Earnings summaries and quarterly performance for Mawson Infrastructure Group.

Executive leadership at Mawson Infrastructure Group.

Board of directors at Mawson Infrastructure Group.

Research analysts who have asked questions during Mawson Infrastructure Group earnings calls.

Recent press releases and 8-K filings for MIGI.

Mawson Infrastructure Group Reports Preliminary Unaudited Q4 and Fiscal Year 2025 Results

MIGI

Earnings

Profit Warning

Legal Proceedings

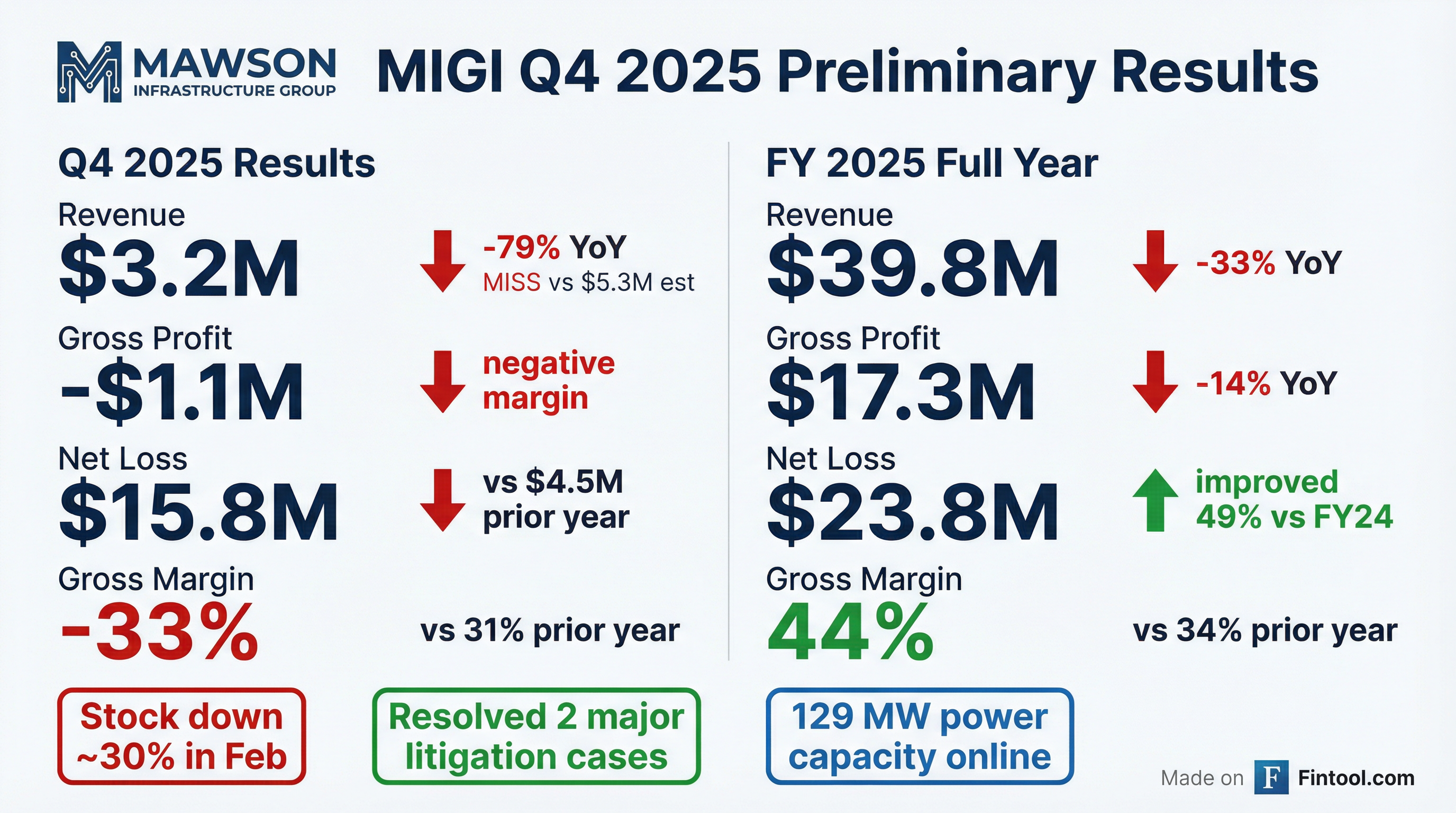

- Mawson Infrastructure Group (MIGI) released preliminary, unaudited financial results for the fourth quarter and fiscal year ended December 31, 2025.

