 129 MW power capacity already online

- Bellefonte lease extension secured

- Greenfield facility in Ohio under development

- Carbon-free energy focus (nuclear power)

AI Pilot Program:

- Launched GPU pilot on decentralized AI network in Q4 2025

- First pilot clients onboarded

- Commercial rollout targeted Q2-Q3 2026

Regulatory Tailwinds (per management):

- FERC ruling allows data centers to connect directly to power plants

- $15B federal/state agreement for AI data center power generation

- Hyperscalers seeking 15-year power commitments

Balance Sheet Snapshot

Cash is declining quarter-over-quarter while debt has remained elevated around $27M. The company announced a $40M ATM facility in December 2025 for growth capital .

Risks and Concerns

-

Going Concern Risk: Filings reference ability to continue as a going concern

-

Nasdaq Delisting Risk: Company regained compliance in Dec 2025 but continues to monitor listing requirements

-

Dilution: $40M ATM facility could significantly dilute current shareholders

-

Execution Risk: AI/HPC pivot is unproven; pilot is still in early stages

-

Customer Concentration: Loss of significant colocation customers has impacted revenue

-

Bitcoin Volatility: Core mining economics remain challenged post-halving

Forward Catalysts

Key Takeaways

-

Significant Miss: Q4 2025 revenue of $3.2M missed estimates by 40% and declined 79% YoY

-

Margin Collapse: Gross margin flipped to -33%, the worst in recent history

-

Improved Net Loss for Full Year: Despite Q4 weakness, FY 2025 net loss improved 49% to $23.8M

-

Legal Clarity: Two major litigation settlements remove significant liability overhang

-

Strategic Pivot: Management focused on AI/HPC infrastructure with 129 MW power platform

-

Stock Under Pressure: Shares near 52-week lows at $2.87, down 93% from highs

For more on Mawson Infrastructure Group: MIGI Company Profile | Latest 10-Q