- For Q4 2025, preliminary estimated revenues are expected to be $3.2 million, representing a 79% year-on-year decrease, with a preliminary net loss of $15.8 million, a 250% year-on-year increase.

- For Fiscal Year 2025, preliminary estimated revenues are expected to be $39.8 million, a 33% year-on-year decrease from 2024, while the preliminary net loss is expected to be $23.8 million, a 49% year-on-year decrease compared to 2024.

- The company also announced settlements with Ionic Digital Mining LLC and another customer, which are expected to significantly reduce Mawson's potential financial liability going forward.

17 hours ago

Mawson Infrastructure Group Inc. Adopts Stockholder Rights Agreement

MIGI

Takeover Bid

Convertible Preferred Issuance

- Mawson Infrastructure Group Inc. (MIGI) adopted a limited-duration stockholder rights agreement on February 2, 2026, as a defensive measure against a potential takeover by Endeavor Blockchain, LLC and its affiliates.

- The Board's decision was prompted by Endeavor's reported beneficial ownership reaching 48.0% of shares outstanding as of January 28, 2026, and a proposal from Endeavor on January 8, 2026, to gain control of the Board and CEO selection.

- The Rights Agreement will become exercisable if a person or group acquires 20% or more of Mawson's outstanding Common Stock without Board approval, resulting in significant dilution for the acquiring party as their Rights become void.

- A dividend of one Right per share of Common Stock was declared for stockholders of record as of February 12, 2026, with each Right entitling the holder to purchase Series C Junior Participating Preferred Stock at an exercise price of $20.60.

- The Rights Agreement is effective immediately and is set to expire on February 1, 2027.

4 days ago

Mawson Infrastructure Group Adopts Stockholder Rights Agreement Amidst Takeover Attempt

MIGI

Takeover Bid

Proxy Vote Outcomes

Board Change

- Mawson Infrastructure Group Inc. (MIGI) adopted a limited-duration stockholder rights agreement on February 2, 2026, to protect the best interests of its stockholders.

- This action was taken in response to the significant and rapid accumulation of the Company’s common stock and a "covert campaign to take over the Company" by Endeavor Blockchain, LLC and its affiliates.

- Endeavor reported purported combined ownership of 48.0% of shares outstanding as of January 28, 2026, although Mawson's records indicated 29.7%.

- The Rights Agreement becomes exercisable if a person or group acquires 20% or more of Mawson’s outstanding Common Stock without prior Board approval, with rights held by the triggering person or group becoming void.

- Endeavor, whose prior takeover proposal was rejected by the Board, has announced its intention to file a preliminary proxy statement to solicit votes for one or more director nominees at the Company’s 2026 annual meeting of stockholders.

4 days ago

Mawson Infrastructure Group Regains Nasdaq Compliance, Reports Q3 2025 Financials, and Advances AI Infrastructure Strategy

MIGI

Legal Proceedings

Delisting/Listing Issues

New Projects/Investments

- Mawson Infrastructure Group regained Nasdaq compliance in December 2025 and remains fully compliant. The company is actively involved in ongoing legal proceedings, including an adversary proceeding filed on December 29, 2025, to pursue damages from an unsuccessful involuntary bankruptcy petition, and a formal complaint filed on January 20, 2026, against certain shareholders for alleged securities law violations.

- The company is undergoing a strategic shift towards AI and high-performance computing (HPC) infrastructure, having launched an AI infrastructure pilot program in October 2025, which is on track for completion by the end of March 2026, with commercial rollout expected in Q2 or Q3 2026. Mawson's 129-megawatt power platform is increasing in value due to recent U.S. energy policy changes, including a December 2025 FERC ruling and a January 2026 federal/state agreement mobilizing $15 billion for new power generation.

- For Q3 2025, Mawson delivered $13.2 million in revenue and returned a positive net income. The company also announced a $40 million at-the-market (ATM) facility on December 11, 2025, for flexible growth capital, to be used judiciously.

Jan 22, 2026, 8:40 PM

Mawson Infrastructure Group (MIGI) Regains Nasdaq Compliance and Repositions as AI/HPC Provider

MIGI

Legal Proceedings

Delisting/Listing Issues

New Projects/Investments

- Mawson Infrastructure Group (MIGI) regained Nasdaq compliance in December 2025 and remains fully compliant with all Nasdaq listing requirements.

- The company is actively involved in significant legal proceedings, including an adversary proceeding filed on December 29, 2025, for damages from an unsuccessful involuntary bankruptcy petition, and a formal complaint filed on January 20, 2026, against certain shareholders for alleged securities law violations.

- MIGI is undergoing a strategic repositioning to become an AI and High-Performance Computing (HPC) infrastructure provider, having launched an AI infrastructure pilot program in October 2025 and a GPU pilot program in Q4 2025.

- In Q3 2025, Mawson delivered $13.2 million in revenue and a positive net income.

- The company announced a $40 million at-the-market (ATM) facility on December 11, 2025, for flexible growth capital, with management committed to judicious use to balance liquidity and shareholder value.

Jan 22, 2026, 8:40 PM

Mawson Infrastructure Group Regains Nasdaq Compliance and Shifts Focus to AI/HPC

MIGI

Delisting/Listing Issues

Legal Proceedings

New Projects/Investments

- Mawson Infrastructure Group (MIGI) regained Nasdaq compliance in December 2025.

- The company is actively pursuing legal actions, including an adversary proceeding filed in December 2025 for damages from a dismissed bankruptcy petition and a formal complaint filed in January 2026 against certain shareholders for alleged securities law violations.

- Mawson is undergoing a strategic shift towards AI and high-performance computing (HPC), having launched an AI infrastructure pilot program in October 2025, expected to complete by March 2026 with commercial rollout in Q2 or Q3 2026, and a GPU pilot program in Q4 2025.

- For Q3 2025, Mawson reported $13.2 million in revenue and a positive net income.

- The company announced a $40 million at-the-market (ATM) facility in December 2025 for growth capital and highlights its 129-megawatt power platform as a valuable asset, benefiting from recent favorable US energy policy developments.

Jan 22, 2026, 8:40 PM

Endeavor Investor Group Calls for Leadership Change at Mawson Infrastructure Group

MIGI

Board Change

Management Change

- The Endeavor Investor Group, a significant stockholder of Mawson Infrastructure Group Inc., has issued a letter to stockholders criticizing the company's 95% decline in share price and failures in governance and leadership. Endeavor notes Mawson's market capitalization fell from $450 million in late 2021 to $15 million by early January 2026, with $9 million of negative equity and over $24 million in borrowings due within one year as of September 30, 2025.

- Endeavor criticizes Mawson's leadership, highlighting the company's temporary CEO status after dismissing two previous CEOs for cause, and an overreliance on dilutive equity issuances.

- Endeavor, which beneficially owned approximately 44.9% of Mawson's outstanding shares as of January 21, 2026, proposes a new strategy, a meaningful equity recapitalization with their own capital, and improved governance, and intends to file a proxy statement to elect director nominees.

Jan 22, 2026, 7:36 PM

MIGI Files Lawsuit Over Dismissed Involuntary Bankruptcy Petition

MIGI

Legal Proceedings

- Mawson Infrastructure Group Inc. (MIGI) filed an adversary proceeding on December 29, 2025, seeking attorneys' fees, costs, and damages against parties responsible for an unsuccessful involuntary bankruptcy petition filed against the company in December 2024.

- The complaint alleges that the petitioning creditors, including W Capital Advisors Pty Ltd, engaged in a coordinated campaign that caused severe financial harm, including a one-day market capitalization loss of approximately $23 million, reputational damage, and millions in legal expenses.

- The involuntary bankruptcy petition was dismissed with prejudice on November 4, 2025, and Mawson is now pursuing compensatory and punitive damages, sanctions, and injunctive relief.

Dec 30, 2025, 2:00 PM

Mawson Infrastructure Group Inc. Regains Nasdaq Listing Compliance

MIGI

Delisting/Listing Issues

- Mawson Infrastructure Group Inc. (MIGI) announced on December 22, 2025, that it has regained compliance with Nasdaq's continued listing requirements.

- The company received confirmation from Nasdaq that it now complies with both the Market Value of Listed Securities (MVLS) Rule 5550(b) and the Bid Price Rule 5550(a)(2).

- This compliance ensures that Mawson Infrastructure Group Inc. will continue to be listed on The Nasdaq Capital Market.

Dec 22, 2025, 7:09 PM

Mawson Infrastructure Group Inc. Regains Nasdaq Listing Compliance

MIGI

Delisting/Listing Issues

- Mawson Infrastructure Group Inc. (MIGI) announced on December 22, 2025, that it has regained compliance with Nasdaq's continued listing requirements.

- The company received confirmation from Nasdaq that it now complies with Listing Rules 5550(b) (the MVLS Rule) and 5550(a)(2) (the Bid Price Rule).

- This compliance ensures Mawson will continue to be listed on The Nasdaq Capital Market.

Dec 22, 2025, 7:05 PM

Quarterly earnings call transcripts for Mawson Infrastructure Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more